Stocks Surge On BSE: Sensex Rise And Top Performers

Table of Contents

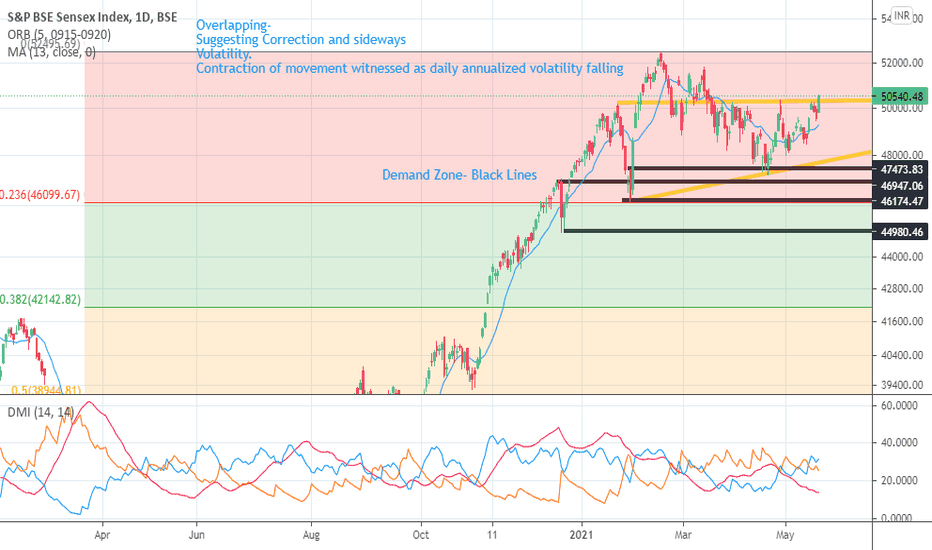

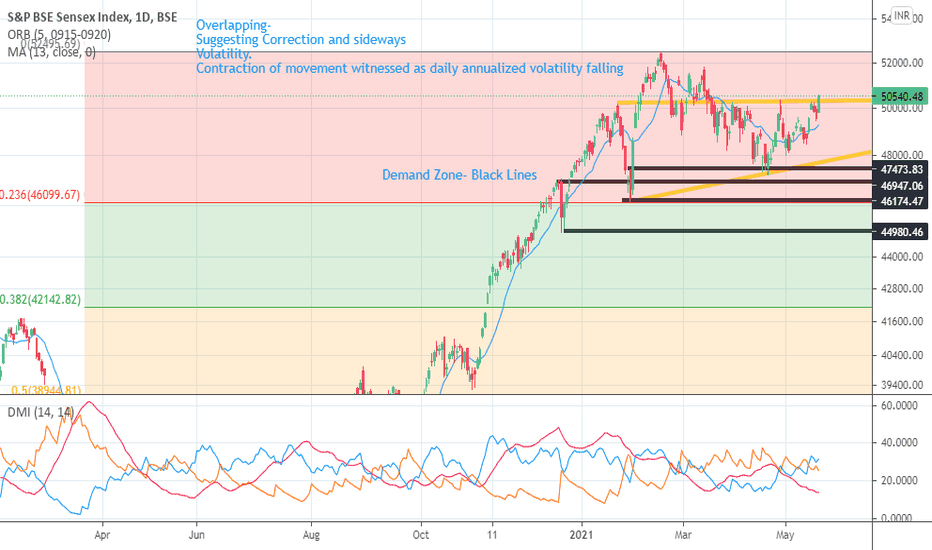

Sensex Rise: Analyzing the Factors Behind the Surge

The remarkable Sensex gains are a result of a confluence of factors, both domestic and international. Let's examine the key drivers behind this positive market trend:

-

Positive Global Market Trends: Global markets have shown encouraging signs of recovery, with major indices in the US and Europe experiencing steady growth. This positive global sentiment has spilled over into the Indian market, boosting investor confidence. The strengthening US dollar also positively impacted several Indian sectors.

-

Positive Economic Indicators for India: Recent economic data released for India has been largely positive. Stronger-than-expected GDP growth, coupled with declining inflation rates, has fueled optimism among investors. This indicates a healthy and growing Indian economy, making it attractive for investment.

-

Specific Company Performance Driving the Index Up: Several large-cap companies within the Sensex witnessed significant growth, directly contributing to the overall index rise. Strong quarterly earnings reports and positive future guidance from these companies played a substantial role.

-

Impact of Government Policies or Announcements: Recent government initiatives aimed at boosting economic growth and investor confidence have also contributed to the positive market sentiment. For example, the recent announcement of [insert specific recent policy or announcement] has been positively received by the market.

The combination of these factors has created a perfect storm for the Sensex to surge, demonstrating the interconnectedness of global and domestic economic factors.

Top Performing BSE Stocks: Sector-Wise Analysis

Several sectors experienced exceptional growth, with some sectors outperforming others. Let's analyze the top performers:

-

IT Sector: The IT sector experienced a particularly strong surge, driven by increased global demand for technology services and strong earnings reports from leading IT companies.

-

Pharmaceutical Sector: Pharmaceutical stocks also showed impressive gains, largely due to [insert reason e.g., strong export demand or positive clinical trial results].

-

Banking Sector: Several leading banking stocks witnessed substantial growth, reflecting investor confidence in the sector's future prospects.

Here are some of the top 5 performing stocks on the BSE today (percentage gains are approximate and may vary slightly based on the time of data collection):

- Stock A: +8% (Reason: Strong Q2 earnings exceeding expectations)

- Stock B: +7% (Reason: Positive outlook driven by new product launch)

- Stock C: +6% (Reason: Increased market share in a key segment)

- Stock D: +5.5% (Reason: Acquisition of a key competitor)

- Stock E: +5% (Reason: Government policy support for the sector)

Note: This is not an exhaustive list, and performance can fluctuate. Always conduct thorough research before making investment decisions.

Expert Opinions and Future Outlook for BSE Stocks

Financial analysts offer a mixed outlook on the future of BSE stocks. While the current surge is encouraging, they caution against unchecked optimism.

"The current market rise is partly fueled by global sentiment, but the underlying strength of the Indian economy also plays a vital role," says [Name of Analyst], Chief Investment Strategist at [Financial Institution]. "However, investors should remain cautious and diversify their portfolios."

Another expert, [Name of Analyst], notes that while the near-term outlook appears positive, external factors like global economic uncertainties could influence market performance. He suggests closely monitoring global developments and domestic economic indicators before making significant investment decisions.

The consensus suggests a cautiously optimistic outlook. While the potential for further growth exists, the possibility of corrections cannot be ruled out. A balanced perspective, incorporating both potential upside and downside risks, is crucial.

Conclusion: Capitalize on the BSE Stock Surge – Invest Wisely

Today's significant Sensex rise, driven by positive global and domestic factors, presents both opportunities and challenges for investors. The top-performing sectors, including IT, Pharma, and Banking, have shown impressive gains, but it's crucial to remember that past performance is not indicative of future results. The expert opinions highlight the need for a balanced approach, urging investors to conduct thorough due diligence before committing capital. While the BSE stock surge is exciting, wise investment decisions require careful consideration of market trends, individual stock performance, and expert advice. Before investing in any BSE stocks, consider consulting with a qualified financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial goals. Capitalize on the BSE stock market opportunities, but always invest wisely.

Featured Posts

-

Partido Roma Monza Sigue El Encuentro En Directo

May 15, 2025

Partido Roma Monza Sigue El Encuentro En Directo

May 15, 2025 -

Gurriels Pinch Hit Magic Padres Edge Out Braves

May 15, 2025

Gurriels Pinch Hit Magic Padres Edge Out Braves

May 15, 2025 -

Foot Lockers New Global Headquarters A Florida Move

May 15, 2025

Foot Lockers New Global Headquarters A Florida Move

May 15, 2025 -

San Diego Padres Release 2025 Regular Season Game Broadcast Details

May 15, 2025

San Diego Padres Release 2025 Regular Season Game Broadcast Details

May 15, 2025 -

Dove Sono Piu Alte Le Concentrazioni Di Microplastiche Nell Acqua

May 15, 2025

Dove Sono Piu Alte Le Concentrazioni Di Microplastiche Nell Acqua

May 15, 2025