Stocks Power Global Risk Rally Amidst U.S.-China Truce

Table of Contents

The U.S.-China Truce: A Catalyst for Market Optimism

The recent easing of tensions between the US and China has acted as a powerful catalyst for the current global risk rally. While not a complete resolution, the "truce" involved a temporary pause in escalating tariffs and a commitment to further negotiations. This de-escalation, however fragile, significantly reduced investor anxieties surrounding a prolonged and damaging trade war.

- Specific examples of de-escalation: The postponement of planned tariff increases on Chinese goods and a commitment to purchase increased amounts of US agricultural products were key concessions.

- Positive statements from officials: Both US and Chinese officials issued statements emphasizing their commitment to resolving trade disputes through dialogue, creating a sense of cautious optimism. (Links to reputable news sources confirming the truce would be inserted here).

- Impact on investor concerns: The trade war had cast a long shadow over global growth forecasts. The truce eased these concerns, leading to a more positive outlook for global economic performance and corporate profitability.

This apparent easing of the US-China trade war significantly reduced geopolitical risk, injecting a wave of market optimism into the global financial markets.

Impact on Global Stock Markets: Sector-Specific Analysis

The impact of the US-China truce was widespread, boosting various stock market indices globally.

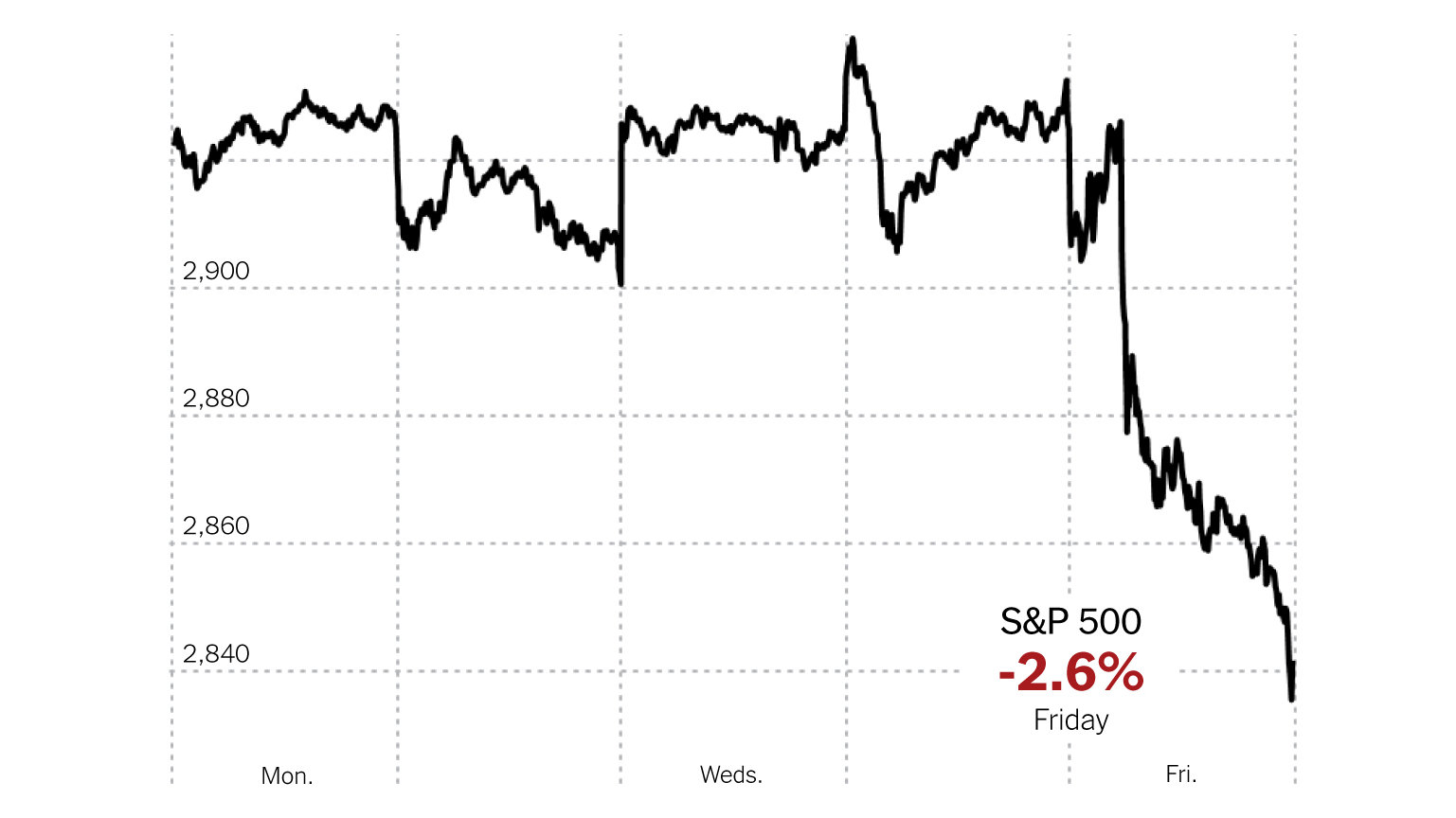

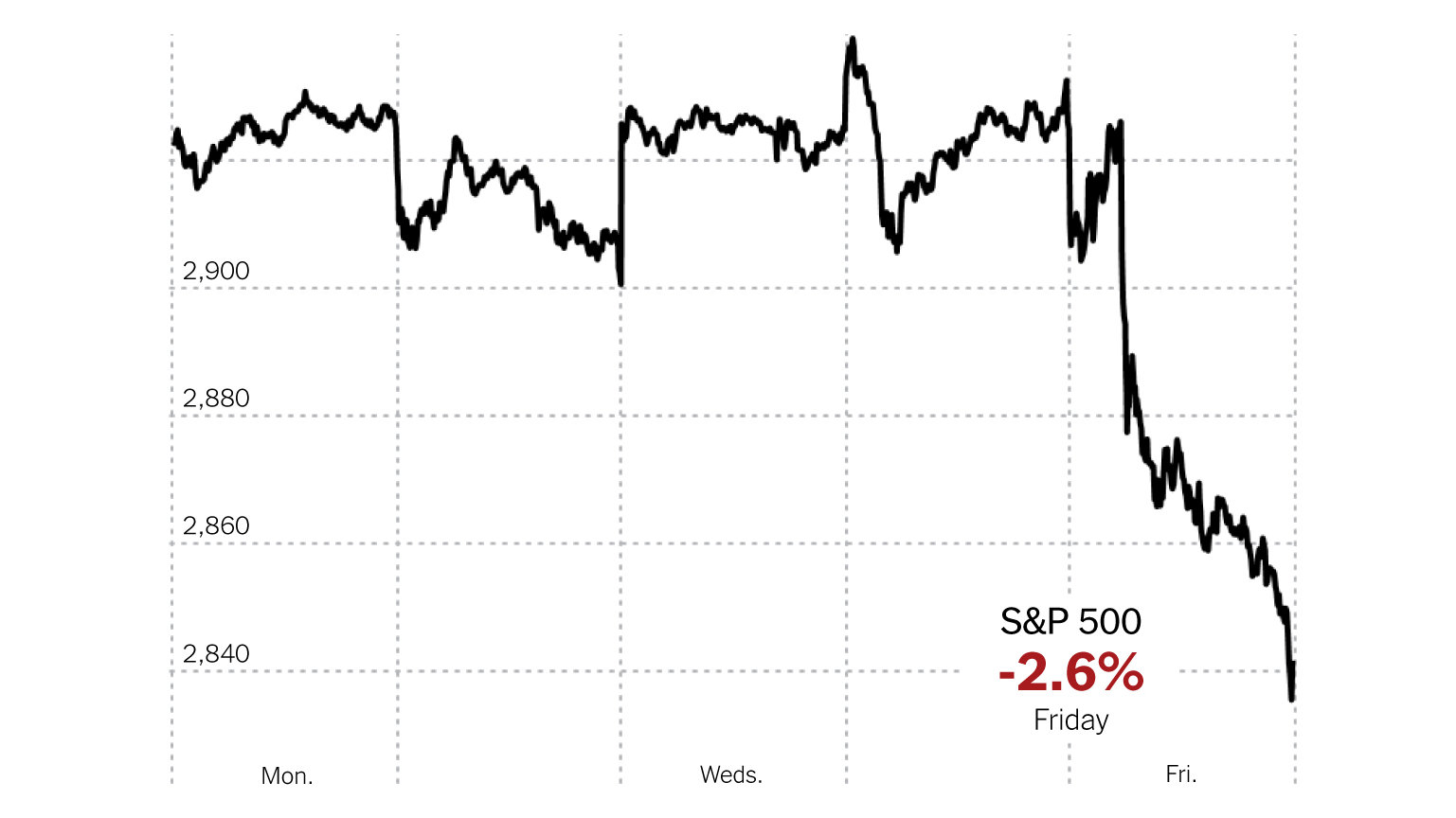

- Percentage gains: Following the truce announcement, the S&P 500 experienced a notable percentage gain (insert actual percentage here), while the Dow Jones Industrial Average also saw significant increases (insert actual percentage here). Similar positive trends were observed in other major indices such as the FTSE 100 and the Hang Seng Index.

- Benefiting sectors: Technology stocks, particularly those heavily reliant on the Chinese market, saw significant gains. The energy sector also benefited from improved global growth expectations. Emerging markets, previously considered high-risk investments due to trade war uncertainty, experienced a substantial surge.

- Unaffected sectors: Certain sectors, such as utilities and consumer staples (often considered safe-haven investments), showed relatively muted responses, indicating a shift in investor appetite towards riskier assets.

The sector performance reflects the complex interplay between global trade and specific industry vulnerabilities and opportunities. Companies with significant exposure to the Chinese market or those directly impacted by tariffs experienced the most dramatic improvements in their stock prices. The market volatility associated with the US-China trade conflict had significantly decreased, at least temporarily. This created more attractive investment opportunities across various sectors.

Re-evaluation of Risk Appetite: Shifting Investor Sentiment

The global risk rally is a clear indication of a shift in investor sentiment from risk aversion to a more pronounced "risk-on" behavior.

- Increased investment in higher-risk assets: Investors poured money into emerging market stocks, high-yield bonds, and other previously shunned riskier assets, driven by newfound optimism.

- Decreased demand for safe-haven assets: The demand for traditionally safe-haven assets like gold and government bonds decreased as investors sought higher returns from riskier investments.

- Investor confidence indicators: The VIX volatility index, often referred to as the "fear gauge," declined significantly, further confirming the improved investor confidence.

This shift in risk appetite has significant implications for portfolio management and asset allocation. Investors are now re-evaluating their portfolios, reducing exposure to safer assets and increasing allocations to sectors expected to benefit from a more stable global economic environment.

Is this Rally Sustainable? Analyzing the Long-Term Outlook

While the current global risk rally is impressive, its sustainability remains a significant question.

- Potential risks: Renewed trade tensions between the US and China, a global economic slowdown, or unexpected geopolitical events could easily derail the rally.

- Factors supporting continued growth: Strong corporate earnings, continued monetary easing by central banks, and sustained global economic growth could support the rally's continuation.

- Expert opinions: (Insert links to reputable sources offering expert opinions on the long-term outlook).

The long-term outlook is far from certain. While the temporary truce offers a period of relative calm, investors must remain vigilant and acknowledge the inherent market risks. Maintaining a balanced perspective and monitoring economic indicators will be crucial to navigate this dynamic market environment and gauge the market sustainability of this rally.

Conclusion

The temporary U.S.-China truce acted as a catalyst for a significant global risk rally, impacting various stock markets and investor sentiment. The rally's sustainability depends on several factors, including the longevity of the truce and broader economic conditions. Understanding the nuances of this global risk rally is crucial.

Call to action: Stay informed about the evolving U.S.-China relationship and its impact on the global risk rally. Monitor market trends and adjust your investment strategy accordingly to capitalize on opportunities presented by this dynamic environment. Understanding the intricacies of the global risk rally is crucial for informed decision-making in today's market.

Featured Posts

-

Snow Whites Box Office Disaster Why Disneys Remake Failed So Spectacularly

May 14, 2025

Snow Whites Box Office Disaster Why Disneys Remake Failed So Spectacularly

May 14, 2025 -

Eurojackpotin 4 8 Miljoonan Euron Paeaevoitto Suomeen Onnen Lipun Kotipaikka Paljastui

May 14, 2025

Eurojackpotin 4 8 Miljoonan Euron Paeaevoitto Suomeen Onnen Lipun Kotipaikka Paljastui

May 14, 2025 -

Watch Young Son Of Scotty Mc Creery Sings George Strait Classic

May 14, 2025

Watch Young Son Of Scotty Mc Creery Sings George Strait Classic

May 14, 2025 -

Sanremo A Rischio Il Piano B Della Regione Liguria Per Il Festival

May 14, 2025

Sanremo A Rischio Il Piano B Della Regione Liguria Per Il Festival

May 14, 2025 -

Muzikos Protestu Ir Saunu Festivalis Bazelyje Eurovizijos Atidarymo Svente

May 14, 2025

Muzikos Protestu Ir Saunu Festivalis Bazelyje Eurovizijos Atidarymo Svente

May 14, 2025