The Black Community And Trump's Student Loan Policy Changes

Table of Contents

Trump Administration's Key Student Loan Policy Changes

The Trump administration implemented several key changes to federal student loan programs, many of which had a disproportionate impact on minority borrowers, particularly within the Black community. These changes significantly altered the landscape of student loan repayment and forgiveness.

Changes to Income-Driven Repayment (IDR) Plans

IDR plans are designed to make student loan repayment more manageable by basing monthly payments on income. Under the Trump administration, several changes were made to these plans:

- Increased Repayment Lengths: Some IDR plans saw extended repayment periods, potentially leading to higher overall interest payments.

- Stricter Eligibility Requirements: The eligibility criteria for certain IDR plans were tightened, excluding some borrowers who previously qualified.

- Reduced Forgiveness Amounts: The amount of loan forgiveness available under some IDR plans was reduced, impacting long-term debt relief.

These changes resulted in increased monthly payments for many borrowers, especially those already struggling financially. While comprehensive data specifically isolating the impact on Black borrowers is limited, anecdotal evidence and studies on the overall impact of these changes suggest a disproportionate effect on communities with lower average incomes, a characteristic that often aligns with the Black community.

Changes to Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program offers loan forgiveness to borrowers who make 120 qualifying monthly payments while working full-time for a government or non-profit organization. The Trump administration made several modifications:

- Stricter Employment Verification: The process for verifying qualifying employment became more rigorous, leading to increased denials for some borrowers.

- Narrower Definition of Qualifying Employment: The definition of "qualifying employment" was narrowed, excluding some public service jobs.

These changes made it significantly harder for borrowers, particularly those in the Black community who are often overrepresented in underpaid public service roles, to qualify for PSLF. The participation rate of Black borrowers in PSLF likely decreased as a result, further increasing their long-term debt burden.

Focus on Increased Enforcement of Loan Repayment

The Trump administration also focused on stricter enforcement of student loan repayment, employing tactics such as:

- Increased Wage Garnishment: More aggressive wage garnishment was implemented to collect on defaulted loans.

- Tax Refund Offset: Tax refunds were increasingly used to offset student loan debt.

These stricter enforcement measures disproportionately affected lower-income borrowers, including many within the Black community, leading to financial hardship and potential legal challenges. The aggressive pursuit of repayment often created further financial instability for already vulnerable populations.

The Disproportionate Impact on Black Borrowers

The policy changes discussed above had a disproportionate impact on Black borrowers, exacerbating existing systemic inequalities within the higher education and financial systems.

Higher Rates of Student Loan Debt

Black students often graduate with higher levels of student loan debt compared to their white counterparts. This disparity stems from several factors:

- Lower Family Wealth: Black families often have less accumulated wealth to contribute to their children's education, necessitating larger loans.

- Limited Access to Financial Aid: Black students may face challenges accessing merit-based and need-based financial aid, resulting in a greater reliance on loans.

These disparities translate into a larger debt burden that is harder to manage, particularly considering the aforementioned policy changes.

Impact on Wealth Accumulation and Homeownership

High student loan debt significantly hinders Black borrowers' ability to build wealth and achieve key financial milestones such as homeownership.

- Reduced Savings Capacity: High monthly payments leave little room for savings and investments, limiting future opportunities.

- Obstacles to Homeownership: Large loan payments make it difficult to qualify for mortgages and achieve homeownership, contributing to the racial wealth gap.

Exacerbation of Existing Systemic Inequalities

Trump's student loan policies exacerbated pre-existing systemic racial and economic inequalities. These policies disproportionately affected already marginalized communities, hindering their social and economic mobility. The intersection of race, class, and gender further complicates the issue, with Black women often facing the most significant challenges.

Potential Long-Term Consequences

The long-term consequences of these policies for the Black community are significant and far-reaching.

Intergenerational Impact of Student Loan Debt

Student loan debt can have a devastating intergenerational impact, affecting not only borrowers but also their families and future generations. The burden of debt can hinder economic mobility and perpetuate cycles of poverty.

Impact on Educational Attainment and Career Paths

The weight of student loan debt can influence educational choices and career paths, potentially discouraging Black students from pursuing higher education or certain professions. This further limits opportunities for economic advancement and social mobility.

Conclusion: Understanding the Impact of Trump's Student Loan Policies on the Black Community

In conclusion, Trump's student loan policy changes had a disproportionately negative impact on the Black community, exacerbating existing systemic inequalities and creating significant long-term financial burdens. Increased repayment amounts, stricter eligibility requirements for forgiveness programs, and aggressive debt collection tactics all contributed to this disparity. The consequences include hindered wealth accumulation, reduced homeownership rates, and a perpetuation of the racial wealth gap. It is crucial to continue examining and discussing "The Black Community and Trump's Student Loan Policy Changes" to advocate for fairer policies and address these critical issues. Learn more about the National Association for Equal Opportunity in Higher Education (NAFEO) and the NAACP to stay informed and get involved in advocating for positive change in student loan policies for Black communities.

Featured Posts

-

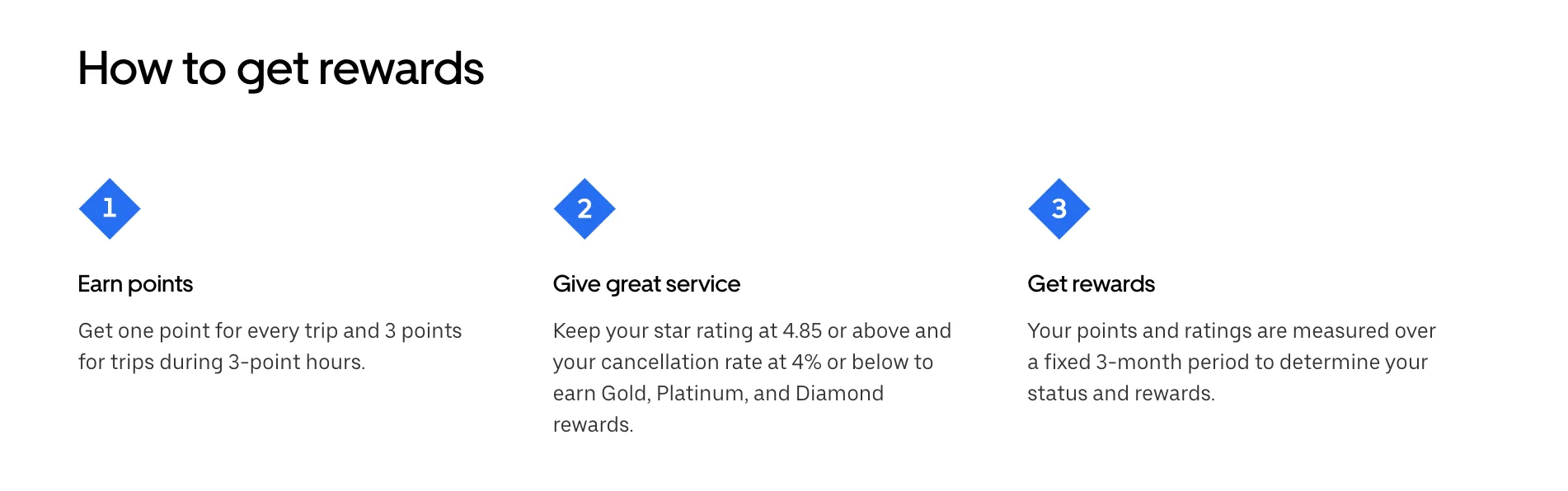

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025 -

Understanding Principal Financial Group Pfg An Analysts Perspective

May 17, 2025

Understanding Principal Financial Group Pfg An Analysts Perspective

May 17, 2025 -

Analyzing Piston And Knicks Performance Key Factors For Success

May 17, 2025

Analyzing Piston And Knicks Performance Key Factors For Success

May 17, 2025 -

China Box Office Awaits Mission Impossible Release Date Confirmed

May 17, 2025

China Box Office Awaits Mission Impossible Release Date Confirmed

May 17, 2025 -

Analyzing Piston And Knicks Success Key Differences This Season

May 17, 2025

Analyzing Piston And Knicks Success Key Differences This Season

May 17, 2025