Tesla Fights Back Against Shareholder Lawsuits Following Musk's Pay Package

Table of Contents

The Controversial Musk Compensation Package

Elon Musk's compensation package, approved in 2018, is at the heart of the Tesla shareholder lawsuits. This multifaceted arrangement grants him stock options based on ambitious performance milestones. The sheer scale of the potential payout – potentially reaching tens of billions of dollars – has drawn intense scrutiny. Compared to CEO compensation at similar companies, Musk's package is undeniably exceptional, raising questions about its fairness and impact on shareholder value.

- Specific details about the stock options granted: The package included options to purchase millions of Tesla shares, vesting contingent upon achieving predetermined market capitalization and operational targets.

- The performance metrics required to unlock the options: These metrics were exceptionally demanding, requiring significant increases in Tesla's market capitalization and revenue over a period of several years.

- Comparison to CEO compensation at similar companies: Analyses revealed that Musk's potential compensation far surpasses that of CEOs at comparable automotive and technology companies.

- Public and media reaction to the package: The public and media reaction was largely negative, with many questioning the fairness and rationale behind such a lucrative package. Articles and news broadcasts highlighted the disparity between Musk's compensation and the average Tesla employee's salary.

The Arguments Presented in the Shareholder Lawsuits

Numerous shareholder lawsuits allege that Tesla's board breached its fiduciary duty by approving such an excessive compensation package for Elon Musk. Shareholders argue this constitutes a waste of corporate assets, unjustly enriching Musk at the expense of other stakeholders. The lawsuits claim this extravagant package is detrimental to Tesla's long-term interests and shareholder value.

- Summary of key allegations in the lawsuits: The lawsuits primarily center on the argument that the compensation package is excessive, lacking appropriate performance-based measures, and ultimately harms shareholder value.

- Legal basis for the lawsuits (relevant laws and precedents): The lawsuits cite Delaware corporate law, which governs Tesla, and rely on precedents establishing the directors' duty of loyalty and care to shareholders.

- Specific examples of how the package allegedly harmed shareholders: Plaintiffs argue that the resources allocated to Musk's compensation could have been used for R&D, expansion, or debt reduction, thus benefiting all shareholders.

The Role of Tesla's Board of Directors

Tesla's board of directors played a pivotal role in approving Musk's compensation. The board's composition and its rationale for approving the package are key elements under scrutiny in the ongoing Tesla shareholder lawsuits. The potential liability of individual board members is also a significant point of contention.

- Composition of Tesla's board: The board's composition is examined to assess potential conflicts of interest and independence.

- The board's rationale for approving the package: The arguments presented by the board in justifying the package's approval are being analyzed to ascertain their validity.

- Potential conflicts of interest: The close relationship between Musk and some board members raises concerns about potential conflicts of interest influencing the board's decision-making process.

Tesla's Defense Strategies

Tesla is vigorously defending itself against the shareholder lawsuits. Its legal strategy centers on arguing that the compensation package was both fair and in the best interests of the company. Tesla's lawyers will likely emphasize Musk's contributions to the company's extraordinary growth and the demanding performance metrics attached to the stock options.

- Key points of Tesla's legal defense: Tesla's defense will likely focus on the extraordinary value Musk has generated for the company, justifying the magnitude of the compensation.

- Evidence presented by Tesla to support its arguments: Tesla will likely present data illustrating its phenomenal growth under Musk's leadership.

- Potential outcomes of the lawsuits: The outcomes could range from dismissal of the lawsuits to settlements or even court-ordered revisions to the compensation agreement.

Implications for Tesla's Future

The outcome of these Tesla shareholder lawsuits carries significant implications for the company's future. Beyond the potential financial penalties, the lawsuits could impact investor confidence, potentially affecting Tesla's stock price and its ability to attract future investment. The case could also set important legal precedents, influencing corporate governance and executive compensation practices.

- Potential financial penalties for Tesla: Depending on the court's decision, Tesla could face substantial financial penalties, including the repayment of portions of the compensation package.

- Impact on investor confidence: Negative publicity and uncertainty surrounding the lawsuits could erode investor confidence in Tesla.

- Changes to corporate governance practices: The lawsuits could lead to changes in Tesla's corporate governance structure and processes related to executive compensation.

- Potential legal precedents set by the case: The case's resolution could influence future legal interpretations of directors' duties and the permissible scope of executive compensation.

Conclusion

The Tesla shareholder lawsuits represent a significant challenge to the company and raise critical questions about corporate governance and the appropriate level of executive compensation. The arguments presented by shareholders, Tesla's defense strategies, and the potential outcomes all carry significant weight for the future of the electric vehicle giant. The case serves as a critical examination of the relationship between executive pay and shareholder value. Stay informed on the ongoing developments in the Tesla shareholder lawsuits. Follow this website/publication for updates and analysis on the legal battle and its impact on Tesla's future. Learn more about the complexities of executive compensation and corporate governance by reading our other articles on [link to relevant articles].

Featured Posts

-

Dodgers Hope Conforto Mirrors Hernandezs Positive Influence

May 18, 2025

Dodgers Hope Conforto Mirrors Hernandezs Positive Influence

May 18, 2025 -

Onet Le Chateau Et Le Lioran Votre Escapade Auvergnate

May 18, 2025

Onet Le Chateau Et Le Lioran Votre Escapade Auvergnate

May 18, 2025 -

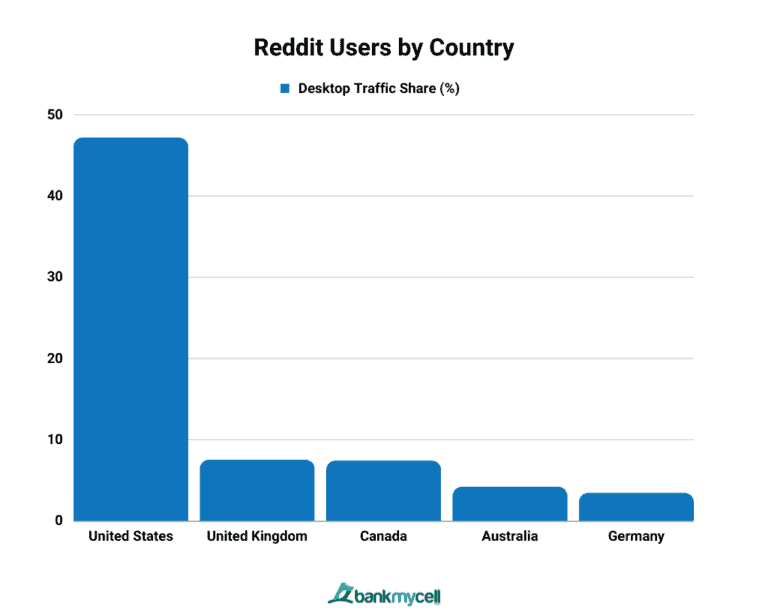

Worldwide Reddit Outage Affecting Thousands Of Users

May 18, 2025

Worldwide Reddit Outage Affecting Thousands Of Users

May 18, 2025 -

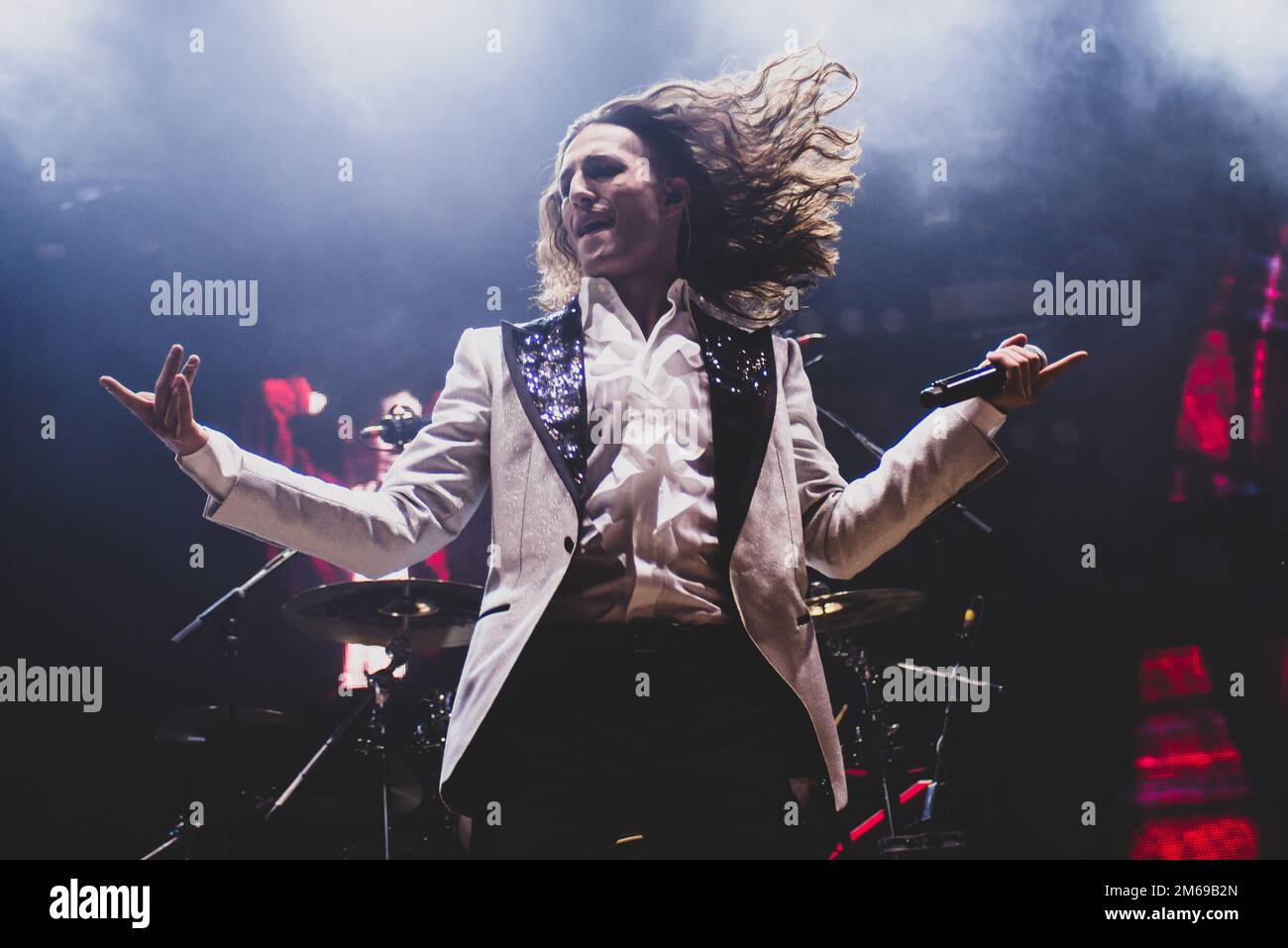

Il Cantante Dei Maneskin Damiano David Si Lancia Nel Progetto Solista

May 18, 2025

Il Cantante Dei Maneskin Damiano David Si Lancia Nel Progetto Solista

May 18, 2025 -

Will Conforto Follow Hernandezs Lead For The Dodgers

May 18, 2025

Will Conforto Follow Hernandezs Lead For The Dodgers

May 18, 2025