Thaksin's Return: Implications For Thai-US Trade And Tariff Negotiations

Table of Contents

Political Instability and its Impact on Trade Agreements

Political stability is paramount for successful trade negotiations. A stable government fosters predictable policy environments, encouraging foreign investment and facilitating the smooth implementation of trade agreements. Thaksin's return, however, introduces a significant element of uncertainty. His past populist policies and the strong reactions they evoked could lead to renewed political polarization, potentially destabilizing the government and hindering effective trade negotiations.

This increased political uncertainty poses several challenges:

- Potential delays or disruptions in ongoing trade negotiations: The lack of a clear and consistent political direction can cause delays and even derail ongoing negotiations, as different factions may hold conflicting viewpoints on trade policy.

- Increased risk aversion among US investors in Thailand: Political instability often discourages foreign investment. US businesses might hesitate to invest in Thailand due to concerns about future policy shifts and the potential for asset expropriation.

- Uncertainty regarding the enforcement of existing trade agreements: A politically unstable environment could weaken the enforcement of existing trade agreements, leading to disputes and legal challenges.

- Impact on foreign direct investment (FDI) flows: Uncertainty regarding the political climate can negatively affect FDI flows into Thailand, potentially harming economic growth and harming Thai-US trade relationships.

The Role of Thaksin's Policies on Trade Relations

Thaksin's past economic policies significantly influenced Thai-US trade relations. His populist approach, characterized by generous subsidies and welfare programs, often involved interventions in the agricultural sector, impacting the competitiveness of Thai agricultural exports in the US market. His return could signal a potential shift towards similar policies, causing friction in trade discussions.

A potential shift in trade policy under Thaksin's influence might include:

- Potential changes to agricultural policies: Renewed focus on agricultural subsidies could trigger trade disputes with the US, given concerns about unfair competition.

- Possible adjustments to import/export tariffs: Changes in tariff structures could affect the competitiveness of both Thai and US goods in each other's markets, potentially leading to retaliatory measures.

- Impact on intellectual property rights protection: Thaksin's previous administrations faced criticism regarding the protection of intellectual property rights, a key concern for US businesses operating in Thailand.

- Changes in regulatory frameworks affecting US businesses: Alterations to regulations could create new hurdles for US companies operating in Thailand, impacting investment and trade.

US Response and Potential Adjustments to Trade Strategy

The US government is likely to closely monitor the evolving political situation in Thailand and adjust its trade strategy accordingly. The increased political uncertainty might prompt a more cautious approach, focusing on risk mitigation and potentially leading to:

- Review of existing trade agreements and potential renegotiations: The US might seek renegotiation of existing trade agreements to address concerns about political stability and policy predictability.

- Increased scrutiny of Thai trade practices: The US could intensify its scrutiny of Thai trade practices, including investigations into potential unfair trade practices.

- Potential imposition of new tariffs or trade restrictions: If concerns about unfair trade practices persist, the US might impose new tariffs or trade restrictions on certain Thai products.

- Impact on US aid and development programs in Thailand: The US might reassess its aid and development programs in Thailand based on the country's political stability and adherence to trade agreements.

Impact on Specific Sectors of Thai-US Trade

Thaksin's return could have a differentiated impact across various sectors of Thai-US trade. Key industries heavily involved in bilateral trade will feel the effects differently:

- Automotive industry: Potential changes to regulations and investment incentives could impact US automotive manufacturers operating in Thailand.

- Agricultural products (e.g., rice, seafood): Changes in agricultural policies could significantly affect the competitiveness of Thai agricultural exports to the US market.

- Textiles and apparel: Shifting labor laws and regulatory frameworks could influence production costs and the competitiveness of Thai textile and apparel exports.

- Electronics and technology: Concerns about intellectual property rights protection could impact US technology companies operating in Thailand.

Conclusion: Thaksin's Return: Navigating Uncertainties in Thai-US Trade

Thaksin's return to Thailand presents significant uncertainties for Thai-US trade negotiations. The potential for increased political instability, coupled with the possibility of shifts in trade policy, creates both challenges and opportunities. The US is likely to respond with increased scrutiny and potentially adjust its trade strategy to mitigate risks. Understanding the evolving dynamics of "Thaksin's Return: Implications for Thai-US Trade and Tariff Negotiations" requires continuous monitoring and proactive engagement. We encourage readers to stay informed by following developments in Thai politics and its impact on bilateral trade relations. For deeper analysis, consult resources from the US Trade Representative's office, the US Department of Commerce, and reputable academic journals focusing on Southeast Asian economics and politics.

Featured Posts

-

The Rise Of Nepotism In Hollywood Examining The Impact On The Oscars

Apr 26, 2025

The Rise Of Nepotism In Hollywood Examining The Impact On The Oscars

Apr 26, 2025 -

Preparing For Empty Shelves Key Insights From Anna Wong

Apr 26, 2025

Preparing For Empty Shelves Key Insights From Anna Wong

Apr 26, 2025 -

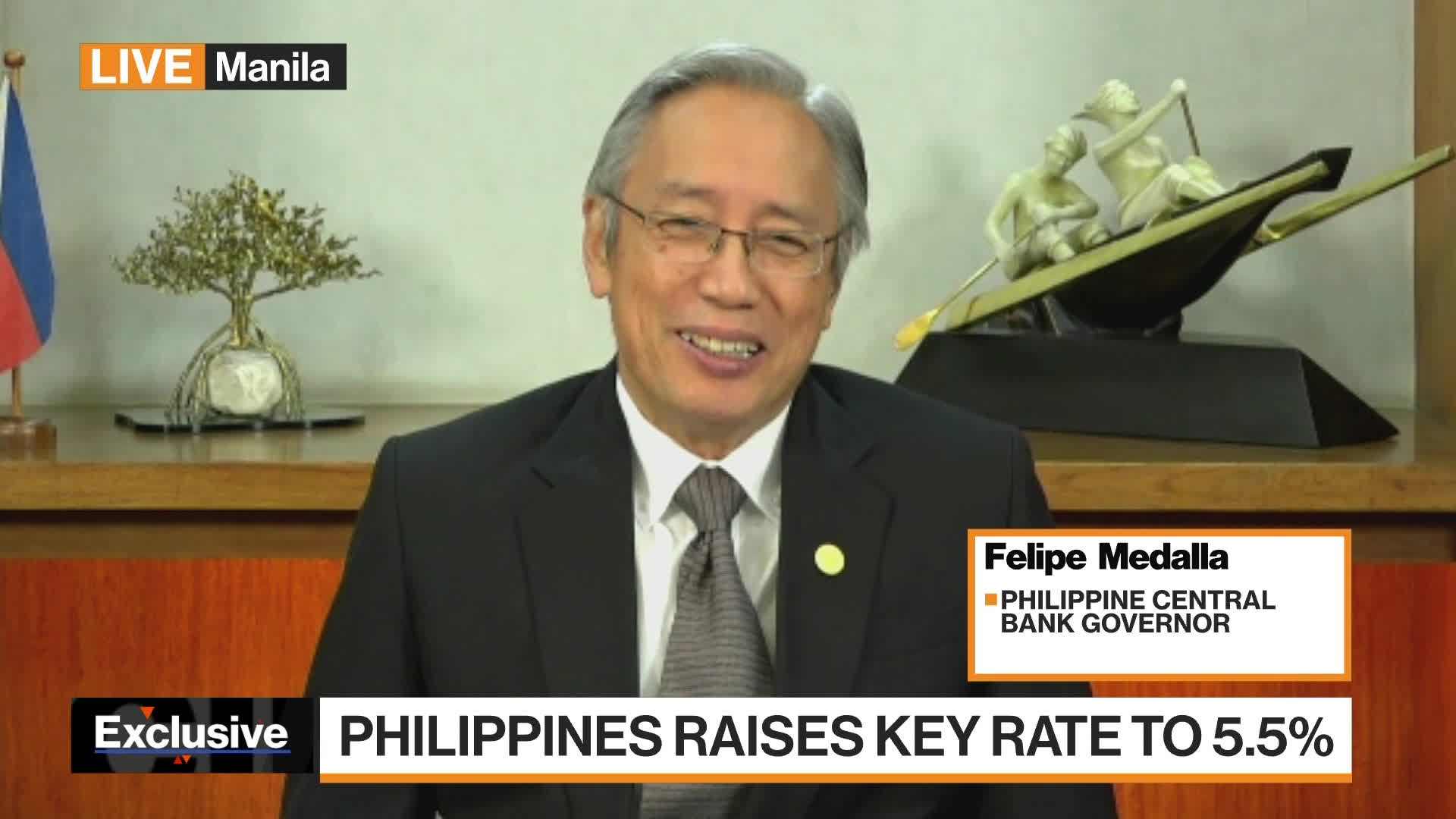

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

Apr 26, 2025

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

Apr 26, 2025 -

Egypts Ahmed Hassanein On The Cusp Of Nfl Draft History

Apr 26, 2025

Egypts Ahmed Hassanein On The Cusp Of Nfl Draft History

Apr 26, 2025 -

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025

Latest Posts

-

Apples Ai Challenges And Opportunities Ahead

May 10, 2025

Apples Ai Challenges And Opportunities Ahead

May 10, 2025 -

Analyzing Apples Position In The Ai Revolution

May 10, 2025

Analyzing Apples Position In The Ai Revolution

May 10, 2025 -

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025 -

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025 -

Cybercriminals Office365 Scheme Millions In Losses Investigation Underway

May 10, 2025

Cybercriminals Office365 Scheme Millions In Losses Investigation Underway

May 10, 2025