Stock Market Pain: Investors Brace For Further Losses

Table of Contents

Inflation's Grip on Stock Market Performance

Rising inflation is a significant driver of the current Stock Market Pain. The direct correlation between inflation and decreased stock market valuations is undeniable. Inflation erodes purchasing power, impacting corporate profits and, consequently, investor confidence. As the cost of goods and services increases, consumers have less disposable income, leading to decreased demand and impacting corporate revenue.

- Increased production costs: Businesses face escalating costs for raw materials, labor, and energy, forcing them to raise prices, further fueling inflation.

- Reduced consumer spending: Higher prices lead to reduced consumer spending, impacting sales and profits across various sectors.

- Central bank responses: Central banks, attempting to curb inflation, implement interest rate hikes, which often have a negative impact on economic growth and stock market valuations. These hikes increase borrowing costs, making expansion and investment more difficult for businesses.

Rising Interest Rates and Their Impact

Central banks' aggressive interest rate hikes to combat inflation are exacerbating Stock Market Pain. These hikes significantly increase borrowing costs for businesses, impacting their ability to invest and expand. This directly affects corporate profitability and future growth prospects. Furthermore, higher interest rates make bonds more attractive to investors compared to stocks, as they offer higher yields with less risk.

- Higher borrowing costs for companies: Increased borrowing costs reduce profitability and hinder growth initiatives, impacting stock prices.

- Reduced corporate investment and expansion: Businesses postpone or cancel expansion plans due to the higher cost of capital, impacting economic growth and the overall market.

- Shift in investor preference towards bonds: Higher bond yields make them a more appealing alternative to stocks, diverting investment away from the equity market.

Geopolitical Instability and Market Volatility

Geopolitical instability is another major contributor to Stock Market Pain. Global conflicts and political uncertainty significantly impact investor sentiment, creating market volatility and triggering sell-offs. Unpredictable geopolitical events introduce significant risks, leading investors to seek safer havens for their investments.

- Supply chain disruptions: Conflicts and political instability can disrupt global supply chains, leading to shortages and price increases.

- Increased commodity prices: Geopolitical tensions often lead to increased demand and prices for essential commodities like oil and gas, impacting inflation and corporate profits.

- Investor flight to safety: Investors often move their money into safer assets like gold during times of geopolitical uncertainty, further impacting stock prices. This “flight to safety” often exacerbates market downturns.

Recessionary Fears and Their Effect on Stock Prices

Growing recessionary fears significantly contribute to the current Stock Market Pain. Predictions of an economic downturn negatively impact consumer and business confidence, resulting in reduced spending and investment. This decrease in activity leads to lower corporate profits and further stock market declines.

- Reduced consumer spending: Fear of job losses and economic uncertainty causes consumers to reduce spending, further dampening economic growth.

- Decreased corporate profits: Reduced consumer demand and business investment directly translate into lower corporate profits.

- Potential for further job losses: A recession often leads to job losses, further eroding consumer confidence and impacting the stock market.

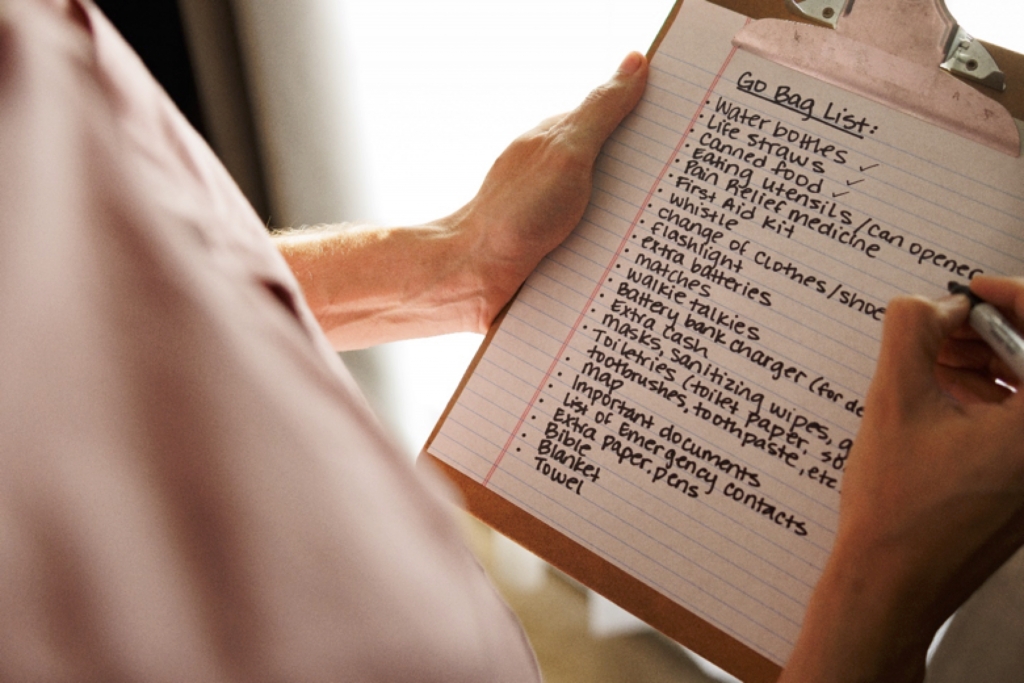

Strategies for Navigating Stock Market Pain

While the current Stock Market Pain is significant, investors can employ strategies to mitigate potential losses and protect their portfolios. Proactive management is crucial during periods of market volatility.

- Diversify your portfolio: Spreading investments across different asset classes reduces the impact of losses in any single sector.

- Rebalance your portfolio regularly: Regular rebalancing ensures that your portfolio aligns with your risk tolerance and investment goals.

- Consider dollar-cost averaging: Investing a fixed amount of money at regular intervals reduces the impact of market fluctuations.

- Consult with a financial advisor: Seeking professional financial advice is crucial for navigating complex market conditions and making informed investment decisions.

Conclusion: Mitigating Stock Market Pain

The current Stock Market Pain is a result of a confluence of factors: high inflation, aggressive interest rate hikes, geopolitical instability, and recessionary fears. Informed decision-making and strategic planning are essential during periods of market volatility. Diversification and robust risk management techniques are crucial for mitigating potential losses. Proactively manage your investments, seek expert advice to navigate this challenging market environment and minimize the impact of the stock market downturn. For further guidance, explore resources on managing investment risk and long-term investment strategies to navigate the current market volatility. Don't let Stock Market Pain paralyze you; take control of your financial future.

Featured Posts

-

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

Revolutionizing Voice Assistant Development Open Ais Latest Tools

Apr 22, 2025

Revolutionizing Voice Assistant Development Open Ais Latest Tools

Apr 22, 2025 -

Wildfire Betting Exploring The Ethics And Implications Of Wagering On Natural Disasters In Los Angeles

Apr 22, 2025

Wildfire Betting Exploring The Ethics And Implications Of Wagering On Natural Disasters In Los Angeles

Apr 22, 2025 -

Is Trumps Trade Policy Undermining Americas Economic Powerhouse Status

Apr 22, 2025

Is Trumps Trade Policy Undermining Americas Economic Powerhouse Status

Apr 22, 2025 -

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Rising Tensions

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Rising Tensions

Apr 22, 2025