Stock Market Recap: Dow, S&P 500 Performance For May 27

Table of Contents

Dow Jones Industrial Average Performance on May 27

Opening and Closing Values:

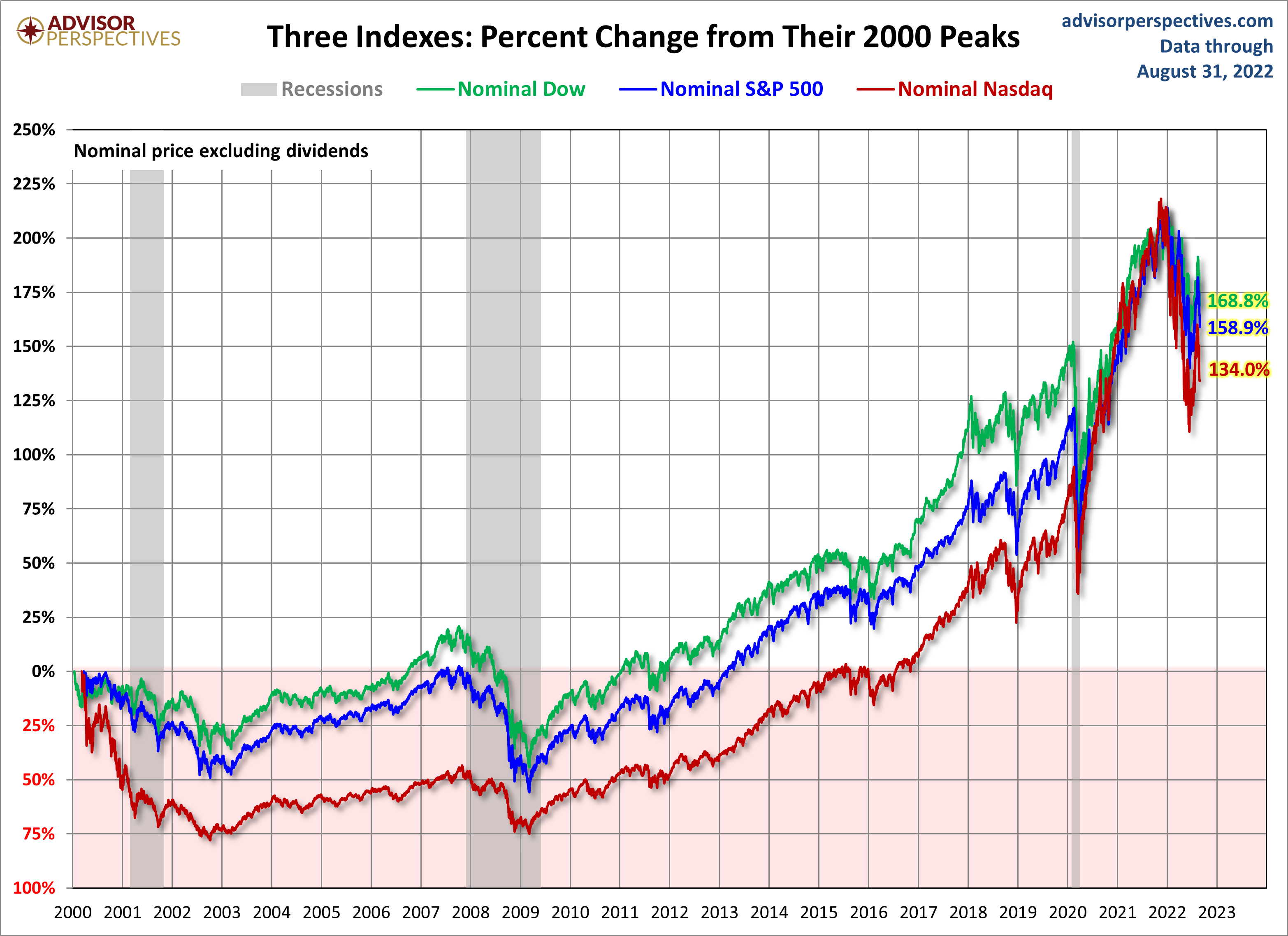

The Dow Jones Industrial Average opened at 33,820.08 on May 27th. By the close of trading, it had experienced a 1.1% decrease, settling at 33,477.35. This negative performance reflects a cautious sentiment among investors. Understanding this percentage change is critical for assessing the day's market performance.

Intraday Volatility:

Throughout the day, the Dow experienced considerable volatility. It reached an intraday high of 33,910.22 and a low of 33,400.15, showcasing the significant swings in investor sentiment. This intraday volatility underscores the importance of monitoring market movements throughout the trading day, rather than solely relying on opening and closing values for stock market analysis.

Key Factors Influencing Dow Performance:

Several factors contributed to the Dow's negative performance on May 27th:

- Inflation Concerns: Persistent inflation concerns, fueled by recent economic data releases, weighed heavily on investor sentiment. The market reacted negatively to anxieties about the Federal Reserve's potential response to rising inflation. Keywords like "inflation rate" and "interest rate hikes" were trending among financial news sources throughout the day.

- Tech Sector Weakness: Weakness in the technology sector, a significant component of the Dow, pulled down the overall index. Several prominent tech companies experienced declines, exacerbating the negative market trend. The overall market performance was noticeably impacted by this sector's underperformance.

- Geopolitical Uncertainty: Ongoing geopolitical tensions added to the overall market uncertainty. International events frequently contribute to stock market volatility, impacting investor confidence and investment strategies.

S&P 500 Index Performance on May 27

Opening and Closing Values:

The S&P 500 index opened at 4,196.75 on May 27th. It closed at 4,167.70, reflecting a decrease of 0.7%. This negative performance mirrors the Dow's trend, indicating a broader market downturn. Comparing the percentage change between the Dow and the S&P 500 offers valuable insights into the overall market sentiment.

Sector Performance:

Sectoral performance within the S&P 500 was mixed. While the technology sector underperformed, the energy sector saw modest gains, driven by rising oil prices. Healthcare and consumer staples also showed some resilience, showcasing the varying responses of different sectors to overall market trends. Examining sector-specific performance reveals opportunities and risks within a diverse investment portfolio.

Key Factors Influencing S&P 500 Performance:

The S&P 500's decline on May 27th was influenced by several factors, many overlapping with those affecting the Dow:

- Interest Rate Expectations: Market participants are carefully assessing the Federal Reserve's likely response to inflation. The anticipation of potential interest rate hikes continues to influence investor decisions and contributes to market volatility. Market sentiment is highly sensitive to interest rate changes.

- Earnings Reports: Several companies released earnings reports on May 27th, with mixed results. Disappointing earnings from some major companies contributed to the overall negative market sentiment. Understanding the impact of earnings releases requires close monitoring of individual company performance.

- Global Economic Outlook: Concerns about the global economic outlook, particularly regarding potential slowdowns in key economies, added to the overall cautious market sentiment. This underscores the interconnectedness of global markets and the influence of international economic conditions on domestic market performance.

Conclusion: Stock Market Recap: Key Takeaways and Future Outlook

In summary, May 27th saw a decline in both the Dow Jones Industrial Average and the S&P 500, driven by a combination of inflation concerns, interest rate expectations, sector-specific weakness, and geopolitical uncertainty. The overall market trend was negative, indicating a cautious investor outlook. This stock market recap highlights the importance of diversified investment strategies and the need for constant market monitoring.

For investors, understanding these market movements is crucial for making informed decisions. To stay ahead of the curve and gain valuable insights into daily stock market fluctuations, regularly check back for future "Stock Market Recaps" – we provide up-to-date analysis and insights into Dow and S&P 500 performance. [Consider adding a link to a relevant subscription or newsletter here]

Featured Posts

-

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025 -

Could Rayan Cherki Join Liverpool This Summer Scouting Report

May 28, 2025

Could Rayan Cherki Join Liverpool This Summer Scouting Report

May 28, 2025 -

Hujan Di Bandung Pukul 1 Siang Cek Prakiraan Cuaca Jawa Barat 22 April

May 28, 2025

Hujan Di Bandung Pukul 1 Siang Cek Prakiraan Cuaca Jawa Barat 22 April

May 28, 2025 -

Is Kanye West Moving On New Romance Rumors Surface

May 28, 2025

Is Kanye West Moving On New Romance Rumors Surface

May 28, 2025 -

Via Rail Facing Potential Strike Union Members Authorize Walkout

May 28, 2025

Via Rail Facing Potential Strike Union Members Authorize Walkout

May 28, 2025