Student Loan Payments And Credit Score: What You Need To Know

Table of Contents

The weight of student loan debt is a significant reality for millions of Americans, often causing considerable stress and financial strain. Many graduates find themselves grappling with repayments while simultaneously trying to build a strong financial future. Understanding the intricate relationship between student loan payments and credit score is crucial for navigating this challenging period successfully. This article will provide essential information and guidance on how your student loan payments directly impact your credit score, and more importantly, how you can manage them effectively to build a positive credit history.

H2: How Student Loan Payments Affect Your Credit Score

Your student loan repayment history is a cornerstone of your creditworthiness. The way you manage your student loans significantly influences your credit score, affecting your ability to secure loans, credit cards, and even rental agreements in the future.

H3: Positive Impact of On-Time Payments:

Consistent, on-time student loan payments are a powerful tool for building a strong credit profile. Every on-time payment contributes positively to your credit history, signaling to lenders that you're a responsible borrower. This positive payment history is meticulously tracked by the major credit reporting agencies: Equifax, Experian, and TransUnion.

- Example: Consistently making on-time payments for a year can boost your credit score by 20-30 points, depending on your overall credit profile.

- Example: A consistently excellent payment history can significantly improve your creditworthiness, potentially leading to lower interest rates on future loans and better terms on credit cards.

- Establishing a positive payment history early in your credit journey is paramount for long-term financial success. It sets the stage for a higher credit score and greater financial opportunities down the line.

H3: Negative Impact of Missed or Late Payments:

Conversely, missed or late student loan payments severely damage your credit score. Even a single late payment can have long-lasting negative consequences. Late payments signal to lenders that you are a higher-risk borrower, resulting in a lower credit score.

- Example: A single missed payment can drop your credit score by 50-100 points.

- Example: Multiple late payments can make it significantly harder to secure loans in the future, potentially leading to higher interest rates and less favorable loan terms. It can also impact your chances of renting an apartment or getting approved for a credit card.

- The impact of late payments extends beyond the immediate score drop; it can affect your credit report for years, making it more challenging to rebuild your credit.

H3: The Role of Payment History in Credit Scoring Models:

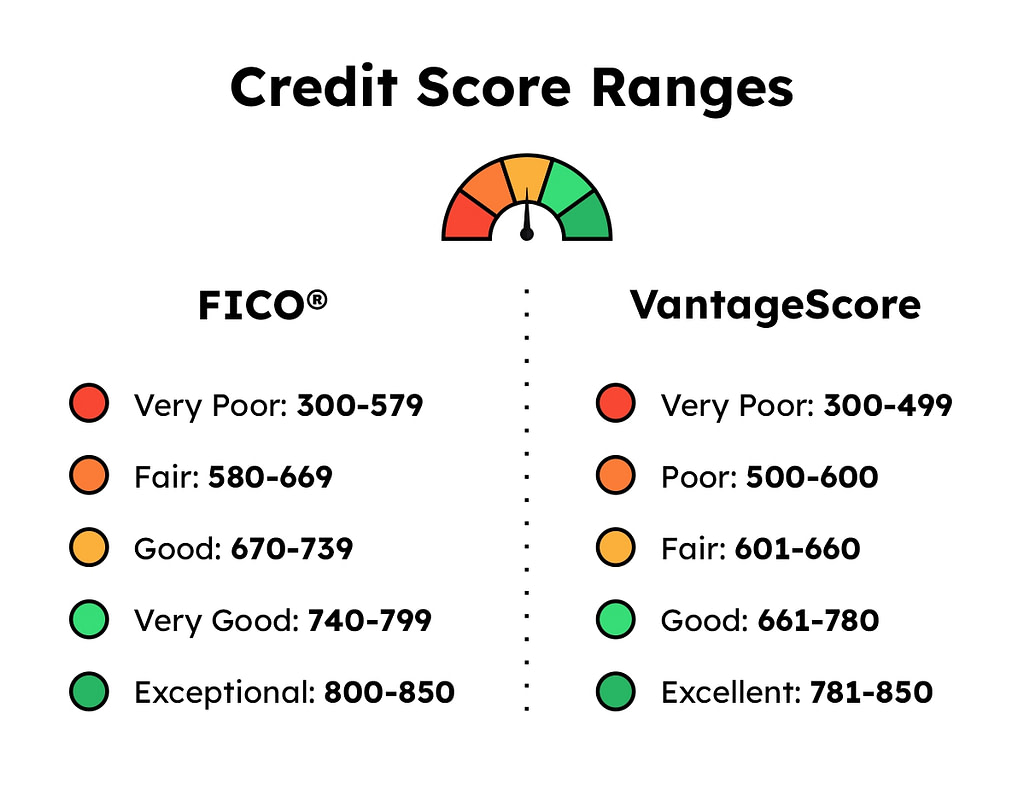

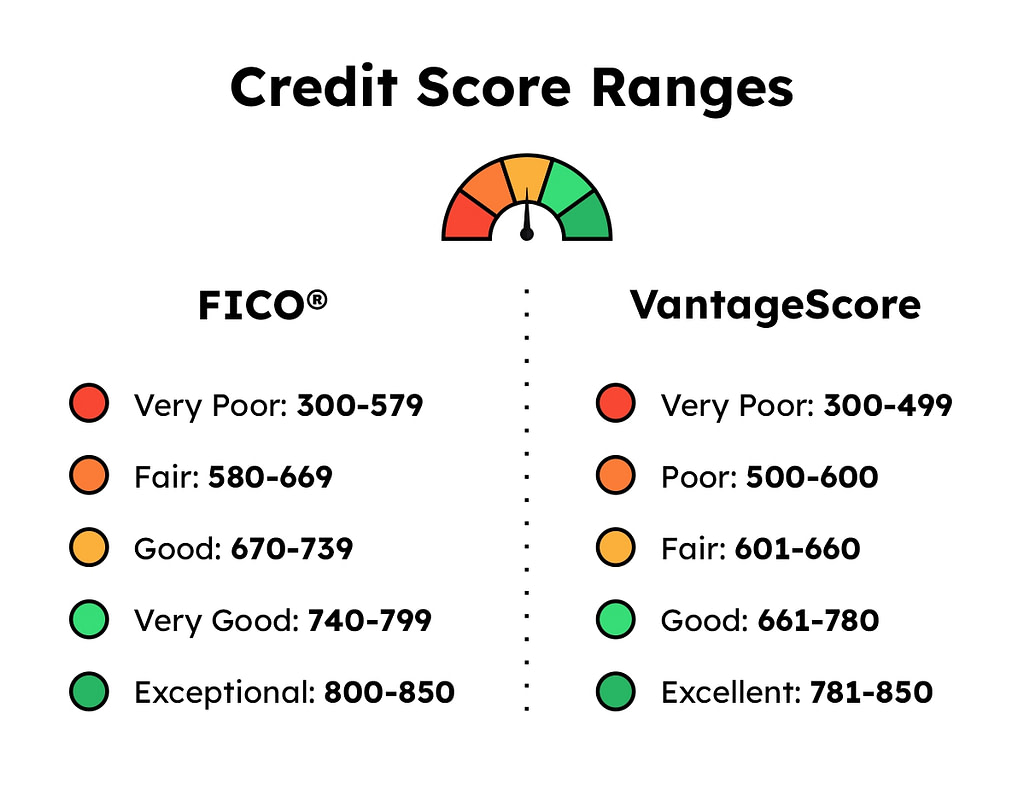

Payment history is the most significant factor in calculating your FICO and VantageScore, two of the most widely used credit scoring models. These models assign a significant weight to your repayment history, reflecting its importance in assessing credit risk.

- Payment history typically accounts for 35% of your FICO score and a similar weight in VantageScore.

- Understanding your credit report and disputing any errors is crucial for maintaining an accurate credit history. Regularly review your reports from all three credit bureaus to catch and correct any inaccuracies.

H2: Strategies for Managing Student Loan Payments and Protecting Your Credit Score

Effectively managing your student loan payments is critical for maintaining a healthy credit score. Here are some strategies to ensure you stay on track:

H3: Budgeting and Payment Planning:

Developing a realistic budget is the cornerstone of successful student loan repayment. You need to accurately assess your income and expenses to allocate funds for your student loan payments while covering other essential needs.

- Use budgeting tools and apps to track income and expenses.

- Consider the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Prioritize student loan payments within your budget.

H3: Exploring Repayment Options:

Several student loan repayment plans are available, each with its implications for your credit score. Understanding these options and choosing the one that best suits your financial situation is essential.

- Standard Repayment: Fixed monthly payments over 10 years. This plan offers the quickest path to repayment but might be challenging for some borrowers.

- Income-Driven Repayment (IDR): Payments are based on your income and family size. While they might result in lower monthly payments, repayment can take longer.

- Extended Repayment: Longer repayment terms, often 25 years, can lower monthly payments but increase the total interest paid over the life of the loan.

- Loan consolidation and refinancing can simplify payments and potentially lower interest rates.

H3: Automating Payments:

Automating your student loan payments is one of the most effective ways to prevent late payments and maintain a good credit score.

- Set up automatic payments directly through your lender's website or banking app.

- Automatic payments eliminate the risk of forgetting a payment and ensure on-time repayment every month.

H3: Monitoring Your Credit Report:

Regularly checking your credit report is crucial for identifying potential problems early and maintaining a healthy credit score.

- Obtain your free credit reports annually from AnnualCreditReport.com.

- Review your reports for inaccuracies and promptly dispute any errors.

3. Conclusion:

The relationship between student loan payments and credit score is undeniable. Consistent on-time payments are crucial for building a strong credit profile, while late or missed payments can severely damage your creditworthiness. By implementing proactive strategies such as creating a realistic budget, exploring different repayment options, automating payments, and monitoring your credit report, you can effectively manage your student loan payments and protect your credit score. Take control of your financial future by learning more about managing student loan payments and boosting your credit score. Start today by visiting [link to a relevant resource, e.g., a credit counseling service or student loan repayment calculator].

Featured Posts

-

Nba Star Jalen Brunson Unhappy About Missing Wwes Raw

May 17, 2025

Nba Star Jalen Brunson Unhappy About Missing Wwes Raw

May 17, 2025 -

Japans Q1 Economic Performance Assessing The Pre Tariff Slowdown

May 17, 2025

Japans Q1 Economic Performance Assessing The Pre Tariff Slowdown

May 17, 2025 -

Data Breach Fbi Investigation Into Millions Stolen Via Office 365 Hacks

May 17, 2025

Data Breach Fbi Investigation Into Millions Stolen Via Office 365 Hacks

May 17, 2025 -

Enhancements To The Fortnite Item Shop A New Player Friendly Feature

May 17, 2025

Enhancements To The Fortnite Item Shop A New Player Friendly Feature

May 17, 2025 -

The Brunson Departure And The Doncic Trade Assessing The Impact On The Dallas Mavericks Future

May 17, 2025

The Brunson Departure And The Doncic Trade Assessing The Impact On The Dallas Mavericks Future

May 17, 2025