Swissquote Bank's Perspective On The Current Sovereign Bond Market

Table of Contents

Global Macroeconomic Factors Impacting Sovereign Bond Yields

Several macroeconomic factors significantly influence sovereign bond yields, impacting investor decisions and market stability. These factors are interconnected and often amplify each other's effects.

Inflation and Central Bank Policy

Inflation's impact on sovereign bond yields is perhaps the most immediate and significant. High inflation erodes the purchasing power of future bond payments, leading investors to demand higher yields as compensation for this risk. Central bank policies, particularly interest rate hikes, directly affect bond prices. When central banks raise interest rates to combat inflation, existing bonds become less attractive, causing their prices to fall and yields to rise. This is because newly issued bonds offer higher yields. Quantitative tightening (QT), where central banks reduce their balance sheets by selling bonds, further adds downward pressure on bond prices.

- Examples:

- The US, experiencing higher-than-target inflation, saw a significant rise in Treasury bond yields.

- Conversely, countries with lower inflation rates, like Switzerland, experienced more stable sovereign bond yields.

- The European Central Bank's interest rate hikes impacted Eurozone sovereign bond yields.

Geopolitical Risks and Uncertainty

Geopolitical events introduce significant uncertainty into the sovereign bond market. Wars, trade disputes, and political instability can trigger a "flight to safety," where investors rush into perceived safe-haven assets like US Treasury bonds, driving down their yields and increasing demand. This often comes at the expense of other sovereign bond markets perceived as riskier. Increased risk aversion leads to lower demand for higher-yielding bonds, impacting their prices and yields.

- Examples:

- The war in Ukraine significantly impacted European sovereign bond markets, causing increased volatility.

- Trade tensions between major economies can negatively impact global bond markets.

- Political instability in emerging markets can lead to capital flight and increased yields on their sovereign debt.

Analysis of Key Sovereign Bond Markets

Understanding the specific dynamics of major sovereign bond markets is vital for effective investment strategies.

US Treasury Bonds

The US Treasury market remains the benchmark for global sovereign debt, often considered a safe haven. However, the market is not without its risks. The ongoing debate surrounding the US debt ceiling introduces uncertainty, potentially impacting investor confidence and yields. Analyzing the yield curve, which plots yields of Treasury bonds with different maturities, provides insights into future economic expectations. An inverted yield curve, where short-term yields exceed long-term yields, is often seen as a recessionary signal.

- Key Indicators and Metrics:

- 10-year Treasury yield

- 2-year/10-year yield curve spread

- Inflation-adjusted yields (real yields)

- US debt-to-GDP ratio

Eurozone Sovereign Bonds

The Eurozone sovereign bond market faces unique challenges, including the ongoing impact of the energy crisis and the war in Ukraine. The divergence in yields across different Eurozone countries reflects varying levels of perceived risk and economic strength. Countries with weaker economies or higher debt burdens tend to have higher yields.

- Key Indicators and Metrics:

- German Bund yields (benchmark for the Eurozone)

- Italian BTP yields (reflecting peripheral risk)

- Eurozone inflation rates

- Sovereign debt levels of individual Eurozone countries

Emerging Market Sovereign Bonds

Emerging market sovereign bonds offer potentially higher yields than those in developed markets, but they also carry increased risks. Currency fluctuations and the risk of default are significant concerns. Global interest rate hikes often impact emerging markets disproportionately, leading to capital outflows and increased yields.

- Examples:

- High-yield emerging market bonds: Brazilian Real bonds, South African Rand bonds.

- Lower-yield emerging market bonds: Mexican Peso bonds, Chilean Peso bonds.

Investment Strategies in the Current Sovereign Bond Market

Effective investment strategies require careful consideration of diversification and risk management.

Diversification and Risk Management

Diversifying across different sovereign bond markets and maturities is crucial to mitigate risk. This reduces exposure to the idiosyncratic risks of individual countries or market segments. Strategies to manage interest rate risk include laddering bond maturities and investing in floating-rate bonds. Hedging techniques, such as using currency futures or swaps, can help mitigate currency risk.

- Examples of Diversified Bond Portfolios:

- A mix of US Treasuries, German Bunds, and high-quality corporate bonds.

- A combination of short-term, medium-term, and long-term bonds.

Active vs. Passive Management

Investors can choose between active and passive management strategies. Active management involves actively selecting bonds based on individual analysis and market forecasts, aiming to outperform benchmarks. Passive management involves tracking a specific bond index, offering lower fees but potentially lower returns. Exchange-traded funds (ETFs) provide a convenient way to passively invest in diversified bond portfolios.

- Advantages and Disadvantages:

- Active management: Higher potential returns, higher fees, requires expertise.

- Passive management: Lower fees, simpler to implement, potentially lower returns.

Conclusion

The sovereign bond market presents both challenges and opportunities for investors. Swissquote Bank's analysis highlights the importance of understanding macroeconomic factors, geopolitical risks, and the nuances of different sovereign bond markets. By employing diversified investment strategies and effective risk management, investors can navigate this complex landscape and potentially achieve their financial goals. To stay informed about the latest developments and gain access to expert insights from Swissquote Bank on the sovereign bond market, visit our website today. Learn more about optimizing your sovereign bond investments with Swissquote Bank's resources and tools.

Featured Posts

-

Decouvrir L Art Du Dessert Francais Recette De Salami Au Chocolat De Sweet France

May 19, 2025

Decouvrir L Art Du Dessert Francais Recette De Salami Au Chocolat De Sweet France

May 19, 2025 -

Snl Season 50 Finale A Star Studded Sendoff With Johansson And Bad Bunny

May 19, 2025

Snl Season 50 Finale A Star Studded Sendoff With Johansson And Bad Bunny

May 19, 2025 -

Is This The Loneliest Generation Dr John Delonys Insights On Cnn

May 19, 2025

Is This The Loneliest Generation Dr John Delonys Insights On Cnn

May 19, 2025 -

Legal Challenge Launched London Parks Future Hangs In The Balance

May 19, 2025

Legal Challenge Launched London Parks Future Hangs In The Balance

May 19, 2025 -

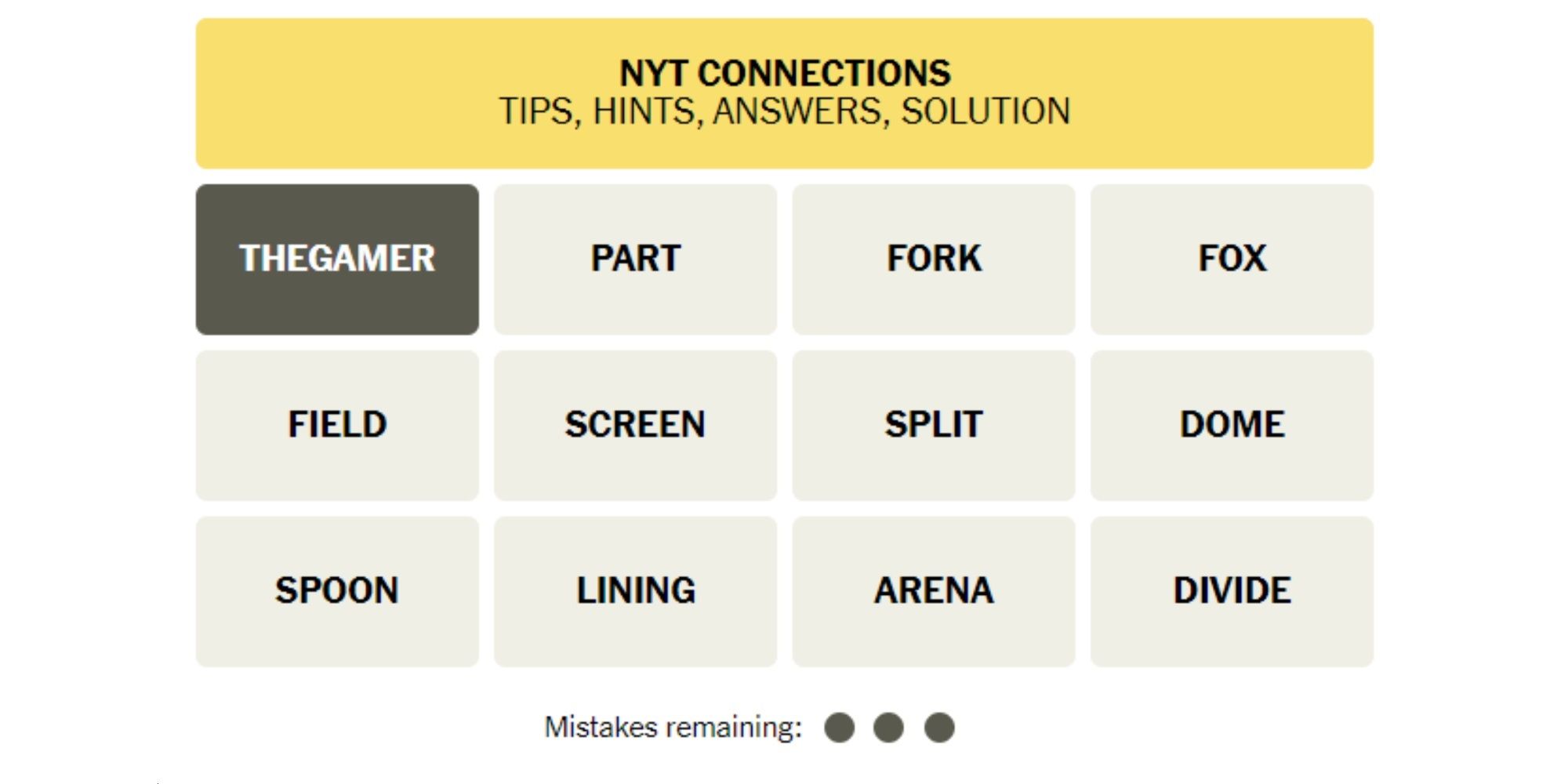

Nyt Connections Answers For February 27 2024 Puzzle 627 Solved

May 19, 2025

Nyt Connections Answers For February 27 2024 Puzzle 627 Solved

May 19, 2025