Tether, SoftBank, And Cantor In Potential $3 Billion Crypto SPAC Deal

Table of Contents

Understanding the Proposed Deal

A SPAC, or Special Purpose Acquisition Company, is essentially a shell company formed to raise capital through an initial public offering (IPO) with the sole purpose of acquiring a private company. This is a common route for private companies seeking to go public without the traditional IPO process. The rumored deal suggests Tether, currently valued at an estimated $3 billion (although this valuation is highly debated and contested), is the target acquisition. SoftBank and Cantor Fitzgerald are reportedly key investors, potentially contributing significantly to the funding. The timeline for this deal remains uncertain, but its potential impact on the crypto landscape is undeniable.

- Estimated valuation of Tether: While officially unconfirmed, the deal suggests a valuation around $3 billion, though this figure is subject to much speculation and scrutiny given the ongoing debate about Tether's reserves.

- SoftBank's investment strategy: SoftBank has a history of bold investments in technology and finance, known for both massive successes and high-profile failures. Their potential involvement signals a significant bet on the future of cryptocurrency and stablecoins.

- Cantor Fitzgerald's role: Cantor Fitzgerald's expertise in financial markets lends credibility to the deal, suggesting a strong financial foundation and strategic guidance. Their role likely extends beyond simple investment to include advisory services and navigating the complexities of regulatory compliance.

- Potential benefits: For Tether, this could mean enhanced legitimacy and increased adoption. For SoftBank and Cantor, the deal offers a potential high-return investment in a rapidly growing sector.

Tether's Position in the Cryptocurrency Market

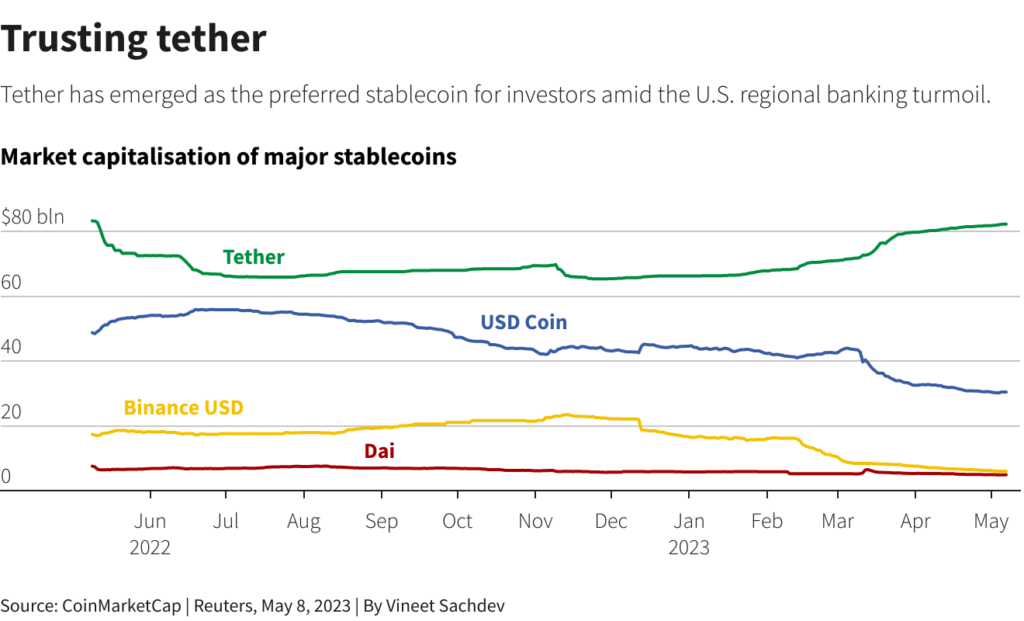

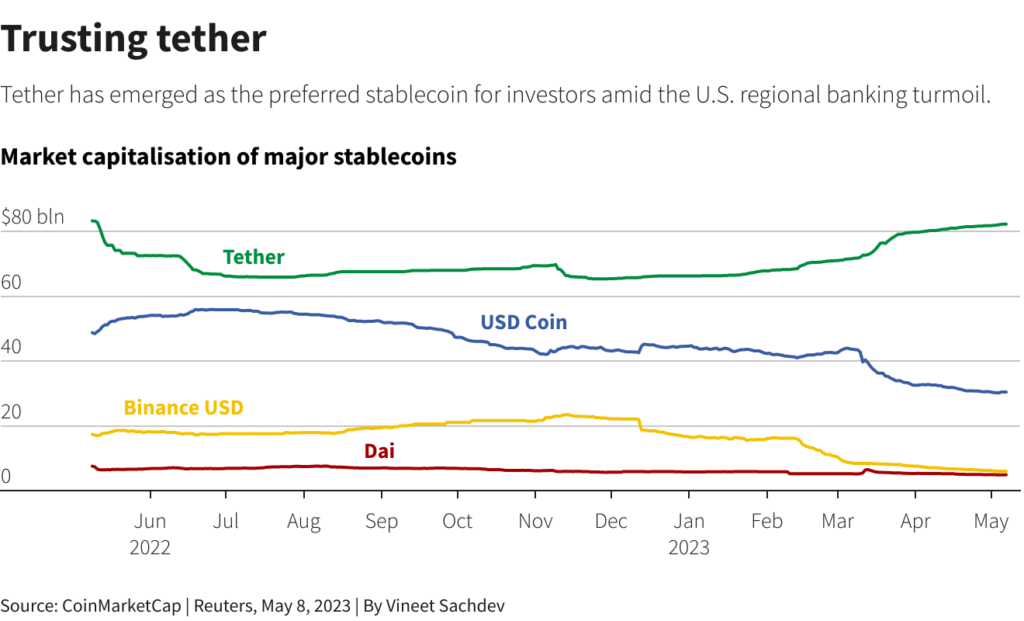

Tether (USDT) is the largest stablecoin by market capitalization, playing a crucial role in the cryptocurrency ecosystem. It's designed to maintain a 1:1 peg with the US dollar, facilitating trading and providing a more stable alternative to volatile cryptocurrencies. Its immense daily trading volume underlines its importance in providing liquidity within the crypto markets.

However, Tether has been embroiled in controversies regarding the transparency of its reserves, raising questions about its true backing and stability. These concerns could impact the proposed deal, potentially leading to renegotiations or even a collapse of the deal.

- Tether's market share: Tether dominates the stablecoin market, holding a significant share compared to competitors like USDC and BUSD.

- Impact on liquidity: Its widespread use directly impacts crypto market liquidity, enabling smoother trading across various exchanges.

- Reserves and transparency: The ongoing debate around the composition and verification of Tether's reserves is a major point of contention and a crucial factor in evaluating the deal's viability.

- Regulatory scrutiny: Increased regulatory scrutiny surrounding stablecoins adds another layer of complexity and risk to the proposed merger.

SoftBank's Investment Strategy and Implications

SoftBank's investment portfolio reflects a high-risk, high-reward approach. They have a history of investing heavily in disruptive technologies and have witnessed both spectacular successes and significant losses. Their potential investment in a Tether SPAC suggests a belief in the long-term growth potential of the cryptocurrency market despite inherent risks.

- Past investments: SoftBank's past investments include major players in the fintech sector, demonstrating their interest in the financial technology space.

- Risk tolerance: SoftBank’s history indicates a willingness to accept substantial risks for potentially massive returns.

- Return on investment: The potential ROI for SoftBank in this deal is significant, but hinges on the success and future performance of Tether and the broader crypto market.

- Strategic implications: The investment reflects SoftBank’s strategy to diversify their portfolio and capitalize on emerging trends in the financial technology sector.

Cantor Fitzgerald's Role and Expertise

Cantor Fitzgerald, a well-established financial services firm, brings invaluable expertise in mergers and acquisitions (M&A), financial advisory, and market analysis. Their involvement adds significant weight to the deal, providing essential financial and strategic guidance.

- M&A experience: Cantor's extensive experience in M&A transactions is crucial for navigating the complexities of this large-scale deal.

- Industry connections: Their broad network within the financial industry facilitates connections and partnerships, supporting a successful integration.

- Advisory services: They will likely provide critical advisory services throughout the merger process, mitigating risks and optimizing outcomes.

- Value addition: Cantor's participation enhances the deal's credibility and significantly increases the likelihood of success.

Potential Market Impact and Future Outlook

The success of this $3 billion Tether SPAC deal would have far-reaching implications for the cryptocurrency market. It could signify increased institutional adoption, drive further price increases for Tether, and potentially influence regulatory discussions surrounding stablecoins. However, significant challenges and risks remain.

- Impact on Tether's price: A successful merger could boost Tether's price and market capitalization, strengthening its position.

- Market sentiment: The deal's outcome will significantly influence overall crypto market sentiment, potentially attracting further institutional investment.

- Regulatory implications: Regulatory hurdles remain significant, and the deal's success hinges on navigating complex regulatory landscapes.

- Long-term prospects: The long-term prospects for the merged entity depend on various factors, including Tether's ability to address concerns about its reserves and the overall maturation of the cryptocurrency market.

Conclusion: Analyzing the Tether, SoftBank, and Cantor SPAC Deal

This potential $3 billion Tether SPAC deal, involving SoftBank and Cantor Fitzgerald, represents a pivotal moment for the cryptocurrency market. It showcases the increasing institutional interest in the sector, although significant challenges, particularly regarding Tether's transparency and regulatory scrutiny, remain. The deal's outcome will significantly shape the future trajectory of stablecoins and the broader cryptocurrency landscape. Stay informed about developments in the Tether SPAC deal and other cryptocurrency investments by following industry news and analysis. The future of cryptocurrency investments may well hinge on the success or failure of this ambitious endeavor. Keep an eye out for updates on this potentially game-changing Tether SPAC deal and its impact on SoftBank's crypto investments and the wider cryptocurrency market.

Featured Posts

-

Hollywood Production Grinds To Halt Amidst Combined Writers And Actors Strike

Apr 24, 2025

Hollywood Production Grinds To Halt Amidst Combined Writers And Actors Strike

Apr 24, 2025 -

The Post Roe Landscape Exploring The Implications Of Otc Birth Control

Apr 24, 2025

The Post Roe Landscape Exploring The Implications Of Otc Birth Control

Apr 24, 2025 -

New Business Hot Spots Across The Country An Interactive Map

Apr 24, 2025

New Business Hot Spots Across The Country An Interactive Map

Apr 24, 2025 -

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025 -

The Papal Signet Ring Tradition Destruction And The End Of A Pontificate

Apr 24, 2025

The Papal Signet Ring Tradition Destruction And The End Of A Pontificate

Apr 24, 2025

Latest Posts

-

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025 -

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025 -

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025 -

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025