TD Predicts 100,000 Job Losses In Looming Recession: The Fear Is Real

Table of Contents

TD's Recession Prediction: A Deep Dive

TD Bank's prediction of 100,000 job losses isn't made lightly. Their analysis considers a confluence of factors contributing to a potential economic downturn. They point to persistent inflation, rising interest rates, and softening consumer spending as key indicators. These factors are interconnected, creating a perfect storm that could lead to significant layoffs across various sectors.

The sectors most likely to be impacted include technology, real estate, and potentially even those reliant on consumer discretionary spending. The tech sector, having experienced rapid growth followed by significant layoffs in recent times, remains particularly vulnerable. Similarly, the real estate market, sensitive to interest rate hikes, could see a substantial contraction, leading to job losses in construction and related industries.

- Specific industries facing the highest risk of layoffs: Technology, Real Estate, Retail, Hospitality, and potentially manufacturing.

- Economic indicators used by TD to reach their conclusion: High inflation, rising interest rates, decreased consumer confidence, slowing GDP growth.

- Comparison to previous recessionary periods and job loss figures: While the exact number of job losses remains uncertain, this prediction aligns with historical trends during previous economic downturns, indicating a potentially severe impact.

The Ripple Effect: How Job Losses Impact the Economy

The consequences of widespread job losses extend far beyond individual unemployment. The ripple effect on the broader economy is substantial and potentially devastating. A significant decrease in employment leads to a reduction in consumer spending, a key driver of economic growth. When people lose their jobs, their ability to purchase goods and services diminishes, impacting businesses across the board.

This decreased consumer confidence and spending further fuels the economic downturn, creating a vicious cycle. Businesses, facing reduced demand and shrinking profits, may cut back on investments and hiring, exacerbating the job losses. Government revenue also suffers, limiting the ability to implement effective countermeasures.

- Decreased consumer confidence and spending: Reduced purchasing power leads to lower demand for goods and services.

- Increased unemployment benefits claims: Increased strain on social safety nets.

- Potential for a further economic downturn: Job losses can trigger a self-reinforcing cycle of decline.

- Impact on the housing market and related industries: Falling demand and rising interest rates negatively impact the housing market.

Preparing for Job Losses: Strategies for Individuals and Businesses

Facing the possibility of job losses looming recession requires proactive planning and adaptation. For individuals, building a strong financial safety net is paramount. This includes creating an emergency fund, updating resumes and professional profiles, and actively networking. Developing new skills and upskilling are also vital in a competitive job market.

Businesses need to implement strategies to mitigate the impact on their workforce and ensure their long-term sustainability. This may involve exploring cost-cutting measures without compromising crucial operations, implementing employee retention programs to keep valuable staff, and diversifying their revenue streams to reduce dependence on single market sectors.

- Tips for individuals: Update resumes and LinkedIn profiles, network actively, develop new skills, build an emergency fund (3-6 months living expenses).

- Strategies for businesses: Explore cost-cutting measures, implement employee retention programs, diversify revenue streams, consider scenario planning.

- Government resources and support available during economic downturns: Utilize unemployment benefits, explore retraining programs, seek guidance from government agencies.

Alternative Economic Forecasts and Perspectives

While TD Bank's prediction of 100,000 job losses is a significant warning, it's crucial to acknowledge that economic forecasting is inherently uncertain. Other economic experts and institutions offer varying perspectives and predictions. Some predict a milder recession, emphasizing the resilience of the consumer and the potential for a soft landing. Others hold more pessimistic views, highlighting the risks of persistent inflation and aggressive interest rate hikes.

The uncertainty stems from several factors, including unpredictable geopolitical events, shifts in consumer behavior, and the effectiveness of government policy responses. The actual outcome could fall anywhere within a wide range of possibilities, making proactive planning crucial regardless of the specific prediction.

- Mention other economists' predictions and their reasoning: Highlight the range of forecasts and the factors contributing to different viewpoints.

- Highlight the factors contributing to the uncertainty of economic forecasting: Discuss unforeseen events and the limitations of economic models.

- Discuss the potential for a softer landing or a more severe recession: Explain the factors that could influence the severity of the economic downturn.

Conclusion

TD Bank's prediction of 100,000 job losses looming recession underscores the serious economic challenges ahead. While uncertainty remains, understanding the potential impact and implementing proactive strategies are crucial for individuals and businesses alike. The ripple effect of job losses is significant, affecting consumer spending, investment, and overall economic growth.

Call to Action: Stay informed about the evolving economic situation and take steps to prepare for potential job losses looming recession. Develop a strong financial plan, diversify your skillset, and engage in proactive career management. Don't underestimate the importance of planning for looming recession job losses. Prepare now to navigate this challenging economic landscape.

Featured Posts

-

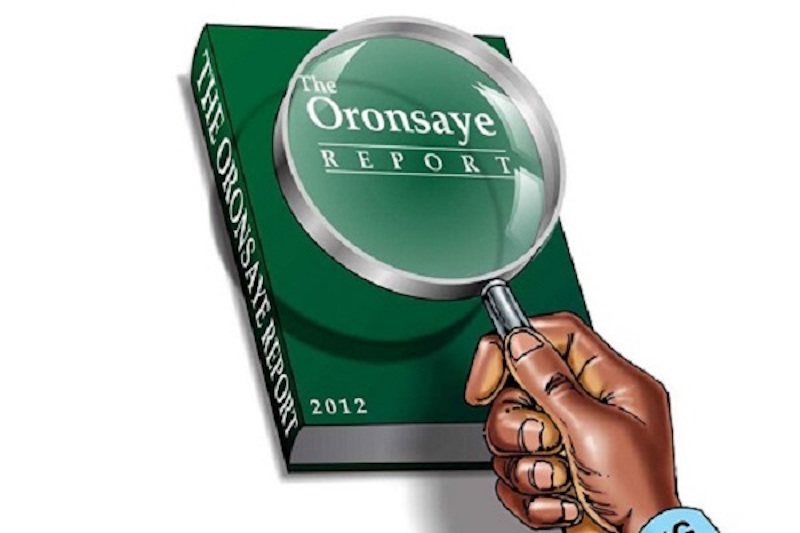

Magyarorszag Alfoeldi Terueleteinek Talajnedvesseg Problemai Es Megoldasi Lehetosegek

May 28, 2025

Magyarorszag Alfoeldi Terueleteinek Talajnedvesseg Problemai Es Megoldasi Lehetosegek

May 28, 2025 -

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025 -

Post Fire La Investigation Into Landlord Price Gouging Practices

May 28, 2025

Post Fire La Investigation Into Landlord Price Gouging Practices

May 28, 2025 -

Winns Home Run Leads Cardinals To 3 Game Sweep Of Diamondbacks

May 28, 2025

Winns Home Run Leads Cardinals To 3 Game Sweep Of Diamondbacks

May 28, 2025 -

Ronaldo 40 Yas Siniri Yok

May 28, 2025

Ronaldo 40 Yas Siniri Yok

May 28, 2025