Tesla's Rise Lifts US Stocks: Tech Giants Power Market Gains

Table of Contents

Tesla's Impact on Investor Sentiment

Tesla's stock performance acts as a powerful barometer for investor confidence and market trends. The company's innovative spirit and growing market dominance have fueled a surge in investor optimism, creating a ripple effect across the broader market.

- Increased investor optimism: Tesla's consistent delivery of groundbreaking electric vehicles and its foray into energy solutions have solidified its position as a leader in sustainable technology. This inspires confidence in other innovative companies.

- The "Tesla effect": Positive news surrounding Tesla often translates into gains for other tech stocks. Investors see Tesla's success as a sign of broader strength in the tech sector, leading to increased investment across the board.

- Impact of financial reports: Tesla's strong financial reports, showcasing robust revenue growth and increasing profitability, directly influence its stock price and positively affect investor sentiment regarding the overall market.

- Future growth projections: Analysts' bullish projections for Tesla's future growth contribute to the positive investor sentiment, further driving up the stock price and influencing the market. This creates a self-reinforcing cycle of positive news and increased investment.

The Broader Tech Sector's Contribution

While Tesla plays a significant role, the overall strength of the US stock market is also driven by the impressive performance of other major tech companies.

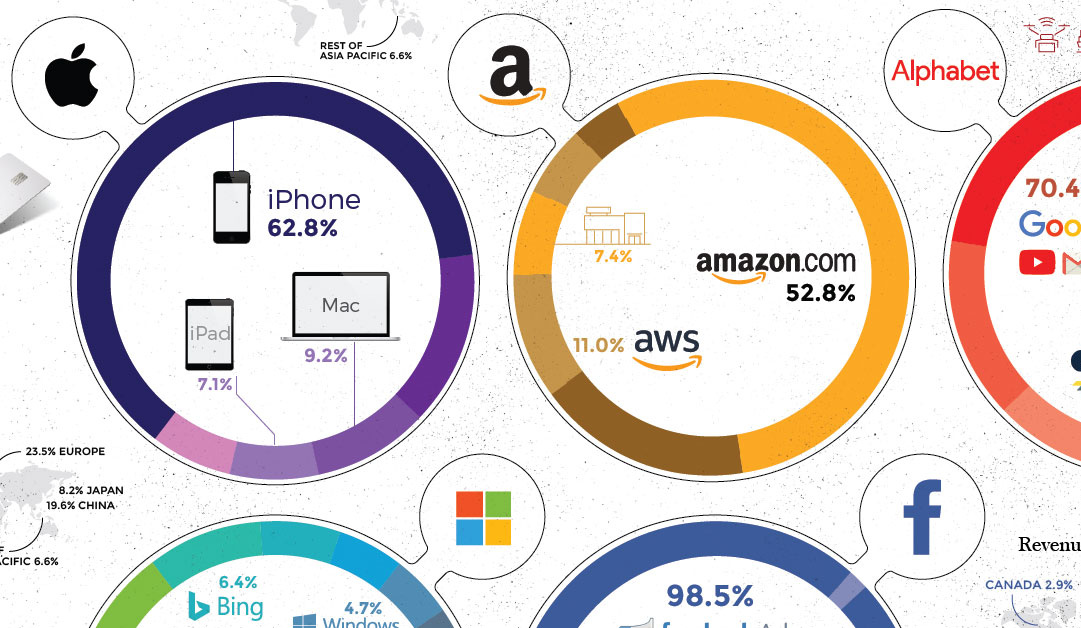

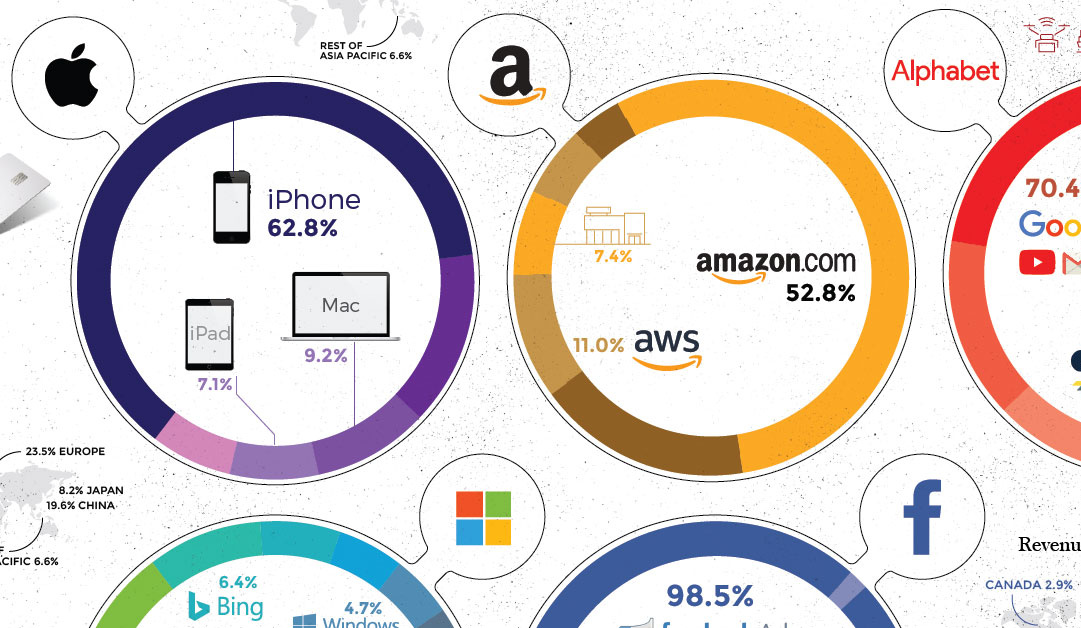

- Tech giant performance: Companies like Apple, Microsoft, Google (Alphabet), and Amazon continue to deliver strong financial results, fueled by advancements in artificial intelligence, cloud computing, and digital services. Their collective success reinforces the positive sentiment in the tech sector.

- Driving forces of tech growth: The relentless pace of innovation in areas like AI, cloud computing, and big data is creating new markets and driving growth for countless tech companies, contributing significantly to market gains.

- Performance across sub-sectors: While some tech sub-sectors might experience fluctuations, the overall trend is positive, with growth seen in software, hardware, semiconductors, and other areas, showcasing the overall health of the sector.

- Synergies and shared supply chains: Tesla's success is intrinsically linked to the success of other tech companies. Shared supply chains, technological collaborations, and similar innovation ecosystems strengthen the interconnectedness and resilience of the tech sector.

Macroeconomic Factors Influencing the Market

The positive trend in the stock market isn't solely driven by tech giants; macroeconomic conditions also play a significant role.

- Interest rates and inflation: While fluctuating interest rates and inflation can create uncertainty, the current economic climate, though subject to change, hasn't severely hampered the positive market trend.

- Government policies and regulations: Government initiatives focused on technological advancement and infrastructure development can positively impact market growth, creating a more favorable environment for tech companies.

- Consumer confidence and spending: High consumer confidence and strong spending habits further fuel economic growth, providing a supportive backdrop for the stock market's positive trajectory.

- Geopolitical factors: While geopolitical instability can introduce uncertainty, the current global situation, while unpredictable, has not significantly dampened the overall positive market sentiment.

Risks and Potential Downturns

Despite the positive trend, it's crucial to acknowledge potential risks and challenges that could impact the market.

- Tech sector correction: The tech sector is prone to corrections; overvalued stocks might experience a downturn, influencing the broader market.

- Tesla's valuation concerns: Tesla's valuation remains a subject of debate. Concerns regarding its current valuation could lead to a correction in its stock price, impacting investor sentiment.

- Geopolitical instability: Unforeseen geopolitical events can introduce significant volatility into the market, leading to potential downturns.

- Future market uncertainties: Economic downturns, unexpected technological disruptions, or changes in consumer behavior can affect the trajectory of the market.

Conclusion: Navigating the Market with Tesla as a Key Indicator

Tesla's performance significantly influences the gains in the US stock market, with the contributions of other tech giants and positive macroeconomic factors further bolstering the positive trend. However, investors must remain aware of potential risks and corrections. Understanding Tesla's influence on the market and staying informed about the overall tech sector performance are crucial for navigating the complexities of US stock investments and making well-informed decisions. Keep a close watch on Tesla's growth and broader market trends to optimize your investment strategy.

Featured Posts

-

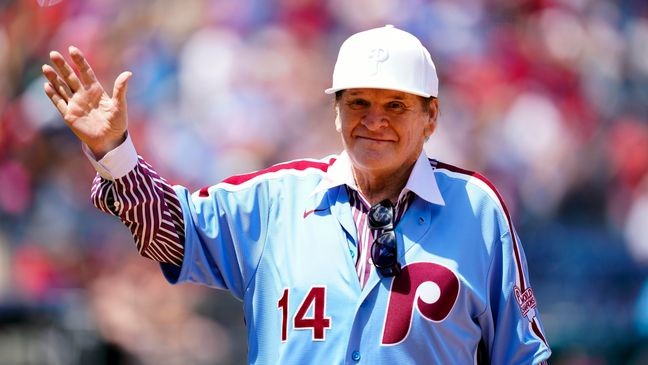

Trump And Pete Rose Could A Presidential Pardon Overturn The Mlb Betting Ban

Apr 29, 2025

Trump And Pete Rose Could A Presidential Pardon Overturn The Mlb Betting Ban

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Your Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets The Ultimate Buying Guide

Apr 29, 2025

Capital Summertime Ball 2025 Tickets The Ultimate Buying Guide

Apr 29, 2025 -

Bombshell Report Uncovering The Causes Of The Black Hawk And Jet Crash That Killed 67

Apr 29, 2025

Bombshell Report Uncovering The Causes Of The Black Hawk And Jet Crash That Killed 67

Apr 29, 2025