Stock Market Rally: Futures Soar After Trump's Comments On Powell

Table of Contents

Trump's Comments and their Market Impact

President Trump's recent comments on Federal Reserve Chairman Jerome Powell and the Federal Reserve's monetary policy sent shockwaves through the financial markets. His statements, characterized by a critical tone toward the Fed's actions, directly impacted investor confidence and risk appetite.

-

Specific quotes from Trump: While exact quotes require referencing specific news sources at the time of publication (for accuracy and to avoid potential misrepresentation), we can say generally that Trump's comments focused on concerns about interest rates and the Fed's perceived slow response to economic indicators. He may have expressed concerns about the pace of rate cuts or the overall direction of monetary policy.

-

Analysis of tone and intent: The tone of Trump's statements was generally critical, expressing dissatisfaction with the Federal Reserve's approach to managing the economy. The intent seemed to be to pressure the Fed into adopting a more expansionary monetary policy.

-

Immediate market reaction: The immediate market reaction was a sharp increase in major indices. Specific stocks within sectors sensitive to interest rate changes, like financials, showed particularly strong gains.

The impact of these comments on investor confidence cannot be overstated. Such pronouncements inject uncertainty into the market, causing increased market volatility. Past instances of similar interventions by the President have resulted in short-term market fluctuations, followed by periods of adjustment. Analyzing the historical context from reputable financial news sources like the Wall Street Journal and Bloomberg provides invaluable insight into how such events influence market behavior.

Analysis of Futures Market Performance

The stock market rally was clearly evident in the futures markets. We saw significant increases across major indices:

-

Percentage increases in key futures indices: The Dow Jones Futures, S&P 500 Futures, and Nasdaq Futures all experienced substantial percentage increases, ranging from [Insert Percentage Ranges Here - replace with actual data at time of publication].

-

Comparison to previous day's closing prices: These increases represented a marked departure from the previous day's closing prices, signaling a significant shift in investor sentiment.

-

Unusual trading volume: It's important to note if there was any unusual increase in trading volume during this period. High trading volume often accompanies significant market movements, indicating heightened investor activity.

[Insert Chart/Graph Here - showing the performance of the key futures indices. Source should be cited.]

The surge in futures contracts strongly predicted the subsequent stock market rally. The magnitude of these increases suggests a strong belief among investors that the market would open significantly higher. Technical analysis of the futures charts could further illuminate the drivers behind these movements.

Impact on Different Sectors and Stocks

The stock market rally did not impact all sectors equally. Certain sectors experienced disproportionately large gains while others remained relatively unaffected or even experienced losses.

-

Specific sectors with significant gains: The technology sector, known for its sensitivity to interest rates and investor confidence, and the financial sector, often benefiting from lower interest rates, generally saw substantial gains.

-

Examples of individual stocks with large price increases: Specific examples of individual stocks (with appropriate disclaimers about not being financial advice) showing significant gains would strengthen this section. These examples should illustrate the impact on specific companies.

-

Sectors that remained relatively unaffected or experienced losses: Some sectors, like those heavily reliant on consumer spending or sensitive to broader economic conditions, may have seen less dramatic gains or even experienced losses depending on the overall market sentiment.

This disparity in performance highlights the sector-specific impact of the stock market rally. The reasons behind these differences often stem from the unique characteristics and sensitivities of each sector to various economic and political factors. Understanding these dynamics is crucial for developing a robust investment strategy.

Potential Long-Term Implications and Investor Strategy

The long-term effects of this stock market rally remain uncertain. The rally's sustainability hinges on several factors, including the Federal Reserve's future policy decisions and the broader economic outlook.

-

Short-term vs. long-term investment strategies: While the short-term gains may be tempting, investors should avoid making rash decisions based solely on short-term political events. A long-term investment strategy focused on fundamental analysis remains crucial.

-

Risks associated with investing based on short-term political events: Investing based on short-term political events involves significant risk. Market reactions can be unpredictable and lead to substantial losses if the initial rally is not sustained.

-

Importance of diversified portfolios to mitigate risk: A well-diversified portfolio, spread across different asset classes and sectors, is essential to mitigate the risks associated with market volatility and unexpected political events.

Investors should adopt a cautious approach, balancing potential opportunities with the inherent risks. Diversification, thorough due diligence, and a long-term perspective are key to successfully navigating this potentially volatile market. Consider consulting a financial advisor for personalized guidance.

Conclusion

President Trump's comments triggered a significant stock market rally, with futures soaring, demonstrating the considerable influence of political statements on investor sentiment and market volatility. The rally's impact was uneven, emphasizing the need for careful consideration of sector-specific dynamics when constructing an investment strategy. Understanding the interplay between political events and market movements is crucial for navigating the complexities of a stock market rally.

Call to Action: Stay informed about ongoing stock market developments and adjust your investment strategy accordingly. Regularly monitor news sources and financial analysis to make informed decisions. Follow our blog for continuous updates and analysis on stock market activity and build a resilient portfolio to navigate future stock market rallies.

Featured Posts

-

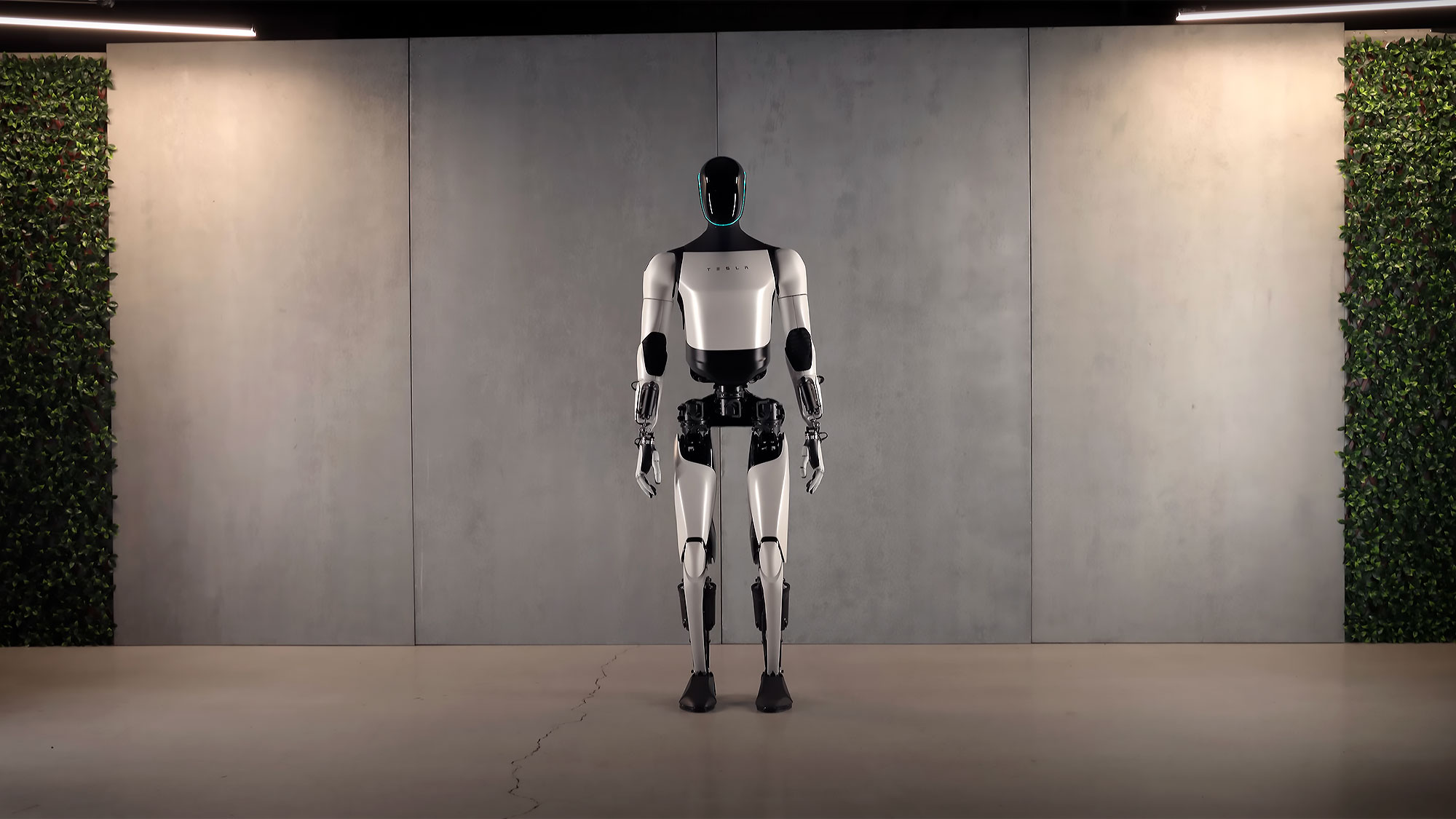

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025 -

Metas Future Under A Trump Administration

Apr 24, 2025

Metas Future Under A Trump Administration

Apr 24, 2025 -

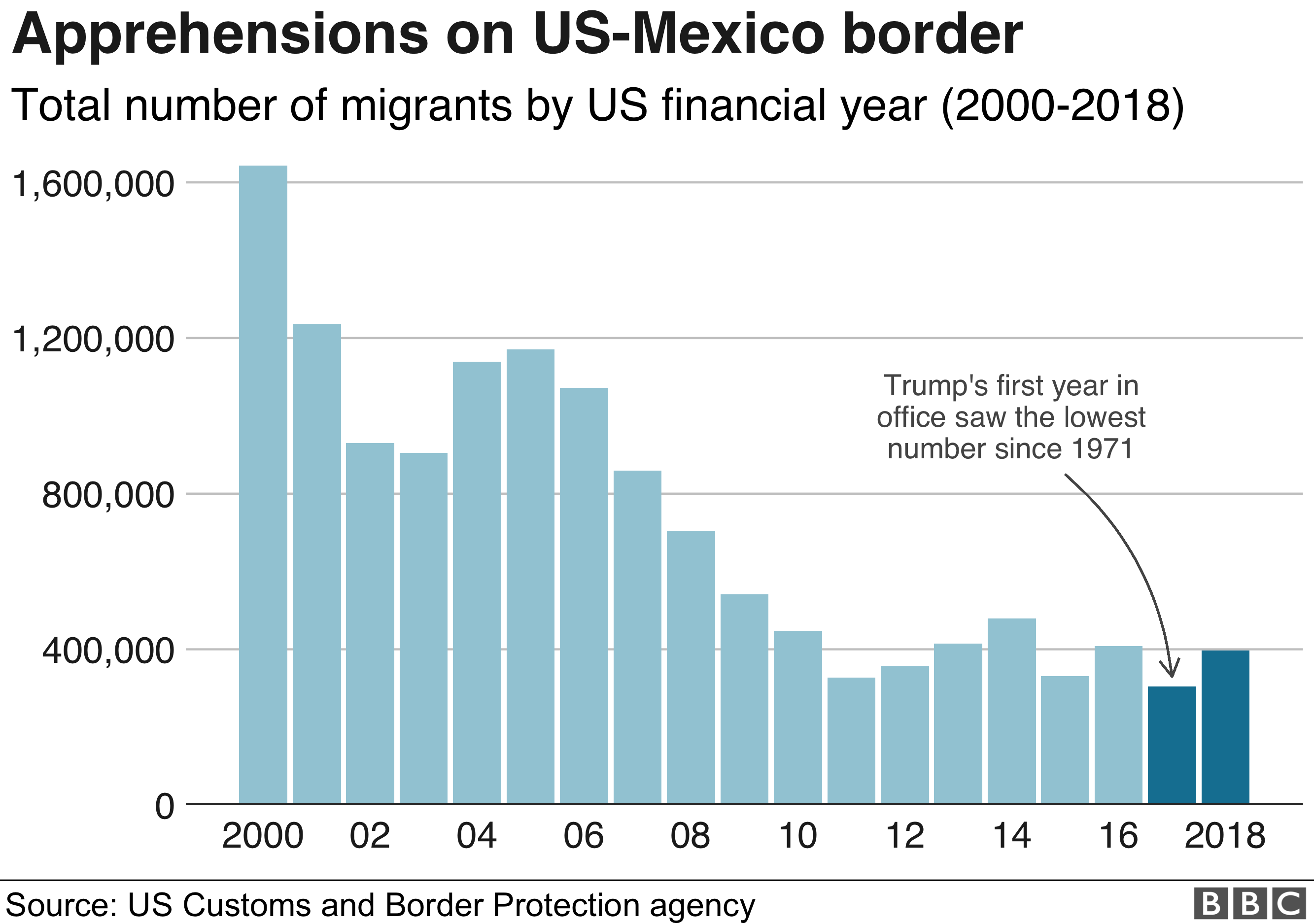

U S Canada Border Crossings Decline White House Data

Apr 24, 2025

U S Canada Border Crossings Decline White House Data

Apr 24, 2025 -

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 24, 2025

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 24, 2025

Latest Posts

-

Office365 Breach Nets Millions Insider Reveals Criminals Tactics

May 10, 2025

Office365 Breach Nets Millions Insider Reveals Criminals Tactics

May 10, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

May 10, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

May 10, 2025 -

Apple Ai Navigating The Crossroads Of Technological Advancement

May 10, 2025

Apple Ai Navigating The Crossroads Of Technological Advancement

May 10, 2025 -

Will Apples Ai Strategy Deliver A Critical Analysis

May 10, 2025

Will Apples Ai Strategy Deliver A Critical Analysis

May 10, 2025 -

Apples Ai Future Innovate Or Fall Behind

May 10, 2025

Apples Ai Future Innovate Or Fall Behind

May 10, 2025