Tesla Shareholders' Concerns Echoed By State Treasurers: Musk's Leadership Questioned

Table of Contents

Declining Shareholder Confidence in Tesla's Leadership

The recent market downturn for Tesla reflects a broader erosion of shareholder confidence in Elon Musk's leadership. This isn't simply short-term market fluctuation; it points to deeper structural issues that are causing significant unease among investors.

Stock Performance and Investor Sentiment

Tesla's stock performance has been erratic, often mirroring the unpredictable nature of Musk's public pronouncements and business decisions.

- Negative Stock Market Trends: Several analysts have linked recent stock drops directly to concerns about Musk's focus on ventures like Twitter, potentially diverting resources and attention away from Tesla's core business. The subsequent layoffs and restructuring within the company also contributed to investor anxiety.

- Specific Criticisms from Analysts: Many financial analysts have voiced concerns about Tesla's valuation, arguing it's inflated compared to its actual performance and future prospects given the current leadership and strategic direction. This has led to calls for more disciplined financial management.

Governance Issues and Executive Compensation

Concerns extend beyond stock performance to encompass Tesla's corporate governance structure and executive compensation.

- Controversial Decisions or Practices: Critics point to instances where Musk's actions, such as his impulsive tweets and unpredictable pronouncements on company strategy, have created market instability and undermined investor confidence.

- Shareholder Lawsuits or Proposals: Several shareholder lawsuits have been filed, alleging breaches of fiduciary duty and mismanagement. This legal pressure further highlights the existing governance concerns.

Musk's Public Persona and its Impact on Tesla's Brand

Elon Musk's highly visible and often controversial public persona has undoubtedly influenced Tesla's brand perception.

- Controversial Tweets or Public Appearances: Musk's frequent use of social media to make significant announcements, often without adhering to traditional corporate communication protocols, has created market volatility and reputational risks.

- Potential Damage to Tesla's Reputation: While Musk's unconventional approach has built a strong following, it has also alienated some potential customers and investors concerned about the long-term stability and brand image of Tesla.

State Treasurers Join the Chorus of Criticism: ESG Concerns

The concerns about Tesla's future aren't limited to individual shareholders. State treasurers, managing substantial public funds, are increasingly scrutinizing Tesla's Environmental, Social, and Governance (ESG) performance. This heightened scrutiny is leading some to divest from Tesla or consider doing so.

Environmental, Social, and Governance (ESG) Issues

State treasurers' ESG concerns regarding Tesla are multifaceted:

- Specific Examples of Tesla's Practices that Raise ESG Concerns: Concerns exist regarding Tesla’s labor practices, particularly at its Gigafactories, allegations of workplace safety issues, and the environmental impact of its mining and manufacturing processes. California, Illinois, and New York are among the states that have expressed concerns.

- States Involved: The growing number of states reviewing or divesting from Tesla demonstrates a widening trend of concern regarding the company’s ESG performance.

Financial Risks Associated with Musk's Leadership

The unpredictable nature of Musk's leadership presents significant financial risks for state treasurers.

- Examples of How These Risks Could Impact the Value of Their Investments: The erratic stock performance, coupled with potential legal and reputational risks, makes Tesla a less attractive investment for risk-averse state treasurers.

The Influence of State Treasurers on Tesla's Future

The actions of state treasurers can significantly impact Tesla's future.

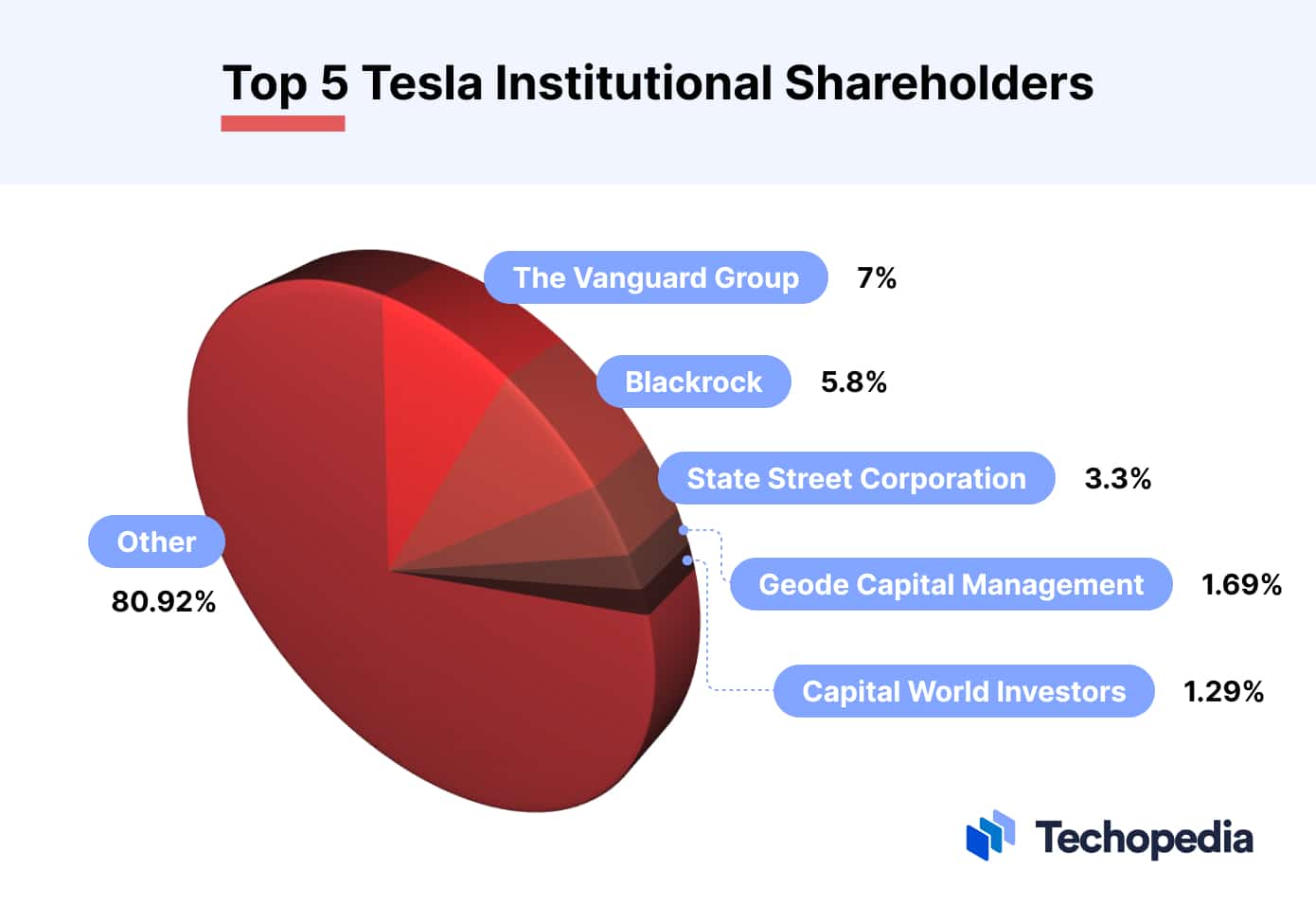

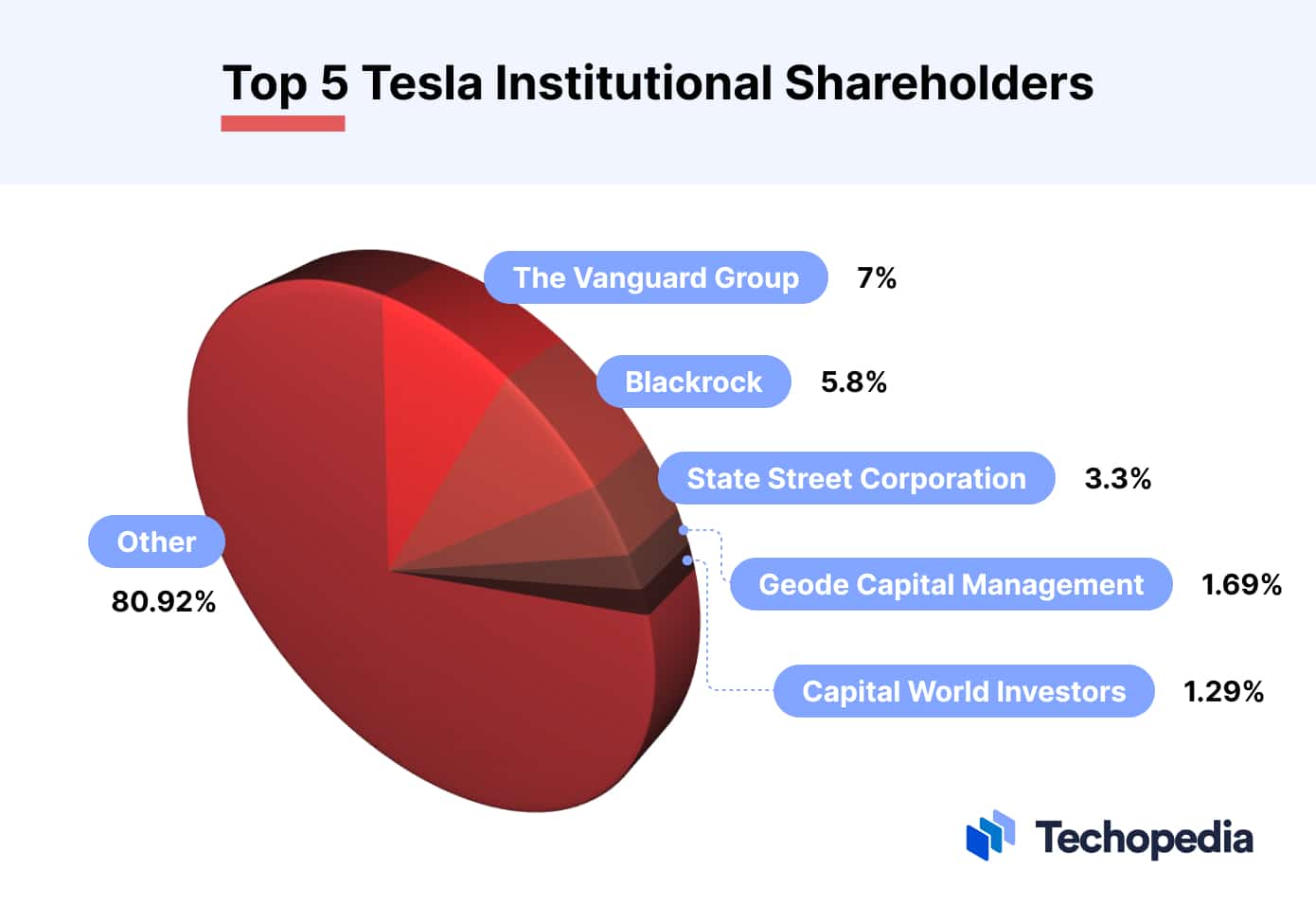

- Potential for Further Divestment: Further divestment by state treasurers could trigger a chain reaction, influencing other institutional investors to reconsider their holdings.

- Influence on Other Institutional Investors: The decisions made by these large public investors send a powerful signal to the market and can influence the investment strategies of others.

Alternative Leadership Models and Potential Solutions

Addressing the concerns of shareholders and state treasurers requires a multi-pronged approach focused on improving Tesla's corporate governance and leadership.

Improving Corporate Governance at Tesla

Several improvements could bolster Tesla's corporate governance:

- Specific Recommendations: Increased board independence, more robust internal controls, and more transparent and consistent communication strategies are crucial. Implementing a formal risk management framework is equally important.

The Role of Institutional Investors in Holding Tesla Accountable

Institutional investors have a vital role to play:

- Examples of Successful Shareholder Activism: History shows that active engagement by institutional investors can lead to positive changes in corporate governance and leadership.

Potential Long-Term Implications for Tesla's Success

The current situation has significant implications for Tesla's long-term success:

- Potential Scenarios, Both Positive and Negative: Positive scenarios include improved governance and a renewed focus on core business. Negative scenarios could involve further stock devaluation and loss of market share.

Conclusion: The Future of Tesla Under Scrutiny: Addressing Shareholder and Treasurer Concerns

The concerns raised by shareholders and state treasurers regarding Elon Musk's leadership are serious and far-reaching. These concerns highlight issues of corporate governance, financial risk, and ESG performance. The future of Tesla hinges on its ability to address these issues effectively. To stay updated on Musk's leadership and the state treasurers' response to Tesla’s practices, follow the latest developments in Tesla shareholder concerns. Understanding the evolving situation is crucial for investors and stakeholders alike.

Featured Posts

-

Windy City Showdown Brewers Defeat Cubs 9 7

Apr 23, 2025

Windy City Showdown Brewers Defeat Cubs 9 7

Apr 23, 2025 -

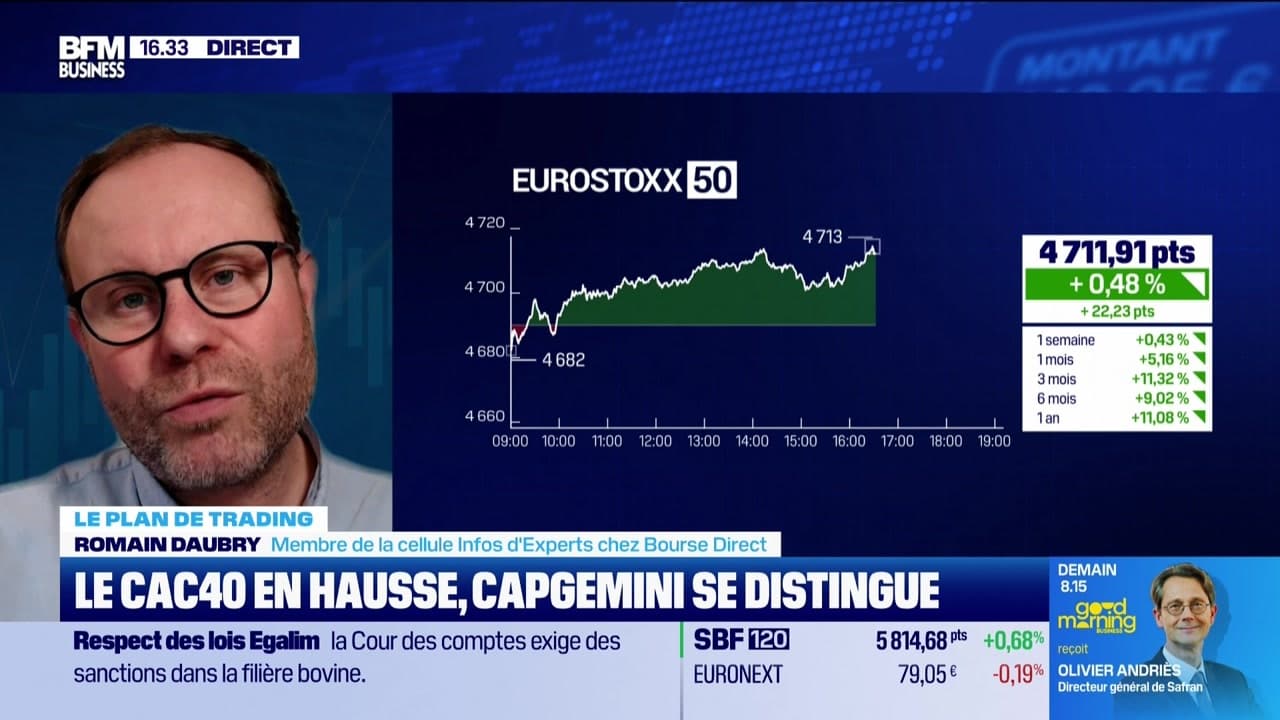

Les Seuils Techniques Incontournables En Alerte Trader Analyse Et Strategie

Apr 23, 2025

Les Seuils Techniques Incontournables En Alerte Trader Analyse Et Strategie

Apr 23, 2025 -

Mapping The Countrys Emerging Business Hubs

Apr 23, 2025

Mapping The Countrys Emerging Business Hubs

Apr 23, 2025 -

Christelle Le Hir Leadership Et Vision A La Vie Claire Et Synadis Bio

Apr 23, 2025

Christelle Le Hir Leadership Et Vision A La Vie Claire Et Synadis Bio

Apr 23, 2025 -

Dinamo Obolon 18 Kvitnya Rezultat Matchu Upl

Apr 23, 2025

Dinamo Obolon 18 Kvitnya Rezultat Matchu Upl

Apr 23, 2025