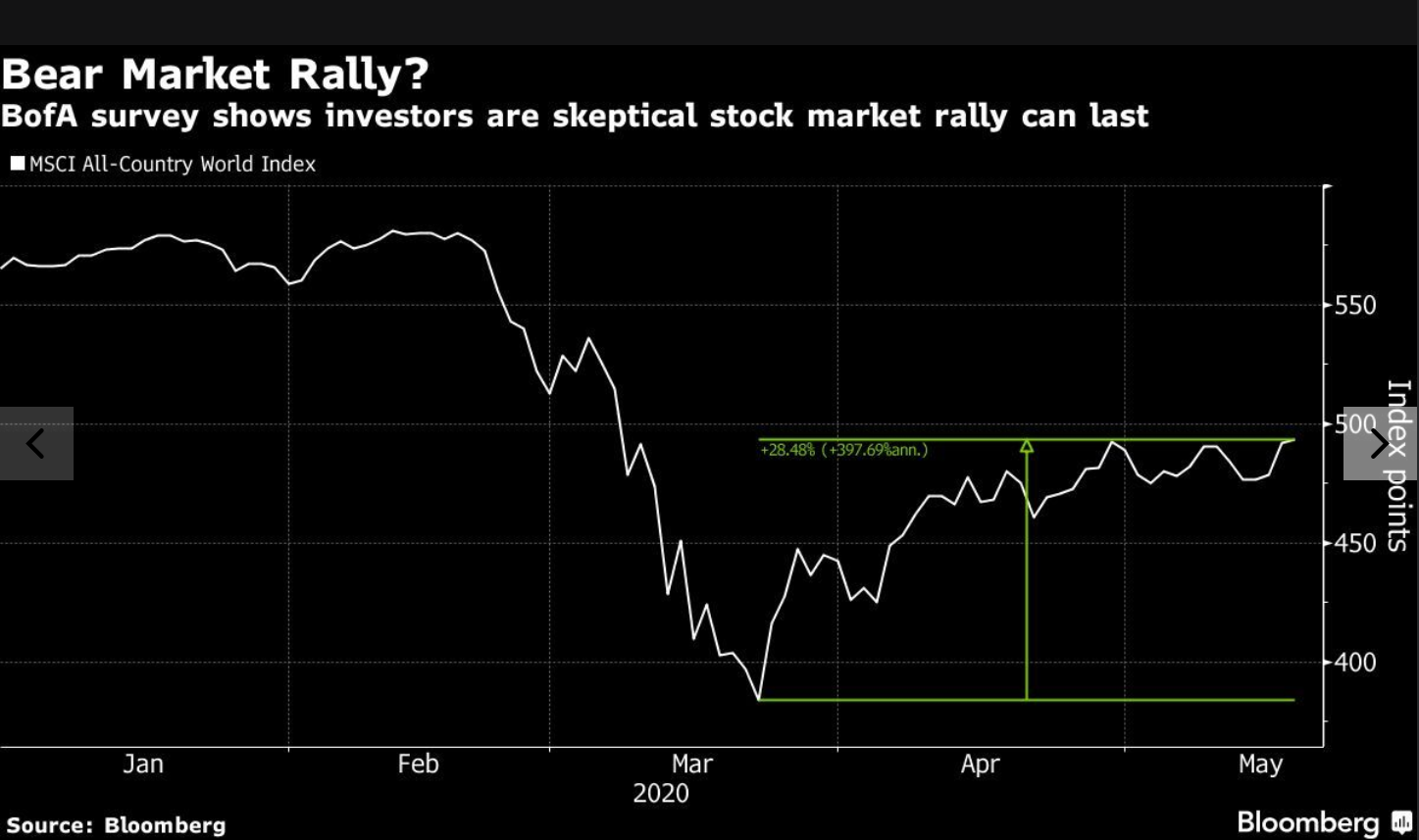

Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Perspective on Current Stock Market Valuations

BofA's assessment of current stock market valuations is cautiously optimistic. While they acknowledge that valuations are historically high compared to long-term averages, they argue that the picture is far from uniformly bleak. Their analysis considers valuations relative not just to historical data but also in comparison to other asset classes, leading to a less alarmist conclusion than some headlines suggest.

- Key Arguments from BofA's Research: BofA points to strong corporate earnings growth and a relatively benign inflation environment as supportive factors. They emphasize the resilience of the US economy, despite global uncertainties.

- Data Points from BofA Reports: While specific data points are subject to change, BofA often cites metrics like forward Price-to-Earnings (P/E) ratios, adjusted for interest rates and expected earnings growth, to support their claims. Their discounted cash flow models, considering future earnings projections, suggest that current valuations are not as excessive as some simpler metrics might indicate.

- Sector-Specific Analysis: BofA's research typically identifies specific sectors, such as technology or consumer staples, as potentially overvalued or undervalued. This granular approach allows for a more nuanced understanding of the market's composition and risk profile. They might, for instance, highlight specific companies within sectors showing strong earnings potential to offset overall market valuation concerns.

The Role of Interest Rates and Monetary Policy

Interest rates play a crucial role in shaping stock market valuations. Lower interest rates generally boost stock valuations because they reduce the cost of borrowing for companies, encouraging investment and increasing the present value of future earnings. Conversely, rising interest rates can put downward pressure on valuations.

- Interest Rates and Discounted Cash Flow: In discounted cash flow (DCF) models—a common valuation method—higher interest rates lower the present value of future cash flows, leading to lower valuations.

- Impact of Future Interest Rate Changes: The Federal Reserve's actions significantly impact investor sentiment and stock prices. Anticipation of future interest rate hikes can lead to market corrections as investors adjust their expectations for corporate profitability.

- Central Bank Policies: Quantitative easing (QE) programs, implemented by central banks to stimulate the economy, can inflate asset prices, including stocks. The tapering or end of such programs can have the opposite effect. Understanding the implications of these policies is vital for assessing stock market valuations.

Long-Term Growth Prospects and Future Earnings

The long-term growth prospects of companies are fundamentally intertwined with their valuations. If investors believe that companies' earnings will grow significantly in the future, they are more willing to pay higher prices today.

- Technological Advancements: Technological advancements, such as artificial intelligence and automation, are driving productivity gains and fostering innovation, which potentially supports higher future corporate earnings.

- Global Economic Growth: Sustained global economic growth fuels corporate profits and contributes to higher stock valuations. However, global economic uncertainties must be carefully considered.

- Sector-Specific Growth Drivers: Certain sectors, like renewable energy or healthcare, may experience significant growth driven by specific trends or technological breakthroughs, justifying current, relatively high valuations within those sectors.

Comparison to Other Asset Classes

To accurately assess stock market valuations, it's essential to compare them to other asset classes. Bonds, real estate, and commodities each have different risk profiles and potential returns.

- Yield and Return Comparisons: Data comparing the yields and returns of different asset classes helps to establish the relative attractiveness of stocks. For example, if bond yields are exceptionally low, stocks might appear relatively more attractive even at higher valuations.

- Risk and Reward Assessment: Stocks generally offer higher potential returns but also carry greater risk than bonds. Real estate and commodities present unique risks and rewards, requiring a thorough risk assessment.

- Stocks' Preferable Position: Despite high valuations, stocks might still be a preferable investment for many investors seeking long-term growth. The potential for higher returns over the long term might still outweigh the risks, especially considering the current low yield environment for other asset classes.

Navigating Stock Market Valuations with Confidence

In conclusion, while current stock market valuations are elevated, BofA's analysis, focusing on factors such as future earnings growth, interest rate environments, and comparative asset class analysis, suggests that investor panic may be unwarranted. It's crucial to remember that long-term growth prospects and diversification are essential aspects of any sound investment strategy. Therefore, instead of reacting emotionally to market fluctuations, focus on conducting thorough research, carefully assessing your risk tolerance, and considering your personal long-term financial goals. Before making any investment decisions based on your understanding of stock market valuations, consider seeking professional financial advice. For further insight into BofA's perspective, we encourage you to review their research reports on stock market valuations directly.

Featured Posts

-

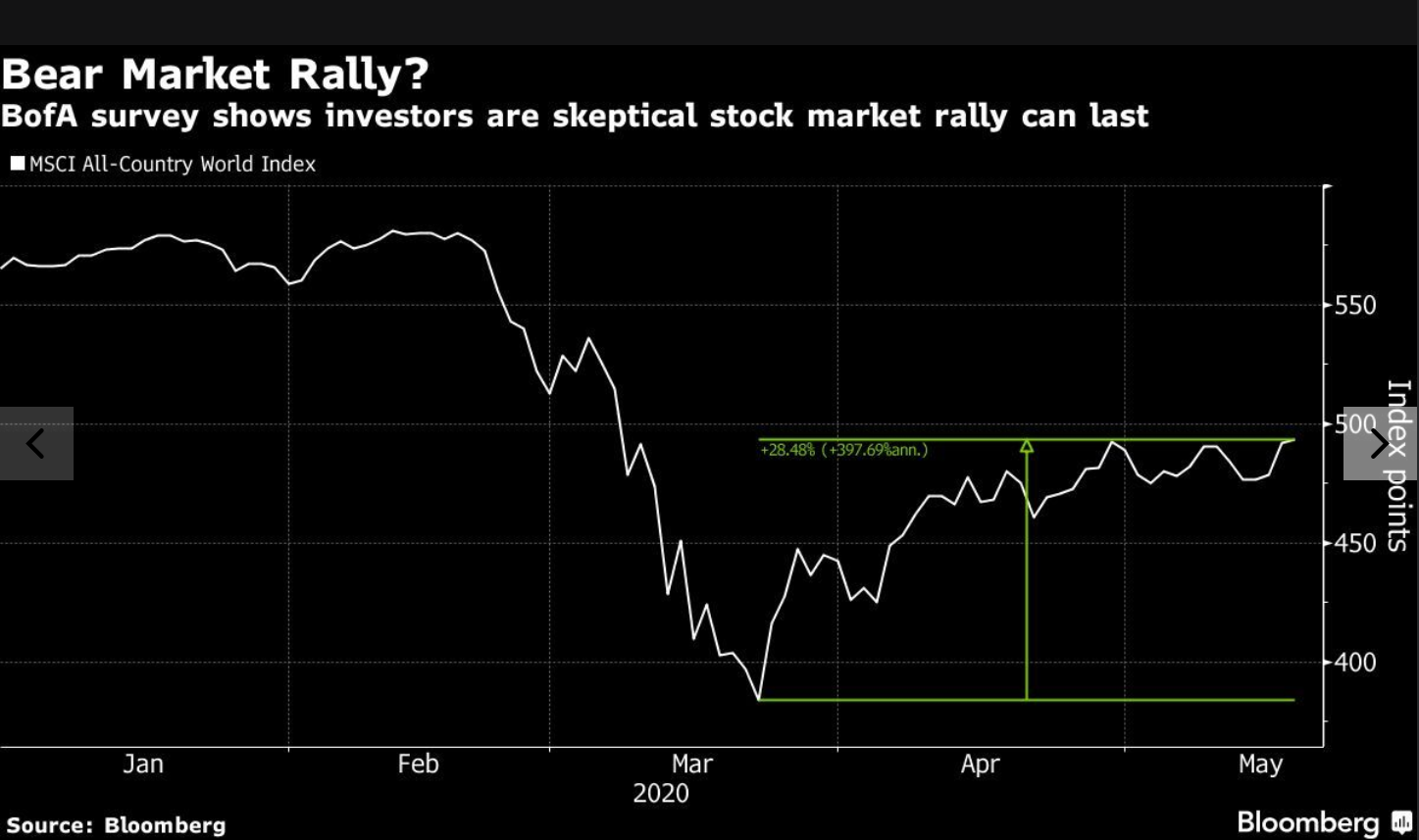

Pley Off N Kh L Vashington Ovechkina Vstretitsya S Monrealem Demidova

May 15, 2025

Pley Off N Kh L Vashington Ovechkina Vstretitsya S Monrealem Demidova

May 15, 2025 -

Entopiste Ta Pio Oikonomika Pratiria Kaysimon Se Oli Tin Kypro

May 15, 2025

Entopiste Ta Pio Oikonomika Pratiria Kaysimon Se Oli Tin Kypro

May 15, 2025 -

The Amber Heard Twins A Deeper Dive Into The Musk Paternity Rumors

May 15, 2025

The Amber Heard Twins A Deeper Dive Into The Musk Paternity Rumors

May 15, 2025 -

Exploring Androids Youthful New Design

May 15, 2025

Exploring Androids Youthful New Design

May 15, 2025 -

Kaysima Sygkrinete Times Kai Eksoikonomiste Xrimata Stin Kypro

May 15, 2025

Kaysima Sygkrinete Times Kai Eksoikonomiste Xrimata Stin Kypro

May 15, 2025