Tech Sector Propels US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Stellar Performance and its Ripple Effect on the Tech Sector

Tesla's recent financial performance has been nothing short of spectacular. Revenue growth has consistently exceeded expectations, profit margins are expanding, and the Tesla stock price has experienced significant increases, boosting investor confidence not just in the electric vehicle (EV) sector but in the broader tech sector as well. This success has created a ripple effect, impacting various aspects of the market:

-

Increased investor interest in electric vehicle (EV) companies: Tesla's dominance has fueled a surge of investment in other EV startups and established automakers venturing into the electric vehicle market. This increased interest translates to higher valuations and more funding opportunities for companies in the burgeoning EV space.

-

Positive sentiment towards renewable energy and sustainable technology stocks: Tesla's focus on sustainable energy solutions has fostered a positive sentiment towards other companies involved in renewable energy and sustainable technologies. Investors are increasingly seeking exposure to this growing market segment.

-

Overall increase in valuations of technology companies: The positive sentiment surrounding Tesla has spilled over into the broader technology sector, leading to increased valuations across the board. This is particularly true for companies involved in areas like artificial intelligence (AI), automation, and battery technology.

-

Specific examples include the rise in stock prices of companies like Rivian and Lucid, both of which have benefited from the increased investor interest in the EV sector fueled by Tesla's success. Other tech companies involved in autonomous driving technology and battery innovation have also seen their valuations boosted.

The Broader Tech Sector's Contribution to US Stock Market Gains

Tesla's success is only one piece of the puzzle. The broader tech sector has played a crucial role in propelling the US stock market higher. Mega-cap tech companies like Apple, Microsoft, and Google (Alphabet) exert considerable influence on major market indices like the S&P 500 and Nasdaq. Their consistent performance contributes significantly to overall market growth. This growth is fueled by:

-

Strong earnings reports from major tech firms: Consistently strong earnings reports from leading tech companies demonstrate their financial health and growth potential, encouraging investor confidence and driving up stock prices.

-

Innovation and technological advancements driving growth: Continuous innovation and groundbreaking technological advancements in areas like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) are fundamental drivers of tech sector growth and market expansion.

-

The impact of cloud computing, AI, and other technological trends: The widespread adoption of cloud computing, AI, and other transformative technologies fuels increased productivity, efficiency, and innovation across various industries, contributing to economic growth and a positive market outlook.

-

Several macroeconomic factors, such as low interest rates in previous periods and increased government spending on technological infrastructure, have also contributed to the tech sector's and the overall market's growth.

Analyzing the Correlation Between Tesla's Success and the Overall Market

A strong correlation exists between Tesla's stock performance and major market indices like the S&P 500 and Nasdaq. However, it's crucial to distinguish between correlation and causation. While Tesla's performance undoubtedly impacts investor sentiment within the tech sector, it's not the sole determinant of the overall market's trajectory.

-

Statistical data demonstrating the relationship: Statistical analysis can reveal the strength of the correlation between Tesla's stock price movements and broader market indices. However, this correlation doesn't necessarily imply that one directly causes the other.

-

Discussion on whether Tesla is a leading indicator or simply a participant in the broader market trend: While Tesla's stock price might reflect broader market trends, it's debatable whether it acts as a leading indicator predicting future market movements. External factors greatly influence both Tesla and the market.

-

Considerations of external factors influencing both Tesla and the overall market: Factors like economic growth, interest rates, geopolitical events, and regulatory changes all influence both Tesla's performance and the overall market's health, making it difficult to isolate Tesla's singular impact.

Risks and Future Outlook for the Tech Sector and Tesla's Role

Despite the current positive outlook, risks and challenges remain for the tech sector and Tesla specifically. These include:

-

Potential for market corrections or downturns: The market is susceptible to corrections, and a downturn could significantly impact Tesla and the broader tech sector.

-

Competition within the EV and tech industries: Intense competition within the EV and broader tech industries poses a threat to Tesla's market share and profitability.

-

Regulatory changes and their impact: Changes in government regulations, particularly those related to environmental protection, subsidies, and data privacy, can have a profound impact on Tesla and the overall tech landscape.

-

Long-term growth prospects for Tesla and the tech sector: Despite the challenges, the long-term growth prospects for Tesla and the tech sector as a whole remain strong, driven by technological innovation and the increasing demand for technological solutions across various industries.

Conclusion: The Enduring Influence of the Tech Sector, Led by Tesla, on the US Stock Market

In conclusion, the tech sector, with Tesla playing a significant role, has been a major catalyst for the recent growth of the US stock market. While a correlation exists between Tesla's performance and broader market indices, it's essential to acknowledge that numerous other factors contribute to the overall market's trajectory. Understanding the interplay between Tesla's success, the broader tech sector's performance, and macroeconomic conditions is crucial for informed investment decisions. Stay informed about the ongoing influence of the tech sector, particularly Tesla's impact, on the US stock market by following our regular updates and analysis on Tesla stock analysis, tech sector investing, US market outlook, and investment strategies.

Featured Posts

-

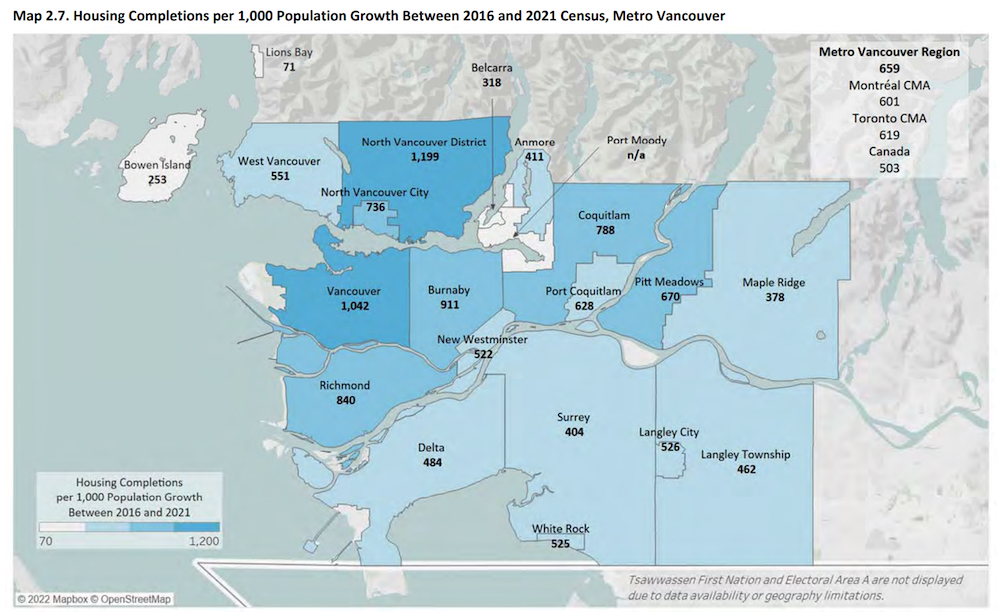

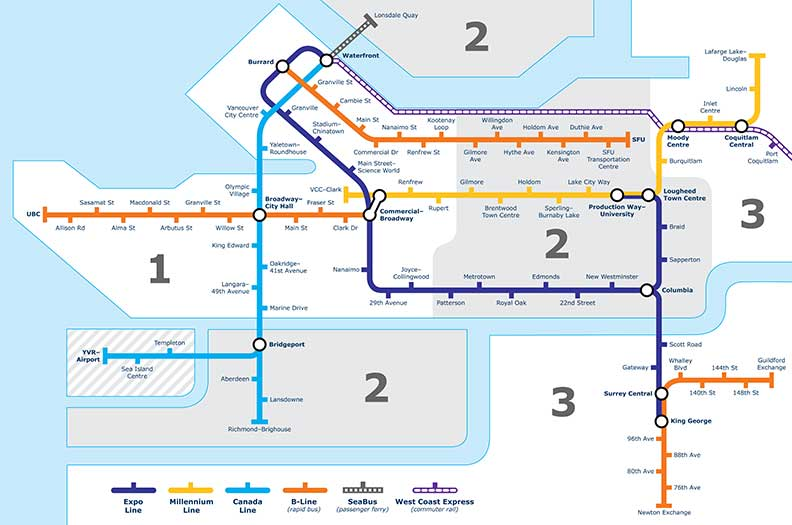

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still Climb

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still Climb

Apr 28, 2025 -

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025 -

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqdh Lsyr Aleml

Apr 28, 2025

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqdh Lsyr Aleml

Apr 28, 2025 -

Housing Market Update Metro Vancouver Rent Increases Ease But Prices Stay Elevated

Apr 28, 2025

Housing Market Update Metro Vancouver Rent Increases Ease But Prices Stay Elevated

Apr 28, 2025 -

Yukon Politicians Cite Contempt Over Mine Managers Evasive Testimony

Apr 28, 2025

Yukon Politicians Cite Contempt Over Mine Managers Evasive Testimony

Apr 28, 2025

Latest Posts

-

Twm Krwz Wana Dy Armas 26 Eama Tfsl Bynhma Hl Alhb Ytkhta Farq Alaemar

May 12, 2025

Twm Krwz Wana Dy Armas 26 Eama Tfsl Bynhma Hl Alhb Ytkhta Farq Alaemar

May 12, 2025 -

Tom Cruises Unique Gesture After Suri Cruises Birth

May 12, 2025

Tom Cruises Unique Gesture After Suri Cruises Birth

May 12, 2025 -

Frwqat Alemr Fy Hwlywwd Drast Halt Elaqt Twm Krwz Wana Dy Armas Almhtmlt

May 12, 2025

Frwqat Alemr Fy Hwlywwd Drast Halt Elaqt Twm Krwz Wana Dy Armas Almhtmlt

May 12, 2025 -

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt Farq Alsn 26 Eama Ythyr Aljdl

May 12, 2025

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt Farq Alsn 26 Eama Ythyr Aljdl

May 12, 2025 -

Haly Wwd Astar Tam Krwz Awr 36 Salh Adakarh Ka Telq Kya Yh Sch He

May 12, 2025

Haly Wwd Astar Tam Krwz Awr 36 Salh Adakarh Ka Telq Kya Yh Sch He

May 12, 2025