Tesla's Rise Lifts US Stocks: Tech Giants Power Market Growth

Table of Contents

Tesla's Stellar Performance and Market Influence

Tesla's recent successes are undeniable, significantly impacting the US stock market. Increased production, successful new model launches like the Cybertruck and Model Y, and consistently positive financial results have fueled this growth. The "Tesla effect" is also palpable, inspiring other electric vehicle (EV) companies and transforming the broader automotive sector. Tesla's innovations in battery technology and autonomous driving have further captivated investor sentiment.

- Key Financial Metrics:

- Stock price increase in 2023 (specify percentage, cite source).

- Market capitalization growth (specify amount, cite source).

- Significant revenue and profit increases (cite source).

Tesla's dominance in the EV market is undeniable, driving growth in the broader EV stocks segment and making Tesla stock a benchmark for the entire electric vehicle market. Its continuous innovation, including advancements in Tesla innovation like its revolutionary battery technology and the development of Full Self-Driving capabilities, fuels investor confidence and pushes Tesla market cap to new heights.

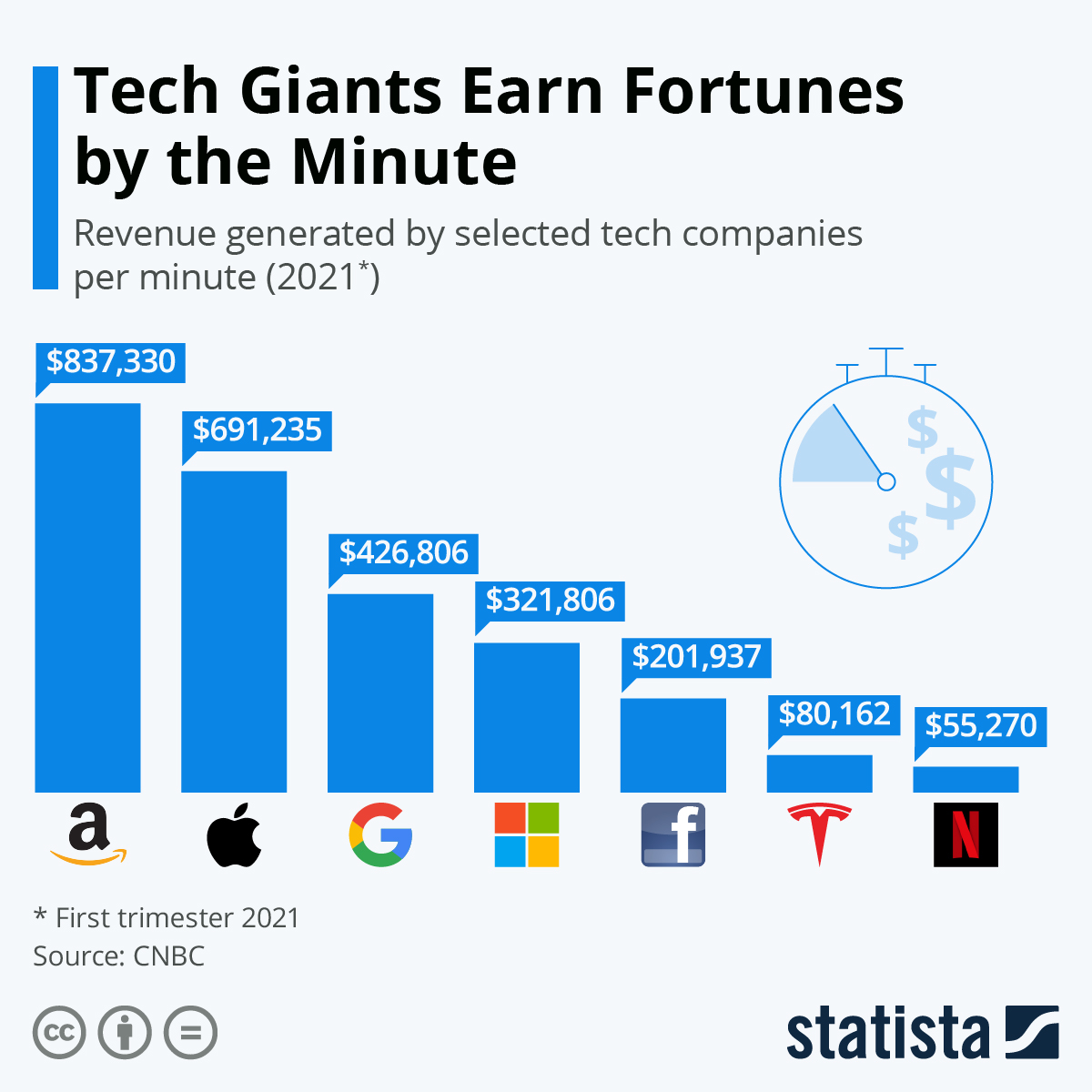

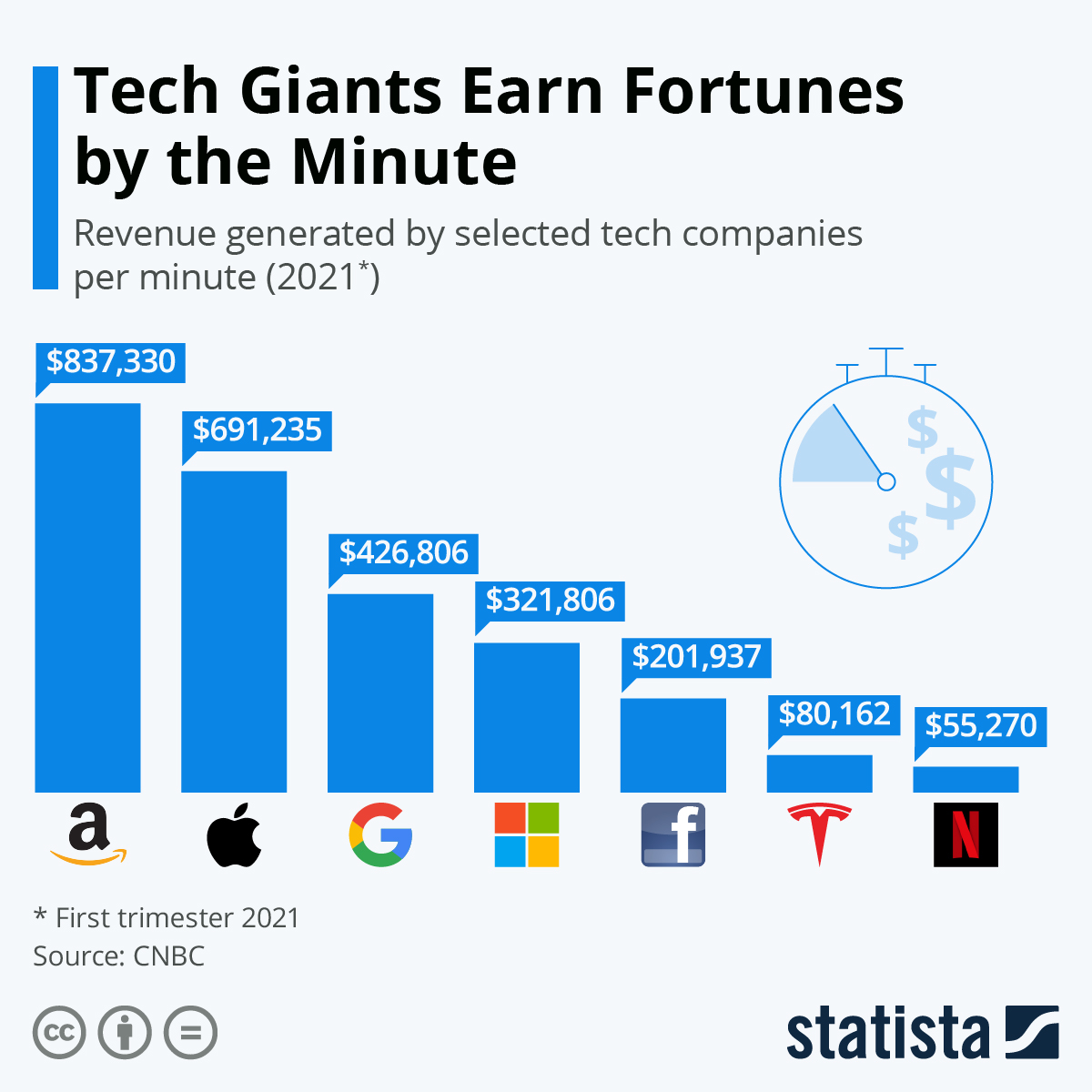

The Broader Tech Sector's Contribution

The tech sector's overall performance has been a major driver of US stock market growth, with companies like Tesla leading the charge. The contribution of major tech companies such as Apple, Microsoft, and Google cannot be overlooked. Factors such as cloud computing, artificial intelligence (AI), and software-as-a-service (SaaS) have fueled this exponential growth.

- Market Capitalization Comparison (cite source):

- Apple (approx. market cap)

- Microsoft (approx. market cap)

- Google (approx. market cap)

- Tesla (approx. market cap)

The strong performance of these tech stocks contributes significantly to the overall strength of the US economy, highlighting the influence of the US tech sector on the broader market capitalization. The expansion of cloud computing, advancements in artificial intelligence, and the increasing reliance on SaaS solutions are driving forces behind this growth.

Economic Factors Influencing the Market

Macroeconomic factors play a crucial role in shaping the overall market landscape. Interest rates, inflation, and consumer spending all interact to influence the performance of Tesla and the tech sector. While low interest rates initially fueled growth, increasing inflation and recessionary concerns pose potential challenges. Geopolitical instability also introduces further uncertainty.

- Key Economic Indicators:

- Current inflation rate (cite source).

- Interest rate levels (cite source).

- Consumer spending trends (cite source).

- GDP growth rate (cite source).

Understanding the US economy and the interplay between these factors—interest rates, inflation, and economic growth—is vital for comprehending the market's trajectory. Concerns about a potential recession and geopolitical risks introduce volatility and present significant challenges to sustained growth.

Investor Sentiment and Market Volatility

Investor sentiment towards Tesla and the broader tech sector is a significant driver of market volatility. Speculation plays a crucial role, influencing stock prices and market trends. News and events, such as regulatory changes, product announcements, and earnings reports, have a powerful impact on investor decisions.

- Key Events Impacting Market Sentiment:

- Recent Tesla product launches (and their market reception).

- Significant regulatory changes affecting the automotive or tech industry.

- Major earnings announcements from key tech companies.

Maintaining a keen understanding of investor confidence is critical in navigating the inherent market volatility. Analyzing stock market trends and assessing the impact of speculation and risk assessment are crucial for making informed investment decisions.

Tesla's Rise Lifts US Stocks – A Summary and Call to Action

Tesla's exceptional performance, combined with the robust growth of the broader tech sector, has significantly contributed to the expansion of the US stock market. Tesla's influence on the EV stocks market and the overall electric vehicle market is undeniable. The interplay of economic factors and investor sentiment has shaped this growth, highlighting the interconnectedness of macroeconomic conditions and company performance. Understanding these dynamics is vital for navigating the market effectively.

Stay tuned for further analysis on Tesla's continuing impact on the US stock market and how to navigate the opportunities and challenges presented by this dynamic sector. Learn more about investing in Tesla and tech stocks and how to analyze Tesla's stock market performance to make informed investment decisions.

Featured Posts

-

Yankees Aaron Judge Matches Babe Ruths Improbable Record

Apr 28, 2025

Yankees Aaron Judge Matches Babe Ruths Improbable Record

Apr 28, 2025 -

Trump And Zelenskys Post Funeral Meeting Moving Past The Oval Office Clash

Apr 28, 2025

Trump And Zelenskys Post Funeral Meeting Moving Past The Oval Office Clash

Apr 28, 2025 -

Where To Buy 2025 New York Yankees Hats Jerseys And Gear Your Ultimate Guide

Apr 28, 2025

Where To Buy 2025 New York Yankees Hats Jerseys And Gear Your Ultimate Guide

Apr 28, 2025 -

Federal Judge To Hear Case Of 2 Year Old Us Citizen Facing Deportation

Apr 28, 2025

Federal Judge To Hear Case Of 2 Year Old Us Citizen Facing Deportation

Apr 28, 2025 -

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025

Latest Posts

-

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025 -

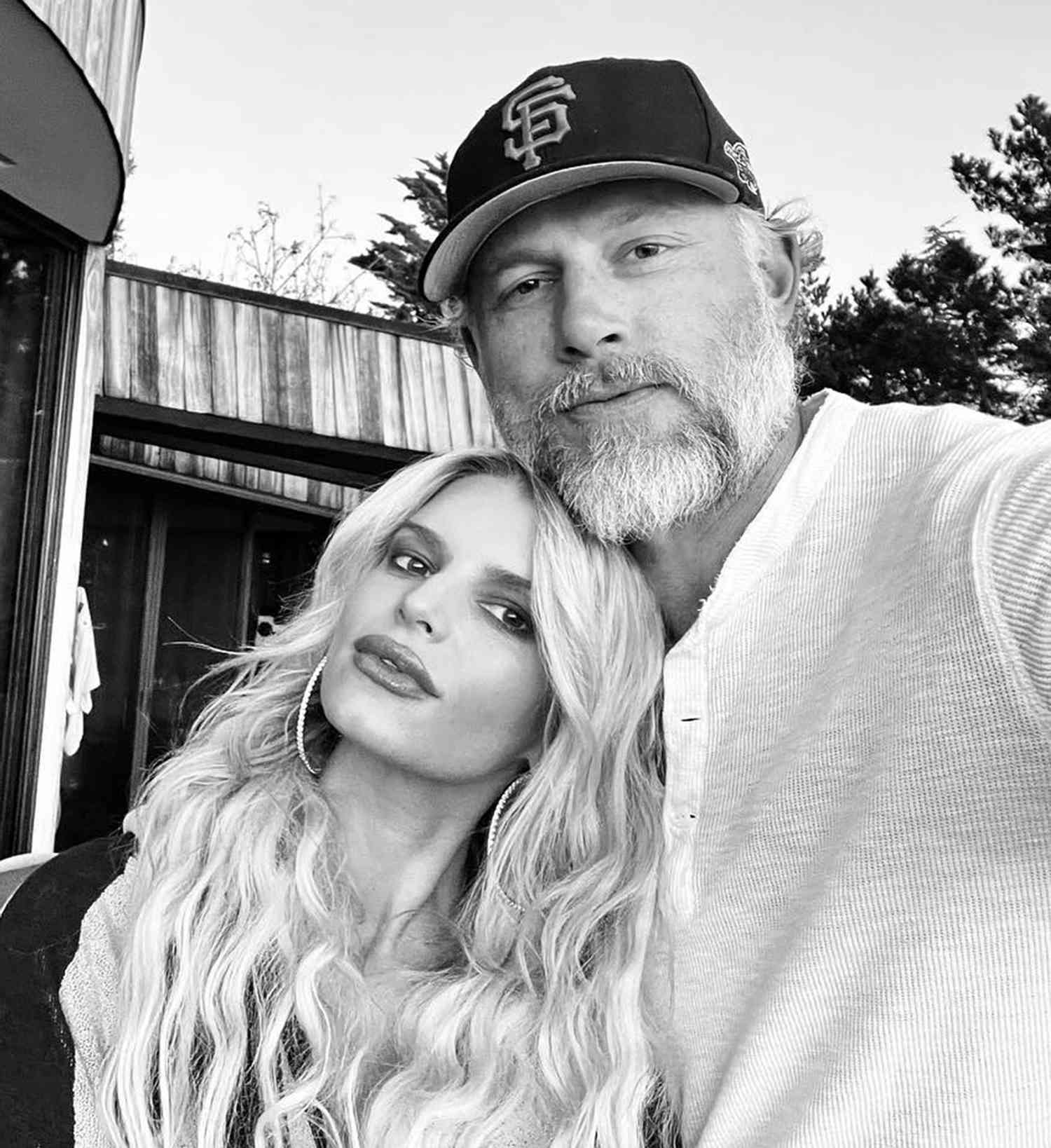

New Music From Jessica Simpson The Support Of Eric Johnson

May 12, 2025

New Music From Jessica Simpson The Support Of Eric Johnson

May 12, 2025 -

Jessica Simpson And Jeremy Renner A Timeline Of Their Reported Interactions

May 12, 2025

Jessica Simpson And Jeremy Renner A Timeline Of Their Reported Interactions

May 12, 2025 -

Jessica Simpson Credits Ex Husband For New Music

May 12, 2025

Jessica Simpson Credits Ex Husband For New Music

May 12, 2025 -

Tzesika Simpson Apokalyptetai I Amfilegomeni Methodos Frontidas Tis Fonis Tis

May 12, 2025

Tzesika Simpson Apokalyptetai I Amfilegomeni Methodos Frontidas Tis Fonis Tis

May 12, 2025