Stock Market Valuations: BofA's Reassuring Take For Investors

Table of Contents

BofA's Core Argument: Why Current Valuations Aren't Overly Expensive

BofA's analysis employs a multifaceted approach to assessing stock market valuations, utilizing a combination of traditional metrics and forward-looking projections. Their methodology incorporates several key factors:

-

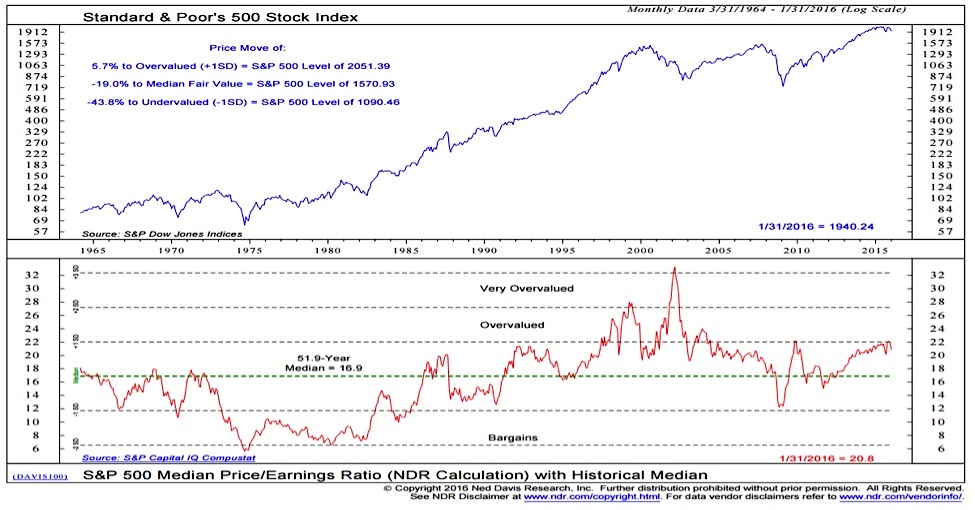

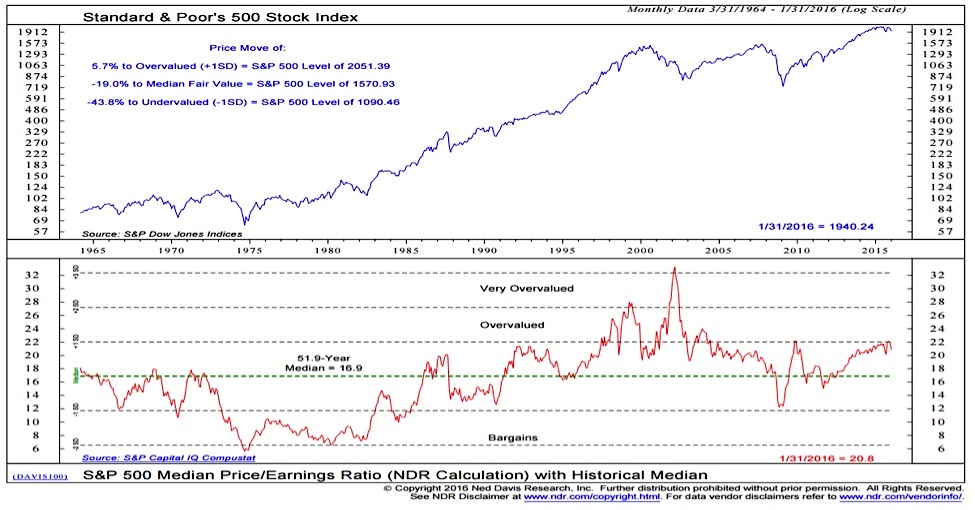

Price-to-Earnings Ratios (P/E): BofA analyzes P/E ratios across various sectors and compares them to historical averages, adjusting for current economic conditions. They consider the current P/E ratios in the context of projected earnings growth.

-

Discounted Cash Flow (DCF) Analysis: This more complex method projects future cash flows and discounts them back to their present value, providing a more intrinsic valuation of companies and the overall market.

BofA's reasoning for considering current valuations reasonable rests on several pillars:

-

Interest Rate Environment: While rising interest rates impact valuations, BofA argues that the current level is still manageable and priced into the market, at least to some extent. Furthermore, they point to the potential for interest rate hikes to slow down, eventually stabilizing the market.

-

Corporate Earnings Growth Projections: Despite economic headwinds, BofA's analysts project moderate corporate earnings growth over the next few years, suggesting that current valuations are sustainable, given these future earnings expectations.

-

Inflationary Pressures: While inflation remains a significant concern, BofA's analysis accounts for its potential impact on corporate profitability and adjusts their valuations accordingly. They suggest that inflation may be beginning to moderate.

-

Geopolitical Factors: The report acknowledges the influence of geopolitical instability, but argues that many of these risks are already partially factored into current stock prices.

Key Data Points from BofA's Report (Illustrative):

- Projected S&P 500 earnings growth: 7-10% in 2024.

- Average P/E ratio of the S&P 500: Slightly above historical average, but justifiable given earnings growth projections.

Identifying Sectors with Attractive Valuations According to BofA

BofA's analysis doesn't paint a uniform picture across all sectors. They highlight specific areas that they believe offer compelling investment opportunities:

-

Energy: BofA points to the continued strong demand for energy and the potential for further price increases as supporting attractive valuations within this sector.

-

Technology (Specific Sub-Sectors): While some tech stocks might appear overvalued, BofA suggests that certain sub-sectors, like those focused on artificial intelligence or cybersecurity, present strong long-term growth prospects at reasonable valuations.

-

Healthcare: The aging global population and continued advancements in medical technology are cited as drivers of growth in this sector, making certain companies within healthcare potentially undervalued.

Why BofA Finds These Sectors Attractive:

-

Strong Growth Prospects: These sectors are poised for significant growth in the coming years, driven by fundamental economic and technological trends.

-

Competitive Landscape: BofA's analysis accounts for the competitive landscape within each sector, identifying companies with a strong competitive advantage.

Addressing Investor Concerns and Potential Risks

While BofA presents a relatively optimistic outlook, it’s crucial to acknowledge potential risks:

-

Recession Fears: The possibility of a recession remains a significant concern. BofA's analysis attempts to quantify the impact of a potential recession on corporate earnings and valuations. They argue that the market might already be pricing in a mild recession.

-

Inflation Risk: Persistently high inflation could erode corporate profits and negatively impact valuations. BofA's projections assume a gradual moderation of inflation.

-

Geopolitical Uncertainty: Geopolitical events, such as the ongoing conflict in Ukraine, introduce uncertainty into the market. BofA's analysis accounts for this uncertainty to a degree but acknowledges the inherent difficulty in predicting geopolitical outcomes.

BofA's analysis integrates these risks, indicating that while these factors present legitimate challenges, they don't necessarily invalidate their positive assessment of valuations overall.

Practical Investment Strategies Based on BofA's Findings

BofA's analysis suggests several practical investment strategies:

-

Diversification: A diversified portfolio across various sectors, including those identified by BofA as potentially undervalued, is crucial for mitigating risk.

-

Long-Term Investing: Investors should maintain a long-term perspective, avoiding impulsive reactions to short-term market fluctuations.

-

Value Investing: BofA's insights may be particularly relevant for value investors who focus on identifying undervalued assets.

-

Growth Investing: The report also provides opportunities for investors focused on growth stocks in specific high-potential sectors.

Caution: It's important to conduct thorough due diligence and tailor your investment strategy to your own risk tolerance and financial goals. Don't solely rely on one source of market analysis.

Conclusion: Navigating Stock Market Valuations with BofA's Guidance

BofA's analysis suggests that current stock market valuations, while not dirt cheap, aren't excessively high when considering projected earnings growth and the current economic landscape. The bank highlights specific sectors offering attractive investment opportunities. However, it's crucial to acknowledge and manage the inherent risks associated with market investing. Utilize BofA's assessment of stock market valuations to make sound investment decisions, but always remember to conduct your own research and consider your individual risk tolerance before making any investment choices. Remember that financial planning and seeking professional advice are crucial aspects of sound investing.

Featured Posts

-

House Democrats Age And Leadership A Growing Internal Conflict

May 06, 2025

House Democrats Age And Leadership A Growing Internal Conflict

May 06, 2025 -

Nadir Hastaliklar Veri Sistemi Nde 13 000 Hasta Saglik Bakanligi Aciklamasi

May 06, 2025

Nadir Hastaliklar Veri Sistemi Nde 13 000 Hasta Saglik Bakanligi Aciklamasi

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025 -

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Ex Colega De The Office

May 06, 2025

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Ex Colega De The Office

May 06, 2025 -

Baqvi Tchnshvo My Yev Bbc I Gvortsvo Nyevo Tyan Dadaryecvo My Adrbyejanvo M

May 06, 2025

Baqvi Tchnshvo My Yev Bbc I Gvortsvo Nyevo Tyan Dadaryecvo My Adrbyejanvo M

May 06, 2025