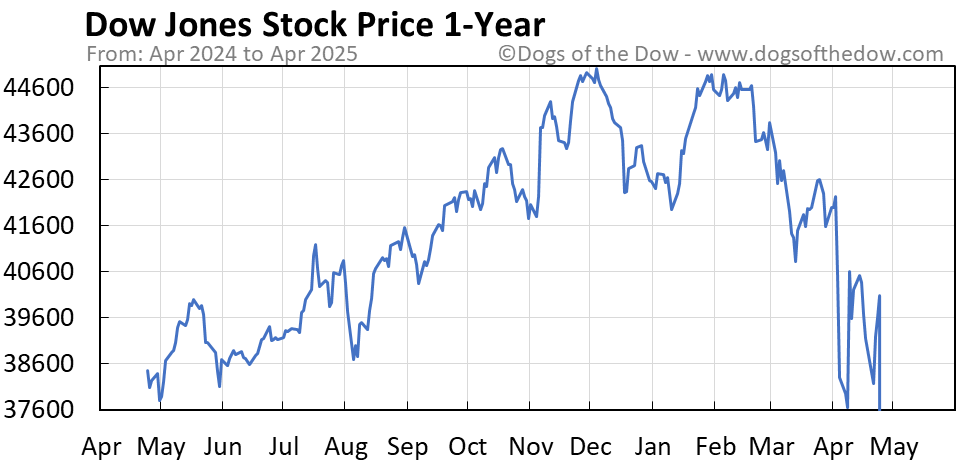

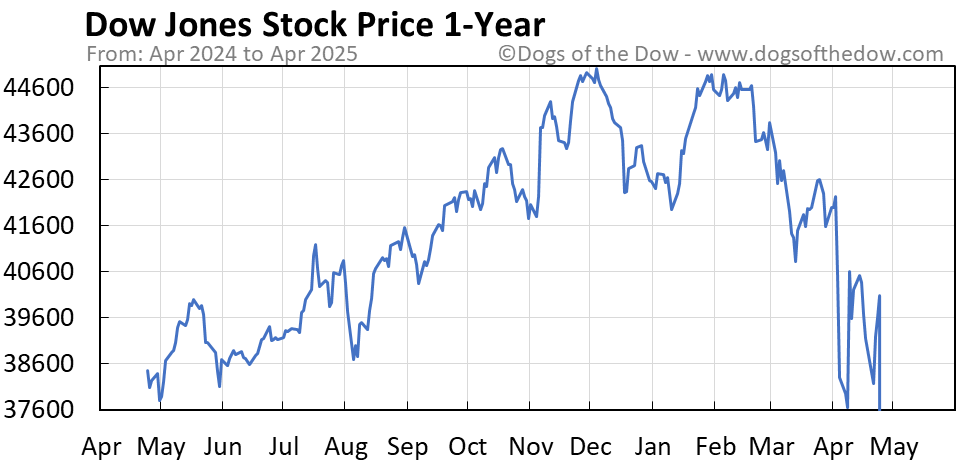

Stock Market Today: Dow Futures Up, Strong Week Ahead?

Table of Contents

Analyzing Dow Futures and Their Implications

Dow Jones futures contracts are derivative instruments that track the expected performance of the Dow Jones Industrial Average. They are frequently used as a predictor of the stock market's direction at the opening bell. Analyzing Dow futures requires understanding both technical and fundamental analysis. While they offer a glimpse into potential market movement, they aren't a foolproof crystal ball.

-

How Dow Futures Contracts are Traded: Dow futures are traded on exchanges like the CME Group, allowing investors to speculate on the future value of the Dow Jones Industrial Average without directly owning the underlying stocks.

-

Factors Influencing Dow Futures Prices: Numerous factors influence Dow futures prices, including global economic events, US economic data releases (like inflation reports), geopolitical tensions, and even investor sentiment based on news and social media trends. Unexpected events, such as significant corporate announcements or natural disasters, can also cause significant price fluctuations.

-

Dow Futures Accuracy: While Dow futures often correlate with the actual market opening, there are instances where the correlation breaks down. For example, overnight news or significant pre-market events can drastically alter the market opening, deviating from the prediction made by futures contracts.

-

Alternative Indicators: Investors should never rely solely on Dow futures. Other indicators, such as the VIX volatility index (a measure of market fear), the breadth of the market (the number of stocks advancing versus declining), and other technical indicators should be considered for a more holistic market outlook.

Key Economic Indicators and Their Influence

Economic data releases significantly influence the stock market's trajectory. This week, investors will be closely watching key indicators like inflation reports, employment figures (specifically the unemployment rate), and GDP growth data. These data points directly impact investor confidence and, subsequently, stock prices.

-

Recent Economic Data Impact: Recent data suggesting a slowdown in inflation has been generally positive for the market, boosting investor sentiment. However, persistent concerns about interest rate hikes by the Federal Reserve remain a potential headwind.

-

Expected Economic Data Releases: The upcoming release of the Consumer Price Index (CPI) report will be closely scrutinized. Any surprises, either positively or negatively, could trigger significant market reactions.

-

Geopolitical Influence: Geopolitical events, such as international conflicts or trade disputes, can also dramatically influence market volatility and investor behavior.

Sector-Specific Performance and Opportunities

Analyzing sector-specific performance is crucial for developing effective investment strategies. Some sectors are inherently more sensitive to economic changes than others.

-

Recent Sector Performance: Recently, the technology sector has shown some strength, while the energy sector has experienced mixed performance depending on global oil prices. The healthcare sector often performs relatively well during periods of economic uncertainty.

-

Catalysts for Growth: Certain sectors may experience accelerated growth based on specific catalysts. For example, advancements in artificial intelligence could fuel growth in the technology sector, while increasing demand for renewable energy could benefit the green energy sector.

-

Promising Investment Opportunities: Identifying promising investment opportunities requires careful analysis of individual company performance within specific sectors. A combination of fundamental and technical analysis is essential for making informed investment decisions.

Potential Risks and Challenges

While Dow futures suggest a potentially strong week, several risks and challenges could impact this positive trajectory. A realistic perspective necessitates acknowledging these potential headwinds.

-

Geopolitical Risks: Escalation of geopolitical tensions or unforeseen international events could trigger market sell-offs.

-

Economic Uncertainty: Lingering concerns about inflation, interest rates, and potential recessions can negatively impact investor sentiment.

-

Unforeseen Events: Unexpected events, such as major corporate scandals or natural disasters, can create significant market volatility and disrupt the current positive trend.

Conclusion

The stock market today shows a mixed picture. While Dow futures suggest a positive start to the week, analyzing key economic indicators, sector-specific performances, and acknowledging potential risks are crucial for investors. Staying informed about the latest economic data releases and geopolitical developments is paramount for effective investment decision-making. The positive outlook indicated by Dow futures should be considered alongside potential headwinds to develop a comprehensive and realistic market outlook.

Stay informed about the evolving "Stock Market Today" and its potential trajectory. Keep checking back for daily updates and insightful analysis to help you navigate the complexities of the market.

Featured Posts

-

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025 -

How Trumps Presidency Unexpectedly Shaped The Canadian Election Landscape

Apr 26, 2025

How Trumps Presidency Unexpectedly Shaped The Canadian Election Landscape

Apr 26, 2025 -

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025 -

King Announces Early Start To Birthday Celebrations

Apr 26, 2025

King Announces Early Start To Birthday Celebrations

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And Falsehoods

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And Falsehoods

Apr 26, 2025

Latest Posts

-

Bert Kreischers Netflix Stand Up A Look At His Marriage And Material

May 10, 2025

Bert Kreischers Netflix Stand Up A Look At His Marriage And Material

May 10, 2025 -

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025 -

Bert Kreischer And His Wife Navigating The Netflix Comedy Special

May 10, 2025

Bert Kreischer And His Wife Navigating The Netflix Comedy Special

May 10, 2025 -

Court Documents Detail Womans Unprovoked Racist Stabbing

May 10, 2025

Court Documents Detail Womans Unprovoked Racist Stabbing

May 10, 2025 -

Investigation Underway Womans Racist Stabbing Leaves Man Dead

May 10, 2025

Investigation Underway Womans Racist Stabbing Leaves Man Dead

May 10, 2025