Telus Q1 2024 Profit Surges, Dividend Increase Announced

Table of Contents

Record Q1 2024 Profits: A Deep Dive into Telus's Financial Performance

Telus reported record Q1 2024 profits, exceeding analyst expectations and demonstrating strong financial health. This success can be attributed to several key factors, analyzed in detail below.

Revenue Growth and Key Drivers

Telus experienced significant revenue growth across multiple sectors in Q1 2024. This positive trend reflects the company's strategic initiatives and favorable market conditions.

- Wireless: Strong growth in wireless subscriptions, driven by increased demand for 5G services and attractive data plans. Percentage growth [Insert Percentage Here]% year-over-year.

- Wireline: Continued growth in high-speed internet subscriptions fueled by increasing work-from-home trends and rising demand for reliable broadband access. Percentage growth [Insert Percentage Here]% year-over-year.

- Internet of Things (IoT): Expanding IoT services contributed to revenue growth, showcasing Telus's diversification strategy. Percentage growth [Insert Percentage Here]% year-over-year.

The robust revenue growth is largely attributed to increased demand for high-speed internet and 5G services, reflecting the ongoing digital transformation and the growing reliance on connectivity. Successful new partnerships and contracts also contributed to this positive performance, solidifying Telus's position in the market. [Insert specific examples of partnerships and contracts].

Improved Profit Margins and Operational Efficiency

Beyond revenue growth, Telus demonstrated enhanced profitability through improved operational efficiency and cost-cutting measures.

- Streamlined Operations: Implementing process improvements and technology upgrades resulted in significant cost savings.

- Strategic Sourcing: Negotiating better deals with suppliers and optimizing resource allocation contributed to improved profit margins.

- EBITDA Growth: [Insert EBITDA figures and percentage growth]. This indicates strong operational performance and improved profitability.

By effectively managing costs and enhancing operational efficiency, Telus has successfully increased its net profit margin, demonstrating a commitment to financial prudence. This is reflected in the improved EBITDA and other key financial ratios [Insert relevant financial ratios and data].

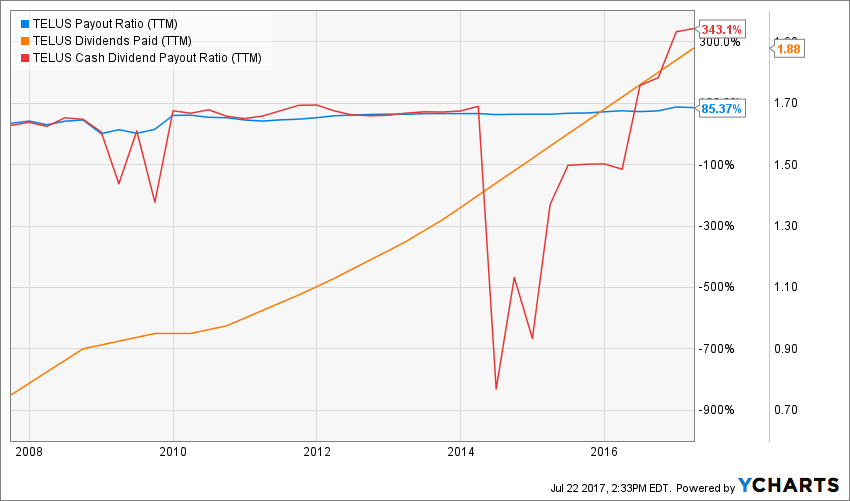

Dividend Increase: A Positive Sign for Investors

The announcement of a dividend increase is a significant positive for Telus investors, highlighting the company's confidence in its future prospects and its commitment to shareholder returns.

Details of the Dividend Announcement

Telus announced a [Insert Percentage]% increase in its quarterly dividend, raising the payout to [Insert New Dividend Amount] per share. The ex-dividend date is [Insert Ex-Dividend Date].

- Increased Dividend per Share: [Insert New Dividend Amount]

- Payout Date: [Insert Payout Date]

- Increased Dividend Yield: [Insert New Dividend Yield]%

This dividend increase demonstrates Telus's strong financial position and its commitment to rewarding its shareholders. The rationale behind the increase reflects the company's confidence in its continued financial strength and long-term growth potential.

Implications for Investors

The increased dividend significantly enhances Telus's attractiveness as a dividend stock.

- Higher Dividend Yield: The new dividend yield makes Telus more competitive compared to other telecom companies. [Insert comparison data if available].

- Long-Term Sustainability: The increase suggests a sustainable dividend policy, based on the company's strong financial performance.

- Potential for Further Increases: Analysts predict further dividend increases in the future, based on Telus's positive outlook. [Insert Analyst Quotes/Forecasts if available].

The increased dividend yield and potential for future growth make Telus an attractive investment for income-seeking investors seeking stable returns.

Future Outlook and Challenges for Telus

While Telus's Q1 2024 performance is impressive, several factors will influence its future trajectory.

Growth Projections and Strategic Initiatives

Telus continues to focus on key strategic initiatives for future growth.

- 5G Expansion: Investing heavily in 5G network infrastructure to enhance coverage and capacity.

- Network Investments: Continuous investment in network modernization and expansion to improve services.

- New Technologies: Exploring and implementing new technologies, such as IoT and AI, to drive innovation.

These strategic investments are expected to fuel future growth and maintain Telus's competitive edge. The company is also exploring opportunities for expansion into new markets and potentially through acquisitions. [mention specific initiatives].

Potential Risks and Headwinds

Despite the positive outlook, Telus faces certain challenges.

- Competition: Intense competition in the telecommunications industry requires constant innovation and adaptation.

- Regulatory Changes: Changes in government regulations could impact operating costs and profitability.

- Economic Downturn: A potential economic downturn could reduce consumer spending and impact demand for services.

Telus is actively addressing these risks through strategic planning, including diversification of services and proactive management of operational costs. Contingency plans are in place to mitigate the impact of potential economic headwinds.

Conclusion:

Telus's Q1 2024 earnings report paints a picture of strong financial performance, marked by a significant profit surge and an encouraging dividend increase. The company's robust revenue growth, improved operational efficiency, and positive outlook suggest a healthy trajectory for the future. The increased dividend reinforces Telus’s commitment to rewarding its shareholders, making it an attractive investment for income-seeking investors. To stay updated on Telus's performance and future announcements, regularly monitor the company's investor relations section and follow reliable financial news sources for further analysis of Telus Q1 2024 earnings and future market trends. Understanding the details of Telus Q1 2024 earnings is crucial for informed investment decisions.

Featured Posts

-

Stream Sylvester Stallones Action Thriller Armor For Free

May 12, 2025

Stream Sylvester Stallones Action Thriller Armor For Free

May 12, 2025 -

Alex Palou Dominates Qualifying Andretti Drivers Struggle At Indianapolis

May 12, 2025

Alex Palou Dominates Qualifying Andretti Drivers Struggle At Indianapolis

May 12, 2025 -

Who Is Debbie Elliott A Biography

May 12, 2025

Who Is Debbie Elliott A Biography

May 12, 2025 -

Unexpected Success Henry Cavills Action Thriller Night Hunter

May 12, 2025

Unexpected Success Henry Cavills Action Thriller Night Hunter

May 12, 2025 -

From Serving Passengers To Soaring Through The Skies A Former Sia Flight Attendants Journey To Becoming A Pilot

May 12, 2025

From Serving Passengers To Soaring Through The Skies A Former Sia Flight Attendants Journey To Becoming A Pilot

May 12, 2025