SSE's £3 Billion Spending Cut: Reasons And Implications For The Future

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

Several interconnected factors contributed to SSE's decision to slash its capital expenditure by £3 billion. These reasons highlight the challenging economic climate and the evolving landscape of the UK energy sector.

Economic Headwinds and Inflation

Soaring inflation and sharply rising interest rates have significantly increased borrowing costs, making large-scale energy investments considerably less attractive. The higher cost of capital directly impacts the financial viability of projects, especially those with longer payback periods, like many renewable energy initiatives. Furthermore, increased material and labour costs are squeezing profit margins and impacting project feasibility. SSE, like other energy companies, is prioritizing short-term cost optimization to maintain profitability in this volatile economic climate.

- Specific Cost Increases: Examples include a 20% increase in steel prices, a 15% rise in the cost of concrete, and a 10% increase in labour costs across various projects. These figures, while illustrative, highlight the significant inflationary pressures affecting the energy sector.

- Focus Shift: The company is now shifting its focus towards projects with quicker returns and greater immediate cost savings.

Regulatory Uncertainty and Policy Changes

Uncertainty surrounding future government energy policies and regulations plays a crucial role in influencing investment decisions. The lack of clear, long-term policy support for renewable energy projects introduces significant risk, impacting the perceived return on investment (ROI). Companies need predictable regulatory frameworks to make informed, long-term investment commitments.

- Policy Changes: Recent changes to renewable energy subsidies or grid connection policies have created uncertainty, making it difficult for SSE to accurately assess the long-term profitability of various renewable energy projects.

- Grid Connection Challenges: Delays and complexities in securing grid connections for new renewable energy generation capacity significantly increase project costs and timelines.

- Planning Permissions: The lengthy and often unpredictable process of obtaining planning permissions for large-scale energy projects adds to the overall risk and uncertainty.

Focus Shift Towards Existing Assets and Efficiency

In response to the challenging economic climate, SSE is prioritizing the optimization and efficiency improvements of its existing energy assets. This approach involves investing in upgrades and modernization to enhance reliability, reduce operational costs, and extend the lifespan of existing infrastructure. This strategy offers a more immediate return on investment compared to developing new, large-scale projects.

- Efficiency Improvements: Investing in smart grid technologies, digitalization initiatives, and data analytics to optimize energy distribution and reduce transmission losses.

- Environmental Impact: Upgrades to existing power plants can also lead to reductions in greenhouse gas emissions and improve overall environmental performance.

- Digitalization and Data Analytics: The adoption of advanced data analytics tools is enabling SSE to monitor and optimize the performance of its assets more effectively, minimizing energy waste and maximizing efficiency.

Implications for the Future of SSE and the UK Energy Sector

SSE's £3 billion spending cut has significant implications for the company's future, the UK energy sector, and the nation's wider energy goals.

Impact on Renewable Energy Development

The reduction in capital expenditure is likely to lead to delays or cancellations of renewable energy projects, potentially hindering the UK's progress towards its ambitious green energy targets. Reduced investment in wind, solar, and other renewable energy sources could slow the transition to a low-carbon energy system.

- Job Losses: Delays or cancellations of renewable energy projects could result in job losses across the supply chain, impacting employment in manufacturing, construction, and other related sectors.

- Net-Zero Ambitions: The slowdown in renewable energy investment could compromise the UK's ability to meet its ambitious net-zero emissions targets.

Financial Performance and Shareholder Value

While the £3 billion spending cut offers short-term benefits in terms of cost reduction and improved financial performance, it might compromise long-term growth and innovation. This strategic shift necessitates a careful assessment of the trade-offs between short-term financial gains and long-term competitive advantage.

- Profitability and Shareholder Returns: The immediate impact on SSE's profitability is likely to be positive, but the long-term consequences for shareholder value remain uncertain.

- Credit Rating and Access to Capital: The reduction in investment might affect SSE's credit rating and its ability to access capital markets for future projects.

Wider Implications for the UK Energy Market

SSE's decision has broader implications for the UK energy market, raising concerns about competition, energy security, and affordability. Reduced investment could affect competition and potentially lead to higher energy prices for consumers.

- Energy Security: A slowdown in renewable energy development might impact the UK's energy security and resilience, particularly its ability to meet future electricity demand.

- Government Intervention: The government might need to intervene to provide further support for renewable energy development to ensure the UK meets its climate goals and maintains energy security.

Conclusion

SSE's £3 billion spending cut represents a significant turning point in the UK energy landscape. The decision, driven by a confluence of economic headwinds, regulatory uncertainty, and a strategic refocus, has profound and far-reaching implications for renewable energy development, SSE's financial performance, and the broader UK energy market. While short-term cost reduction offers immediate benefits, the long-term consequences necessitate careful analysis and proactive measures. To stay informed on the evolving situation and the impact of this major decision, continue monitoring updates on SSE's £3 billion spending cut and its evolving implications for the UK energy sector.

Featured Posts

-

The Fight Against Ev Mandates Heats Up Dealers Push Back

May 24, 2025

The Fight Against Ev Mandates Heats Up Dealers Push Back

May 24, 2025 -

Trump E I Dazi Analisi Dell Effetto Negativo Sul Mercato Della Moda

May 24, 2025

Trump E I Dazi Analisi Dell Effetto Negativo Sul Mercato Della Moda

May 24, 2025 -

Italian Citizenship New Path Through Great Grandparent Ancestry

May 24, 2025

Italian Citizenship New Path Through Great Grandparent Ancestry

May 24, 2025 -

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025 -

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 24, 2025

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 24, 2025

Latest Posts

-

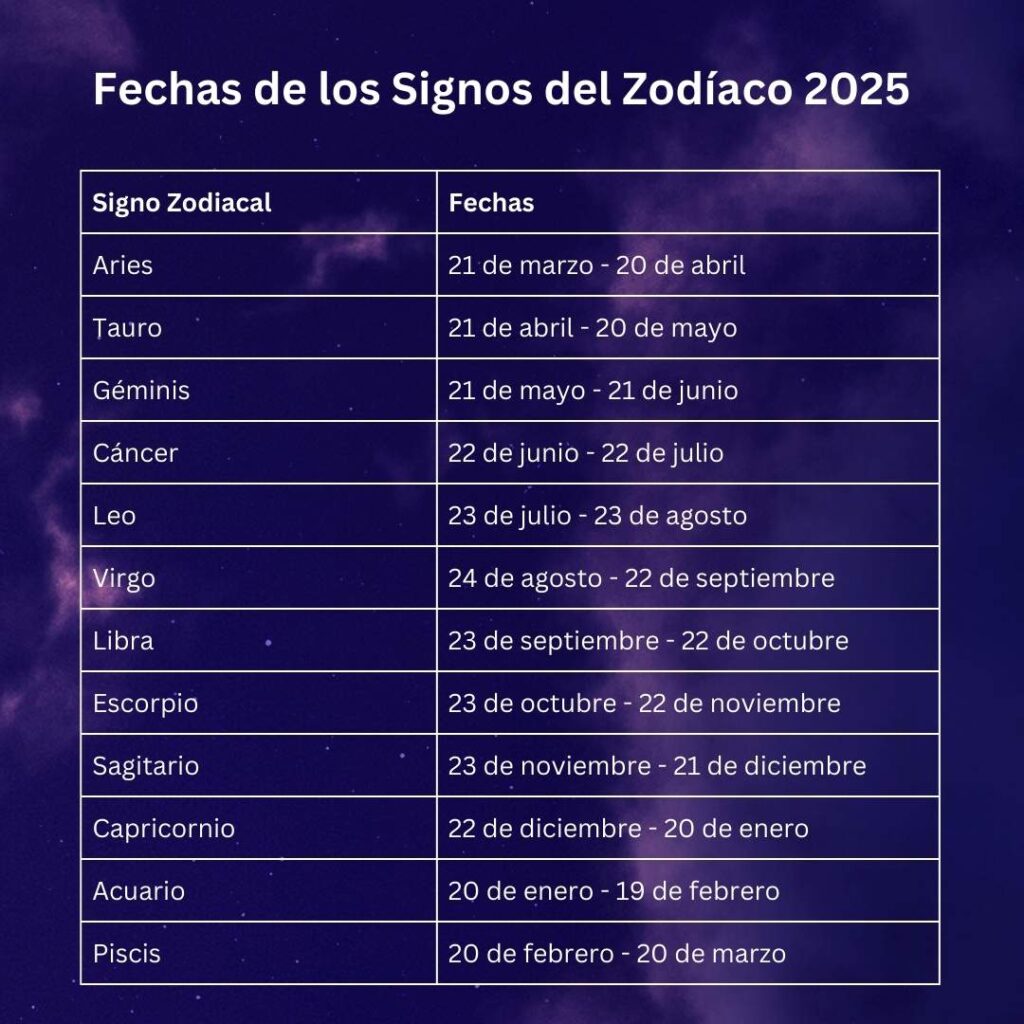

Tu Horoscopo Semanal 4 Al 10 De Marzo De 2025 Predicciones Para Cada Signo

May 24, 2025

Tu Horoscopo Semanal 4 Al 10 De Marzo De 2025 Predicciones Para Cada Signo

May 24, 2025 -

Burclar Ve Babalik Hangi Erkek Burclari Daha Zorlu Babalar

May 24, 2025

Burclar Ve Babalik Hangi Erkek Burclari Daha Zorlu Babalar

May 24, 2025 -

Horoscopo Completo 4 Al 10 De Marzo De 2025 Todos Los Signos Zodiacales

May 24, 2025

Horoscopo Completo 4 Al 10 De Marzo De 2025 Todos Los Signos Zodiacales

May 24, 2025 -

En Cok Yakan Erkek Burclari Babalik Ve Iliski Dinamikleri

May 24, 2025

En Cok Yakan Erkek Burclari Babalik Ve Iliski Dinamikleri

May 24, 2025 -

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025