Student Loan Delinquency: The Effect On Your Credit Rating

Table of Contents

Understanding Student Loan Delinquency

Student loan delinquency refers to the failure to make your scheduled student loan payments on time. Delinquency is categorized by the number of days your payment is past due. The longer you are delinquent, the more severe the consequences become.

- 30 Days Late: While considered early delinquency, this can already negatively impact your credit score.

- 60 Days Late: Your loan servicer will likely contact you, and the negative impact on your credit score increases significantly.

- 90 Days Late: This is a serious stage of delinquency. Your credit score takes a substantial hit, and collection agencies may become involved.

- 120+ Days Late: Your loan could be referred to collections, leading to further damage to your credit and potentially impacting your ability to obtain credit in the future. This can also lead to wage garnishment or tax refund offset.

What constitutes a missed payment? A missed payment is any payment not received by your loan servicer by the due date specified in your loan agreement. This includes payments that are insufficient to cover the minimum amount due. It's important to differentiate between delinquency and default. Delinquency is the state of being late on payments, while default occurs when the loan is significantly past due and often involves legal action.

How Delinquency Impacts Your Credit Score

Late student loan payments are reported to all three major credit bureaus: Equifax, Experian, and TransUnion. This negative information remains on your credit report for seven years from the date of the missed payment.

The impact on your credit score can be substantial. A single missed payment can result in a drop of 50-100 points or more, depending on your overall credit history and the severity of the delinquency.

- Impact on FICO Score: Your FICO score, a crucial factor in loan approvals, will decrease significantly, making it harder to qualify for favorable interest rates.

- Effect on Loan Approval Chances: Securing mortgages, auto loans, and even credit cards becomes significantly more challenging, or you may be offered loans with much higher interest rates.

- Increased Interest Rates: Lenders view borrowers with delinquent accounts as higher risks, resulting in significantly higher interest rates on future loans.

Preventing Student Loan Delinquency

Proactive measures are essential to avoid the pitfalls of student loan delinquency and its damaging effects on your credit.

- Automatic Payment Setup: Set up automatic payments directly from your bank account to ensure timely payments. This eliminates the risk of forgetting due dates.

- Budgeting and Financial Planning: Create a detailed budget that includes your student loan payment. Track your income and expenses carefully to identify areas where you can save.

- Income-Driven Repayment Plans: Explore income-driven repayment plans (IDR) offered by the government. These plans adjust your monthly payment based on your income and family size, making payments more manageable.

- Communicating with Your Loan Servicer: If you anticipate difficulty making a payment, contact your loan servicer immediately. They may offer forbearance or deferment options, preventing your account from becoming delinquent.

- Exploring Student Loan Forgiveness or Rehabilitation Programs: Research programs like Public Service Loan Forgiveness (PSLF) or loan rehabilitation to see if you qualify for assistance.

Recovering from Student Loan Delinquency

Recovering from student loan delinquency requires effort and time, but it's achievable.

- Paying Off Delinquent Loans as Quickly as Possible: Make every effort to pay off your delinquent loans as rapidly as possible. This demonstrates to lenders your commitment to resolving the situation.

- Dispute Any Inaccuracies on Your Credit Report: Review your credit report regularly and dispute any incorrect information with the credit bureaus.

- Monitoring Your Credit Report Regularly: Continuously monitor your credit report to track your progress and identify any further issues.

- Seeking Credit Counseling: A credit counselor can provide valuable guidance on managing your debt and creating a plan for recovery.

Conclusion

Student loan delinquency carries severe consequences for your credit score and overall financial health. Understanding the stages of delinquency, its impact on your credit report, and the methods for prevention and recovery are crucial. Don't let student loan delinquency damage your financial future. Take control of your student loans today by exploring repayment options, creating a budget, and actively monitoring your credit report. Avoiding student loan delinquency and managing existing delinquency effectively are key steps toward securing your financial well-being. Remember, early intervention and proactive management are critical in preventing and recovering from student loan delinquency.

Featured Posts

-

Latest Fortnite Shop Update Receives Backlash From Players

May 17, 2025

Latest Fortnite Shop Update Receives Backlash From Players

May 17, 2025 -

Unlock Bet365 Bonus Code Nypbet Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025

Unlock Bet365 Bonus Code Nypbet Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025 -

El Gobierno De Puerto Rico Y La Crisis De Los Prestamos Estudiantiles Morosos

May 17, 2025

El Gobierno De Puerto Rico Y La Crisis De Los Prestamos Estudiantiles Morosos

May 17, 2025 -

Former Minnesota Lynx Star Joins Golden State Valkyries

May 17, 2025

Former Minnesota Lynx Star Joins Golden State Valkyries

May 17, 2025 -

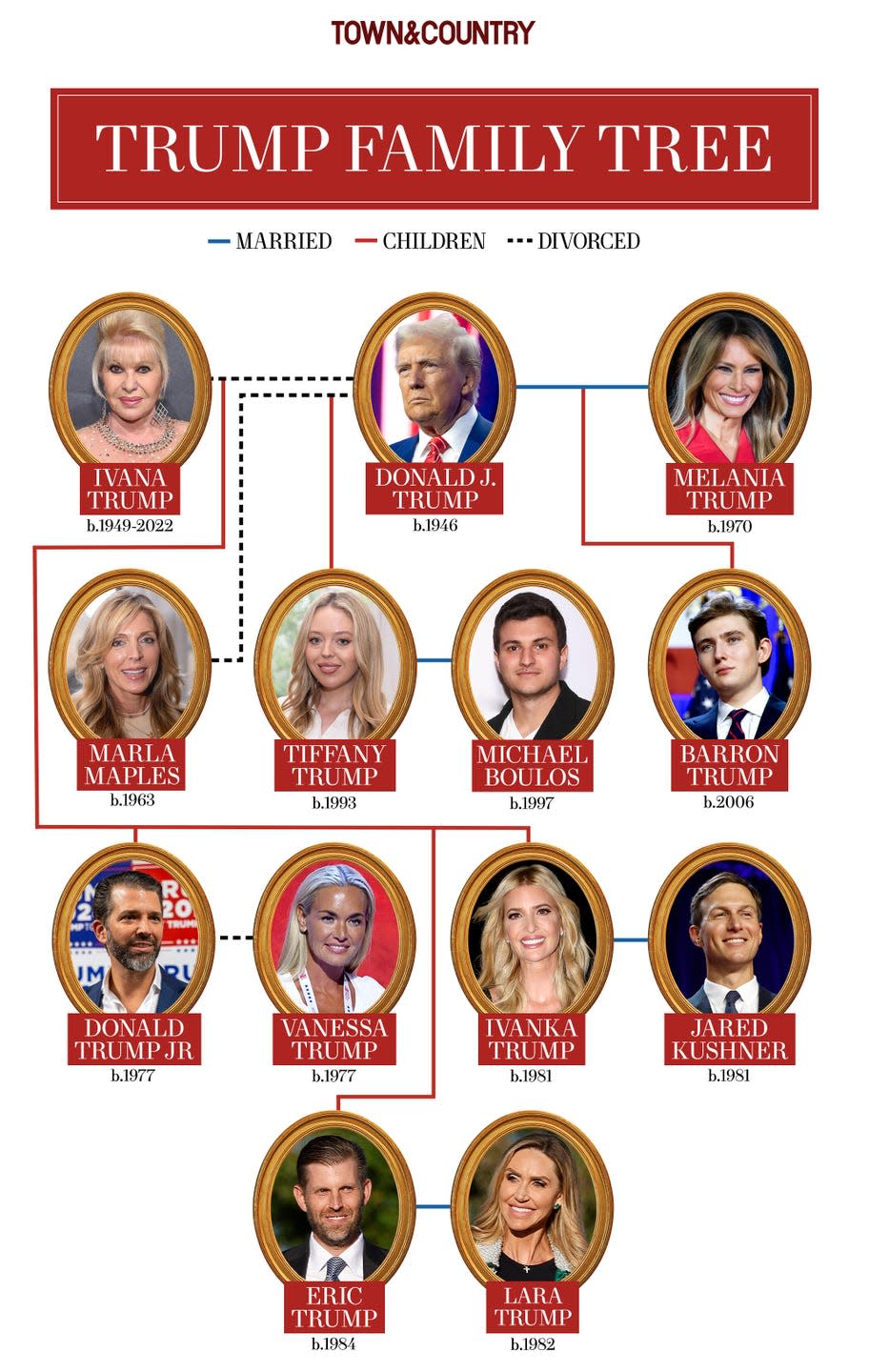

Alexander Bouloss Arrival Updating The Trump Family Tree

May 17, 2025

Alexander Bouloss Arrival Updating The Trump Family Tree

May 17, 2025