Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Global Sovereign Bond Market

The global sovereign bond market is currently experiencing a period of significant change, shaped by several interconnected factors. Understanding these factors is crucial for investors seeking to optimize their portfolios.

Interest Rate Environments and Their Impact

Interest rates are a fundamental driver of sovereign bond prices. Central banks worldwide wield considerable influence over these rates, impacting bond yields and investor returns.

- The Federal Reserve (Fed): The Fed's monetary policy decisions significantly affect US Treasury yields and, consequently, global bond markets. Recent rate hikes have impacted bond prices inversely.

- The European Central Bank (ECB): The ECB's actions influence Eurozone sovereign bond yields, affecting investor sentiment across the continent. Their approach to inflation significantly impacts sovereign bond prices within the Eurozone.

- Inverse Relationship: Bond prices and interest rates share an inverse relationship. When interest rates rise, bond prices generally fall, and vice versa. This fundamental concept is crucial for understanding bond market dynamics.

- Specific Examples: For example, the rise in US interest rates in 2022 led to a decline in the prices of many longer-term government bonds, while short-term bonds saw increased demand.

Inflation and its Influence on Sovereign Bond Yields

Inflation significantly impacts sovereign bond yields. High inflation erodes the purchasing power of future bond payments, leading investors to demand higher yields to compensate for this risk.

- Inflation Expectations: Market participants closely watch inflation expectations, which influence how they price sovereign bonds. Higher expected inflation typically translates into higher demanded yields.

- Real Return: Inflation reduces the real return on bonds—the return after accounting for inflation. Investors need to carefully consider this when assessing the attractiveness of sovereign bond investments.

- Country-Specific Analysis: Examining individual countries’ inflation rates is crucial. Countries with high inflation rates typically see higher yields on their sovereign bonds to reflect the increased risk.

Key Sovereign Bond Market Trends and Predictions

Understanding current trends and making informed predictions is vital for navigating the sovereign bond market. Geopolitical factors and economic growth forecasts play a significant role in shaping market dynamics.

Geopolitical Risks and their Impact

Geopolitical instability significantly impacts investor sentiment and sovereign bond markets. Periods of uncertainty often lead to a flight to safety, driving demand for bonds issued by perceived safe-haven countries.

- Examples: The war in Ukraine led to increased demand for US Treasury bonds and other safe-haven assets, pushing their yields lower. Political instability in a particular region can negatively impact the bonds issued by countries in that region.

- Risk Aversion: During times of geopolitical risk, investors tend to become more risk-averse, seeking the relative safety of sovereign bonds, particularly those issued by countries with strong credit ratings.

- Safe-Haven Assets: US Treasury bonds, German Bunds, and Japanese Government Bonds are often considered safe-haven assets, experiencing increased demand during times of global uncertainty.

Economic Growth Forecasts and their Implications

Economic growth forecasts significantly influence sovereign bond markets. Strong economic growth often leads to higher interest rates, potentially impacting bond prices.

- Growth and Interest Rates: Generally, robust economic growth can lead central banks to raise interest rates to combat inflation, thereby affecting bond yields.

- Strong vs. Weak Growth: Countries experiencing strong economic growth may see higher bond yields reflecting investor confidence, while countries with weak growth might see lower yields reflecting increased risk.

- Forecasting Models: Various economic forecasting models are employed to predict future growth, influencing investor decisions and market dynamics.

Investment Strategies in the Sovereign Bond Market

Successful investing in the sovereign bond market requires a well-defined strategy encompassing diversification and robust risk management.

Diversification Strategies for Sovereign Bonds

Diversifying across different countries and maturities is crucial for mitigating risk within a sovereign bond portfolio.

- Types of Sovereign Bonds: Investors can diversify by investing in different types of sovereign bonds, such as government bonds, treasury bills, and inflation-linked bonds.

- Reducing Risk: Diversification helps reduce the impact of negative events affecting a specific country or maturity. A diversified portfolio is better equipped to withstand market volatility.

- Portfolio Examples: A well-diversified portfolio might include bonds from developed and emerging markets, incorporating a range of maturities to balance risk and return.

Risk Management in Sovereign Bond Investments

Managing risks associated with sovereign bond investments is essential for protecting capital and achieving investment objectives.

- Credit Risk: The risk that the issuer might default on its debt obligations.

- Interest Rate Risk: The risk that changes in interest rates will negatively impact the value of bonds.

- Inflation Risk: The risk that inflation will erode the real return on bonds.

- Risk Mitigation: Strategies like hedging, diversification, and careful maturity matching can help mitigate these risks.

- Swissquote Bank's Services: Swissquote Bank offers a range of tools and services to help investors manage risks effectively in the sovereign bond market.

Conclusion

The sovereign bond market presents both opportunities and challenges for investors. Understanding the interplay of interest rates, inflation, geopolitical risks, and economic growth forecasts is crucial for making informed decisions. Diversification and effective risk management are key strategies for navigating this complex market. Gain a deeper understanding of the sovereign bond market and make informed investment decisions with Swissquote Bank. Explore our comprehensive research and resources on sovereign bonds, government bonds, and other fixed-income instruments today!

Featured Posts

-

Tonawanda Worker Faces Charges For Providing Drugs To Colleague

May 19, 2025

Tonawanda Worker Faces Charges For Providing Drugs To Colleague

May 19, 2025 -

Florida State University Shooting Details Emerge About Deceased Employees Family History

May 19, 2025

Florida State University Shooting Details Emerge About Deceased Employees Family History

May 19, 2025 -

La Muerte De Juan Aguilera El Maestro De Boris Becker Ya No Esta Con Nosotros

May 19, 2025

La Muerte De Juan Aguilera El Maestro De Boris Becker Ya No Esta Con Nosotros

May 19, 2025 -

Fighters Honest Confession Ufc 313 Result Questioned

May 19, 2025

Fighters Honest Confession Ufc 313 Result Questioned

May 19, 2025 -

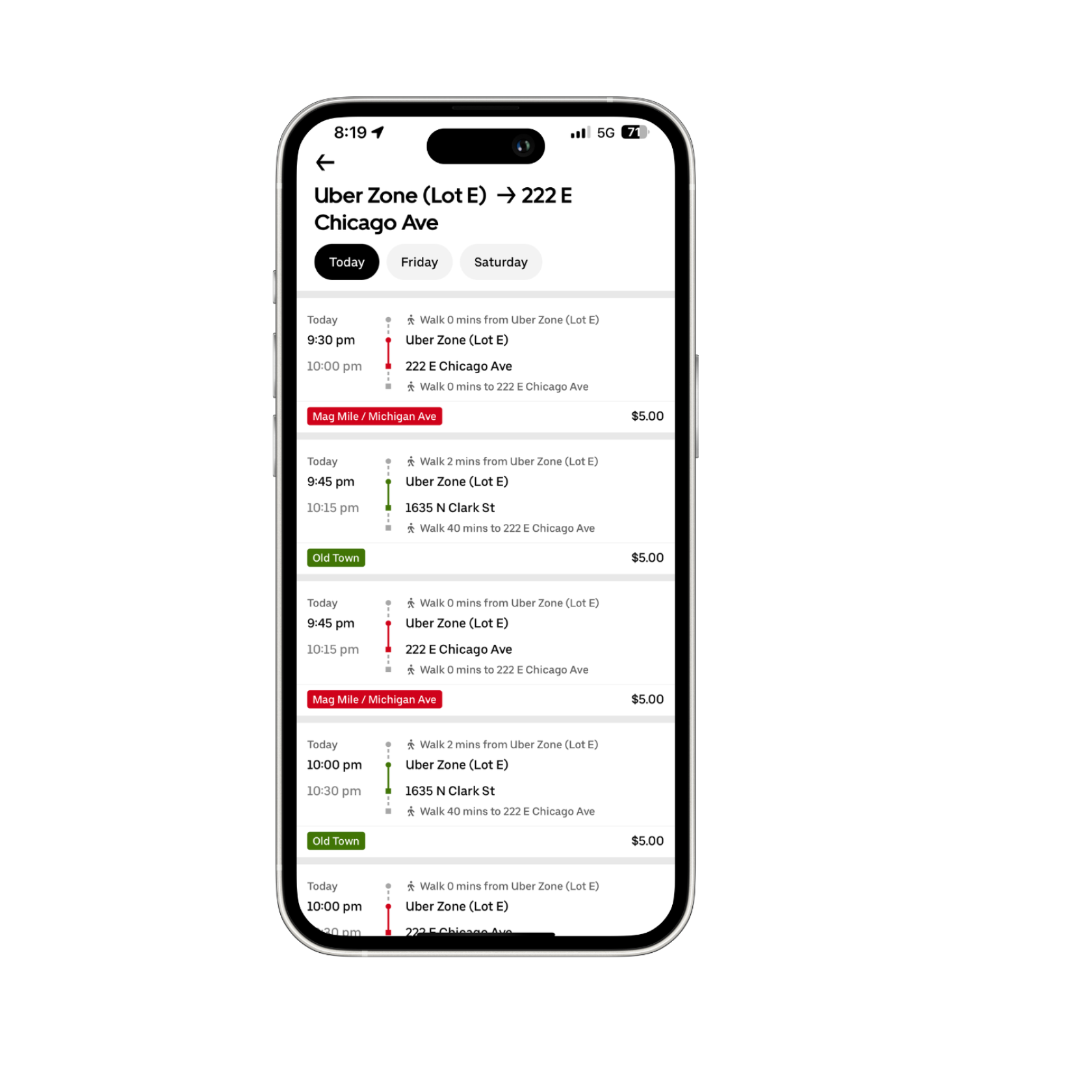

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 19, 2025

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 19, 2025