Stock Market Valuation Concerns: BofA's View And Investor Guidance

Table of Contents

BofA's Current Assessment of Stock Market Valuation

BofA's recent reports on market valuation provide a nuanced, albeit cautious, outlook. Their assessment relies on a comprehensive methodology, incorporating various key valuation metrics like price-to-earnings ratios (P/E), price-to-book ratios (P/B), and dividend yields, alongside analysis of market capitalization and sector-specific performance. While BofA doesn't offer a simple "bullish" or "bearish" prediction, their findings suggest a cautious approach, highlighting potential overvaluation in certain sectors while identifying others as relatively undervalued. Their models incorporate forward-looking earnings estimates, trying to predict future market performance, acknowledging the significant uncertainties inherent in such predictions.

- Summary of BofA's key valuation metrics: BofA's analysis often emphasizes the widening gap between current valuations and projected future earnings, particularly in certain high-growth technology sectors. They also scrutinize dividend yields, considering them in the context of prevailing interest rates.

- Specific sectors identified as potentially overvalued or undervalued: Recent reports have highlighted technology and consumer discretionary sectors as potentially overvalued, while sectors like energy and healthcare have been identified as potentially more attractively valued, depending on specific sub-sectors and individual company performance. These assessments are, however, dynamic and subject to change based on evolving market conditions.

- BofA's predicted market performance in the short and long term: While precise predictions are difficult, BofA's outlook generally suggests a period of volatility and potential for moderate growth in the long term, contingent upon favorable economic developments and the successful navigation of global uncertainties. Short-term predictions are naturally more uncertain due to current macroeconomic instability.

Understanding the Factors Driving BofA's Valuation Concerns

BofA's valuation concerns are deeply rooted in the current macroeconomic landscape. Several significant factors are influencing their assessment:

- Impact of inflation on corporate earnings and stock prices: Persistently high inflation erodes corporate profit margins, impacting earnings per share (EPS) and subsequently stock prices. This is a major factor affecting BofA's valuation models.

- Effect of rising interest rates on investor sentiment and borrowing costs: The Federal Reserve's aggressive interest rate hikes increase borrowing costs for businesses and reduce investor appetite for riskier assets. Higher interest rates also make bonds more attractive, diverting investment away from equities.

- Analysis of recession probabilities and their potential effects on the market: BofA's analysts incorporate recession probabilities into their models, acknowledging that a recession could significantly depress corporate earnings and trigger a market correction. The potential depth and duration of any recession are crucial variables in their valuation assessments.

- Discussion of significant geopolitical events and their influence on market stability: Geopolitical events, such as the war in Ukraine and ongoing tensions in other regions, introduce significant uncertainty into the market, impacting investor sentiment and potentially leading to increased volatility.

The Role of Earnings Growth in Stock Market Valuation

Earnings growth is a cornerstone of stock market valuation. Future earnings expectations are a major driver of current stock prices. BofA's analysis carefully examines the relationship between current valuations and projected earnings growth. Discrepancies between these two factors are key indicators of potential overvaluation or undervaluation.

- Analysis of current EPS growth and forecasts: BofA's analysts closely monitor EPS growth across various sectors, comparing current performance with future forecasts to assess the sustainability of current valuations.

- Discussion of the impact of revenue growth on stock valuations: Sustained revenue growth is crucial for supporting EPS growth and justifies higher valuations. BofA analyzes revenue trends to understand the underpinnings of current market valuations.

- Examination of profit margins and their relation to stock market performance: Profit margin trends are critical indicators of a company's financial health and future earning potential. BofA examines profit margin dynamics to gauge the potential for future earnings growth and their impact on stock valuations.

Investor Guidance: Strategies for Navigating Valuation Concerns

Given BofA's analysis, investors need a robust strategy to navigate the current market environment. Several key strategies can help manage risk and potentially capitalize on opportunities:

- Importance of a well-diversified portfolio: Diversification across different asset classes and sectors is crucial to reduce overall portfolio risk. This minimizes exposure to any single sector's underperformance.

- Strategies for mitigating risk in a volatile market: Risk mitigation strategies include adjusting asset allocation based on risk tolerance, focusing on high-quality companies with strong fundamentals, and incorporating defensive stocks into the portfolio.

- Advantages and disadvantages of value vs. growth investing: Value investing focuses on companies trading below their intrinsic value, while growth investing targets companies with high growth potential. Both have their advantages and disadvantages, and the choice depends on individual risk tolerance and market outlook.

- Recommendations for specific asset allocation strategies based on risk tolerance: Investors should adjust their portfolios based on their own risk tolerance, considering factors like age, financial goals, and investment horizon. Professional financial advice is highly recommended to determine the appropriate asset allocation strategy.

Conclusion

BofA's analysis highlights significant concerns regarding stock market valuation, driven by macroeconomic factors such as inflation, rising interest rates, and geopolitical risks. Understanding these factors and their influence on corporate earnings and stock prices is crucial for making informed investment decisions. A well-diversified portfolio, a long-term investment horizon, and a thorough understanding of different investment strategies are vital for navigating this complex market. Mitigate stock market valuation risks by adopting a cautious and adaptable approach, and remember to seek professional financial advice tailored to your individual circumstances. Further research into BofA's reports and other reliable market analyses can provide valuable insights into the current landscape and help you refine your investment strategy.

Featured Posts

-

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

Nottingham Stabbing Data Breach Exposes Patient Records Nhs Staff Involved

May 09, 2025

Nottingham Stabbing Data Breach Exposes Patient Records Nhs Staff Involved

May 09, 2025 -

Boston Celtics Coach Provides Update On Jayson Tatums Wrist Injury

May 09, 2025

Boston Celtics Coach Provides Update On Jayson Tatums Wrist Injury

May 09, 2025 -

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 09, 2025

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 09, 2025 -

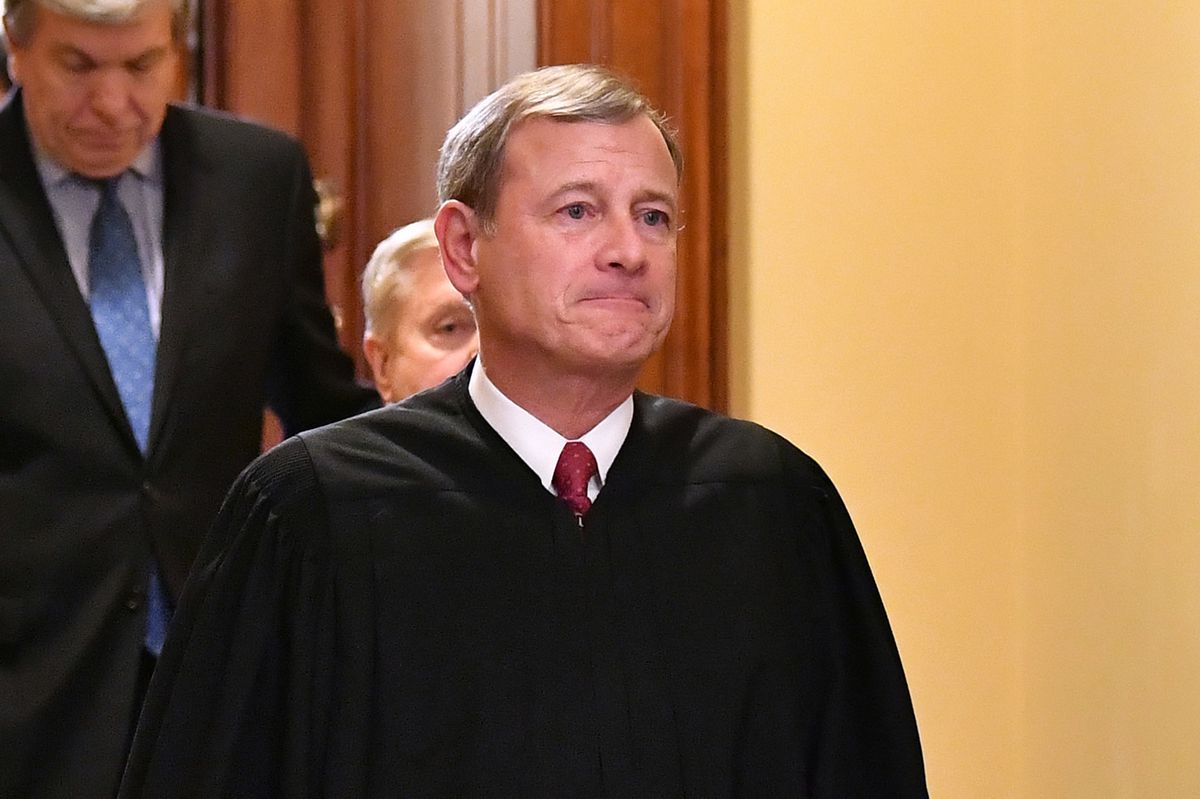

Chief Justice Roberts Shares Story Of Mistaken Identity

May 09, 2025

Chief Justice Roberts Shares Story Of Mistaken Identity

May 09, 2025