The Billionaire Successor To Warren Buffett: A Canadian Perspective

Table of Contents

Identifying Key Characteristics of a Warren Buffett Successor

To identify a potential "Warren Buffett's Canadian Successor," we must first understand the hallmarks of his success.

Value Investing Philosophy

Buffett's success is deeply rooted in value investing – identifying undervalued companies with strong fundamentals and holding them for the long term. A true successor would embrace this philosophy wholeheartedly.

- Examples of value investing strategies: Analyzing financial statements, identifying intrinsic value, seeking a margin of safety, understanding competitive advantages.

- Canadian companies demonstrating value investing: Identifying Canadian companies with strong balance sheets, consistent earnings, and undervalued assets. Analyzing companies like Fortis Inc. or Brookfield Asset Management for their adherence to value principles provides useful examples.

- Importance of long-term perspective: Resisting the urge for short-term gains and focusing on long-term growth, understanding that market fluctuations are temporary.

Long-Term Investment Horizon

Patience is paramount in value investing. Buffett's legendary success stems from his ability to hold investments for years, even decades, weathering market storms and reaping the rewards of long-term growth.

- Examples of Canadian investors known for their long-term vision: Highlighting Canadian investors with a proven track record of long-term success.

- Benefits of long-term investing: Compounding returns, minimizing transaction costs, reducing emotional decision-making.

- Risk mitigation strategies: Diversification, thorough due diligence, and understanding the inherent risks associated with long-term investments.

Strong Ethical Conduct and Philanthropy

Buffett is renowned not only for his investment prowess but also for his unwavering ethical standards and substantial philanthropic contributions. A suitable successor would embody these values.

- Examples of Canadian business leaders known for their ethical standards and charitable giving: Showcasing examples of Canadian business leaders with strong ethical reputations and significant philanthropic involvement.

- The positive impact of corporate social responsibility: Demonstrating the importance of environmental, social, and governance (ESG) factors in investing and business decisions.

- Measuring philanthropic impact: Discussing ways to assess the effectiveness and long-term impact of philanthropic initiatives.

Potential Canadian Candidates

Identifying a direct successor to Warren Buffett is challenging, but some Canadian business leaders exhibit characteristics that align with his approach.

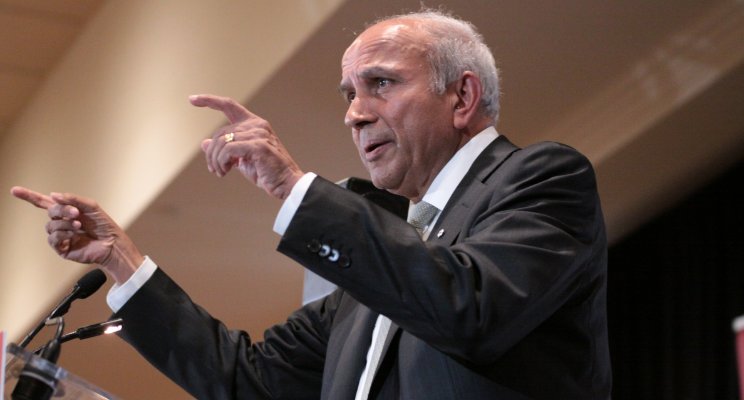

Candidate 1: (Example: Prem Watsa, Fairfax Financial Holdings)

Prem Watsa, the CEO of Fairfax Financial Holdings, is often cited as a potential Canadian counterpart to Buffett. His value investing approach, long-term investment horizon, and shrewd deal-making have yielded significant returns.

- Key investments: Highlighting some of Fairfax's key investments and their performance.

- Business achievements: Showcasing Fairfax's growth and success under Watsa's leadership.

- Philanthropic activities: Mentioning Watsa's philanthropic endeavors and contributions to society.

- Similarities and differences to Warren Buffett’s style: A direct comparison in style and investment approaches.

Candidate 2: (Example: Mark Wiseman, former CEO of the Canada Pension Plan Investment Board)

Mark Wiseman, previously at the helm of the Canada Pension Plan Investment Board (CPPIB), demonstrates a long-term perspective and sophisticated investment strategies. His experience managing a large global investment portfolio shows his skills in handling complex investments.

- Key investments: Showcasing notable investments made during his tenure at CPPIB.

- Business achievements: Highlighting the growth and success of CPPIB under his leadership.

- Philanthropic activities: Mentioning his public commitments to philanthropy and community involvement.

- Similarities and differences to Warren Buffett’s style: Direct comparison to determine alignment with Buffett's strategies.

Assessing the Candidates

Both Prem Watsa and Mark Wiseman, while successful in their own right, represent different facets of investment management. Watsa's focus on value investing mirrors Buffett's more directly, while Wiseman's experience in managing a large, diversified portfolio reflects a different but equally impressive skill set. Ultimately, a definitive "successor" remains elusive, yet both demonstrate strong Canadian leadership within the financial sector. The market capitalization of the companies they built or significantly influenced offers another benchmark for comparison.

The Canadian Economic Landscape and its Influence

The Canadian economic landscape presents both unique challenges and opportunities for investors.

Unique Challenges and Opportunities

Canada's economy, heavily reliant on natural resources, differs significantly from the US. This impacts investment strategies and the potential for a "Warren Buffett-like" figure to emerge.

- Impact of natural resources: Analyzing how reliance on natural resources influences investment decisions and risk profiles.

- Regulatory environment: Considering the regulatory environment in Canada and its impact on business and investment.

- Differences in the Canadian and US stock markets: Comparing and contrasting the two markets and their implications for investors.

- Opportunities for diversification: Exploring the opportunities for diversification within the Canadian market and globally.

Future of Canadian Investing

The future of Canadian investing is promising, with potential for growth in various sectors.

- Emerging sectors: Identifying key emerging sectors in the Canadian economy with high growth potential.

- Technological advancements: Assessing the impact of technological advancements on Canadian businesses and investments.

- Potential for growth in specific industries: Analyzing opportunities for growth in specific industries, such as technology, renewable energy, and healthcare.

- Predictions for the future of Canadian finance: Offering informed speculations on the future direction of Canadian finance and the types of investors who will succeed.

Conclusion

Finding a direct "Warren Buffett's Canadian Successor" is a formidable task. While no single individual perfectly replicates Buffett's unique blend of investment acumen, ethical conduct, and philanthropic spirit, individuals like Prem Watsa and Mark Wiseman embody aspects of his enduring success. Their long-term investment horizons, focus on value, and significant contributions to the Canadian financial landscape are noteworthy. The Canadian market presents unique opportunities and challenges, shaping the investment strategies of future generations. Discover potential future Warren Buffett's Canadian Successors by researching the featured Canadian business leaders and delving deeper into the world of Canadian value investing. Learn more about Canadian value investors and explore the world of Canadian finance to better understand the nuances of this dynamic market. Investigate the strategies of these leading Canadian investors to gain insights into long-term investment success.

Featured Posts

-

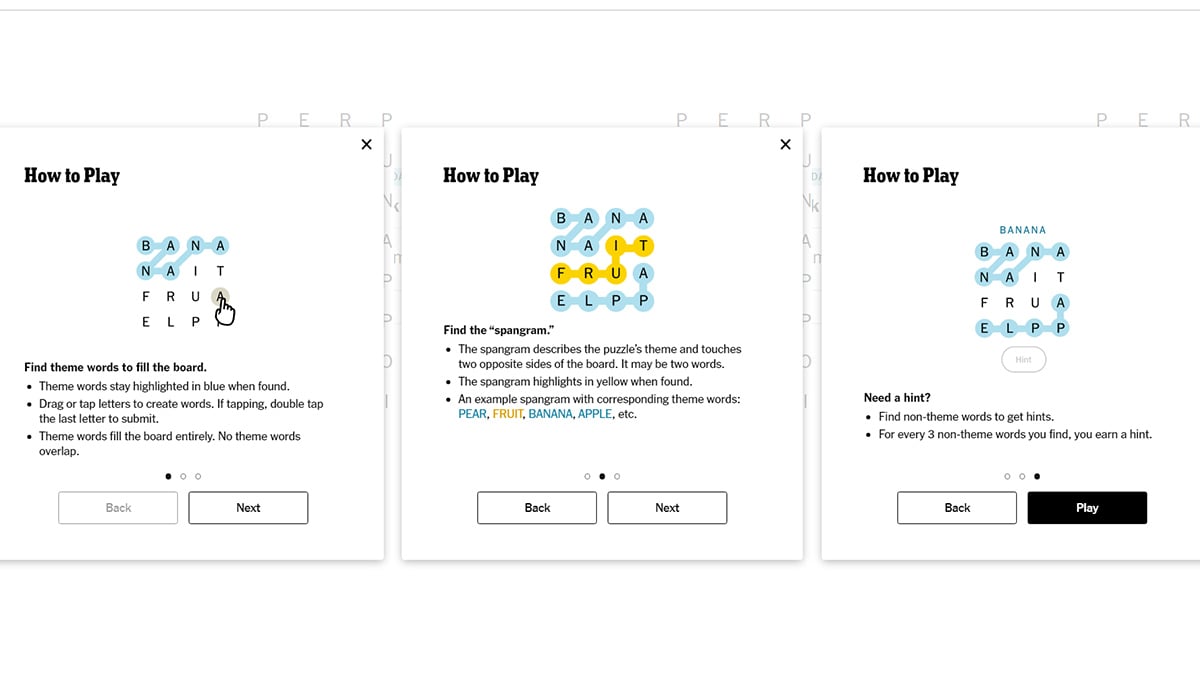

Nyt Strands Answers Saturday March 15th 2024 Game 377

May 09, 2025

Nyt Strands Answers Saturday March 15th 2024 Game 377

May 09, 2025 -

Mariah The Scientists Burning Blue A Deep Dive Into The New Release

May 09, 2025

Mariah The Scientists Burning Blue A Deep Dive Into The New Release

May 09, 2025 -

Palantir Stock Price Surge A New Forecast From Analysts

May 09, 2025

Palantir Stock Price Surge A New Forecast From Analysts

May 09, 2025 -

Travailler A Dijon Recrutement Restaurants Et Rooftop Dauphine

May 09, 2025

Travailler A Dijon Recrutement Restaurants Et Rooftop Dauphine

May 09, 2025 -

Statistika I Prognozy Na Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025

Statistika I Prognozy Na Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025