Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Perspective on Current Stock Market Valuations

BofA's assessment of current stock market valuations considers several key factors, painting a more nuanced picture than simple headline valuations might suggest.

Considering Long-Term Growth Potential

BofA's analysis emphasizes the importance of considering long-term economic growth potential when evaluating stock market valuations. They believe that focusing solely on short-term fluctuations can lead to misguided investment decisions. Their assessment points to a number of factors supporting continued, albeit perhaps slower, growth.

- Technological Advancements: Continued innovation in sectors like artificial intelligence, biotechnology, and renewable energy fuels long-term growth, driving stock valuations in related companies.

- Demographic Shifts: Global demographic trends, such as the growth of the middle class in emerging markets, create sustained demand for goods and services, impacting various market sectors positively.

- Government Investments: Infrastructure spending and investments in clean energy initiatives globally contribute to economic expansion and create opportunities for growth in specific sectors.

These factors, according to BofA's analysis, suggest that the current stock market valuation, while perhaps high relative to some historical benchmarks, is not necessarily unsustainable in the context of long-term growth prospects. Understanding the underlying drivers of long-term growth is crucial for assessing the true value of stock market investments.

The Role of Interest Rates and Inflation

BofA's analysis also considers the significant impact of interest rates and inflation on stock market valuations. Higher interest rates generally lead to higher discount rates, reducing the present value of future earnings and thus impacting stock prices. Inflation erodes purchasing power and impacts corporate earnings.

- Inflation's Impact: BofA acknowledges the inflationary pressures and their effect on corporate profit margins. However, they analyze how individual companies are managing these pressures and identifying those best positioned to navigate the current environment.

- The Federal Reserve's Role: The actions of central banks, particularly the Federal Reserve (the Fed), play a crucial role in shaping interest rate levels and influencing inflation. BofA incorporates the Fed's projected rate adjustments into its valuation models.

- Future Rate Adjustments: BofA's analysts anticipate future interest rate adjustments and model their potential impacts on stock valuations, allowing for a more comprehensive and dynamic assessment.

Therefore, BofA's analysis integrates the interplay between interest rates, inflation, and company-specific performance to arrive at a balanced view of current stock market valuations.

Analyzing Sector-Specific Valuations

Instead of a broad-brush approach, BofA conducts a thorough sector-specific valuation analysis. This granular approach recognizes that valuations vary significantly across different market sectors.

- Tech Sector: While some segments of the technology sector may appear overvalued based on certain metrics, BofA identifies sub-sectors with strong growth potential and reasonable valuations.

- Healthcare Sector: BofA’s analysis pinpoints opportunities within healthcare, recognizing the long-term growth potential driven by aging populations and technological advancements.

- Energy Sector: The energy sector presents a mix of valuations, depending on the specific energy source (renewable versus fossil fuels) and the company's efficiency and sustainability initiatives.

This sector-specific approach allows BofA to identify both potentially overvalued and undervalued stocks, offering investors a more refined understanding of opportunities within the market. By understanding these sector-specific valuations, investors can make more informed decisions about asset allocation and diversification.

Why Investors Shouldn't Panic: Addressing Common Concerns

Despite recent market fluctuations, BofA argues against panic selling, addressing common investor anxieties.

Addressing the "Overvalued Market" Narrative

The claim that the entire market is fundamentally overvalued is often based on simplistic valuation metrics. BofA refutes this narrative by utilizing a more comprehensive approach.

- Multiple Valuation Metrics: BofA employs a range of valuation metrics, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and discounted cash flow analysis, to avoid relying on any single indicator.

- Long-Term Perspective: BofA's analysis emphasizes the importance of taking a long-term perspective, recognizing that short-term market fluctuations are normal and that focusing on fundamental company performance is key.

- Data-Driven Analysis: Their conclusions are supported by rigorous data analysis and research, providing a robust foundation for their assessment.

These points counter the simplistic “overvalued market” narrative and support the idea that current valuations, while perhaps not historically low, are not necessarily indicative of an imminent market crash.

Managing Risk in a Potentially Volatile Market

Even with a positive long-term outlook, BofA acknowledges the potential for market volatility and provides risk management recommendations.

- Portfolio Diversification: BofA emphasizes the importance of maintaining a well-diversified portfolio across different asset classes and sectors to mitigate risk.

- Asset Allocation Strategy: Adjusting asset allocation based on individual risk tolerance and investment goals is crucial for managing risk effectively.

- Regular Portfolio Review: BofA suggests a regular review of one's investment portfolio to ensure it remains aligned with their risk tolerance and long-term objectives.

Conclusion: Maintaining a Long-Term Perspective on Stock Market Valuations

BofA's analysis suggests that while short-term market volatility is a normal occurrence, the long-term growth potential of the economy and certain market sectors supports a measured and less anxious approach to stock market valuations. Understanding the nuances of valuation, considering long-term growth prospects, and managing risk effectively are key takeaways for investors.

To gain a more comprehensive understanding of stock market valuations and to develop a robust investment strategy tailored to your risk tolerance, consult BofA's research and resources. Learn how to manage your stock market investments effectively and build a successful long-term stock market strategy. Don't let short-term fluctuations derail your long-term investment goals; understand stock market valuations and invest wisely.

Featured Posts

-

Plan Your North East Easter Holiday A Guide To Top Destinations

Apr 25, 2025

Plan Your North East Easter Holiday A Guide To Top Destinations

Apr 25, 2025 -

La Mat Hinh Anh Voi Trang Diem Du Tiec Buffet

Apr 25, 2025

La Mat Hinh Anh Voi Trang Diem Du Tiec Buffet

Apr 25, 2025 -

Ridley Scotts New Apple Tv Series 5 Reasons The Reviews Are Positive

Apr 25, 2025

Ridley Scotts New Apple Tv Series 5 Reasons The Reviews Are Positive

Apr 25, 2025 -

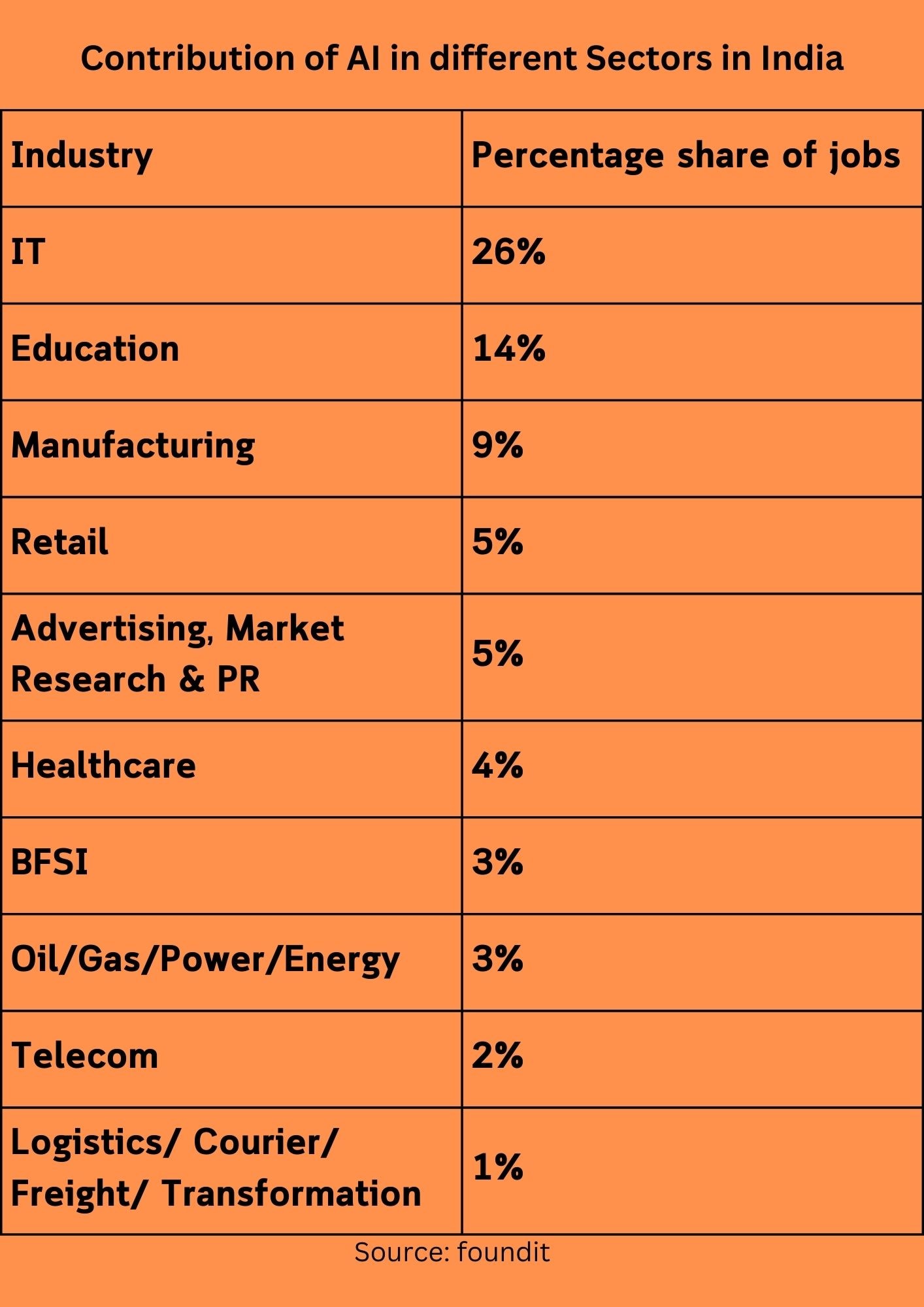

Hundreds Of New Ai Jobs At Databricks In India

Apr 25, 2025

Hundreds Of New Ai Jobs At Databricks In India

Apr 25, 2025 -

Los Angeles Wildfires And The Gambling Industry A Growing Concern

Apr 25, 2025

Los Angeles Wildfires And The Gambling Industry A Growing Concern

Apr 25, 2025