Stock Market News: Analysis Of Today's Bond Market Decline And Bitcoin Surge

Table of Contents

Analyzing the Bond Market Decline

The recent dip in the bond market represents a significant development in the current financial climate. Several interconnected factors contribute to this decline, creating a complex web of influences that require careful consideration.

Factors Contributing to the Bond Market Dip:

-

Rising Interest Rates: The Federal Reserve's recent interest rate hikes directly impact bond yields. Higher interest rates make newly issued bonds more attractive, causing older bonds with lower yields to lose value. This effect is amplified by the expectation of further rate increases, pushing bond prices down. For instance, the recent 0.25% increase in the federal funds rate triggered a noticeable sell-off in the treasury bond market.

-

Inflationary Pressures: Persistent inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises, the real return on bonds decreases, making them less attractive to investors seeking to preserve their capital. The current high inflation rate is a key driver behind the reduced demand for bonds.

-

Geopolitical Events: Global instability and uncertainty, such as the ongoing war in Ukraine or escalating trade tensions, significantly impact investor sentiment. During times of uncertainty, investors often flock to safer assets, leading to a decline in bond prices as capital flows elsewhere. The resulting market volatility adds pressure to the bond market.

-

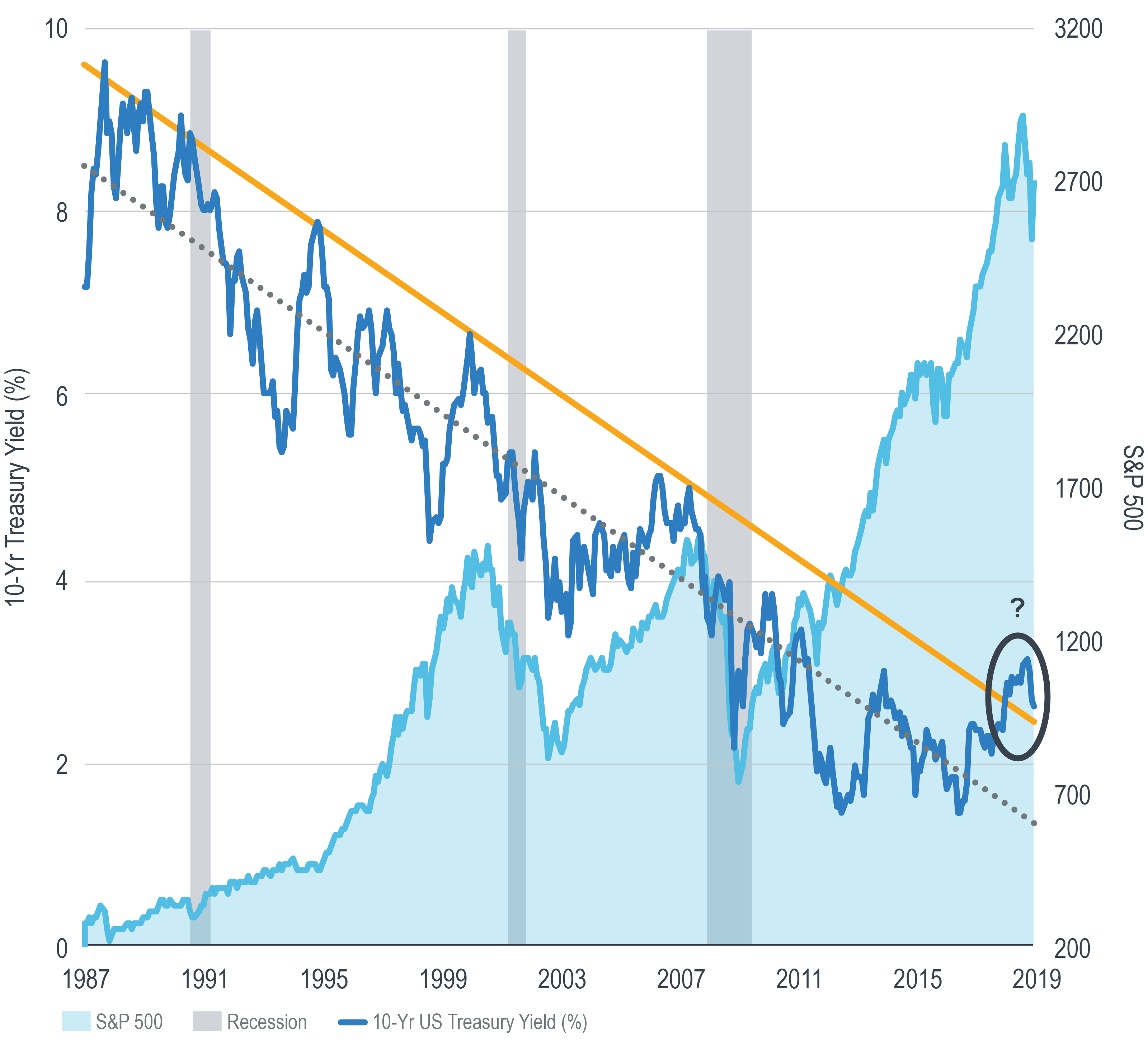

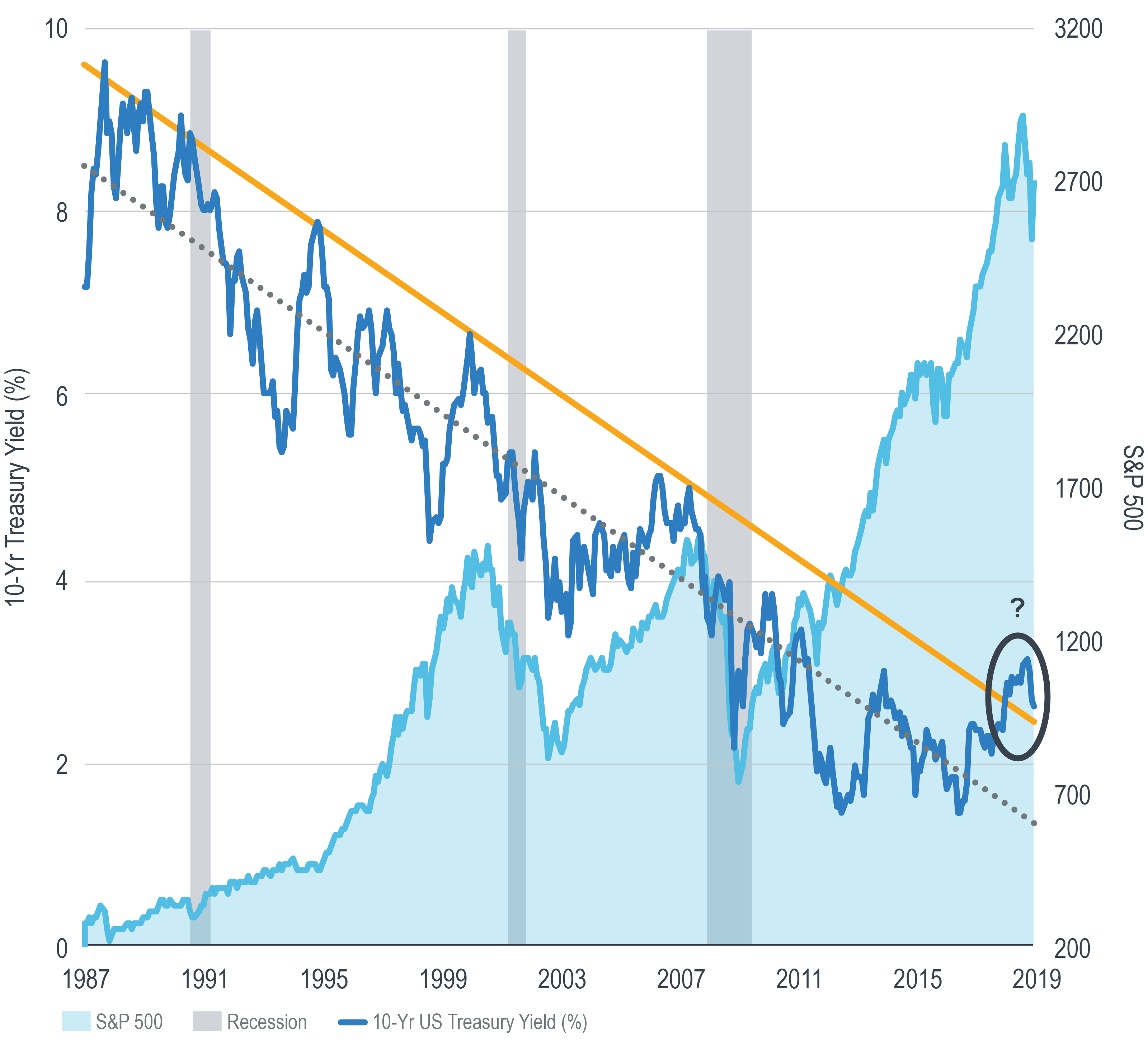

Technical Analysis of Bond Market Indicators: The yield curve, a graphical representation of the yields of bonds with different maturities, provides valuable insights. An inverted yield curve, where short-term yields exceed long-term yields, is often considered a predictor of an economic recession, further impacting bond market performance. Charts showing the yield curve inversion alongside bond price declines provide clear visual evidence of this correlation.

(Insert relevant chart/graph here showing yield curve and bond prices)

Implications of the Bond Market Decline:

-

Impact on Fixed-Income Investors: Fixed-income investors holding bonds are experiencing capital losses as bond prices fall. This affects retirement portfolios and other investments heavily reliant on bond returns.

-

Potential Ripple Effects on Other Asset Classes: The bond market decline can have knock-on effects on other asset classes. For example, reduced bond market activity can lead to decreased liquidity across the broader market.

-

Economic Consequences of Decreased Bond Market Activity: A weakening bond market can signal broader economic slowdown or recessionary concerns, potentially impacting overall economic growth. This can also limit the ability of companies to borrow money at favorable rates.

-

Potential Opportunities: While the decline presents challenges, it also creates potential opportunities for savvy investors who can identify undervalued bonds or capitalize on market corrections.

Deciphering Bitcoin's Recent Surge

In stark contrast to the bond market's decline, Bitcoin has experienced a notable price increase. This surge is driven by several interwoven factors.

Potential Drivers of Bitcoin's Price Increase:

-

Increased Institutional Investment: A growing number of institutional investors, including hedge funds and corporations, are allocating a portion of their portfolios to cryptocurrencies, increasing demand for Bitcoin. This signifies growing acceptance of Bitcoin as an asset class.

-

Growing Adoption of Bitcoin as a Payment Method: The increasing acceptance of Bitcoin as a payment method by businesses globally boosts its utility and appeal, driving demand. This trend is accelerated by the development of Bitcoin payment processing systems.

-

Regulatory Developments: Regulatory clarity or positive developments in the regulatory landscape concerning cryptocurrencies can positively influence market sentiment and Bitcoin's price. Conversely, negative regulatory actions can lead to price drops.

-

Technical Factors: Events like Bitcoin halving (reducing the rate of new Bitcoin creation) or significant network upgrades can impact its scarcity and efficiency, leading to price fluctuations.

-

Market Sentiment and Speculation: Investor sentiment, speculation, and media coverage significantly influence Bitcoin's price volatility. Positive news and hype tend to drive the price upwards. Conversely, negative news or fear can trigger sell-offs.

Analyzing the Relationship Between Bond Market Decline and Bitcoin Surge:

The simultaneous occurrence of a bond market decline and a Bitcoin surge raises questions about potential correlations. Some analysts suggest that investors might be shifting assets from bonds (considered relatively safer during periods of economic uncertainty) to Bitcoin, seeking higher potential returns, despite its inherent volatility. This flight to riskier assets could be driven by the search for inflation hedges, as Bitcoin is often considered a potential inflation hedge. Macroeconomic factors, such as inflation and interest rate hikes, influence both markets, making the relationship complex and requiring further analysis.

Conclusion: Navigating the Complexities of Today's Markets

In summary, the recent decline in the bond market is primarily attributed to rising interest rates, inflationary pressures, and geopolitical uncertainty. Conversely, Bitcoin's price surge is fueled by increased institutional investment, growing adoption, and speculation. While a correlation between the two is plausible, further research is necessary to establish a definitive causal relationship. Understanding these dynamics is crucial for navigating today's volatile markets. Stay updated on the latest stock market news, particularly regarding the bond market and Bitcoin, to make informed investment decisions. Understanding these dynamic forces is crucial for navigating the complexities of today's financial landscape. Consider consulting a financial advisor for personalized investment strategies tailored to your risk tolerance and financial goals.

Featured Posts

-

Is A Trump Era Plan To Blame For Newark Airports Air Traffic Control Problems

May 24, 2025

Is A Trump Era Plan To Blame For Newark Airports Air Traffic Control Problems

May 24, 2025 -

2nd Edition Best Of Bangladesh In Europe A Platform For Collaboration And Expansion

May 24, 2025

2nd Edition Best Of Bangladesh In Europe A Platform For Collaboration And Expansion

May 24, 2025 -

Resurfaced Allegations Sean Penns Public Support For Woody Allen Sparks Debate

May 24, 2025

Resurfaced Allegations Sean Penns Public Support For Woody Allen Sparks Debate

May 24, 2025 -

Neal Mc Donough Would Damien Darhk Beat Superman Exclusive Interview

May 24, 2025

Neal Mc Donough Would Damien Darhk Beat Superman Exclusive Interview

May 24, 2025 -

Michael Caines Unexpected Guest During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected Guest During Mia Farrow Sex Scene Filming

May 24, 2025

Latest Posts

-

Neal Mc Donoughs Impact On The Last Rodeo

May 24, 2025

Neal Mc Donoughs Impact On The Last Rodeo

May 24, 2025 -

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025 -

Analyzing Neal Mc Donoughs Role In The Last Rodeo

May 24, 2025

Analyzing Neal Mc Donoughs Role In The Last Rodeo

May 24, 2025 -

The Last Rodeo Exploring Neal Mc Donoughs Character

May 24, 2025

The Last Rodeo Exploring Neal Mc Donoughs Character

May 24, 2025 -

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 24, 2025

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 24, 2025