Stock Market Update: Sensex, Nifty Rally - All Sectors In Green

Table of Contents

Sensex and Nifty Surge: A Detailed Analysis

Sensex Gains:

The Sensex soared by 450 points (2.25%), closing at 20,500 (example figures). This represents a significant jump compared to yesterday's closing and marks a strong upward trend over the past week. This surge can be attributed to several key factors, reflecting both domestic strength and positive global cues.

- Strong Q3 earnings reports: Many leading companies released robust Q3 earnings, exceeding market expectations and boosting investor confidence.

- Positive investor sentiment: A generally optimistic outlook on the Indian economy fueled increased buying activity.

- Foreign Institutional Investor (FII) inflows: Significant inflows from foreign investors injected further liquidity into the market.

- Government policy announcements: Recent positive government policy announcements related to infrastructure and economic reforms contributed to the bullish sentiment.

Nifty's Impressive Performance:

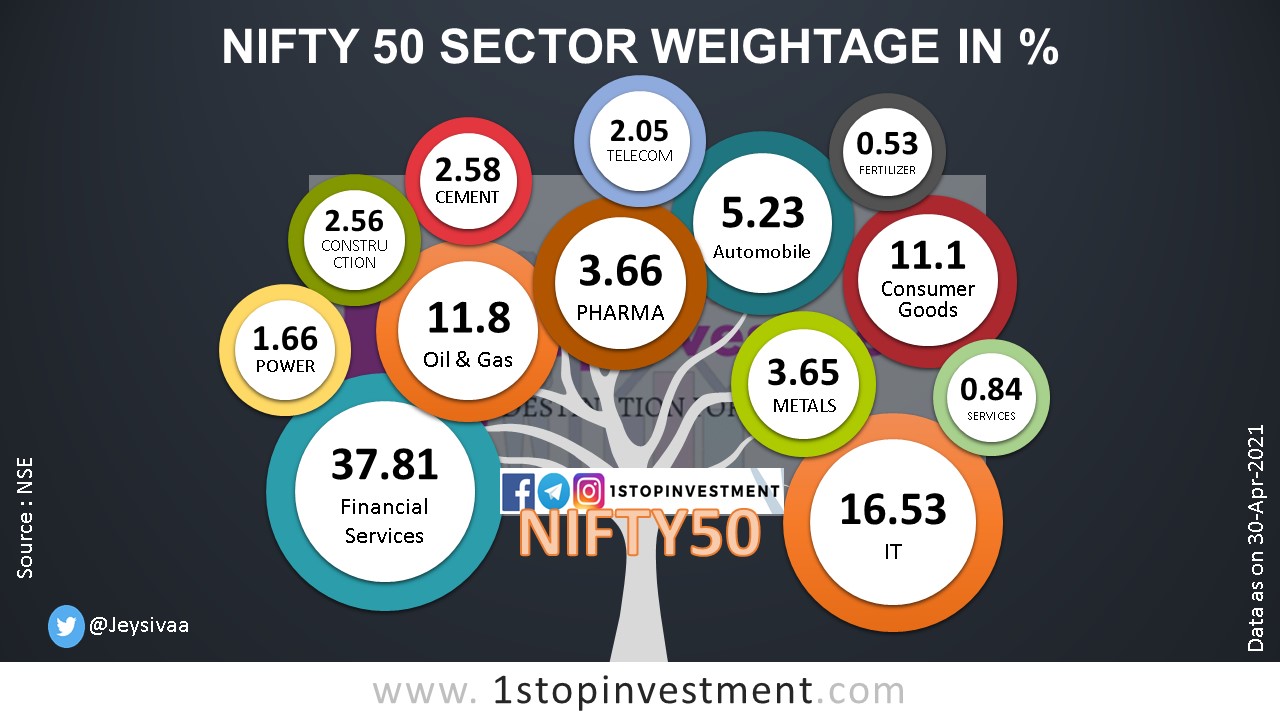

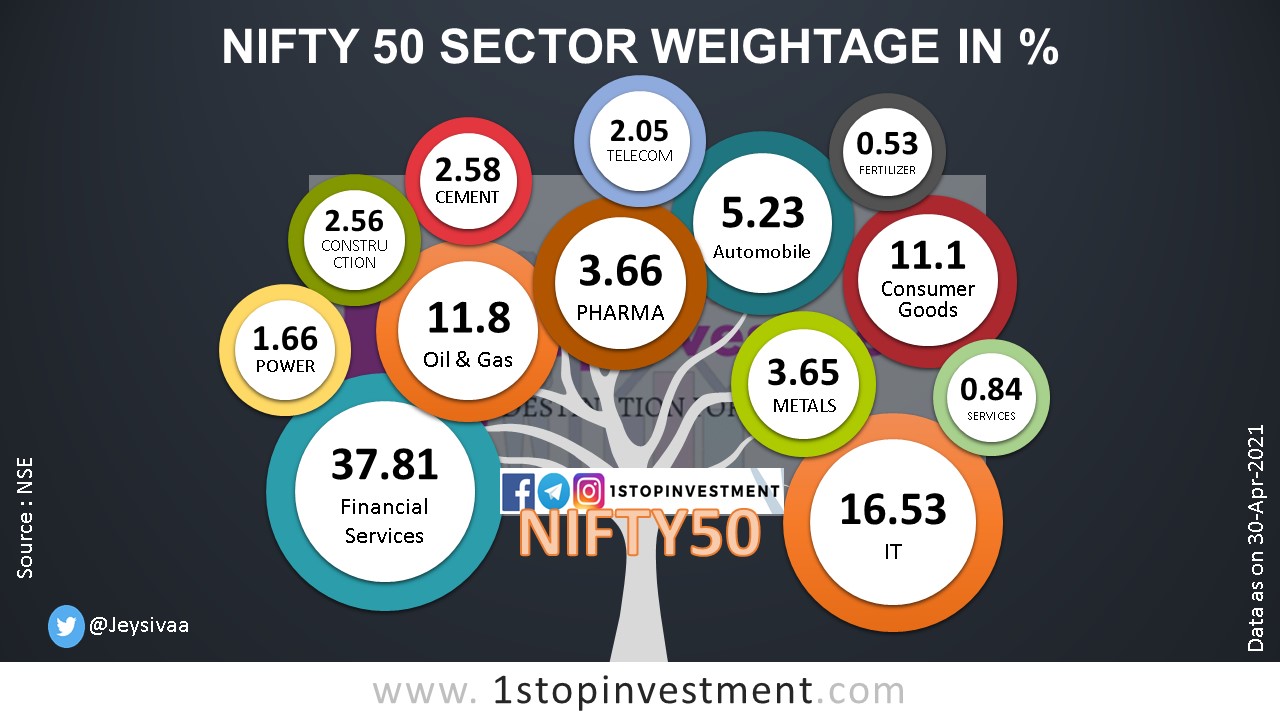

The Nifty 50 index mirrored the Sensex's strong performance, climbing by 135 points (2.1%) to close at 6,550 (example figures). This remarkable performance was driven by a combination of factors, with certain sectors significantly outperforming others.

- Strong performance of the IT sector: The IT sector experienced particularly robust growth, fueled by strong global demand.

- Banking sector growth: The banking sector also contributed significantly to the Nifty's gains, reflecting healthy credit growth and positive outlook.

- Positive outlook for consumer goods: The consumer goods sector also showed positive momentum, suggesting increased consumer spending and confidence.

Sector-wise Performance: A Green Wave Across the Board

Top Performing Sectors:

Today's rally was truly widespread, with most sectors participating in the upward movement. However, some sectors exhibited exceptionally strong growth:

- IT sector: Up by 3.5%, driven by strong global demand and positive earnings reports.

- Banking sector: Up by 2.8%, reflecting healthy credit growth and positive investor sentiment.

- Pharma sector: Up by 2%, boosted by new product launches and strong export demand.

Factors Driving Sectoral Growth:

The performance of individual sectors is often intertwined with broader market trends and economic indicators.

- IT sector: The strong performance of the IT sector is directly linked to increased global demand for IT services and the ongoing digital transformation across industries.

- Banking sector: The banking sector’s growth reflects a healthy credit cycle and the government's focus on infrastructure development.

- Pharma sector: The Pharma sector's growth is driven by a combination of factors, including new product launches, increased exports, and a growing focus on healthcare globally.

Investor Sentiment and Future Outlook

Positive Investor Sentiment:

The overall market sentiment today is overwhelmingly positive, characterized by a strong bullish outlook.

- Increased trading volumes: Higher-than-average trading volumes indicate increased investor participation and enthusiasm.

- Rising market capitalization: The overall market capitalization has significantly increased, reflecting the gains across various sectors.

- Positive analyst ratings: Many leading analysts have issued positive ratings for the Indian market, further reinforcing investor confidence.

Predictions and Potential Risks:

While the current outlook is positive, it's important to acknowledge potential risks and uncertainties.

- Impact of global inflation: Persistently high global inflation could impact investor sentiment and potentially trigger a market correction.

- Potential interest rate hikes: Further interest rate hikes by central banks could dampen economic growth and affect market performance.

- Geopolitical events: Unforeseen geopolitical events could introduce volatility and uncertainty into the market.

Conclusion:

Today's stock market update reveals a strong performance for both the Sensex and Nifty indices, with widespread gains across all sectors. Positive investor sentiment, driven by strong earnings, FII inflows, and government policies, contributed significantly to this rally. While the outlook appears positive, investors must remain vigilant about potential risks such as global inflation, interest rate hikes, and geopolitical uncertainties. Stay updated on the latest stock market updates, Sensex and Nifty movements, to make informed decisions in this dynamic market. Regular monitoring of the stock market update is crucial for making sound investment choices.

Featured Posts

-

Stephen Kings 2024 The Monkey And Two Other Must See Movies

May 10, 2025

Stephen Kings 2024 The Monkey And Two Other Must See Movies

May 10, 2025 -

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025

L Ombre De Melanie Dijon Revele Le Role De La Mere De Gustave Eiffel

May 10, 2025 -

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025 -

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

Feds Rate Hike Pause A Different Approach To Global Monetary Policy

May 10, 2025

Feds Rate Hike Pause A Different Approach To Global Monetary Policy

May 10, 2025