Succession Planning For The Ultra-Wealthy: A Growing Trend

Table of Contents

The Unique Challenges of Ultra-High-Net-Worth (UHNW) Succession Planning

Succession planning for the ultra-wealthy differs significantly from traditional estate planning. The sheer scale and complexity of assets, combined with intricate family relationships, necessitate a highly specialized and proactive approach.

Complex Asset Structures

UHNW individuals typically possess a diverse portfolio extending far beyond simple bank accounts. These often include: real estate holdings across multiple jurisdictions, private equity investments, significant art collections, privately held businesses, and other illiquid assets. This complexity presents unique challenges in valuation and transfer.

- International tax implications: Assets located in different countries are subject to varying tax laws, requiring careful international tax planning to minimize liabilities and ensure compliance. This often involves navigating complex treaties and regulations.

- Valuation challenges of illiquid assets: Determining the fair market value of assets like private businesses or art collections can be complex and require specialized appraisals. Accurate valuation is crucial for equitable distribution and accurate tax reporting.

- Coordination across multiple jurisdictions: Managing assets and legal compliance across different countries requires coordination with legal and financial professionals in multiple jurisdictions. This necessitates a seamless and efficient global strategy.

Family Dynamics and Disputes

Wealth can unfortunately exacerbate existing family tensions or create new ones. Disagreements over inheritance can lead to protracted legal battles, damaging family relationships and eroding the intended legacy. Proactive planning is crucial to mitigate these risks.

- Pre-nuptial agreements and family governance structures: These legal instruments can help define expectations and responsibilities, establishing clear guidelines for wealth distribution and family decision-making.

- Mediation and conflict resolution strategies: Implementing strategies for addressing disagreements early and fairly, often utilizing professional mediators, can minimize the potential for protracted legal disputes.

- Establishing clear communication channels: Open and honest communication between family members, facilitated by professional guidance, is essential for fostering understanding and preventing misunderstandings.

Key Strategies for Effective Ultra-Wealthy Succession Planning

Effective succession planning for the ultra-wealthy involves a multi-pronged approach, leveraging sophisticated strategies to protect assets, minimize tax burdens, and ensure a smooth transition of wealth across generations.

Establishing a Family Office

A dedicated family office provides centralized management of assets, offering specialized expertise and a holistic approach to wealth management.

- Expert financial and legal advice: Family offices employ professionals across various disciplines, including investment management, tax planning, legal counsel, and philanthropic advisors.

- Consolidated asset management: This simplifies the management of diverse assets, providing a single point of control and oversight.

- Long-term strategic planning: A family office focuses on long-term wealth preservation and growth, aligning with the family's goals and values.

Utilizing Trusts and Foundations

Trusts and foundations offer sophisticated tools for asset protection, tax optimization, and wealth preservation across multiple generations.

- Different trust structures and their suitability: Various trust structures cater to different needs and objectives, requiring careful selection based on specific circumstances.

- International trust jurisdictions: Certain jurisdictions offer favorable legal and tax environments for establishing trusts, providing additional asset protection and tax benefits.

- Foundation governance and oversight: Establishing robust governance structures for foundations ensures responsible management and alignment with the family's philanthropic goals.

Charitable Giving and Philanthropy

Integrating philanthropy into succession plans allows for legacy building, fulfilling personal values, and generating tax benefits.

- Establishing family foundations: A family foundation provides a structured vehicle for charitable giving, allowing for strategic grantmaking and impact investing.

- Impact investing strategies: Combining charitable giving with investment strategies that generate both social and financial returns.

- Tax-efficient charitable giving vehicles: Utilizing tax-advantaged vehicles to maximize the impact of charitable contributions.

The Role of Experienced Professionals in Ultra-Wealthy Succession Planning

Navigating the complexities of ultra-high-net-worth succession planning requires a team of experienced professionals.

Estate Planning Attorneys

Essential for drafting and implementing legal documents, ensuring compliance with all relevant laws and regulations. They deal with wills, trusts, and other legal instruments.

Financial Advisors

Provide expertise in investment management, asset allocation, and portfolio diversification, helping to preserve and grow wealth across generations.

Tax Advisors

Crucial for minimizing tax liabilities through strategic planning and compliance, navigating the complex tax implications of various assets and jurisdictions.

Family Therapists/Counselors

Support family communication and conflict resolution, helping families navigate sensitive discussions around wealth and inheritance.

Conclusion

Succession planning for the ultra-wealthy is a multifaceted process demanding careful consideration of intricate financial, legal, and familial aspects. By proactively addressing complex asset structures, family dynamics, and utilizing professional expertise, UHNW individuals can effectively secure their legacy and ensure a smooth transition of wealth to future generations. Don't wait until it's too late; take control of your financial future and initiate your comprehensive ultra-wealthy succession planning today. Consult with experienced professionals to tailor a bespoke strategy that aligns with your unique circumstances and aspirations. Secure your family's future with proactive succession planning tailored to your ultra-high-net-worth status.

Featured Posts

-

T And T Government Restricts Vybz Kartels Travel

May 22, 2025

T And T Government Restricts Vybz Kartels Travel

May 22, 2025 -

Exploring The Cultural Impact Of The Goldbergs

May 22, 2025

Exploring The Cultural Impact Of The Goldbergs

May 22, 2025 -

Zagrozi Grema Ta Perspektivi Peremir Ya Analiz Situatsiyi V Ukrayini

May 22, 2025

Zagrozi Grema Ta Perspektivi Peremir Ya Analiz Situatsiyi V Ukrayini

May 22, 2025 -

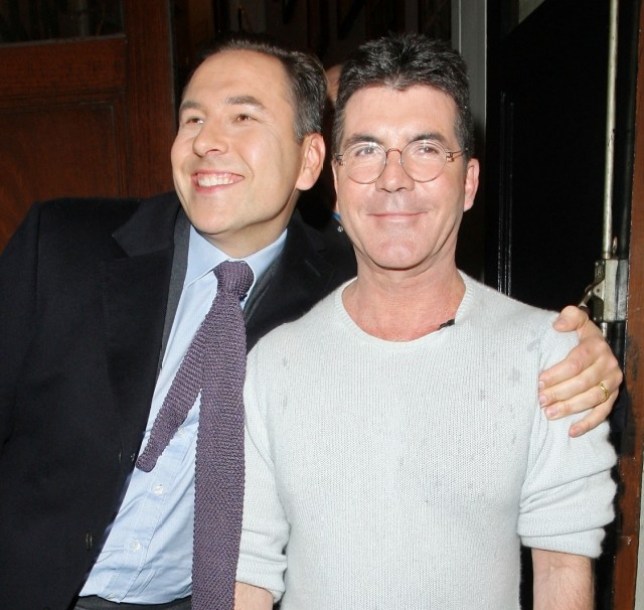

David Walliams Vs Simon Cowell A Breakdown Of Their Public Dispute

May 22, 2025

David Walliams Vs Simon Cowell A Breakdown Of Their Public Dispute

May 22, 2025 -

The Irish Pm Jd Vance And Trumps Funniest White House Moments

May 22, 2025

The Irish Pm Jd Vance And Trumps Funniest White House Moments

May 22, 2025