Stock Market Outlook: Dow Futures Indicate Strong Week Close

Table of Contents

Analyzing the Dow Futures Signal

Dow Futures contracts serve as a leading indicator for the overall stock market performance. They reflect the predicted opening prices of the Dow Jones Industrial Average, providing a glimpse into investor sentiment before the market officially opens. By analyzing these futures, traders and investors can gauge the potential direction of the market and adjust their investment strategies accordingly. For instance, a strong upward trend in Dow Futures, as observed this week, suggests a positive outlook for the broader market.

Let's look at the specifics: This week, Dow Futures experienced a consistent upward trend, showing a significant percentage increase. While specific numbers will fluctuate depending on the exact time of observation, the overall trend has been strongly positive. This positive movement wasn't isolated; we observed a high volume of contracts traded, indicating strong investor participation and confidence. Furthermore, this positive movement in Dow Futures shows a positive correlation with other major indices like the S&P 500 and Nasdaq, reinforcing the broader positive market sentiment.

- High volume of contracts traded, indicating strong investor activity.

- Consistent upward trend observed throughout the week, showing sustained positive momentum.

- Positive correlation with other major indices (S&P 500, Nasdaq), confirming a broader market trend.

Key Economic Indicators Contributing to Positive Outlook

The positive Dow Futures signal is underpinned by several encouraging economic indicators. These indicators influence investor sentiment and directly impact stock market performance. Positive news in these areas generally boosts confidence, leading to increased investment and higher stock prices. For example, stronger-than-expected employment numbers often fuel positive market sentiment, as does easing inflation concerns.

Recent data has shown a positive impact on the stock market outlook:

- Stronger-than-expected employment numbers: A robust jobs market signifies economic strength and increased consumer spending.

- Easing inflation concerns: Lower inflation rates reduce the pressure on the Federal Reserve to raise interest rates, potentially boosting corporate profits and stock valuations.

- Positive corporate earnings reports from key sectors: Strong earnings reports from major companies indicate a healthy economic climate and increased profitability.

Potential Market Trends and Investment Strategies

Based on the positive Dow Futures signal and strong economic indicators, several potential market trends emerge. Investors may see opportunities in various sectors, leading to potential investment strategies. However, it's crucial to remember the importance of diversification and risk management.

Potential Market Trends and Investment Strategies:

- Opportunities in technology and growth sectors: These sectors often benefit from positive economic outlooks and increased investor risk appetite.

- Potential for increased volatility: While the overall trend is positive, short-term fluctuations are always possible.

- Importance of a well-diversified portfolio: Diversification helps mitigate risk and protect against potential market corrections.

Risk Factors and Considerations

While the current Dow Futures signal is positive, it's crucial to acknowledge potential risks and uncertainties that could impact the market. The stock market is inherently unpredictable, and unforeseen events can significantly influence its direction.

- Geopolitical tensions: International conflicts or political instability can negatively impact market sentiment and investor confidence.

- Unexpected economic data releases: Unexpectedly poor economic data can lead to market corrections and negatively impact investor confidence.

- Potential for market corrections: Even with a positive outlook, market corrections are a normal part of the investment cycle.

Conclusion

The positive signal from Dow Futures suggests a strong week close for the stock market, driven by positive economic indicators and investor confidence. However, it's crucial to consider the potential risk factors outlined above and maintain a diversified investment strategy. Understanding the nuances of Dow Futures and correlating them with other economic indicators is key to making informed investment decisions.

Call to Action: Stay informed about the latest market trends and Dow Futures movements to make informed investment decisions. Continue monitoring the stock market outlook and Dow Futures for further insights into potential investment opportunities. Understanding Dow Futures signals can significantly enhance your stock market analysis and overall investment strategy.

Featured Posts

-

She Ll Have Anything She Wants Michael Cliffords Candid Take On His Daughters Future

Apr 26, 2025

She Ll Have Anything She Wants Michael Cliffords Candid Take On His Daughters Future

Apr 26, 2025 -

The Return Of Neighbours A Murder Mystery After 38 Years

Apr 26, 2025

The Return Of Neighbours A Murder Mystery After 38 Years

Apr 26, 2025 -

George Santos Faces 87 Month Prison Sentence Doj Seeks Lengthy Term In Fraud Case

Apr 26, 2025

George Santos Faces 87 Month Prison Sentence Doj Seeks Lengthy Term In Fraud Case

Apr 26, 2025 -

Ajax 125th Anniversary Evaluating Dam Safety Risks

Apr 26, 2025

Ajax 125th Anniversary Evaluating Dam Safety Risks

Apr 26, 2025 -

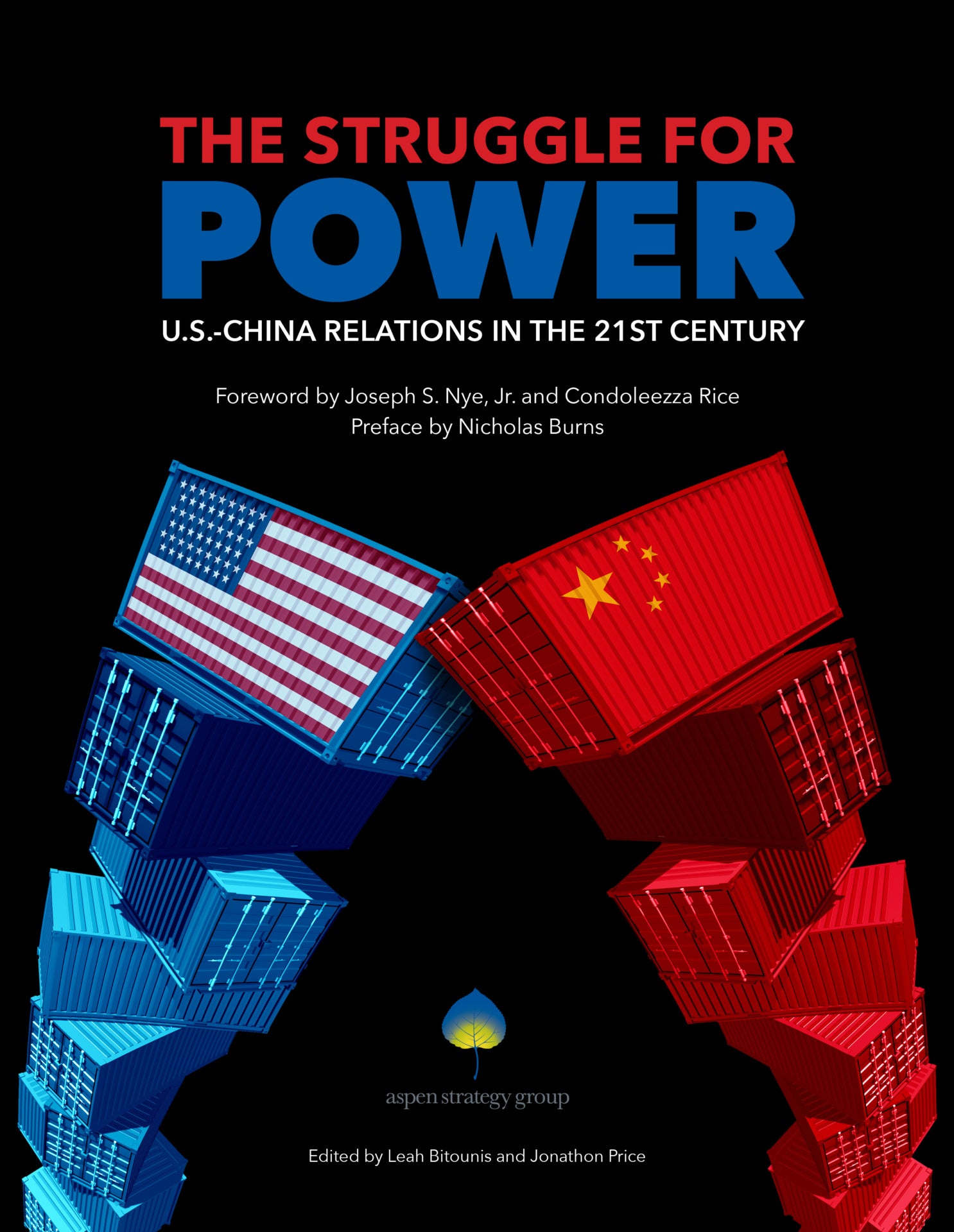

Geopolitical Stakes Analyzing A Critical Military Base In The Us China Power Struggle

Apr 26, 2025

Geopolitical Stakes Analyzing A Critical Military Base In The Us China Power Struggle

Apr 26, 2025

Latest Posts

-

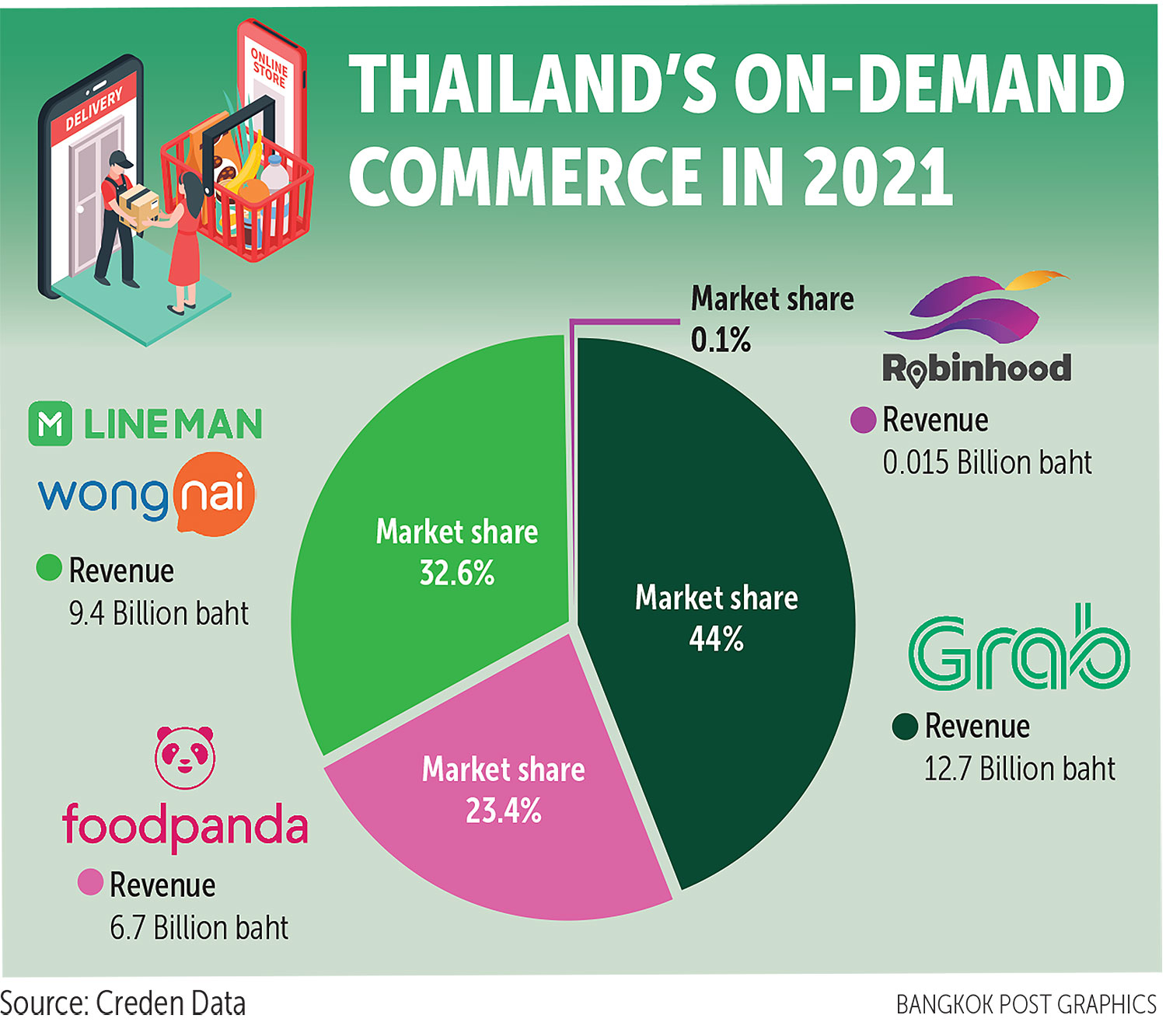

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

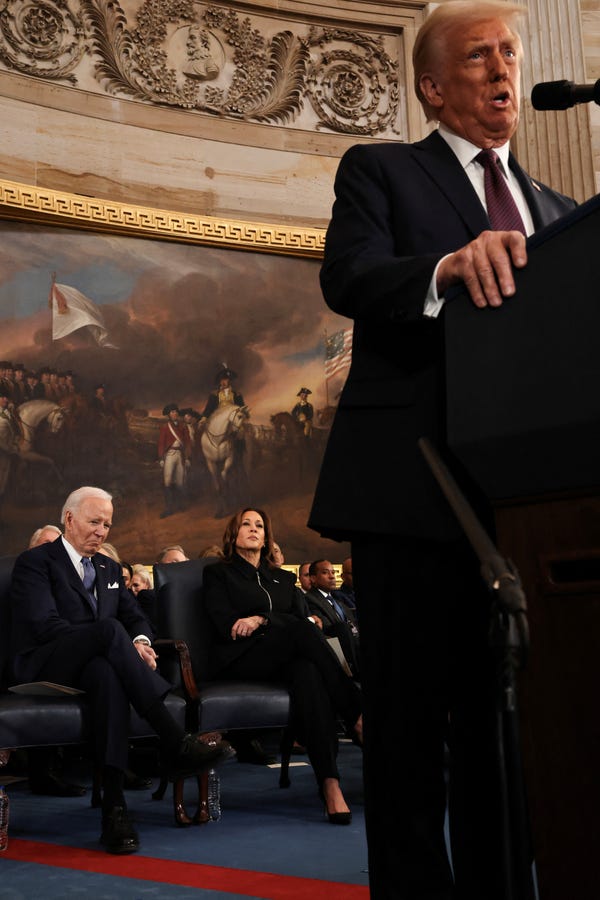

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025