Tesla's Q1 Financial Report: Profit Plunge And The Musk Controversy

Table of Contents

Tesla Q1 2024 Financial Performance: A Detailed Look

Tesla's Q1 2024 financial report painted a mixed picture, with some positive aspects overshadowed by a significant drop in profitability. Let's examine the key financial indicators.

Revenue Analysis

Tesla's overall revenue for Q1 2024, while still substantial, fell short of analyst expectations and previous quarter performance.

- Total Revenue: [Insert actual Q1 2024 revenue figure]. This represents a [percentage]% decrease compared to Q4 2023 and a [percentage]% change year-over-year.

- Vehicle Sales: [Insert vehicle sales revenue figures], showing a [percentage]% decrease compared to the previous quarter. This decline can be attributed to increased competition and aggressive price cuts implemented by Tesla.

- Energy Generation and Storage: Revenue in this segment reached [Insert figures], demonstrating [growth/decline percentage] compared to Q4 2023.

Several factors contributed to the revenue fluctuations. Increased competition in the electric vehicle market, particularly from established automakers launching their own EV models, put downward pressure on sales. Furthermore, Tesla's decision to implement several price cuts, while aimed at boosting sales volume, negatively impacted profit margins. Supply chain disruptions, though less impactful than in previous years, still played a minor role.

Profit Margin Decline

The most concerning aspect of Tesla's Q1 report was the dramatic decrease in profit margins.

- Gross Profit Margin: [Insert Q1 2024 gross profit margin percentage]. This represents a significant drop of [percentage]% compared to Q4 2023 and [percentage]% compared to Q1 2023.

- Operating Profit Margin: [Insert Q1 2024 operating profit margin percentage], showcasing a similar decline to the gross profit margin.

The decline in profit margins is largely attributed to the price cuts implemented by Tesla to remain competitive. The increased cost of raw materials and manufacturing, coupled with higher logistics expenses, further exacerbated the pressure on profitability. The strategy of prioritizing sales volume over maximizing profit per vehicle is a key factor contributing to this decline.

Impact on Tesla Stock Price

The market reacted negatively to Tesla's Q1 2024 earnings report, with the stock price experiencing a notable dip.

- Pre-Report Stock Price: [Insert stock price before the report release].

- Post-Report Stock Price: [Insert stock price after the report release], showing a [percentage]% decrease.

- Investor Sentiment: Investor sentiment shifted to cautious optimism following the report, reflecting concerns about the company's profitability and future growth trajectory.

Elon Musk's various actions and public statements have undoubtedly influenced investor sentiment and, consequently, the stock price. Periods of uncertainty surrounding his leadership and the impact of his other ventures often translate into volatility in Tesla's stock performance.

The Elon Musk Factor: Controversies and Their Financial Repercussions

Elon Musk's actions and public pronouncements have consistently been a significant factor influencing Tesla's narrative and stock valuation. His involvement in various controversies during Q1 2024 undoubtedly had an impact on the company’s financial performance.

Recent Controversies

Several controversies surrounding Elon Musk dominated headlines during Q1 2024.

- Twitter/X Acquisition and Management: The ongoing saga of the Twitter/X acquisition and its associated financial burdens continued to draw attention and scrutiny. [Link to relevant news article].

- [Insert other relevant controversies and links to news articles].

The negative publicity generated by these controversies undoubtedly affected Tesla's brand image and investor confidence. Concerns about Musk's focus and potential distraction from Tesla’s core business contributed to the overall negative sentiment.

Musk's Leadership and its Impact on Tesla's Performance

The correlation between Musk's leadership style and Tesla's Q1 financial performance remains a subject of ongoing debate.

- Decision-Making: Musk's quick decision-making, while often innovative, can also lead to unexpected consequences, such as the rapid price cuts.

- Public Statements: His outspoken nature and sometimes controversial statements on social media can impact investor confidence and the overall market perception of Tesla.

Experts offer varying opinions on the impact of Musk's leadership on Tesla. Some argue his visionary approach is essential to the company's success, while others express concern about the risks associated with his unconventional style. Ultimately, separating the impact of his leadership from other contributing factors to Tesla's Q1 performance is a complex task.

Conclusion: Tesla's Q1 Report – Navigating Uncertainty

Tesla's Q1 2024 financial report reveals a significant profit decline, raising concerns about the company's future trajectory. The impact of Elon Musk's various controversies and their influence on investor sentiment cannot be ignored. While Tesla remains a major player in the electric vehicle market, it faces significant challenges moving forward, including increased competition and the need to restore investor confidence. The interplay between Tesla’s financial performance and Elon Musk’s actions will continue to be a key area of focus. Share your thoughts on Tesla's Q1 performance and the Musk controversy in the comments below, and stay informed on future Tesla financial reports and news related to Tesla Q1 earnings and Elon Musk’s influence.

Featured Posts

-

The Untold Story Of Chalet Girls Work Lifestyle And Challenges In European Ski Resorts

Apr 24, 2025

The Untold Story Of Chalet Girls Work Lifestyle And Challenges In European Ski Resorts

Apr 24, 2025 -

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025 -

Is This Startup Airlines Reliance On Deportation Flights Ethical

Apr 24, 2025

Is This Startup Airlines Reliance On Deportation Flights Ethical

Apr 24, 2025 -

Why The Popes Ring Is Destroyed The Significance Of The Ritual Following The Death Of A Pontiff

Apr 24, 2025

Why The Popes Ring Is Destroyed The Significance Of The Ritual Following The Death Of A Pontiff

Apr 24, 2025 -

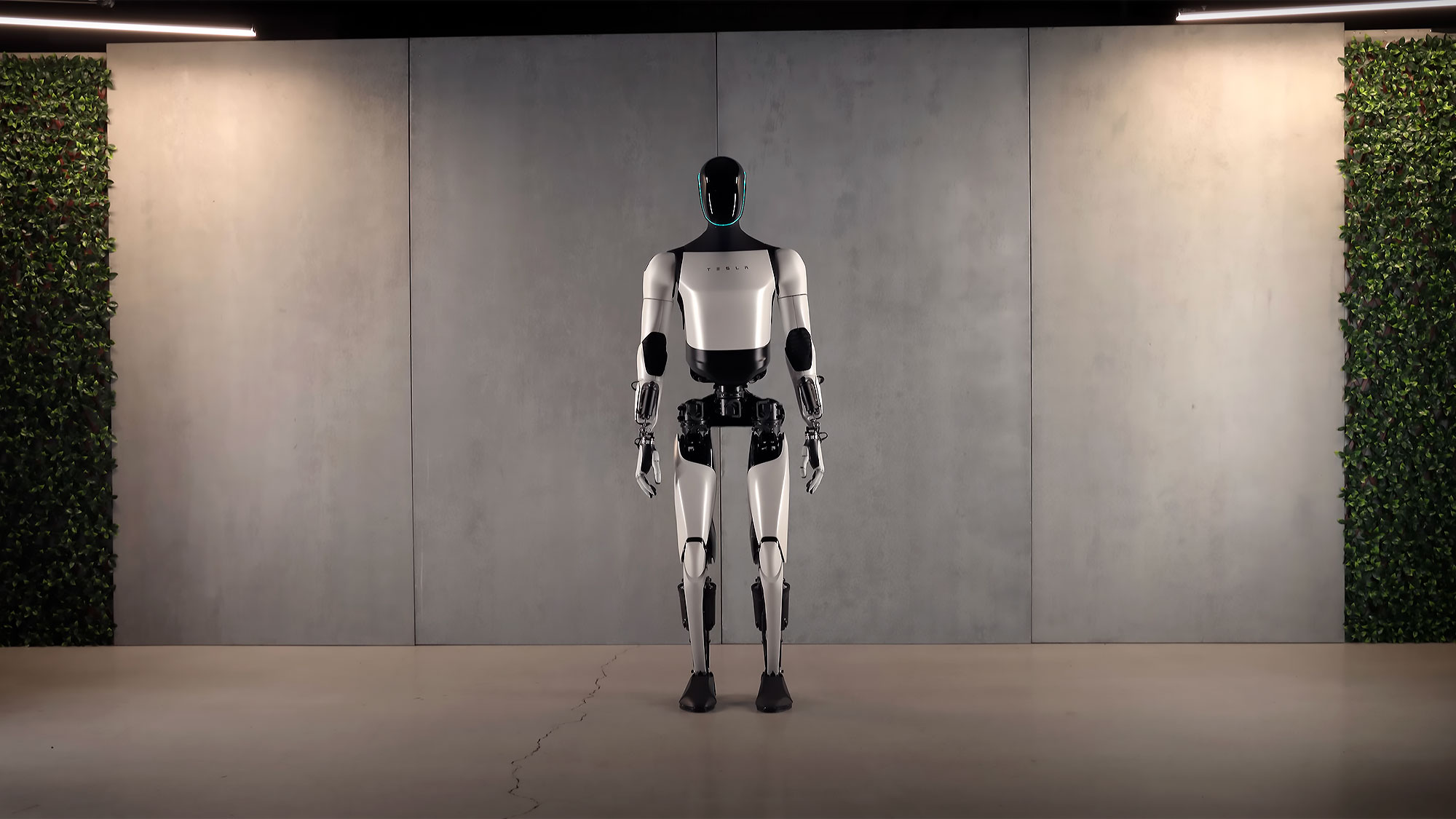

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Latest Posts

-

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025 -

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

May 10, 2025

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

May 10, 2025 -

Apples Ai Challenges And Opportunities Ahead

May 10, 2025

Apples Ai Challenges And Opportunities Ahead

May 10, 2025 -

Analyzing Apples Position In The Ai Revolution

May 10, 2025

Analyzing Apples Position In The Ai Revolution

May 10, 2025 -

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025