Stock Market Valuations: A BofA Analysis And Why Investors Shouldn't Panic

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's research provides a comprehensive overview of the current market landscape, offering valuable insights for investors seeking to understand stock market valuations accurately. Their analysis incorporates both quantitative and qualitative factors, leading to a nuanced perspective on the current market climate.

Assessing Price-to-Earnings Ratios (P/E):

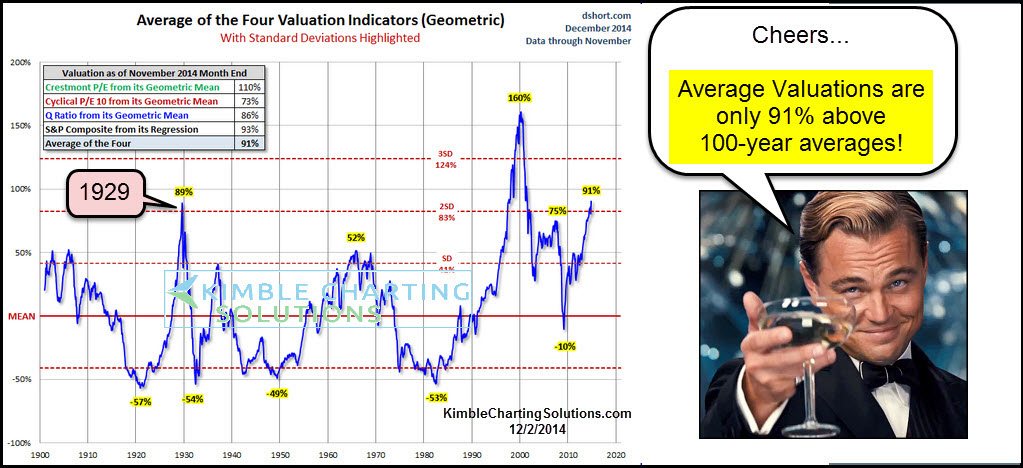

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share. A high P/E ratio generally suggests that investors are willing to pay a premium for the company's future earnings potential, while a low P/E ratio might indicate undervaluation. BofA's analysis considers the current P/E ratios across various sectors and compares them to historical averages.

- BofA's specific P/E ratio data points: While precise figures are proprietary, BofA's reports often highlight sectors showing elevated P/E ratios compared to historical averages (e.g., technology) and those with more conservative valuations (e.g., utilities). These discrepancies reflect varying investor sentiment and expectations for future growth.

- Comparison to previous market cycles: BofA's analysts compare current P/E ratios to those observed during previous market cycles, including bull markets and corrections. This historical context helps gauge whether current valuations are unusually high or low.

- Mention sectors with higher/lower P/E ratios and the rationale: The analysis usually explains the reasons behind the differences in P/E ratios across various sectors. For instance, high P/E ratios in the tech sector might reflect expectations of rapid growth and innovation, while lower ratios in utilities might reflect more stable, but slower, growth prospects.

Analyzing Interest Rate Impacts on Valuations:

Interest rates significantly influence stock market valuations. Higher interest rates generally increase borrowing costs for companies, potentially reducing profitability and lowering stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock valuations. BofA's analysis incorporates their outlook on interest rate movements and their potential effects.

- BofA's predicted interest rate trajectory: BofA's economists regularly provide forecasts for future interest rate changes. These predictions are crucial in assessing the potential impact on stock valuations, providing valuable information for investment planning.

- How these predictions influence stock valuations: The predicted interest rate trajectory directly impacts the discounted cash flow models used to value stocks. Higher interest rates lead to lower present values of future earnings, reducing stock valuations.

- Discussion of potential risks and opportunities associated with interest rate changes: BofA’s analysis typically addresses the potential risks and opportunities associated with the predicted interest rate changes, highlighting sectors that might benefit or suffer most from the altered economic climate.

Considering Factors Beyond Traditional Metrics:

BofA's valuation assessment goes beyond traditional metrics like P/E ratios. They also consider qualitative factors that significantly influence market sentiment and investment decisions.

- Specific economic indicators BofA is tracking: BofA closely monitors various economic indicators like GDP growth, inflation, employment rates, and consumer confidence to gauge the overall health of the economy and its impact on stock valuations.

- Geopolitical risks and their potential impact on valuations: Geopolitical events, such as trade wars, political instability, and global conflicts, significantly influence investor sentiment and market volatility. BofA's assessment incorporates these external factors.

- Analysis of current investor sentiment and its influence: Investor sentiment, often reflected in market breadth, volatility indices, and surveys, influences stock valuations. BofA's analysis considers the current level of optimism or pessimism among investors and its effects on market behavior.

Why Investors Shouldn't Panic Sell

Market volatility is an inherent characteristic of investing. However, panic selling during periods of uncertainty can lead to significant losses. BofA's analysis suggests a measured, long-term approach is advisable.

The Importance of a Long-Term Investment Strategy:

Long-term investing is crucial to mitigate the risks associated with short-term market fluctuations. Emotional decision-making during periods of volatility often leads to poor investment outcomes.

- Statistical data supporting long-term investment success: Historical data demonstrates that long-term investors have generally outperformed those who frequently trade based on short-term market movements.

- Examples of past market corrections and subsequent recoveries: BofA might cite examples of past market corrections and the subsequent rebounds to illustrate the resilience of the market over the long term.

- Advice on maintaining a disciplined investment approach: The emphasis is on sticking to a well-defined investment strategy, avoiding impulsive actions driven by fear or greed.

Identifying Potential Opportunities within the Market:

Despite market volatility, BofA's analysis may identify potentially undervalued sectors or asset classes presenting attractive investment opportunities.

- Specific sectors BofA identifies as potentially attractive: BofA’s research might highlight sectors poised for growth despite current market conditions, even if their valuations appear temporarily depressed.

- Reasons for their undervaluation and potential for growth: The analysis would delve into the reasons why these sectors are undervalued and present compelling growth potential.

- Risks associated with investing in these sectors: It’s crucial to acknowledge the risks involved, providing a balanced perspective.

Diversification as a Risk Mitigation Strategy:

Diversification is a fundamental risk management strategy. Spreading investments across different asset classes reduces exposure to the volatility of any single asset.

- Different asset classes to consider for diversification: This includes stocks, bonds, real estate, commodities, and alternative investments.

- Examples of diversified portfolio strategies: BofA might offer examples of well-diversified portfolios tailored to different risk tolerances.

- The role of professional financial advice in diversification: Seeking professional financial advice helps create a diversified portfolio aligned with individual needs and risk profiles.

Conclusion

This article reviewed BofA's analysis of current stock market valuations, considering P/E ratios, interest rate impacts, and various qualitative factors. Despite market volatility, BofA's analysis suggests a measured, long-term approach. Long-term investors should focus on their investment strategies, consider diversification, and avoid rash decisions based on short-term market fluctuations. Understanding stock market valuations is crucial for informed investing. Don't let short-term market noise dictate your long-term financial strategy. Conduct thorough research and consider consulting a financial advisor to develop a robust investment plan tailored to your individual needs and risk tolerance. Learn more about effectively managing your investment portfolio and navigating stock market valuations for long-term success.

Featured Posts

-

Reddit Downtime Resolved Official Statement On Recent Service Disruption

May 17, 2025

Reddit Downtime Resolved Official Statement On Recent Service Disruption

May 17, 2025 -

Celebrating Local Stem Scholarship Recipients

May 17, 2025

Celebrating Local Stem Scholarship Recipients

May 17, 2025 -

Top Australian Crypto Casino Sites For 2025

May 17, 2025

Top Australian Crypto Casino Sites For 2025

May 17, 2025 -

Apple Tv Subscription Deal 3 Months At 3 Ends Soon

May 17, 2025

Apple Tv Subscription Deal 3 Months At 3 Ends Soon

May 17, 2025 -

Uber One Launches In Kenya Enjoy Savings On Rides And Deliveries

May 17, 2025

Uber One Launches In Kenya Enjoy Savings On Rides And Deliveries

May 17, 2025