Stock Market Update: Analyzing Dow Futures In Light Of China's Economic Measures

Table of Contents

China's Economic Measures and Their Global Impact

China's economic policies significantly impact global markets, and recent measures have introduced considerable volatility. Understanding these shifts is paramount for interpreting Dow Futures movements.

Recent Policy Changes in China

The Chinese government has implemented several key economic measures recently, aiming to stabilize growth and address various challenges. These include:

- Interest Rate Adjustments: Recent cuts in interest rates aim to stimulate borrowing and investment, potentially boosting economic activity. However, this could also lead to inflationary pressures in the long term.

- Stimulus Packages: Targeted stimulus packages focusing on infrastructure development and technological innovation have been announced. The effectiveness of these measures in driving sustainable growth remains to be seen.

- Regulatory Changes: New regulations impacting specific sectors, such as technology and real estate, have introduced uncertainty and affected investor confidence. These changes aim to curb monopolistic practices and promote fair competition.

These policy changes have both short-term and long-term implications. Short-term effects might include increased economic activity and improved market sentiment. However, long-term consequences could include higher inflation or slower, less sustainable growth if not managed carefully. The impact extends globally, affecting supply chains and trade relationships worldwide.

Analyzing the Sentiment Surrounding China's Economy

Investor sentiment regarding China's economy is currently mixed. News and analysis surrounding these measures have created uncertainty in the market. Key indicators reflecting this sentiment include:

- Stock Market Indices in China: Fluctuations in major Chinese stock market indices reflect the shifting confidence among investors. A decline in these indices often signals negative sentiment.

- Analyst Opinions and Predictions: Analyst predictions regarding China's economic growth vary considerably, reflecting the uncertainty surrounding the effectiveness of the implemented measures.

- Credit Ratings: Credit rating agencies are carefully monitoring China's economic performance and adjusting their ratings accordingly, further influencing global investor perceptions. Any downgrade could trigger further market volatility. The prevailing uncertainty and risk factors surrounding China's economic outlook significantly influence global market sentiment.

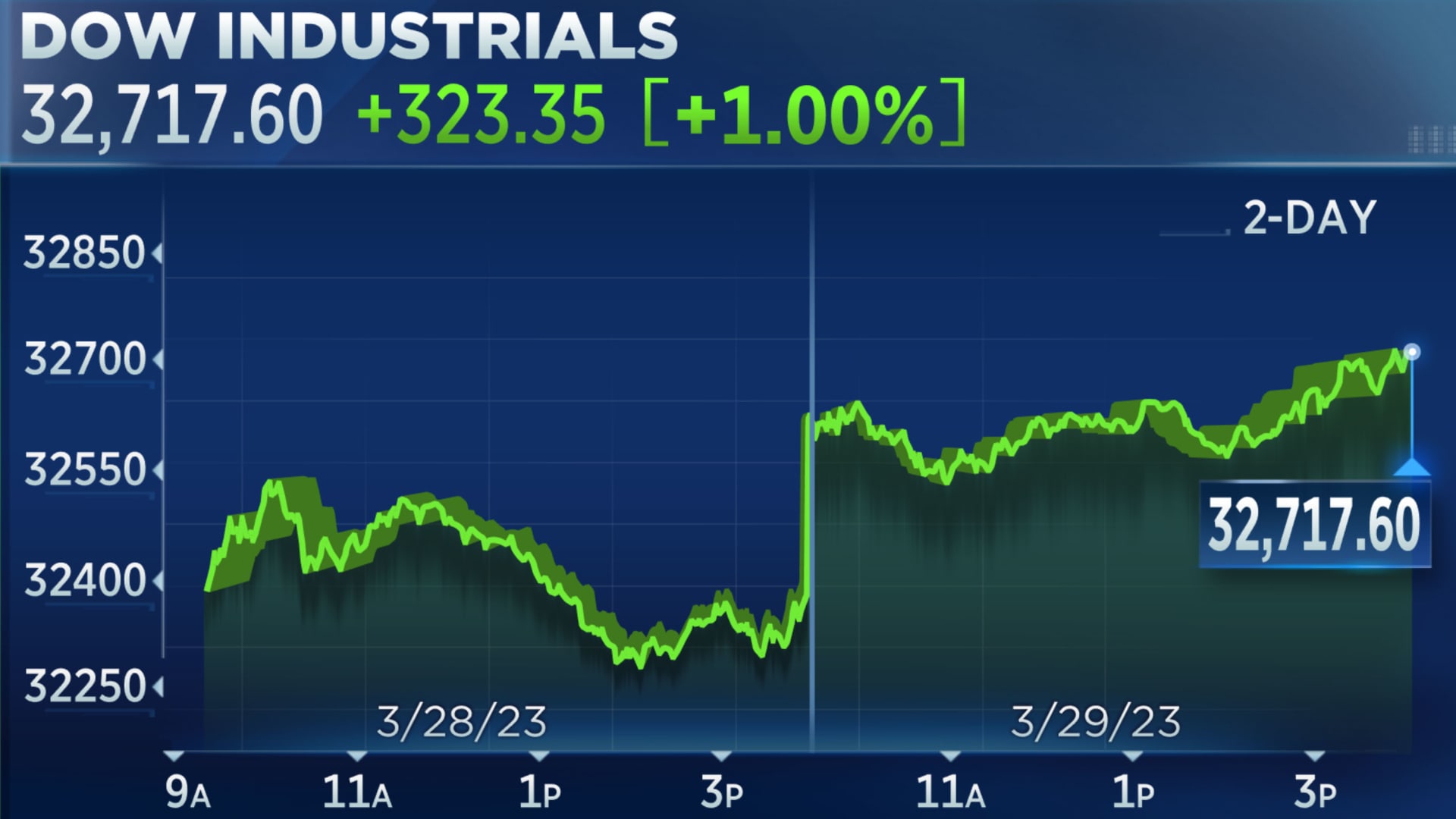

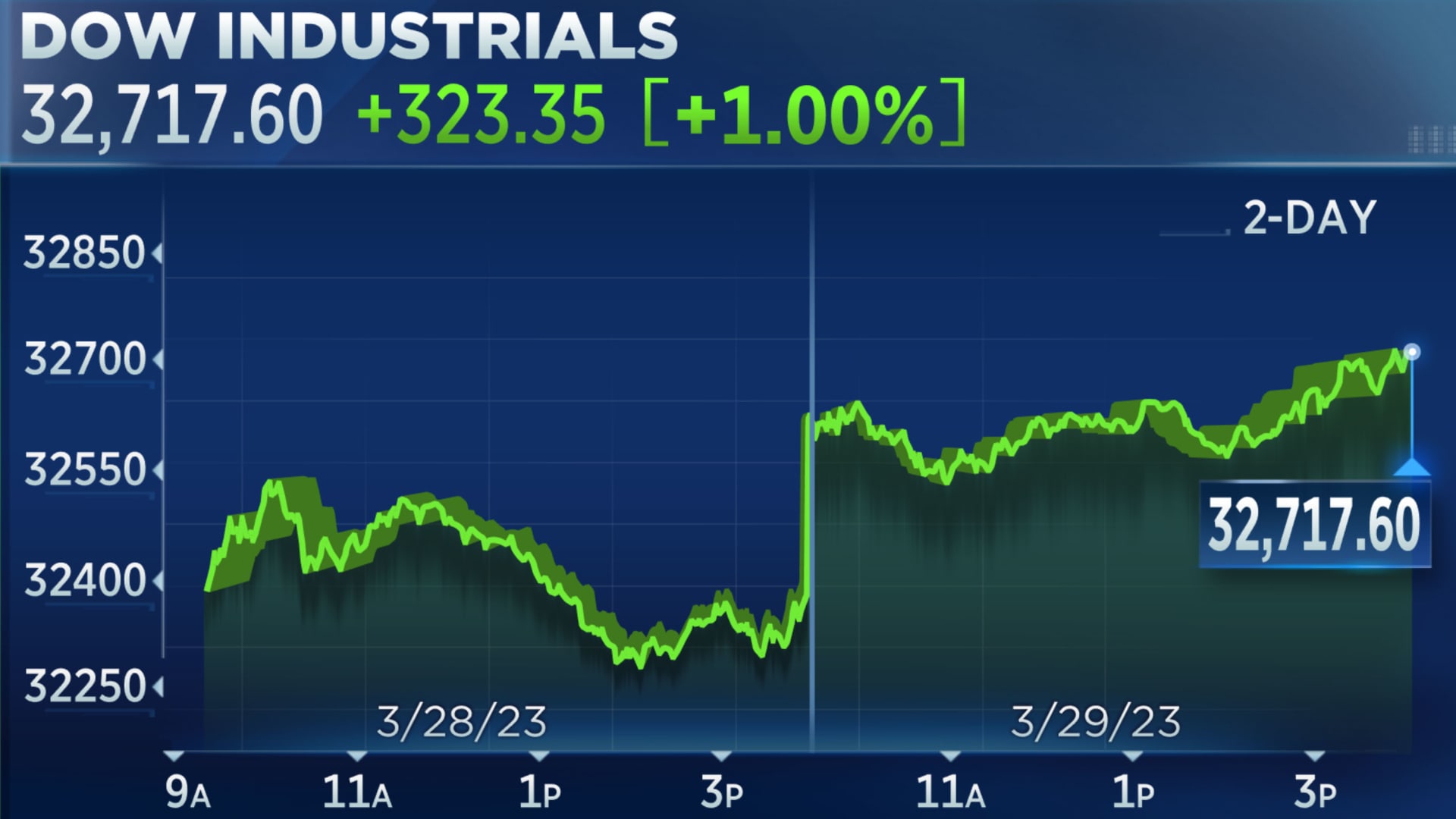

Dow Futures' Response to China's Actions

The relationship between Dow Futures and Chinese economic indicators is complex and not always directly proportional. However, significant events in China often trigger reactions in the US markets.

Correlation Between Dow Futures and Chinese Economic Indicators

Historically, there has been a degree of correlation between Dow Futures performance and key Chinese economic indicators, though the strength of this correlation varies over time. Periods of strong Chinese economic growth have often coincided with positive movements in Dow Futures, while negative economic news from China has sometimes led to declines.

- Past Instances: Past examples include instances where significant economic slowdowns in China have triggered sell-offs in US equities, impacting Dow Futures.

- Mechanisms of Influence: China's influence on US markets is multifaceted. It operates through trade relationships, supply chain connections, and investor sentiment. Negative news from China can impact investor confidence globally, affecting US markets.

- Current Correlation: Analyzing recent data allows us to assess the current correlation. While there's no perfect one-to-one relationship, shifts in Chinese economic data frequently correlate with changes in Dow Futures.

Predicting Future Dow Futures Movement Based on Current Trends

Predicting the future movement of Dow Futures is inherently challenging. However, considering the current economic climate and China's policy shifts, several scenarios are possible:

- Upward Trend: Successful implementation of stimulus packages and a rebound in Chinese economic activity could lead to an upward trend in Dow Futures.

- Downward Trend: Further economic challenges in China, combined with negative global events, could trigger a downward trend.

- Sideways Movement: A period of sideways movement (consolidation) is also possible if the positive and negative factors balance each other out.

Factors influencing the future trajectory include geopolitical events and US economic data releases. Significant volatility is expected given the current uncertainties.

Investment Strategies in Light of Current Market Conditions

Navigating volatile markets requires careful planning and risk management.

Managing Risk in Volatile Markets

During periods of uncertainty, adopting a cautious approach is vital. Effective strategies include:

- Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Hedging Strategies: Employing hedging strategies, such as using options or futures contracts, can mitigate potential losses.

- Long-Term Perspective: Maintaining a long-term investment horizon and avoiding impulsive reactions to short-term market fluctuations is crucial.

Opportunities and Potential Pitfalls

This analysis highlights potential investment opportunities and risks. Thorough research and professional financial advice are essential.

- Affected Sectors: Certain sectors might be disproportionately affected by China's economic measures. Careful analysis of sector-specific risks and opportunities is necessary.

- Staying Informed: Staying informed about market developments and global economic trends is paramount for making sound investment decisions.

- Limitations: This analysis offers a general overview, and personalized investment advice from qualified professionals is crucial.

Conclusion: Stock Market Update: Key Takeaways and Call to Action

China's economic measures have a significant impact on Dow Futures, though the correlation is not always straightforward. The current uncertainty necessitates careful risk management and diversification. Opportunities and pitfalls exist, highlighting the need for thorough research and professional financial guidance. Stay updated on the latest developments regarding China's economic policies and their effect on Dow Futures. Regularly review your investment strategy in light of these impactful global events, focusing on a comprehensive Dow Futures analysis and a thorough understanding of the China economic outlook.

Featured Posts

-

Jorgenson Defends Paris Nice Victory

Apr 26, 2025

Jorgenson Defends Paris Nice Victory

Apr 26, 2025 -

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025 -

Chelsea Handlers Whistler Trip Unexpected Star Joins The Fun

Apr 26, 2025

Chelsea Handlers Whistler Trip Unexpected Star Joins The Fun

Apr 26, 2025 -

Turning Poop Into Prose An Ai Powered Podcast From Mundane Documents

Apr 26, 2025

Turning Poop Into Prose An Ai Powered Podcast From Mundane Documents

Apr 26, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025