Stock Market Reaction: Analyzing The House Tax Bill's Impact

Table of Contents

Sector-Specific Impacts of the House Tax Bill

The House Tax Bill, with its proposed changes to corporate tax rates, deductions, and incentives, is likely to have a differentiated impact across various economic sectors. Understanding this sectoral analysis is crucial for investors seeking to navigate the potential market shifts. The tax implications vary significantly depending on the industry.

-

Technology: The tech sector, often reliant on R&D tax credits, could see a mixed reaction. Reductions in these credits might negatively impact some companies' profitability, while changes to corporate tax rates could benefit others. The overall impact will depend on the specific details of the bill.

-

Energy: The energy sector, particularly fossil fuel companies, might face challenges with new environmental regulations or increased taxes on carbon emissions potentially included in the bill. Conversely, incentives for renewable energy sources could boost that segment of the sector. This creates a complex scenario requiring careful stock market predictions.

-

Healthcare: Changes to healthcare tax deductions or regulations, if included in the bill, could have a considerable impact on healthcare providers and insurance companies. Analyzing the potential cost shifts is key for assessing their investment strategy.

-

Financials: The financial sector, sensitive to interest rate changes and banking regulations, will closely watch the bill's impact on lending rates and compliance costs. Any alterations to regulatory frameworks will undoubtedly influence this sector's performance.

This sectoral analysis highlights the importance of a diversified investment strategy to mitigate sector-specific risks.

Investor Sentiment and Market Volatility

The House Tax Bill's passage (or failure) will significantly influence investor sentiment and market stability. Uncertainty surrounding the bill's final form and implementation is likely to create market volatility in the short term. Several factors will contribute to this:

-

Uncertainty surrounding the bill's final passage: The legislative process itself introduces uncertainty, causing investors to adopt a wait-and-see approach.

-

Impact on corporate earnings and future growth prospects: The bill's effects on corporate tax rates and deductions will directly impact corporate earnings, leading to revised growth forecasts and potentially influencing investor behavior.

-

Changes in interest rates and their influence on investment decisions: Changes to interest rates, often a consequence of tax policy adjustments, will impact investment decisions and could affect market valuation.

Accurately assessing investor behavior and understanding the drivers of market volatility is critical for risk management. Investors need to carefully perform their own risk assessment and create a stock market forecast based on the best information available.

Long-Term Implications for Stock Market Growth

The long-term impact of the House Tax Bill on stock market growth will depend on its effect on economic fundamentals. Several scenarios are possible:

-

Increased economic growth leading to higher stock valuations: If the bill stimulates economic activity through tax cuts or incentives, it could lead to increased corporate profits and higher stock valuations.

-

Slower economic growth due to increased taxes or uncertainty: Conversely, increased taxes or regulatory uncertainty could dampen economic activity, leading to slower growth and lower stock valuations. This also affects sustainable investing strategies.

-

Impact on foreign investment and capital flows: Changes in the tax code could impact foreign investment and capital flows, affecting the overall performance of the US stock market.

Analyzing these potential scenarios requires a thorough understanding of long-term investment strategies and how market trends are shaped by macroeconomic factors.

Conclusion: Navigating the Stock Market After the House Tax Bill

The House Tax Bill's passage is expected to have a multifaceted impact on the stock market reaction, affecting various sectors differently and causing fluctuations in investor sentiment. Understanding the potential sector-specific impacts, the anticipated market volatility, and the long-term implications for economic growth is crucial. Investors should avoid knee-jerk reactions. Remember to conduct thorough research and develop a diversified investment strategy. Before making any significant investment decisions based on the House Tax Bill, consider consulting with a qualified financial advisor. Analyze the stock market reaction to tax legislation carefully, understand the House Tax Bill's impact on your investments, and effectively navigate the stock market in the face of tax changes.

Featured Posts

-

Flintoffs Story New Documentary Premieres On Disney This Month

May 23, 2025

Flintoffs Story New Documentary Premieres On Disney This Month

May 23, 2025 -

Kevin Pollak Joins Tulsa King Season 3 Trouble For Sylvester Stallone

May 23, 2025

Kevin Pollak Joins Tulsa King Season 3 Trouble For Sylvester Stallone

May 23, 2025 -

International Cricket Summit Zimbabwes Role In The Future Of The Game

May 23, 2025

International Cricket Summit Zimbabwes Role In The Future Of The Game

May 23, 2025 -

Rb Leipzigs Summer Target Erik Ten Hag Transfer News And Analysis

May 23, 2025

Rb Leipzigs Summer Target Erik Ten Hag Transfer News And Analysis

May 23, 2025 -

Harry Maguire Speaks Out After Losing Man Utd Captaincy

May 23, 2025

Harry Maguire Speaks Out After Losing Man Utd Captaincy

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025 -

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

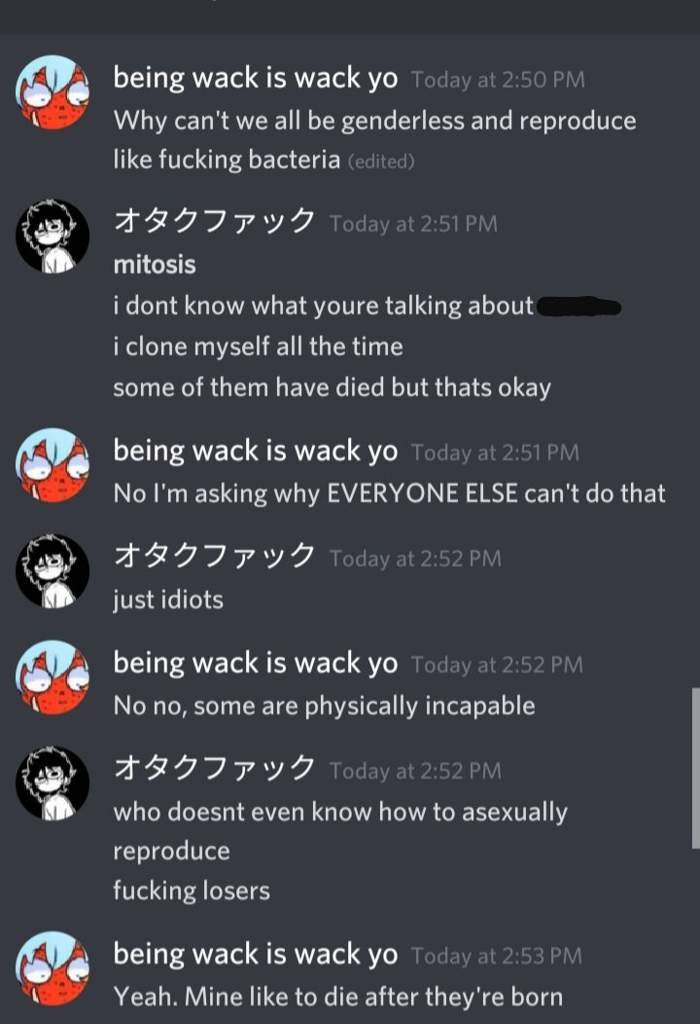

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025