Tech Firms Delay IPOs: Tariff Uncertainty Creates Headwinds

Table of Contents

The Impact of Tariff Uncertainty on Tech Company Valuation

Tariffs significantly impact the cost of goods for tech companies, affecting their profitability and, consequently, their valuations. Increased import duties on components, raw materials, and finished goods directly translate to higher production costs. This erosion of profit margins can lead to a downward revision of company valuations, making an IPO less attractive to investors.

- Increased material and manufacturing costs due to tariffs: The imposition of tariffs increases the cost of imported components, crucial for many tech products. This directly impacts the manufacturing cost, reducing profit margins.

- Reduced consumer demand due to higher prices: These increased production costs are often passed on to consumers in the form of higher prices. This can lead to reduced consumer demand, impacting sales volume and further impacting profitability.

- Uncertainty surrounding future tariff policies makes long-term financial forecasting difficult: The unpredictable nature of tariff policies creates significant uncertainty for tech companies. Accurate long-term financial forecasting, crucial for successful IPOs, becomes exceedingly challenging.

- Impact on global supply chains, leading to delays and increased costs: Tariffs disrupt global supply chains, leading to delays in receiving crucial components and increased logistical costs, further impacting profitability and valuation. This supply chain disruption adds another layer of complexity to the already challenging IPO process.

How Tariffs Affect Investor Sentiment and IPO Readiness

Tariff uncertainty significantly impacts investor sentiment and risk appetite. Investors are naturally hesitant to invest in companies facing potential losses due to unpredictable trade policies. This translates to a higher risk assessment for tech companies planning IPOs.

- Investors demand higher returns to compensate for increased risk: Given the increased uncertainty, investors demand higher returns to offset the perceived risk associated with investing in a company facing potential tariff-related losses.

- Uncertainty makes it difficult to accurately price an IPO: Accurately pricing an IPO requires a clear understanding of the company's future financial performance. Tariff uncertainty makes this incredibly difficult, leading to potential mispricing and impacting investor confidence.

- Negative media coverage surrounding tariffs can further damage investor sentiment: Negative news surrounding tariffs and their impact on businesses can further dampen investor enthusiasm, making it harder for companies to attract the necessary investment for a successful IPO.

- Increased regulatory scrutiny in the face of global trade disputes: Global trade disputes often lead to increased regulatory scrutiny, adding another layer of complexity and risk for companies preparing for an IPO.

Case Studies: Tech Companies Delaying IPOs Due to Tariff Concerns

Several tech companies have publicly cited tariff uncertainty as a key factor in their decision to postpone their IPOs. While specific details are often confidential, the trend is undeniable.

- Example 1: [Company Name A], a semiconductor manufacturer, delayed its IPO citing increased costs due to tariffs on imported materials. [Link to news article]. This delay resulted in an estimated loss of [estimated financial impact]. They are now aiming for an IPO in [expected timeline].

- Example 2: [Company Name B], a software company with significant international operations, postponed its IPO due to concerns about the impact of tariffs on its global supply chains and customer base. [Link to news article]. The company is currently reassessing its strategy and exploring options to mitigate the risks before attempting another IPO.

Alternative Strategies for Tech Firms Facing Tariff Headwinds

While tariff uncertainty presents significant challenges, tech companies can employ several strategies to mitigate the negative effects:

- Restructuring supply chains to reduce reliance on tariff-affected regions: Diversifying supply chains to include multiple sourcing locations can reduce reliance on regions affected by tariffs, mitigating the impact on production costs.

- Investing in automation to reduce labor costs: Automation can help reduce reliance on labor-intensive processes, minimizing the impact of tariffs on manufacturing costs.

- Exploring strategic partnerships to share risk: Partnering with other companies can help share the risk associated with tariff uncertainty, providing greater stability.

- Engaging in political lobbying to advocate for trade policy reforms: Companies can engage in lobbying efforts to advocate for trade policy reforms that would benefit their industry.

Tech Firms Delay IPOs: Navigating the Uncertain Landscape

Tariff uncertainty is significantly impacting tech firm IPO decisions. The challenges faced by these companies, including increased costs, reduced consumer demand, and difficulty in accurate financial forecasting, are significant obstacles to a successful IPO. Understanding the intricacies of global trade and its impact on specific sectors is crucial for both investors and tech entrepreneurs.

Key Takeaways: The unpredictable nature of tariffs creates considerable risk and uncertainty for tech companies considering an IPO. Companies must proactively manage these risks through careful planning and strategic decision-making.

Call to Action: Stay informed about the evolving landscape of global trade and its impact on tech IPOs. Understanding the headwinds facing tech firms can help investors and entrepreneurs make informed decisions in this uncertain climate. [Link to relevant resource on global trade].

Featured Posts

-

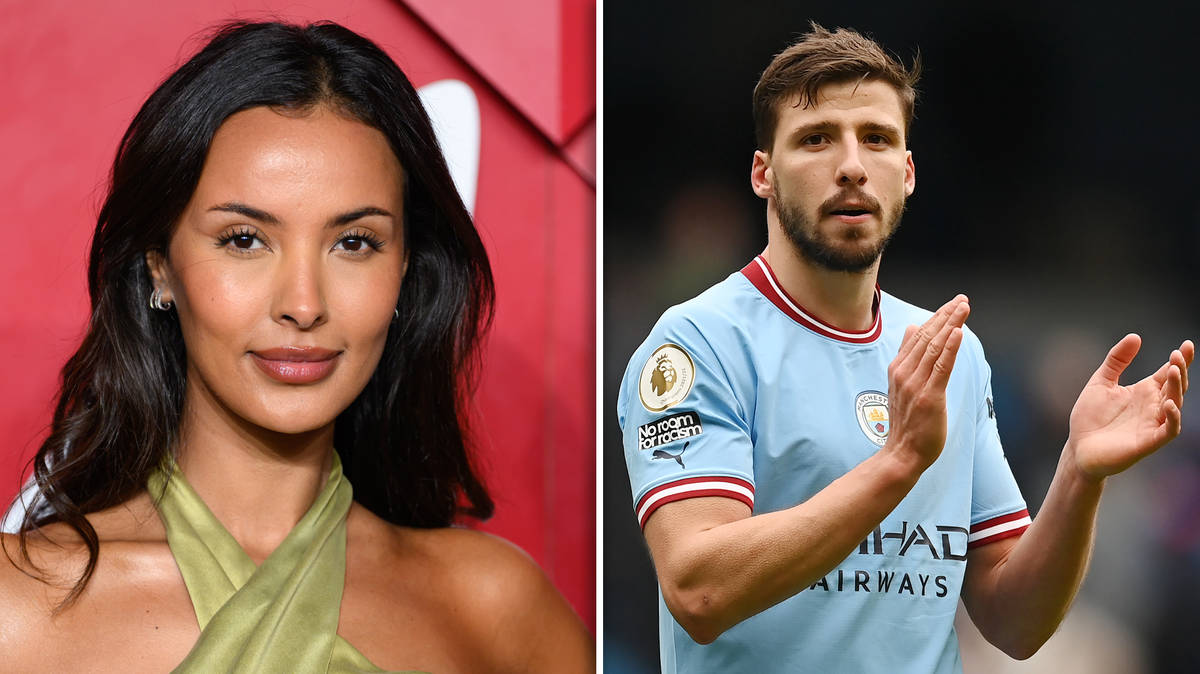

Maya Jama Confirms Relationship With Ruben Dias

May 14, 2025

Maya Jama Confirms Relationship With Ruben Dias

May 14, 2025 -

Muere Jose Mujica Un Adios Al Presidente Que Cautivo Al Mundo

May 14, 2025

Muere Jose Mujica Un Adios Al Presidente Que Cautivo Al Mundo

May 14, 2025 -

24 Hours Of Le Mans Roger Federers Special Appearance

May 14, 2025

24 Hours Of Le Mans Roger Federers Special Appearance

May 14, 2025 -

Wynonna Judd And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025

Wynonna Judd And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025 -

Tommy Tiernans Wife Steps Back From Managing His Career A Look At Their Private Life

May 14, 2025

Tommy Tiernans Wife Steps Back From Managing His Career A Look At Their Private Life

May 14, 2025