Stock Market Valuations: BofA Assures Investors, Despite Elevated Prices

Table of Contents

BofA's Assessment of Current Stock Market Valuations

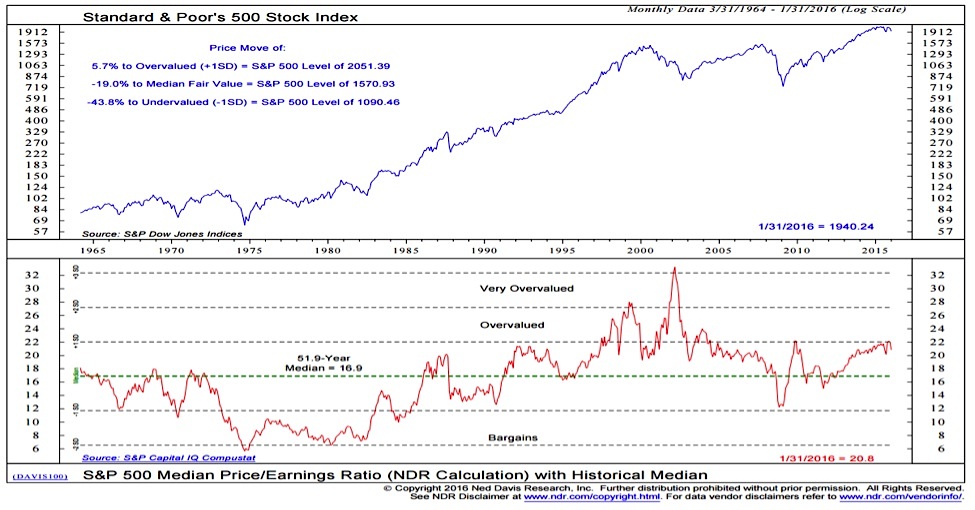

BofA's analysis of current stock market valuations employs a multifaceted approach, incorporating various key metrics. Their market assessment considers both absolute levels and relative comparisons to historical data. Specific metrics like the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) are central to their evaluation.

- Key Findings: BofA's analysis suggests that while stock market valuations are indeed high compared to historical averages, they aren't necessarily at unprecedented levels. The degree of overvaluation varies across sectors.

- Historical Comparison: While current P/E ratios are above long-term averages, they are not as extreme as those seen at the peak of previous market bubbles. The Shiller PE ratio, which considers inflation-adjusted earnings over a longer period, provides a more nuanced perspective.

- Sectoral Analysis: BofA's report likely identifies specific sectors or asset classes exhibiting greater or lesser degrees of overvaluation. For example, technology stocks may be highlighted as potentially overvalued, while certain value sectors might be seen as relatively undervalued, given their current stock market valuations. This granular analysis helps investors make informed decisions. Understanding this nuanced BofA analysis is crucial for strategic investment choices.

Factors Contributing to Elevated Stock Market Valuations

Several macroeconomic factors are contributing to the current elevated stock market valuations. These factors interplay to create a complex environment that influences investor behavior and market performance.

- Impact of Low Interest Rates: Historically low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand fuels stock prices, driving up stock market valuations.

- Contribution of Robust Corporate Earnings: Strong corporate earnings, particularly in certain sectors, support higher stock valuations. Consistent profit growth provides a fundamental justification for elevated prices, although future earnings projections need careful consideration as part of a comprehensive stock market valuation analysis.

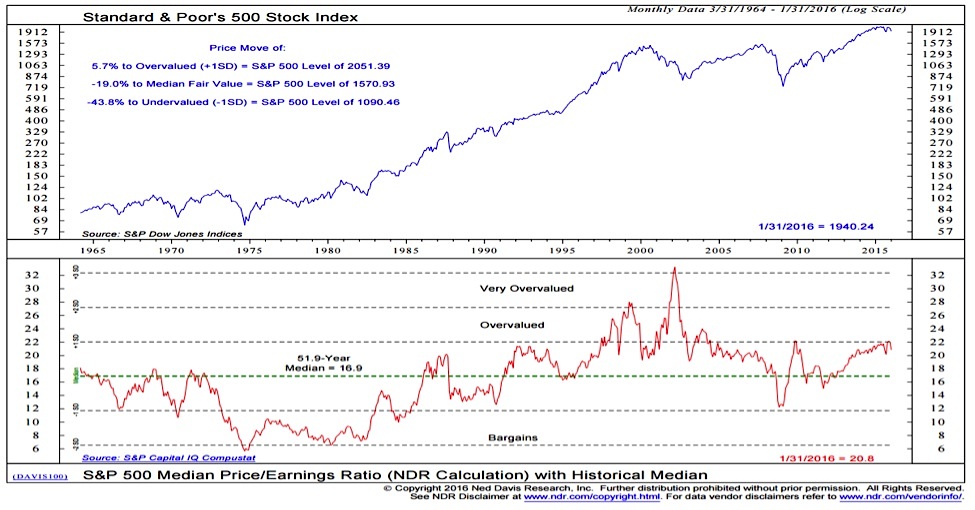

- Role of Technological Innovation: Rapid technological advancements, particularly in areas like artificial intelligence and cloud computing, are driving significant growth and innovation in specific sectors. This fuels investor enthusiasm and contributes to higher stock market valuations in the associated companies.

BofA's Outlook and Recommendations for Investors

BofA's outlook on future market performance is likely cautiously optimistic, acknowledging the potential for corrections while maintaining a generally positive long-term view. Their recommendations for investors are likely centered around prudent portfolio management and risk mitigation.

- Portfolio Adjustments: BofA might suggest diversifying portfolios across various asset classes to reduce exposure to any single overvalued sector. This investment strategy is crucial in navigating the complexities of today's market.

- Risk Management Strategies: Emphasis on risk management is likely a key part of BofA's recommendations, including strategies to protect capital during potential market downturns.

- Investment Opportunities: BofA might identify specific undervalued sectors or investment opportunities that offer attractive risk-adjusted returns, balancing higher stock market valuations in some areas with potentially stronger growth in others.

Addressing Investor Concerns about High Stock Market Valuations

Many investors are understandably anxious about the potential for a market correction or even a crash given the current high stock market valuations. BofA's analysis likely addresses these concerns by providing a context that tempers extreme pessimism.

- Rebuttal of Crash Arguments: BofA likely counters arguments suggesting an imminent market crash by highlighting the differences between the current market conditions and those preceding previous crashes. They might stress the importance of considering long-term growth prospects, not just short-term fluctuations in stock market valuations.

- Positive Outlook Justification: BofA likely justifies its cautiously positive outlook by pointing to the underlying strength of the economy and the continued growth potential of many companies.

- Downside Risk Mitigation: The importance of a well-diversified portfolio and prudent risk management strategies is likely emphasized to mitigate potential downsides and reduce exposure to sudden shifts in stock market valuations.

Conclusion: Navigating Stock Market Valuations with BofA's Insights

BofA's analysis offers a measured perspective on current high stock market valuations. While acknowledging the elevated prices, their assessment suggests that the situation isn't necessarily as precarious as some fear. Understanding the factors contributing to high prices, along with BofA's recommended portfolio adjustments and risk management strategies, allows investors to make more informed decisions. To better understand stock market valuations and manage your investments wisely, consult BofA's full report or seek professional financial advice. Learn more about BofA's insights on stock market valuations and navigate this dynamic market with confidence.

Featured Posts

-

Ticketmaster Cae Hoy 8 De Abril Informacion Y Reportes De Grupo Milenio

May 30, 2025

Ticketmaster Cae Hoy 8 De Abril Informacion Y Reportes De Grupo Milenio

May 30, 2025 -

Cts Eventim Q1 Results Strong Ebitda And Revenue Increase

May 30, 2025

Cts Eventim Q1 Results Strong Ebitda And Revenue Increase

May 30, 2025 -

Ticketmaster Experiencia Inmersiva De Compra Con Virtual Venue

May 30, 2025

Ticketmaster Experiencia Inmersiva De Compra Con Virtual Venue

May 30, 2025 -

Nvidia Q Quarter Earnings Growth Forecast And Chinas Impact

May 30, 2025

Nvidia Q Quarter Earnings Growth Forecast And Chinas Impact

May 30, 2025 -

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025

Instagram Die Stars Denen Steffi Graf Folgt

May 30, 2025