SSE's Revised Spending Plan: £3 Billion Less Amidst Slowing Economic Growth

Table of Contents

The £3 Billion Reduction: A Detailed Breakdown

SSE's revised spending plan represents a substantial shift in the company's investment strategy. This £3 billion cut necessitates a closer look at the specific areas affected and the reasoning behind the decision.

Specific Areas Affected by the Spending Cuts

The reduction impacts several key areas of SSE's operations:

- Offshore wind farm development: A reported £500 million reduction in planned investments, potentially delaying or scaling back several crucial projects.

- Grid modernization projects: A massive £1 billion cut, impacting the crucial upgrades needed to support the integration of renewable energy sources into the national grid.

- Renewable energy R&D: While specific figures may not be publicly available, it's likely that investment in research and development of new renewable technologies has also been reduced.

- Network infrastructure upgrades: Significant cuts here could compromise the reliability and resilience of the energy network, impacting consumers.

Reasons Cited by SSE for the Spending Reduction

SSE has attributed the reduction to a confluence of factors:

- Increased costs of materials: Inflationary pressures and supply chain disruptions have driven up the cost of essential materials needed for energy projects.

- Supply chain disruptions: Global supply chain issues continue to hamper the timely delivery of critical components, leading to project delays and increased costs.

- Economic uncertainty: The current economic climate, marked by high inflation and potential recession, has created uncertainty around future energy demand and investment returns.

- Regulatory hurdles: Changes in government policy or regulatory approvals may have played a role in the decision to reduce investment in specific projects.

Comparison to Previous Spending Plans

To understand the significance of this reduction, comparing it to previous years' budgets is crucial. [Insert Chart/Graph here showing percentage reduction compared to the previous 3-5 years]. This visual representation clearly demonstrates the dramatic scale of SSE's revised spending plan compared to previous investment levels.

Impact on the UK Energy Sector and Economy

The implications of SSE's revised spending plan extend far beyond the company itself, impacting the UK energy sector and the broader economy.

Consequences for Renewable Energy Targets

The cuts risk jeopardizing the UK's ambitious renewable energy targets and its commitment to net-zero emissions.

- Delays in renewable energy projects: Reduced investment directly translates into delays in crucial renewable energy projects, slowing down the transition to cleaner energy sources.

- Impact on emission reduction goals: The postponement of projects could significantly hinder the UK's ability to meet its carbon reduction targets, potentially leading to penalties under international agreements.

Effects on Job Creation and Employment within the Energy Sector

The reduced spending has potential consequences for employment within the energy sector:

- Potential job losses: Project delays and cancellations may lead to job losses among contractors and employees involved in the affected projects.

- Delays in hiring: Future hiring plans may be scaled back due to the reduced investment, impacting the growth of the renewable energy workforce. [Mention any official statements from SSE regarding job impacts].

Wider Economic Implications

The ripple effects of reduced investment in the energy sector could extend to other industries:

- Impact on the supply chain: The reduction in demand for materials and services from the energy sector could negatively impact businesses in the supply chain.

- Reduced economic growth: Lower energy investment contributes to reduced overall economic growth, potentially affecting related industries and overall GDP.

Analyst Reactions and Market Response to SSE's Revised Spending Plan

The announcement of SSE's revised spending plan prompted immediate reactions from analysts and investors.

Summarizing Analyst Opinions

Financial analysts have expressed mixed reactions, with some expressing concern about the impact on the UK's energy transition, while others see it as a necessary adjustment to the current economic climate. [Include quotes from relevant analysts and experts].

Market Response

The market responded to the news with [describe stock price fluctuations, for example: a slight dip in SSE's share price initially, followed by a gradual recovery]. [Insert Chart/Graph here showing the stock price fluctuation following the announcement]. Investor sentiment appears to be cautiously optimistic, acknowledging the challenges while considering SSE's long-term strategy.

Conclusion: Analyzing the Implications of SSE's Revised Spending Plan

SSE's revised spending plan, a £3 billion reduction, is a significant event with far-reaching implications for the UK energy sector and the wider economy. The decision, driven by increased costs, supply chain issues, and economic uncertainty, raises concerns about the pace of the UK's energy transition and its commitment to renewable energy targets. Potential delays in crucial projects, reduced job creation, and wider economic ripple effects are all significant consequences to consider. The market's response has been mixed, reflecting both the challenges and the potential for future adjustments. The long-term impact of this decision on SSE and the UK's energy future remains to be seen. Stay tuned for updates on SSE's revised spending plan and its impact on the future of UK energy.

Featured Posts

-

Resurfacing Accusations Sean Penns Support For Woody Allen Sparks Debate On Sexual Abuse

May 25, 2025

Resurfacing Accusations Sean Penns Support For Woody Allen Sparks Debate On Sexual Abuse

May 25, 2025 -

Deadly Myrtle Beach Hit And Run Suspect Apprehended

May 25, 2025

Deadly Myrtle Beach Hit And Run Suspect Apprehended

May 25, 2025 -

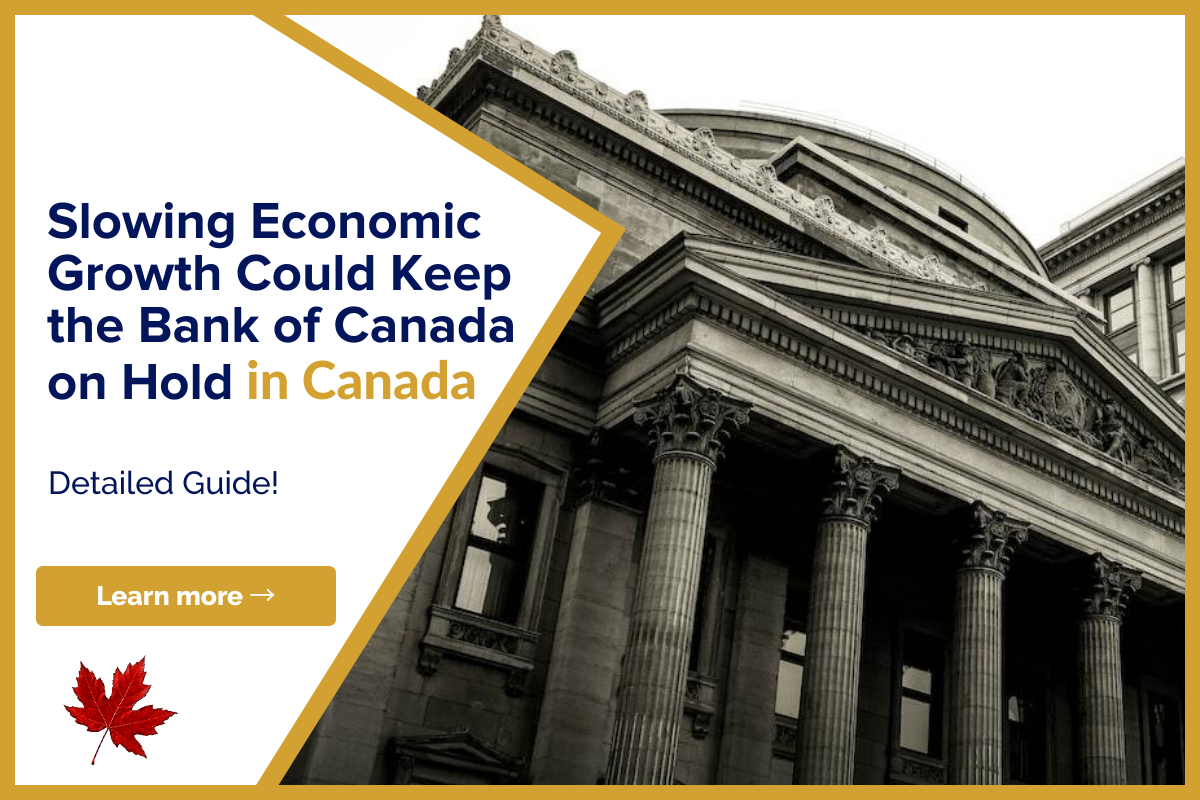

Is De Recente Prestatieverschillen Tussen Europese En Amerikaanse Aandelen Houdbaar

May 25, 2025

Is De Recente Prestatieverschillen Tussen Europese En Amerikaanse Aandelen Houdbaar

May 25, 2025 -

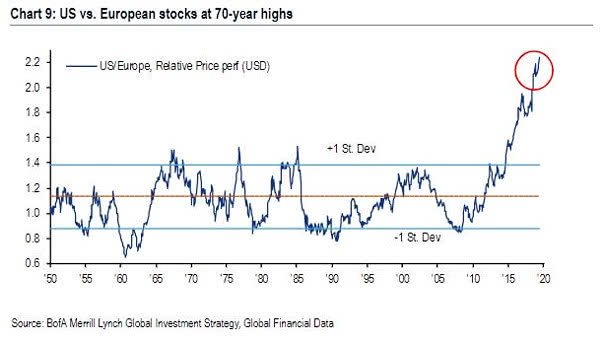

Flood Warnings And Flash Floods A Comprehensive Guide To Safety And Preparedness

May 25, 2025

Flood Warnings And Flash Floods A Comprehensive Guide To Safety And Preparedness

May 25, 2025 -

Southern Tourist Destination Reassures Visitors Following Safety Concerns

May 25, 2025

Southern Tourist Destination Reassures Visitors Following Safety Concerns

May 25, 2025