Stocks Soar As U.S. And China Agree To Truce

Table of Contents

Details of the U.S.-China Trade Truce Agreement

The details of the U.S.-China trade truce agreement are complex but represent a significant step towards de-escalation. Both sides made key concessions, aiming to resolve long-standing trade disputes. The agreement includes specific commitments on both sides, designed to foster greater trust and cooperation in the future. This trade deal is not without conditions, however, and its long-term success depends on continued good faith and implementation.

- Specific tariff rollbacks or suspensions: The agreement involves the suspension or reduction of tariffs on a significant number of goods, lessening the burden on businesses and consumers on both sides.

- Quantifiable commitments on purchasing American goods: China committed to purchasing a substantial amount of American goods over a specified period, boosting U.S. exports and economic growth. Exact figures are still being clarified but represent a considerable increase compared to previous years.

- Key milestones and deadlines in the agreement: The agreement outlines a series of key milestones and deadlines for both parties, ensuring accountability and progress monitoring. Regular meetings and reporting mechanisms will track the implementation process.

- Mechanisms for dispute resolution: The agreement includes a detailed dispute resolution mechanism to address any future disagreements or trade conflicts that may arise. This is crucial for maintaining stability and avoiding future trade wars.

Impact on Major Stock Indices

The immediate impact of the U.S.-China trade truce was a sharp increase across major stock indices. Investor confidence rebounded swiftly, leading to a significant stock market rally. Specific sectors, particularly technology and manufacturing, saw disproportionately large gains.

- Percentage change in Dow Jones Industrial Average: The Dow Jones Industrial Average experienced a [Insert Percentage]% increase following the announcement.

- Percentage change in S&P 500: The S&P 500 saw a [Insert Percentage]% rise, reflecting broad-based market optimism.

- Percentage change in Nasdaq Composite: The tech-heavy Nasdaq Composite experienced a particularly strong rally, with a [Insert Percentage]% increase, showcasing the positive impact on technology companies.

- Specific stock examples showing significant gains: Several companies, including [Insert Example Stock Tickers], experienced double-digit percentage gains, reflecting the market’s enthusiastic response to the trade truce.

Analyst Reactions and Market Outlook

Leading financial analysts offered diverse perspectives on the long-term implications of the truce, but most expressed cautious optimism. While the short-term outlook appears positive, the long-term success depends on the effective implementation of the agreement.

- Quotes from prominent financial analysts: "[Insert quote from a prominent analyst about the short-term impact]," and "[Insert quote from a prominent analyst highlighting long-term challenges]."

- Predictions for future market performance: Many analysts predict continued growth in the short term, but caution against excessive exuberance. The market remains subject to various factors, and sustained growth will depend on the ongoing success of the trade deal.

- Identification of remaining challenges or uncertainties: Potential risks remain, including the possibility of future trade disputes and economic uncertainties unrelated to the trade deal.

Investor Strategies Following the U.S.-China Trade Truce

The stock market rally presents both opportunities and challenges for investors. A well-defined investment strategy, taking into account risk management and diversification, is crucial for navigating this period of uncertainty.

- Strategies for investors with a long-term horizon: Long-term investors may consider maintaining their current portfolios, potentially rebalancing to adjust to the new market conditions.

- Strategies for investors with a short-term horizon: Short-term investors may adjust their portfolios based on the current market trends, but should remain aware of the potential for increased volatility.

- Importance of portfolio diversification: Diversification remains a critical risk management strategy, even in the current positive market environment.

- Cautionary notes about market volatility: Investors should be aware that market volatility can increase, and the current positive sentiment may not be sustained in the long term.

Conclusion: Navigating the Post-Truce Stock Market

The U.S.-China trade truce has undeniably triggered a significant stock market rally, boosting investor confidence and improving the overall market outlook. However, investors should remain vigilant, carefully monitoring market developments and adapting their investment strategies accordingly. The agreement represents a positive step, but several challenges and uncertainties remain. Learn more about the U.S.-China trade truce and its market implications to make informed investment decisions. Monitor your investments following the U.S.-China agreement and stay updated on the latest developments in the U.S.-China trade negotiations. The ongoing impact of this trade deal will continue to shape the global economic landscape and demands careful attention.

Featured Posts

-

Jake Paul Vs Tommy Fury The Pub Fight And Pauls Daddy Diss

May 14, 2025

Jake Paul Vs Tommy Fury The Pub Fight And Pauls Daddy Diss

May 14, 2025 -

Diddys Empire A Comprehensive Analysis Of His Successes And Setbacks

May 14, 2025

Diddys Empire A Comprehensive Analysis Of His Successes And Setbacks

May 14, 2025 -

Pressure Intensifies Israels Eurovision Future Uncertain

May 14, 2025

Pressure Intensifies Israels Eurovision Future Uncertain

May 14, 2025 -

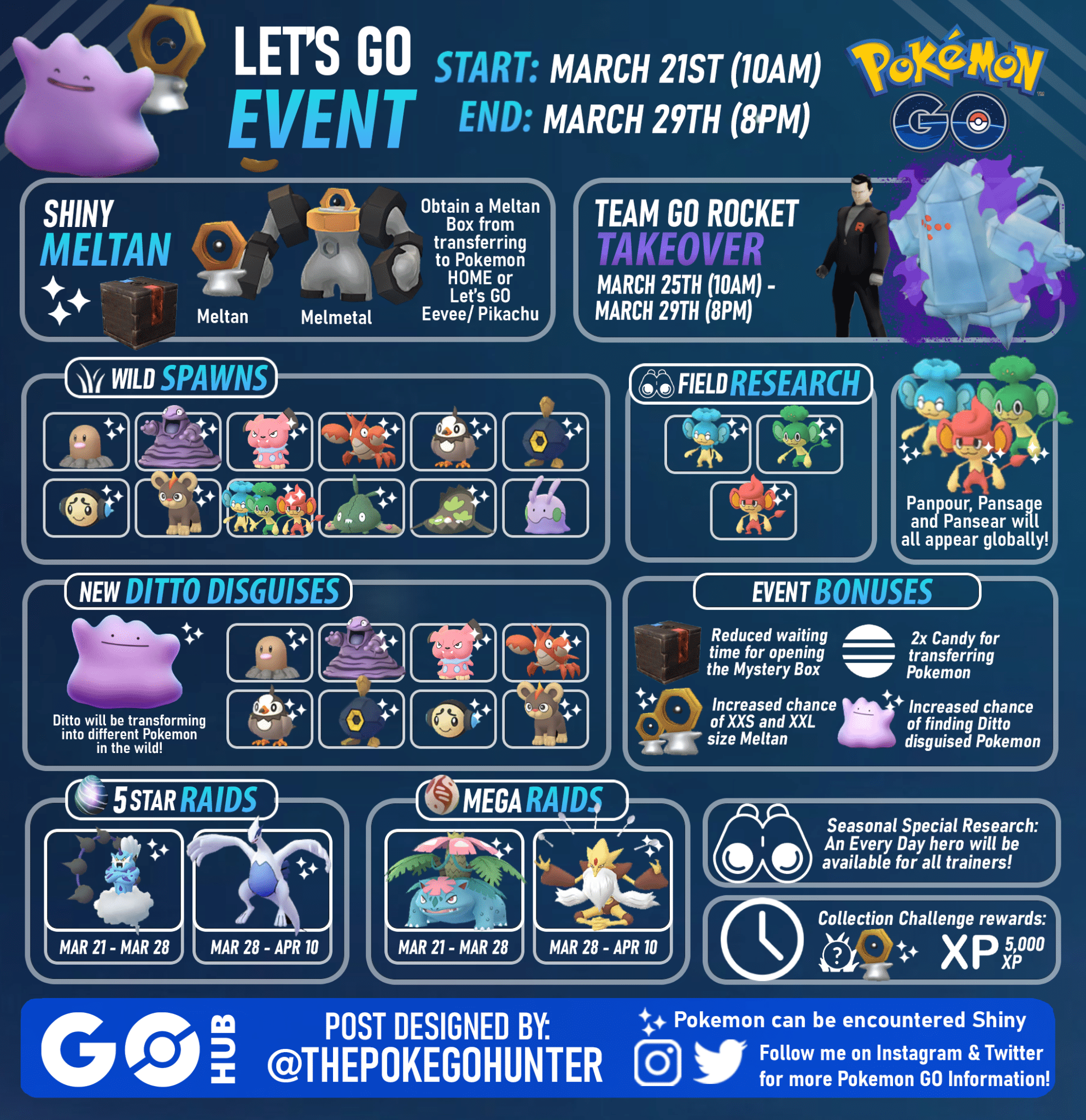

Pokemon Go May 2025 Complete Event Calendar

May 14, 2025

Pokemon Go May 2025 Complete Event Calendar

May 14, 2025 -

Mission Impossibles Ving Rhames Recalls Early Near Miss And Hints At Poignant Conclusion

May 14, 2025

Mission Impossibles Ving Rhames Recalls Early Near Miss And Hints At Poignant Conclusion

May 14, 2025