Stock Market News: Analyzing The Impact Of Trump's China Tariffs And UK Trade Agreements

Table of Contents

The Ripple Effect of Trump's China Tariffs on Stock Market News

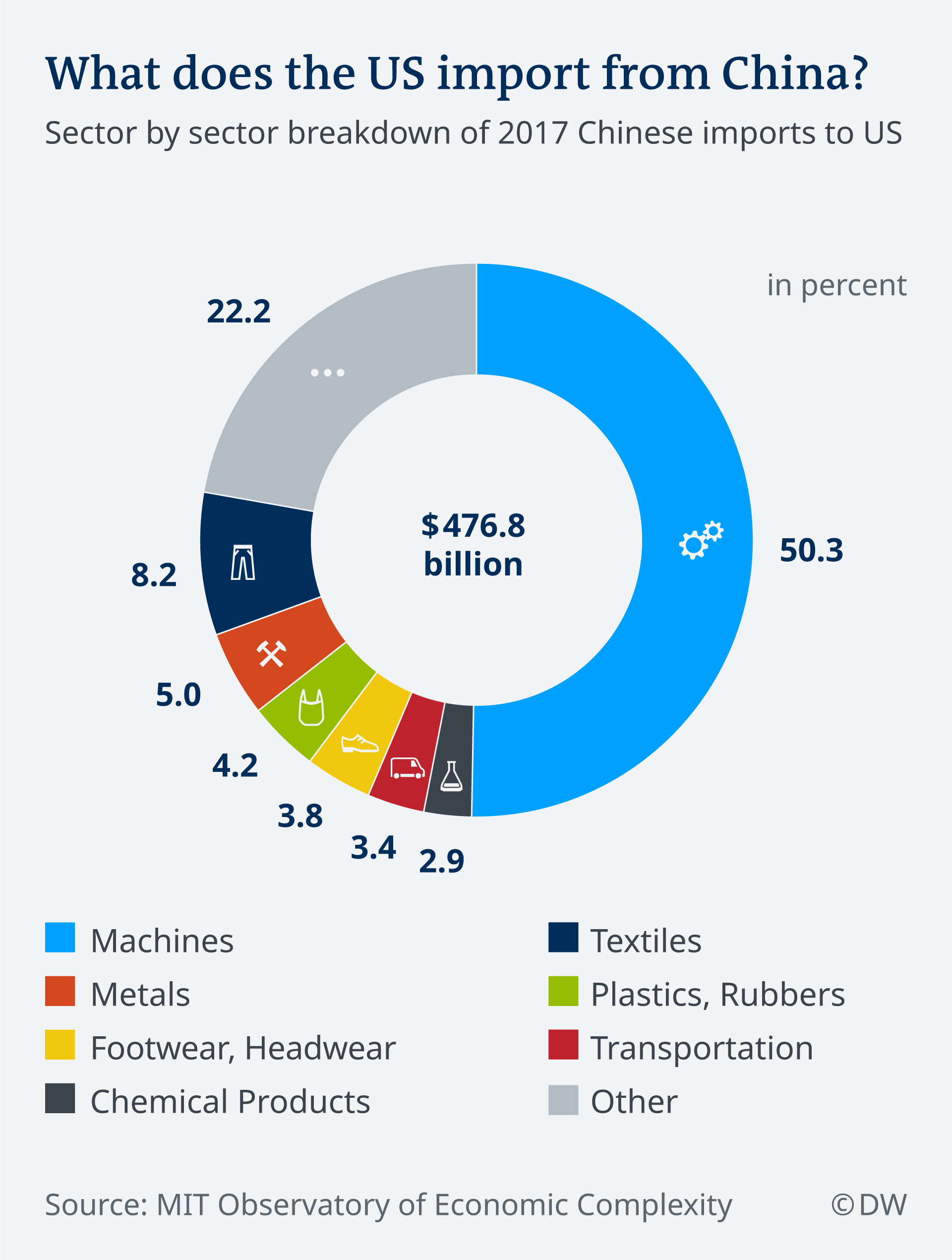

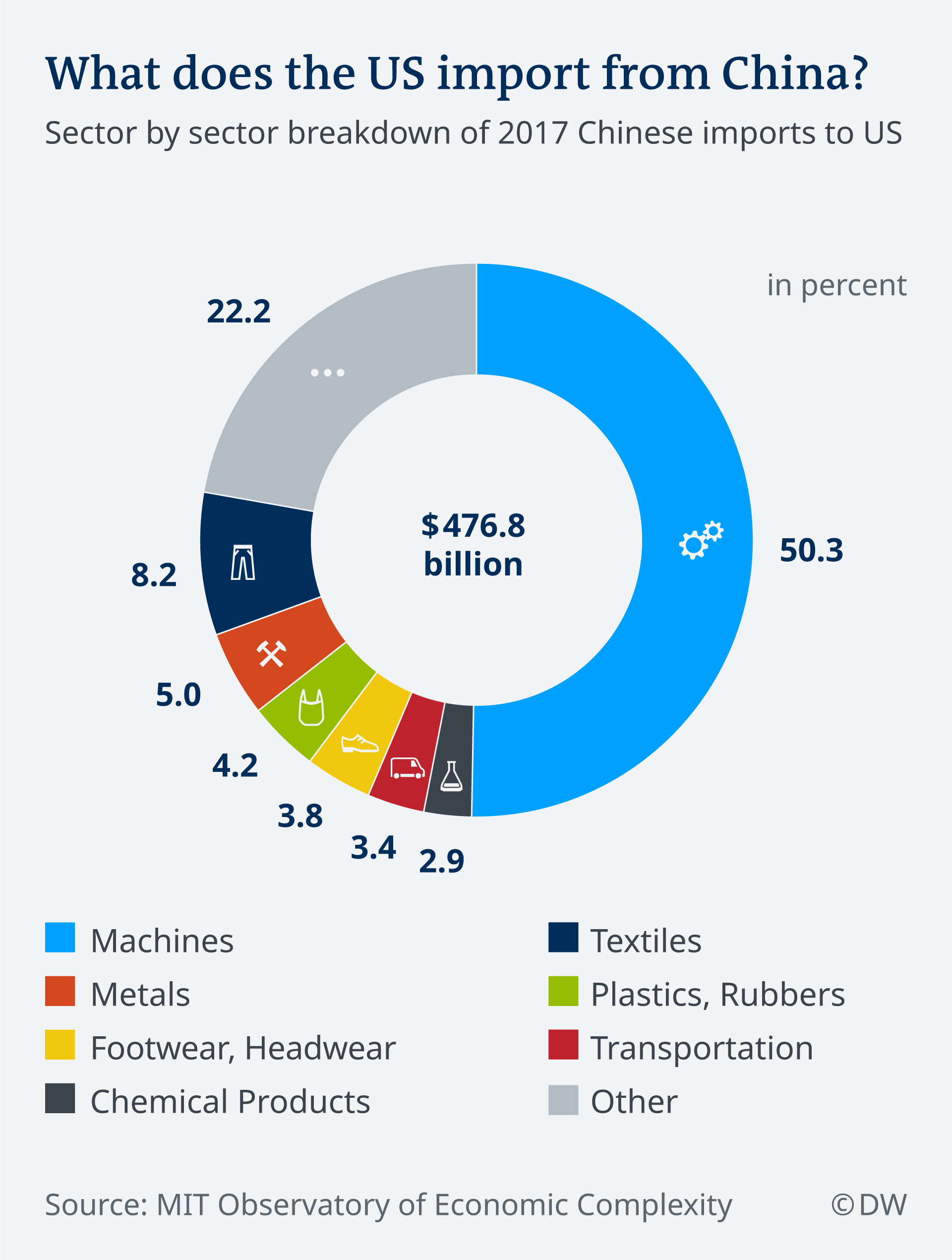

Trump's trade war with China, characterized by escalating tariffs on billions of dollars worth of goods, sent shockwaves through the global stock market. Understanding the resulting impact requires examining both the direct effects and the cascading consequences.

Disrupted Supply Chains and Increased Costs

The tariffs dramatically increased the cost of importing Chinese goods into the US. This had a multi-layered impact:

-

Examining the impact of tariffs on import prices for US businesses: Businesses reliant on Chinese imports faced significantly higher input costs, squeezing profit margins. The increased cost wasn't just limited to the tariff itself; logistical complexities and delays added further financial strain.

-

Analyzing the resulting increase in consumer prices and its effect on consumer spending: These higher input costs were often passed on to consumers, leading to inflation and reduced consumer spending. This dampened economic growth and impacted the overall stock market performance.

-

Bullet Points:

- Increased production costs for manufacturers reliant on Chinese imports, leading to reduced profitability and potential job losses.

- Reduced consumer purchasing power due to inflation, resulting in decreased demand for goods and services.

- Shifting of supply chains away from China, leading to uncertainty, increased costs associated with establishing new supply chains, and potential delays in production and delivery.

Stock Market Volatility and Sector-Specific Impacts

The impact of the tariffs wasn't uniform across all sectors. Some industries were hit harder than others:

-

Discussion of how specific sectors (technology, manufacturing, retail) were differentially affected: The technology sector, heavily reliant on Chinese-manufactured components, experienced significant pressure. Manufacturing companies saw reduced competitiveness due to increased prices, while retailers faced difficult choices between absorbing higher costs or passing them on to consumers, potentially impacting sales.

-

Analysis of stock market reactions (e.g., increased volatility, sector-specific downturns) to tariff announcements: Announcements of new or increased tariffs often triggered immediate stock market volatility. Sectors particularly vulnerable to the tariffs experienced sharper downturns.

-

Bullet Points:

- Technology companies faced higher costs for components sourced from China, impacting profit margins and share prices.

- Manufacturing companies experienced reduced competitiveness due to increased prices, leading to lower sales and reduced stock valuations.

- Retailers faced pressure to absorb increased costs or pass them on to consumers, impacting profit margins and potentially affecting consumer sentiment and spending.

Navigating the UK's Post-Brexit Trade Agreements: Stock Market Implications

Brexit, the UK's withdrawal from the European Union, created significant uncertainty and impacted the UK stock market in profound ways.

Uncertainty and the Impact on the UK Stock Market

The period leading up to and immediately following Brexit was marked by considerable volatility:

-

Analyzing the initial uncertainty following Brexit and its effect on UK stock prices: The uncertainty surrounding the future trading relationship between the UK and the EU led to significant volatility in UK stock prices. Investors were hesitant to commit capital until clarity emerged.

-

Discussion of how different Brexit scenarios were priced into the market: The market reacted differently depending on the perceived likelihood of various Brexit scenarios, reflecting investors' assessment of the potential economic consequences.

-

Bullet Points:

- The pound's volatility in relation to Brexit developments, reflecting shifts in investor confidence.

- Uncertainty affecting investment decisions in the UK, leading to delayed or cancelled projects.

- Potential for both gains and losses based on negotiated trade deals, making accurate forecasting extremely difficult.

New Trade Deals and Opportunities for the UK Stock Market

While Brexit presented challenges, it also opened up opportunities for new trade agreements:

-

Exploring the potential benefits of new trade agreements with countries outside the EU: The UK sought to establish new trade deals globally, potentially boosting exports and attracting foreign investment.

-

Examining the sectors expected to benefit most from these agreements: Sectors with strong export potential, such as financial services and certain manufacturing industries, were expected to be the biggest beneficiaries.

-

Bullet Points:

- Increased export opportunities for UK businesses, potentially leading to increased revenue and job creation.

- Attraction of foreign investment into specific sectors, boosting economic growth and stock market performance.

- Potential for economic growth driven by new trade partnerships, creating a more diversified and resilient economy.

Conclusion

Trump's China tariffs and the UK's post-Brexit trade agreements represent significant geopolitical and economic shifts that have dramatically impacted global stock market news. Understanding the ripple effects of these events, particularly their influence on supply chains, inflation, and investor sentiment, is crucial for informed investment decisions. By analyzing sector-specific impacts and potential opportunities presented by new trade deals, investors can better navigate the complexities of the global market. Stay informed on stock market news to effectively manage your portfolio in the face of ongoing international trade developments and utilize resources to stay ahead of the curve regarding Trump's China tariffs and the impact of UK trade agreements. Regularly monitor the latest stock market news to make informed investment choices.

Featured Posts

-

Astros Foundation College Classic 2025 All Tournament Team Announced

May 11, 2025

Astros Foundation College Classic 2025 All Tournament Team Announced

May 11, 2025 -

Accelerating Sea Level Rise A Threat To Coastal Cities And Towns

May 11, 2025

Accelerating Sea Level Rise A Threat To Coastal Cities And Towns

May 11, 2025 -

The Payton Pritchard Phenomenon Understanding His Successful Nba Season

May 11, 2025

The Payton Pritchard Phenomenon Understanding His Successful Nba Season

May 11, 2025 -

Ofilis 100 000 Grand Slam Track Race A Third Place Performance

May 11, 2025

Ofilis 100 000 Grand Slam Track Race A Third Place Performance

May 11, 2025 -

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 11, 2025

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 11, 2025