Stock Market Valuations: BofA's Case For Continued Investment

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

BofA's core argument rests on the expectation of continued earnings growth despite potentially high valuations. They believe that robust corporate profits and a positive outlook for the economy will ultimately justify current price levels. Their analysis utilizes several key metrics to support this position.

- BofA's forecast for future earnings growth: BofA projects healthy earnings growth for the S&P 500 and other major indices over the next few years, fueled by factors such as technological innovation and global economic expansion. Their projections often consider various economic scenarios to provide a range of possible outcomes.

- Their assessment of current interest rate environments and its impact: While rising interest rates can impact valuations, BofA's analysis may incorporate the expectation that rate hikes will eventually slow or stabilize, minimizing their negative impact on the stock market. They might factor in the potential for the Federal Reserve to pause or even reverse rate hikes depending on economic data.

- Specific sectors BofA identifies as particularly promising: BofA may highlight specific sectors like technology, healthcare, or renewable energy as particularly promising for future growth, leading to a more optimistic outlook on overall market performance.

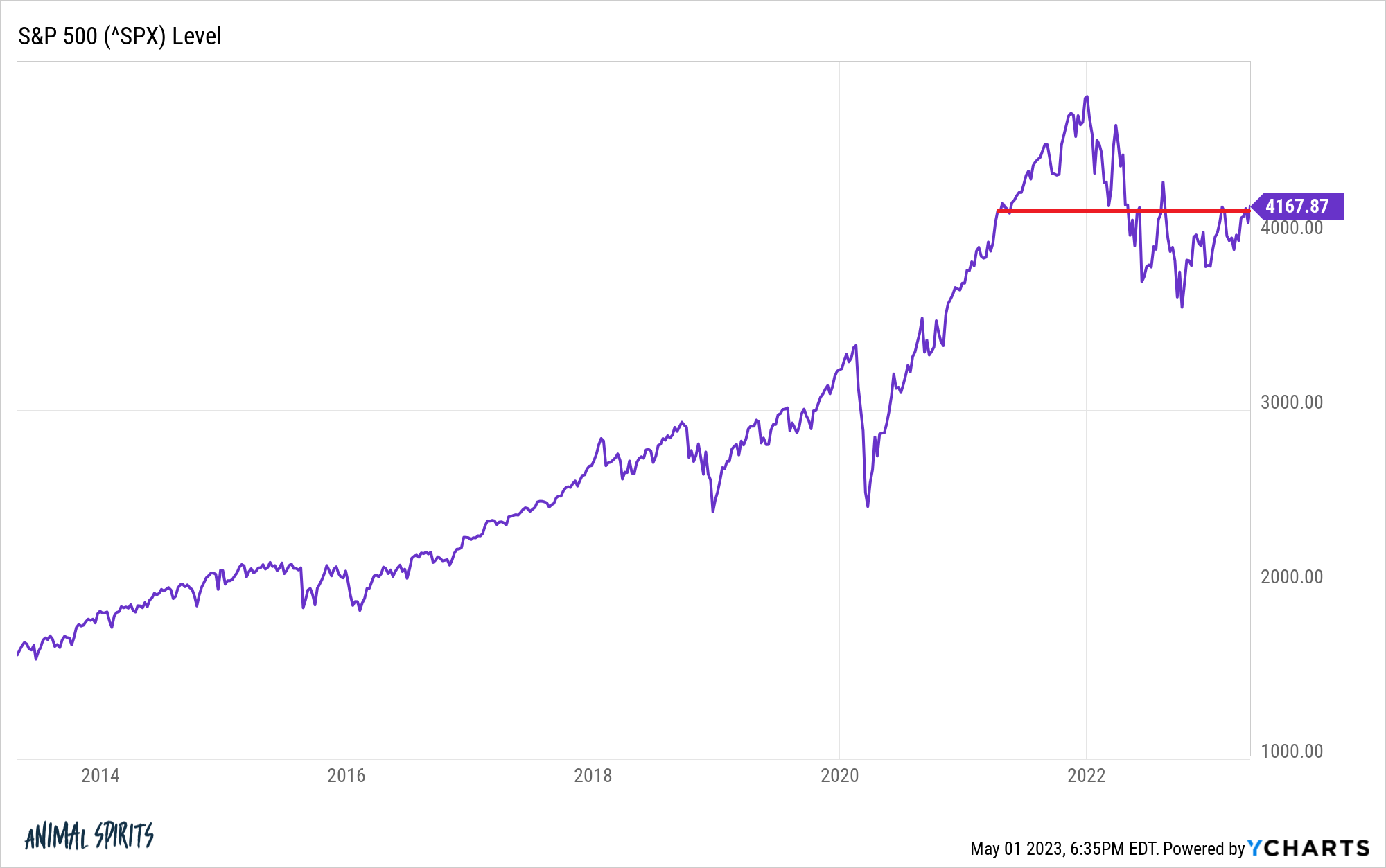

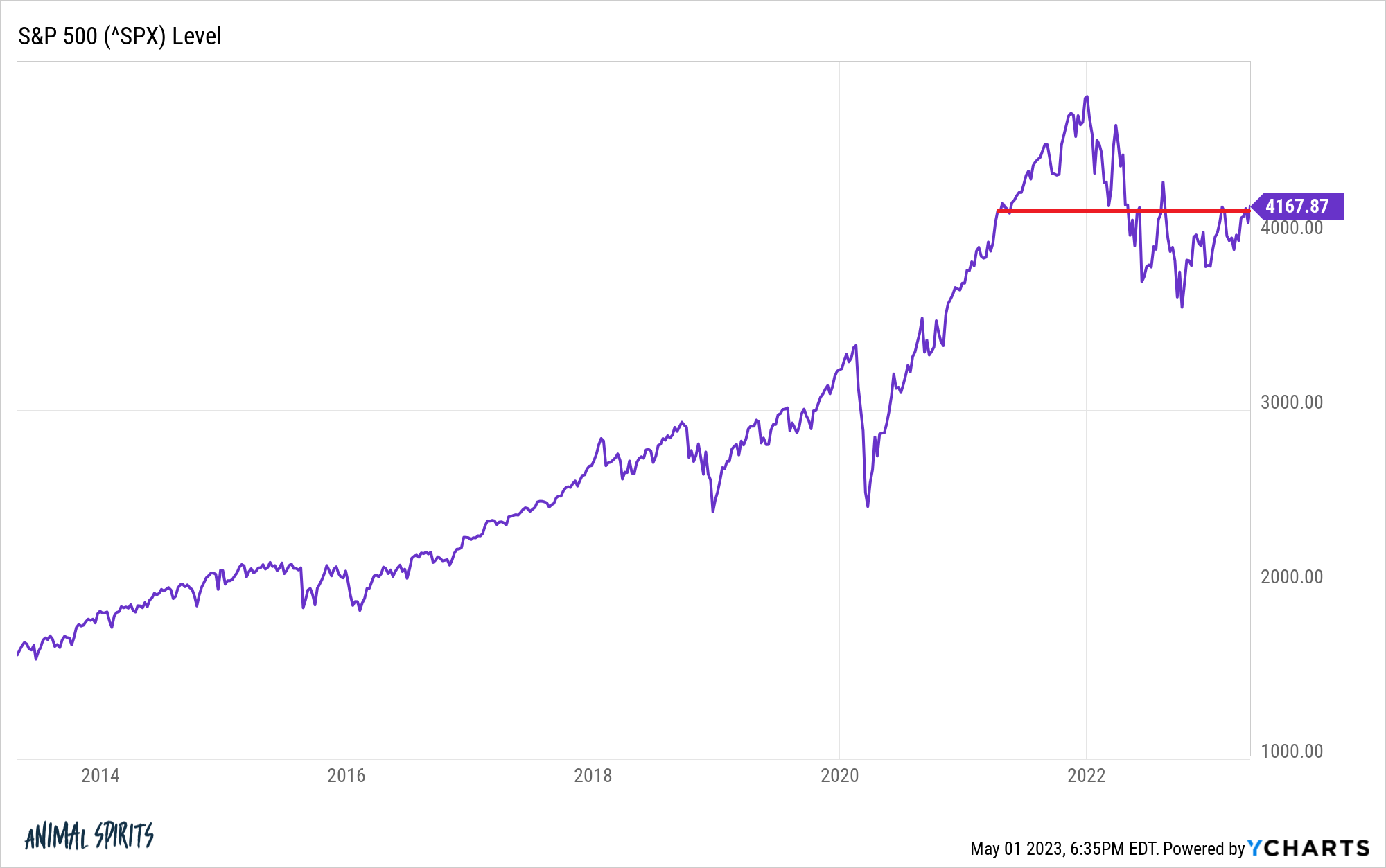

- Mention any specific indices BofA focuses on (e.g., S&P 500, Nasdaq): BofA's analysis typically focuses on major market indices like the S&P 500 and Nasdaq Composite, using them as benchmarks for overall market health and performance.

Analyzing Key Valuation Metrics

While BofA may focus on Price-to-Earnings (P/E) ratios, a comprehensive analysis of stock market valuations requires considering other crucial metrics.

- Price-to-Sales ratio (P/S): This metric compares a company's market capitalization to its revenue, providing insights even if the company is not yet profitable. A high P/S ratio might suggest overvaluation, but it must be considered within the context of the company's growth prospects.

- Price-to-Earnings-to-Growth ratio (PEG): The PEG ratio adjusts the P/E ratio by considering the company's growth rate. It's a more refined tool for evaluating growth stocks compared to the simple P/E ratio.

- Market sentiment and its influence on valuations: Investor psychology plays a significant role. Periods of excessive optimism or pessimism can lead to valuations that deviate significantly from their intrinsic value, potentially creating buying or selling opportunities.

Comparing current valuation metrics to historical averages helps establish a benchmark. However, past performance is not indicative of future results. Market cycles and technological disruptions constantly reshape the landscape.

Addressing Potential Risks and Counterarguments

BofA's bullish outlook doesn't negate the existence of potential risks.

- Potential downsides of maintaining a long-term investment strategy: Market corrections and prolonged bear markets are always possibilities, even with a long-term horizon. Investors need to be prepared for short-term losses.

- Analysis of current economic indicators that could negatively impact the market: Inflation, recessionary fears, and geopolitical instability are all factors that could negatively affect stock market performance and challenge BofA's optimistic forecast.

- Strategies for mitigating risks: Diversification across different asset classes (stocks, bonds, real estate), dollar-cost averaging (investing a fixed amount regularly), and having a well-defined risk tolerance are crucial risk mitigation strategies.

Long-Term Investment Strategies in Light of Current Stock Market Valuations

Based on BofA's analysis and the broader market context, investors should consider several factors.

- Specific investment strategies aligning with BofA's outlook: Investors might focus on sectors identified as promising by BofA, while still maintaining a diversified portfolio.

- Importance of risk tolerance assessment for individual investors: Risk tolerance varies significantly between individuals. A long-term investment strategy should align with an investor's comfort level with market fluctuations.

- Recommendations for portfolio diversification based on current market conditions: Diversification is always key. In times of uncertainty, a well-diversified portfolio that balances risk and reward is crucial.

Conclusion

BofA's analysis presents a compelling case for continued investment, emphasizing future earnings growth and the potential for specific sectors. However, a balanced perspective requires acknowledging potential risks like inflation and geopolitical instability. Investors should utilize multiple valuation metrics, understand their risk tolerance, and employ strategies like diversification and dollar-cost averaging to mitigate potential downsides. While BofA's view on stock market valuations offers valuable insight, thorough due diligence and a well-defined investment strategy remain paramount. Continue your research into stock market valuations to make informed decisions about your investment portfolio.

Featured Posts

-

Trumps Influence Unifying Canada Ahead Of The Election

Apr 26, 2025

Trumps Influence Unifying Canada Ahead Of The Election

Apr 26, 2025 -

Nyt Spelling Bee Solutions February 5th Puzzle 339 Hints And Answers

Apr 26, 2025

Nyt Spelling Bee Solutions February 5th Puzzle 339 Hints And Answers

Apr 26, 2025 -

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025 -

Mission Impossible 7 Final Reckoning Full Trailer Analysis

Apr 26, 2025

Mission Impossible 7 Final Reckoning Full Trailer Analysis

Apr 26, 2025 -

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025

Latest Posts

-

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025 -

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025 -

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025 -

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025 -

The Lasting Power Of High Potential An 11 Year Retrospective

May 10, 2025

The Lasting Power Of High Potential An 11 Year Retrospective

May 10, 2025