SPAC Stock Surge: Should You Invest In This MicroStrategy Competitor?

Table of Contents

Understanding the SPAC Market and its Risks

What are SPACs?

Special Purpose Acquisition Companies (SPACs), often called "blank-check companies," raise capital through an initial public offering (IPO) to acquire an existing private company. They are essentially shell corporations with no operational business, seeking a suitable target to merge with. This merger takes the private company public without undergoing a traditional IPO process. SPACs offer a quicker route to the public markets for private companies, bypassing some of the regulatory hurdles.

The Allure of SPACs

The attractiveness of SPACs stems from several factors:

- Faster access to capital: Private companies can access funding more rapidly compared to a traditional IPO.

- Reduced regulatory scrutiny: The SPAC process is generally perceived as less stringent than a traditional IPO.

- Potential for high returns: Successful SPAC mergers can deliver substantial returns for investors.

The Risks of SPAC Investing

Despite the allure, SPAC investing carries significant risks:

- Lack of due diligence: Investors often have limited information about the target company before the merger is announced, hindering thorough due diligence.

- Management team expertise: The SPAC sponsor's track record is crucial, but past success doesn't guarantee future performance. Inexperienced management teams can lead to poor investment decisions.

- Target company valuation: Overvalued targets are a common issue, potentially leading to substantial losses for investors after the merger.

- Redemption risk: SPAC investors can redeem their shares before the merger is finalized. High redemption rates can jeopardize the SPAC's ability to complete the acquisition.

SPAC Market Volatility

The SPAC market has experienced considerable volatility. Initial exuberance has been followed by periods of significant price drops, demonstrating the inherent risks associated with this investment vehicle. This volatility underscores the need for careful analysis before committing capital.

MicroStrategy and its Competitors in the SPAC Landscape

MicroStrategy's Bitcoin Strategy

MicroStrategy's substantial investment in Bitcoin has significantly impacted its valuation and positioned it as a leader in corporate Bitcoin adoption. This bold move has attracted attention and sparked interest in similar ventures.

Identifying MicroStrategy Competitors

Several companies are emerging as potential MicroStrategy competitors, entering the market through SPAC mergers. These companies may focus on various aspects of the cryptocurrency space, including:

- Example: Company A – Focus on blockchain technology development for enterprise solutions, merging with SPAC XYZ.

- Example: Company B – Focus on cryptocurrency mining and infrastructure, merging with SPAC ABC.

Competitive Advantages and Disadvantages

Comparing these emerging competitors to MicroStrategy requires a thorough analysis of their business models, technological capabilities, management teams, and market positioning. Some competitors might possess advantages in specific niches (e.g., superior technology), while others may face challenges in scaling operations or competing with MicroStrategy's established brand recognition. This comparative analysis is crucial for identifying potentially undervalued opportunities or avoiding overvalued investments.

Analyzing Investment Opportunities in MicroStrategy SPAC Competitors

Due Diligence for SPAC Investments

Before investing in any SPAC, particularly those focused on MicroStrategy competitor space, thorough due diligence is paramount. This includes:

- Management team assessment: Evaluate the experience and track record of the SPAC sponsor and the target company's management team.

- Financial analysis: Scrutinize the target company's financial statements, assessing its revenue streams, profitability, and debt levels.

- Market competition: Analyze the competitive landscape, identifying potential threats and opportunities.

- SPAC's prospectus: Carefully review the SPAC's prospectus for any red flags or potential risks.

Valuation and Pricing

Determining a fair valuation for a SPAC and its target company requires careful comparison to established players like MicroStrategy. Consider factors such as revenue growth, market share, and technological innovation when assessing potential returns.

Risk Assessment and Diversification

SPAC investments are inherently risky. It's crucial to assess your risk tolerance and diversify your portfolio accordingly. Don't allocate a significant portion of your investment capital to a single SPAC, especially in a volatile market.

Conclusion: Making Informed Decisions about SPAC Stock Surges

Investing in SPACs, particularly those featuring MicroStrategy competitors, presents both significant opportunities and substantial risks. The potential for high rewards coexists with the potential for equally significant losses. Thorough due diligence, a realistic assessment of risk, and a well-diversified investment portfolio are crucial for navigating the complexities of the SPAC stock surge. Understand the inherent volatility and potential for substantial losses before investing. Invest wisely in SPAC stock; don't be swept away by the hype. Navigate the SPAC stock surge strategically and understand the risks before investing in a MicroStrategy competitor via a SPAC. Conduct your own thorough research before committing any capital.

Featured Posts

-

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Wyckoff Accumulation In Ethereum Could We See A Price Rally To 2 700

May 08, 2025

Wyckoff Accumulation In Ethereum Could We See A Price Rally To 2 700

May 08, 2025 -

Miras Planlamanizda Kripto Paralarin Rolue Sifre Guevenligi Oenemli

May 08, 2025

Miras Planlamanizda Kripto Paralarin Rolue Sifre Guevenligi Oenemli

May 08, 2025 -

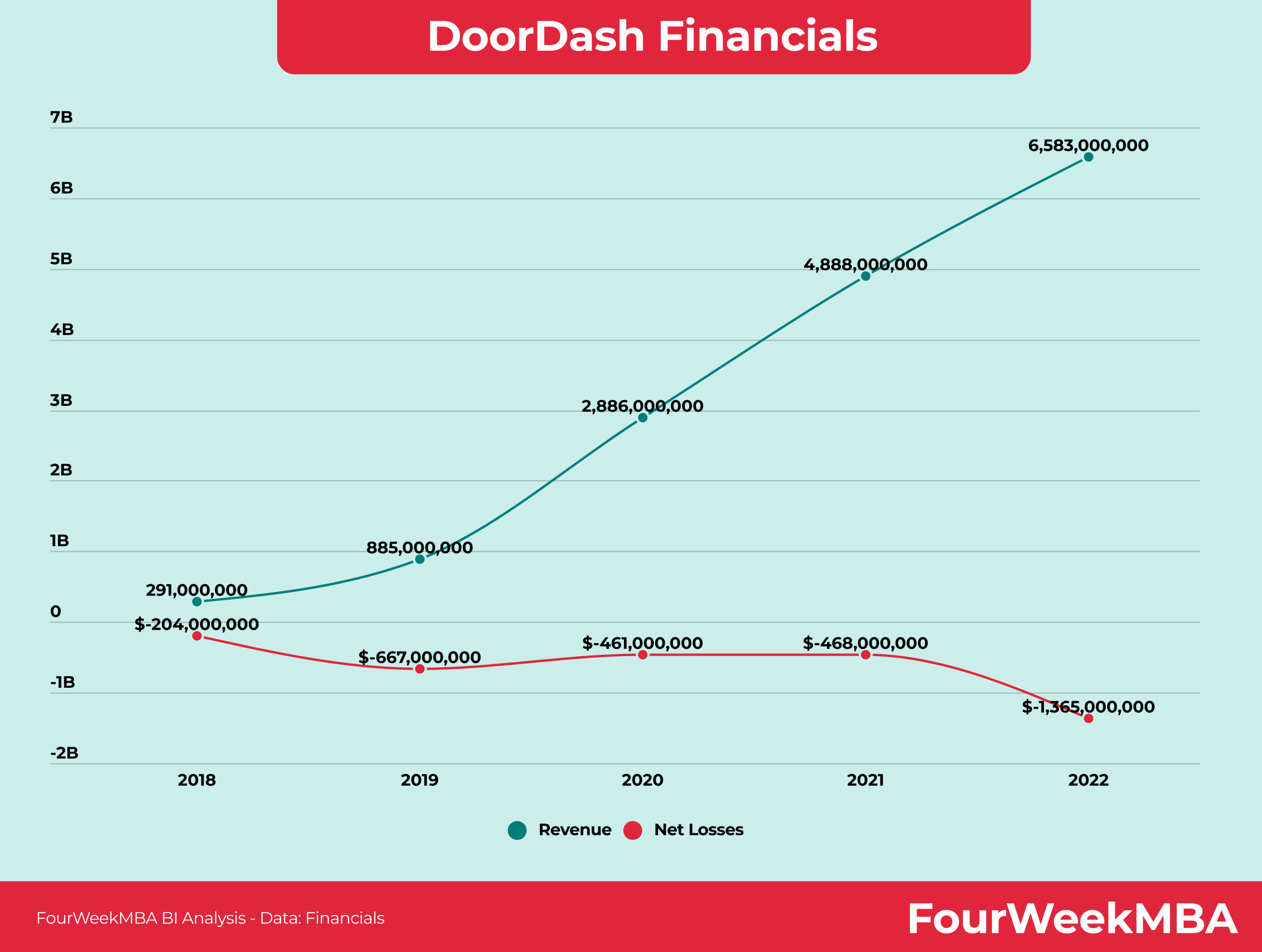

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025 -

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

May 08, 2025

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

May 08, 2025