Strategists Ditch Optimism On European Stocks: Trump's Trade War Risk

Table of Contents

The Direct Impact of Tariffs on European Businesses

The imposition of tariffs on European goods exported to the US has a direct and demonstrably negative impact on European businesses. Keywords: Tariffs, European Union, import/export, trade restrictions, supply chain disruption. These increased costs eat into profit margins, forcing companies to either absorb the losses or raise prices, potentially impacting competitiveness.

- Increased tariffs on European goods exported to the US directly impact profitability. The automotive industry, for example, has been significantly affected, with increased tariffs on cars and car parts leading to reduced sales and profits for European manufacturers.

- Disruption of supply chains due to trade restrictions leads to production delays and increased costs. Tariffs and trade disputes create uncertainty and instability in global supply chains, making it difficult for businesses to plan and execute their operations efficiently. This leads to delays, increased costs, and potentially lost revenue.

- Retaliatory tariffs imposed by the EU on US goods further exacerbate the negative impact. The EU's response to US tariffs has created a tit-for-tat scenario, further disrupting trade flows and negatively impacting both US and European economies. This escalation intensifies the negative impact on European businesses.

- Specific examples of industries significantly affected (e.g., automobiles, agricultural products). Beyond automobiles, sectors like agriculture (wine, cheese) and aerospace have also experienced substantial negative impacts due to increased tariffs and trade restrictions. These tariffs have resulted in reduced export volumes and increased production costs for these industries.

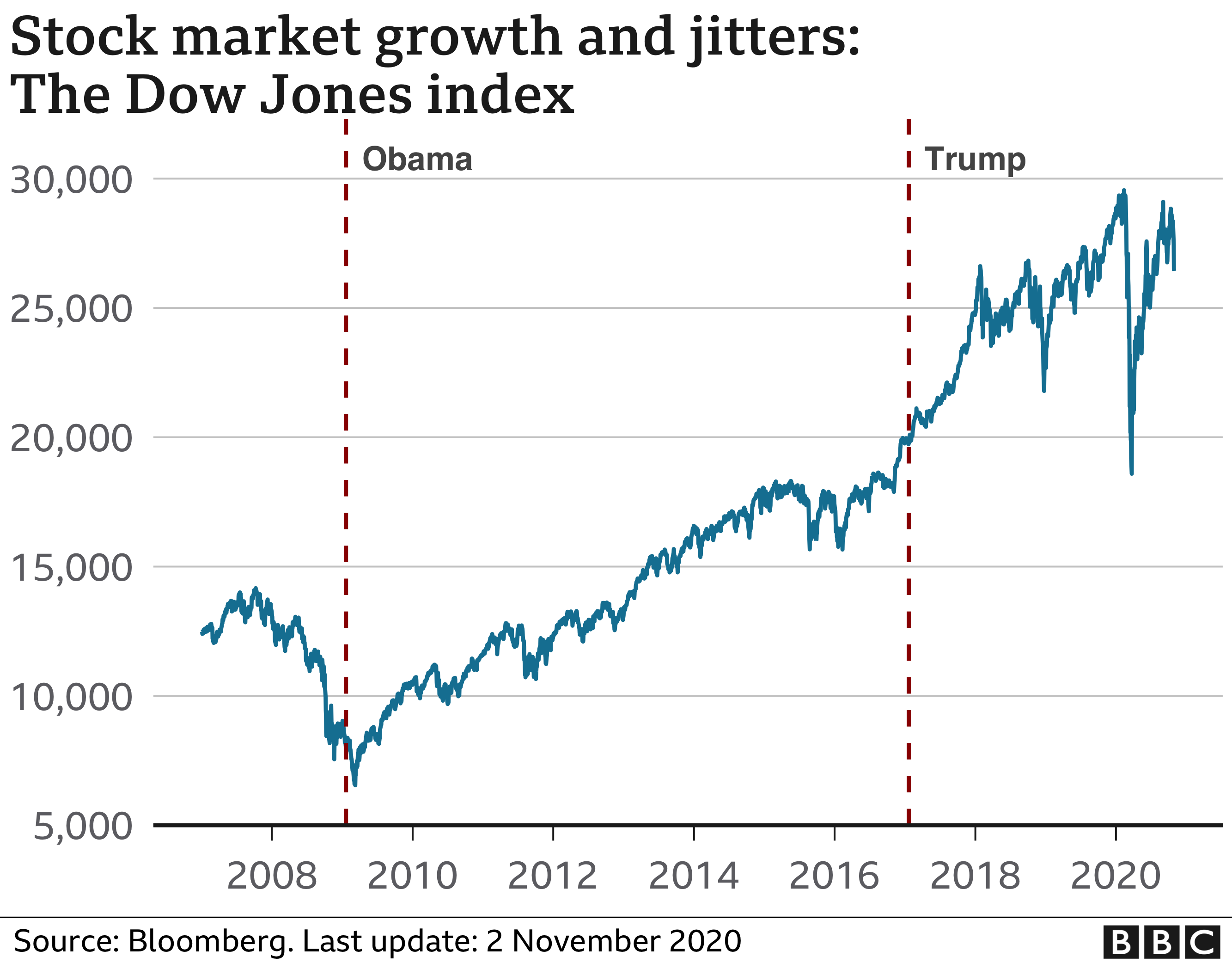

Increased Market Volatility and Investor Uncertainty

The ongoing trade war is creating a climate of fear and uncertainty, leading to increased market volatility and a shift in investor sentiment. Keywords: Market volatility, investor sentiment, stock market decline, risk aversion, investment decisions. This uncertainty makes it exceptionally difficult to predict market movements, resulting in increased risk aversion among investors.

- Uncertainty about future trade policies creates a climate of fear and uncertainty. The unpredictable nature of Trump's trade policies makes it nearly impossible for businesses and investors to plan for the future. This creates a climate of fear and uncertainty.

- Investors are becoming increasingly risk-averse, leading to capital flight from European markets. As investors seek safer havens, capital is flowing out of European markets, further exacerbating the decline. This capital flight puts downward pressure on European stock prices.

- Increased volatility makes accurate market predictions more difficult. The unpredictable nature of the trade war and its impacts makes it extremely challenging for analysts to accurately predict market trends. This unpredictability increases the risk for investors.

- Discussion of market indicators reflecting decreased investor confidence. Market indicators such as the VIX volatility index are showing increased volatility, while stock prices in several European markets are showing a clear downward trend, reflecting decreased investor confidence.

Alternative Investment Strategies in the Face of Uncertainty

Given the current economic climate, investors need to reassess their strategies and adopt a more cautious approach. Keywords: Portfolio diversification, risk management, defensive investments, alternative assets, investment strategy, hedging. Diversification and risk management are now more crucial than ever.

- Strategies for mitigating risk in a volatile market. Strategies like hedging against currency fluctuations and diversifying across asset classes can help mitigate risk.

- Diversification of investment portfolios to reduce reliance on European stocks. Investors should consider diversifying their portfolios beyond European equities, perhaps including investments in other geographical regions or asset classes.

- Exploration of defensive investment options (e.g., government bonds, precious metals). Defensive investments, such as government bonds and precious metals, are generally less volatile and can provide a degree of stability during periods of uncertainty.

- The role of alternative assets in mitigating trade war risks. Alternative assets, such as real estate or private equity, can offer diversification benefits and potentially provide better protection against trade war-related risks.

Geopolitical Implications and Long-Term Outlook

The trade war's impact extends far beyond economics; it carries significant geopolitical implications. Keywords: Geopolitical risk, global economy, economic slowdown, international relations, long-term investment. The long-term outlook for European stocks remains uncertain and hinges heavily on how the trade war evolves.

- The potential for the trade war to escalate further and its impact on global economic growth. A further escalation of the trade war could lead to a significant slowdown in global economic growth, with negative consequences for European economies.

- Analysis of the potential long-term consequences for the European economy. The long-term economic impacts on Europe depend heavily on the duration and intensity of the trade war, as well as the effectiveness of the EU's response.

- Discussion of potential geopolitical ramifications beyond the economic impact. The trade war is straining relationships between the US and its allies, potentially altering the geopolitical landscape in unforeseen ways.

- Predictions for the future performance of European stocks based on current trends. Based on current trends, the outlook for European stocks remains cautious, with significant downside risk if the trade war continues to escalate.

Conclusion

This article has highlighted the considerable impact of Trump's trade war on investor sentiment towards European stocks. The increased uncertainty, market volatility, and the direct negative effects of tariffs have compelled strategists to abandon their previously optimistic outlook. We've explored the resulting implications for investors and proposed alternative investment strategies to help mitigate the risks.

Call to Action: Understanding the complexities of the trade war and its implications for European stocks is paramount for making informed investment decisions. Don't let the current uncertainty negatively impact your portfolio. Learn more about effective risk management strategies and how to navigate the challenges posed by Trump's trade war on European stocks. Consult a financial advisor to create a tailored investment strategy that protects your assets and helps you weather this period of economic uncertainty.

Featured Posts

-

Navigating The Chinese Market The Bmw And Porsche Case Study

Apr 26, 2025

Navigating The Chinese Market The Bmw And Porsche Case Study

Apr 26, 2025 -

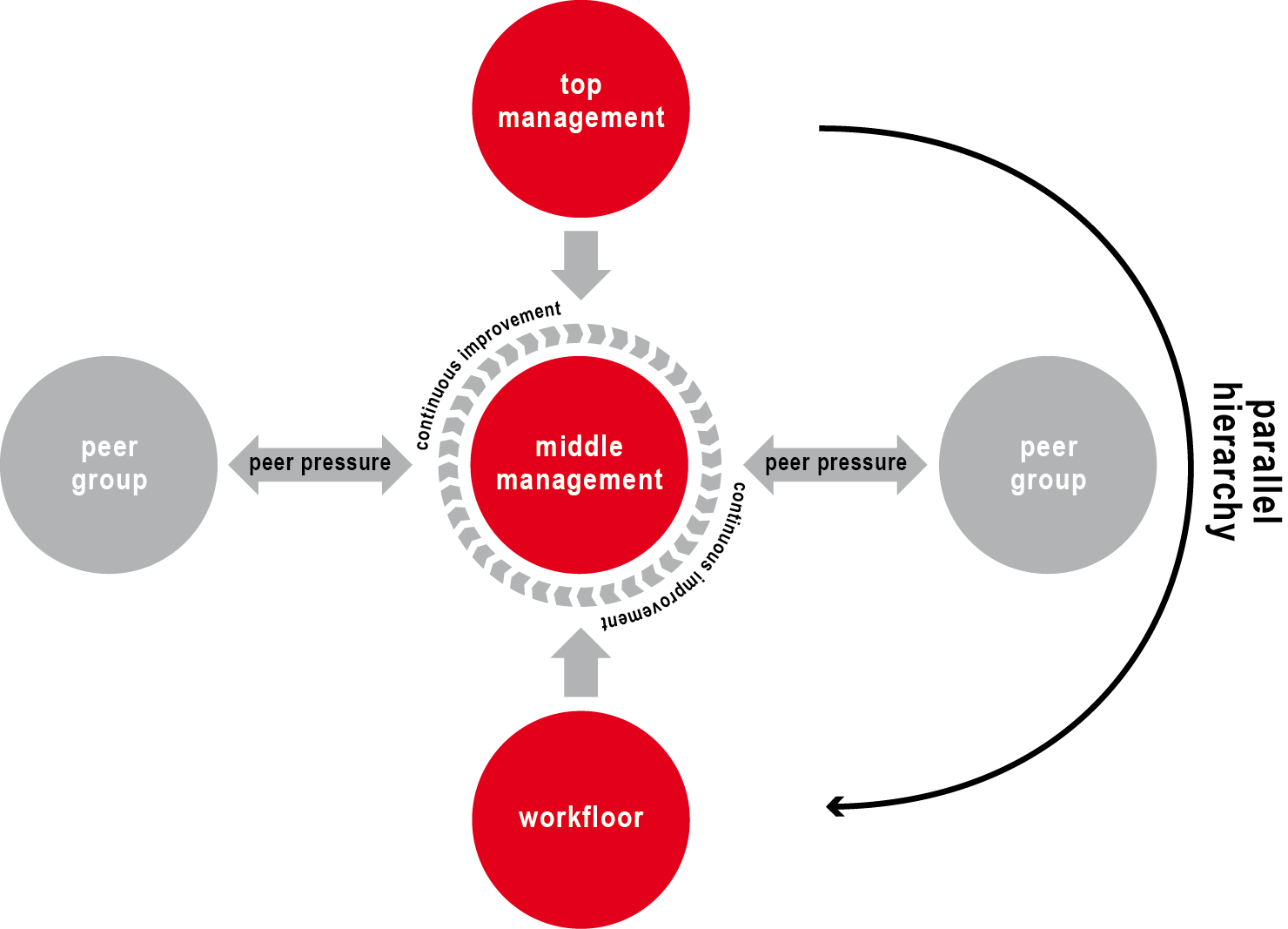

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025 -

George Santos Fear Of Prison His Outburst Explained

Apr 26, 2025

George Santos Fear Of Prison His Outburst Explained

Apr 26, 2025 -

87 Month Sentence Sought For George Santos By Department Of Justice

Apr 26, 2025

87 Month Sentence Sought For George Santos By Department Of Justice

Apr 26, 2025 -

Nyt Spelling Bee Answers And Strategies March 25th Puzzle 387

Apr 26, 2025

Nyt Spelling Bee Answers And Strategies March 25th Puzzle 387

Apr 26, 2025

Latest Posts

-

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

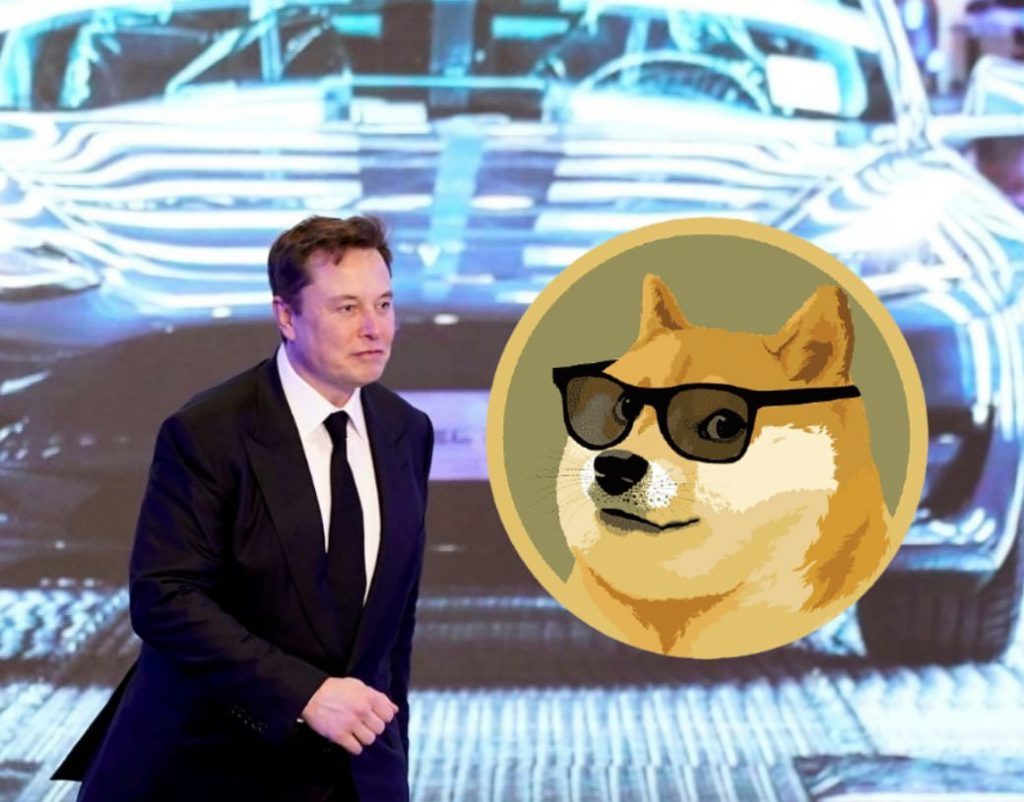

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025