Stock Market Update: Dow Futures Rise, Positive Week End In Sight

Table of Contents

Dow Futures Surge: A Leading Indicator

Dow futures contracts act as a significant predictor of overall market trends. They represent agreements to buy or sell the Dow Jones Industrial Average at a future date. A surge in Dow futures often foreshadows a positive opening for the broader market. Today, we've seen a notable increase, suggesting a bullish start to the week. The Dow futures are up by [Insert Percentage Increase Here]%, a significant indicator of potential market gains.

- High Trading Volume: The volume of futures contracts traded today was exceptionally high, further reinforcing the strength of this upward trend. This signifies strong investor interest and confidence.

- Positive Economic Data: The recent release of positive economic data, including [mention specific data like strong GDP growth or positive consumer confidence numbers], likely contributed to the increase in futures prices. This positive news boosted investor sentiment.

- Technical Analysis: Technically, the Dow futures have broken through key resistance levels, suggesting further upward potential. Support levels at [Insert Support Level] appear to be holding strong, providing a cushion against potential downward pressure.

Positive Economic Indicators Fueling the Rally

Recent economic data releases paint a generally optimistic picture, fueling the current market rally. Stronger-than-expected GDP growth, coupled with moderating inflation and stable unemployment figures, are key factors driving investor confidence. This positive economic backdrop encourages investment and fuels market growth.

- Key Positive Data Points:

- GDP growth exceeding expectations at [Insert Percentage/Value].

- Inflation rate slightly decreased to [Insert Percentage/Value].

- Unemployment rate remained stable at [Insert Percentage/Value].

- Sectoral Impact: These positive economic indicators are having a broad, positive impact across various market sectors. Consumer discretionary stocks, for example, are benefiting from increased consumer spending, while industrials are seeing a boost from increased business activity.

- Source Verification: You can verify this information via official government sources such as the Bureau of Economic Analysis (BEA) [link to BEA website] and the Bureau of Labor Statistics (BLS) [link to BLS website].

Sector-Specific Performance: Winners and Losers

While the overall market shows positive momentum, individual sectors are experiencing varying degrees of success. Let's examine the key performers and underperformers.

- Top Performing Sectors:

- Technology: [Insert Percentage Change] – Driven by strong earnings reports and continued technological innovation.

- Energy: [Insert Percentage Change] – Benefiting from sustained high energy prices.

- Financials: [Insert Percentage Change] – Responding positively to rising interest rates.

- Underperforming Sectors:

- Utilities: [Insert Percentage Change] – Often less volatile, these sectors may see slower growth during periods of strong market gains.

- Real Estate: [Insert Percentage Change] – Potentially impacted by rising interest rates.

- Investment Opportunities: The strong performance of the technology and energy sectors presents potential investment opportunities for those with a higher risk tolerance. However, thorough research and diversification are crucial.

Technology Sector's Continued Strength

The technology sector continues to be a significant driver of market growth. Strong earnings from major tech companies and continued innovation in areas like artificial intelligence and cloud computing are contributing factors. Specific companies like [mention specific company examples and their performance] are leading the charge.

Potential Risks and Challenges

Despite the current positive momentum, several potential risks and challenges could impact the market. It's crucial to acknowledge these factors and incorporate them into your investment strategy.

-

Geopolitical Risks: Ongoing geopolitical tensions could trigger market volatility.

-

Inflationary Pressures: Although inflation is moderating, persistent inflationary pressures could dampen economic growth.

-

Interest Rate Hikes: Further interest rate hikes by central banks could negatively affect certain sectors.

-

Risk Mitigation Strategies: Diversification of your investment portfolio, careful risk assessment, and a long-term investment horizon can help mitigate these risks.

Conclusion

This Stock Market Update highlights the positive momentum in the market, driven by rising Dow futures and encouraging economic indicators. While potential risks remain, the overall outlook appears optimistic for the week ahead. The strong performance of certain sectors, particularly technology, offers potential investment opportunities. However, remember to always conduct your own thorough research before making any investment decisions.

Call to Action: Stay informed with our regular Stock Market Updates to make well-informed investment decisions. Follow us for the latest news and analysis on your portfolio's performance and the overall market trends. Don't miss out on crucial Stock Market Updates – subscribe now!

Featured Posts

-

Newsom Under Fire Dave Portnoys Harsh Critique

Apr 26, 2025

Newsom Under Fire Dave Portnoys Harsh Critique

Apr 26, 2025 -

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025 -

Galerie Le Labo Du 8 Decouvrez L Exposition Photo De Pierre Terrasson

Apr 26, 2025

Galerie Le Labo Du 8 Decouvrez L Exposition Photo De Pierre Terrasson

Apr 26, 2025 -

Ajax And Az Enhanced Security Protocols In Place For The Match

Apr 26, 2025

Ajax And Az Enhanced Security Protocols In Place For The Match

Apr 26, 2025 -

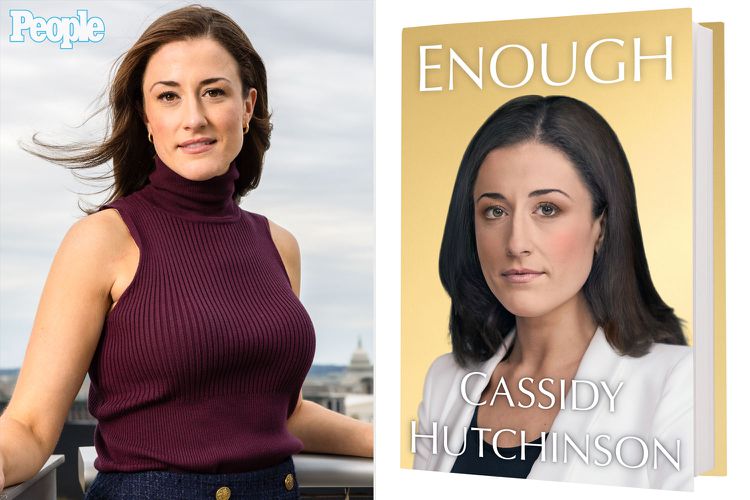

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 26, 2025

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 26, 2025

Latest Posts

-

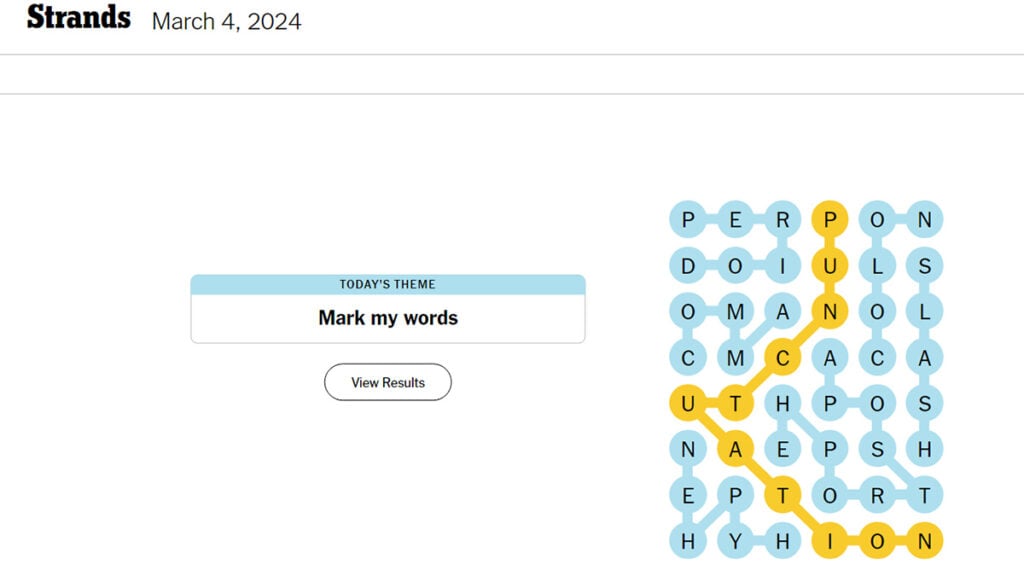

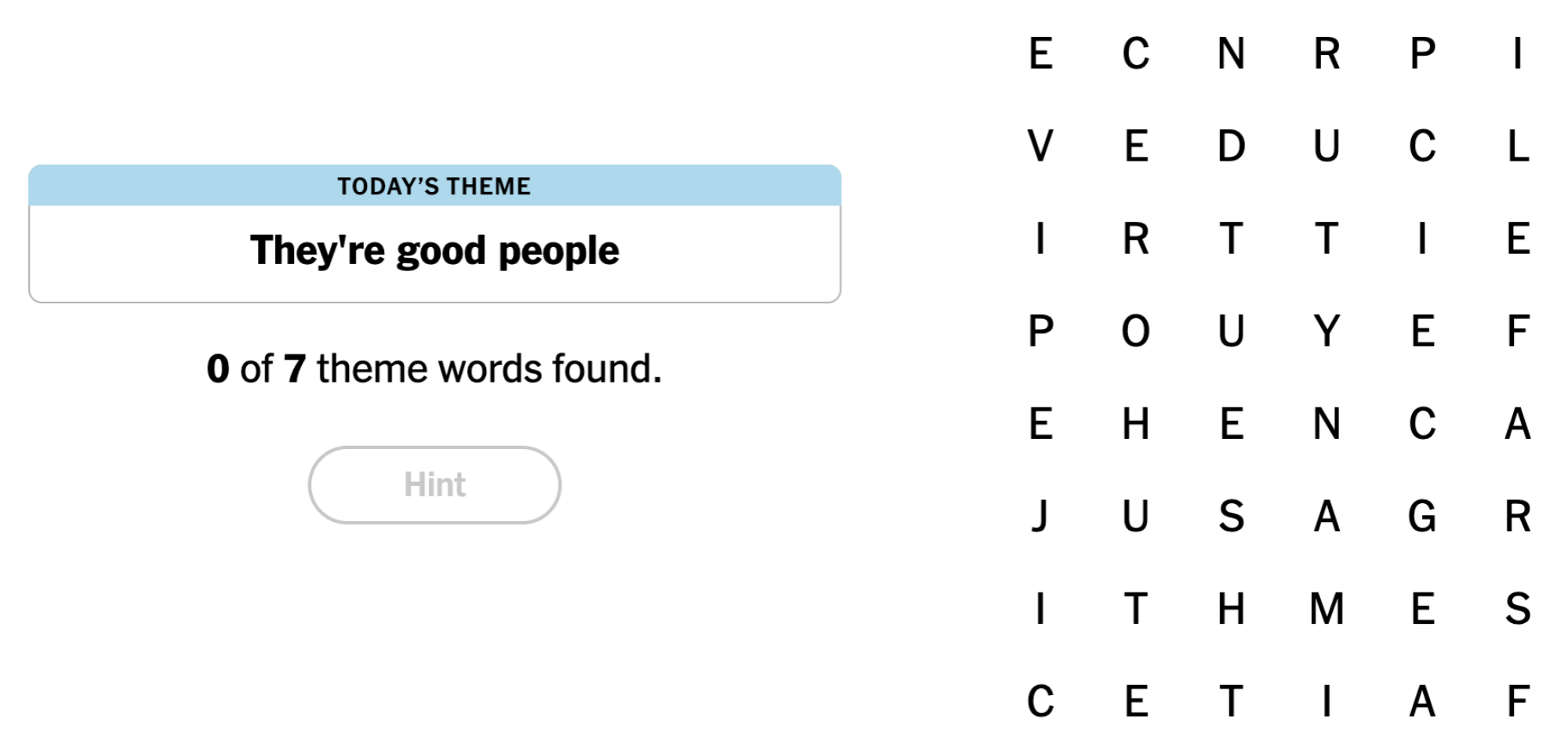

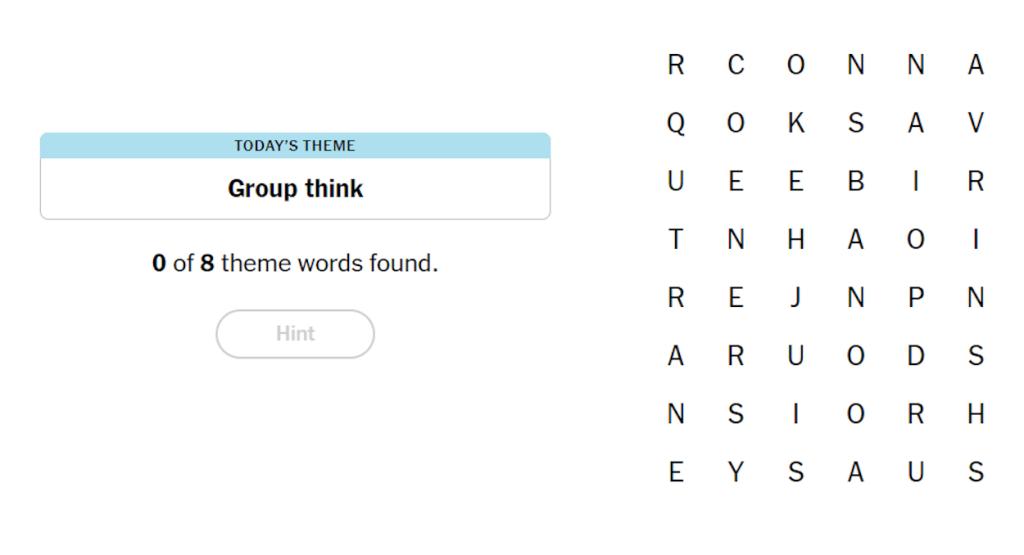

Thursday April 10th Nyt Strands Answers Game 403

May 09, 2025

Thursday April 10th Nyt Strands Answers Game 403

May 09, 2025 -

Nyt Strands Solutions For Saturday April 12th 2024 Game 405

May 09, 2025

Nyt Strands Solutions For Saturday April 12th 2024 Game 405

May 09, 2025 -

Nyt Strands April 10th Game 403 Complete Solution Guide

May 09, 2025

Nyt Strands April 10th Game 403 Complete Solution Guide

May 09, 2025 -

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram Solution

May 09, 2025

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram Solution

May 09, 2025 -

Nyt Strands Today April 4 2025 Clues And Solutions

May 09, 2025

Nyt Strands Today April 4 2025 Clues And Solutions

May 09, 2025