The BofA View: Why Stretched Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

Strong Corporate Earnings and Revenue Growth Fueling the Market

BofA's analysis points to a robust and resilient corporate sector as a key driver of current market strength, even with seemingly high stock market valuations. This resilience is not merely based on speculation, but is grounded in concrete financial data.

Robust Profitability

Corporate profitability remains impressively strong. Many sectors are exhibiting robust profit margins and experiencing significant revenue growth, defying expectations in a challenging economic environment.

- Technology: The tech sector continues to show exceptional earnings growth, driven by cloud computing, AI, and software-as-a-service (SaaS) models.

- Energy: The energy sector has benefited from high commodity prices, leading to increased profitability.

- Financials: Banks and financial institutions are reporting strong earnings, benefiting from rising interest rates and increased lending activity.

These examples are supported by data showing significant year-over-year increases in key financial indicators such as Earnings Per Share (EPS) and Return on Equity (ROE) across various sectors. This robust profitability is a critical factor in justifying current valuations, and suggests sustained growth potential despite concerns about stretched stock market valuations.

Sustained Consumer Spending

The strength of the US economy is also bolstered by surprisingly resilient consumer spending. Despite inflation, consumer confidence remains relatively high, driving robust demand for goods and services.

- Retail sales figures: Recent retail sales data indicate continued consumer spending across various categories.

- Consumer confidence index: Although slightly decreased from peak levels, the consumer confidence index still signals a relatively optimistic outlook among consumers.

- Labor market strength: A strong labor market with low unemployment contributes significantly to consumer spending power and confidence.

This sustained consumer spending directly impacts corporate performance, creating a positive feedback loop that fuels revenue growth and ultimately supports current stock market valuations.

The Impact of Falling Inflation and Interest Rate Stabilization

The Federal Reserve's actions to combat inflation are starting to yield results, creating a more favorable environment for both businesses and the stock market. This easing of inflationary pressures and subsequent interest rate stabilization are significant factors in BofA's bullish outlook.

Easing Inflationary Pressures

Inflation rates are showing signs of cooling, easing pressure on businesses struggling with increased input costs. This decrease in inflationary pressures is a major positive for corporate profitability and consumer spending.

- CPI and PPI data: Recent reports indicate a steady decline in both the Consumer Price Index (CPI) and the Producer Price Index (PPI), signaling cooling inflation.

- Supply chain improvements: Easing supply chain disruptions contribute to lower input costs for businesses.

- Decreased energy prices: A decline in energy prices is directly impacting the overall inflation rate.

This trend significantly reduces the burden on businesses, allowing them to maintain profit margins and continue investing in growth, a factor directly impacting stock market valuations.

Interest Rate Stability and Its Positive Implications

The stabilization of interest rates, after a period of aggressive hikes, creates a more predictable and stable environment for businesses and investors.

- Reduced borrowing costs: While rates remain elevated, the pause in further increases reduces borrowing costs for businesses, facilitating investment and expansion.

- Increased investment: Lower borrowing costs encourage investment in new projects and expansion plans, fueling economic growth.

- Predictable environment: A more predictable interest rate environment reduces uncertainty, encouraging investment and overall market stability.

This stability mitigates risks associated with volatile interest rates, creating a more favorable environment for stock market valuations.

Long-Term Growth Potential and Technological Advancements

BofA’s bullish outlook extends beyond short-term factors, emphasizing the significant long-term growth potential fueled by technological innovation and global economic opportunities.

Technological Innovation Driving Growth

Technological advancements are driving transformative changes across various sectors, creating new markets and fueling future growth.

- Artificial Intelligence (AI): The rapid advancement of AI is poised to revolutionize numerous industries, boosting productivity and efficiency.

- Renewable Energy: The transition to renewable energy sources represents a massive growth opportunity with long-term implications.

- Biotechnology: Advances in biotechnology are unlocking new medical treatments and therapies, creating substantial growth potential.

These technological innovations are driving sector-specific growth and contribute to the long-term expansion of the overall market, potentially justifying current stock market valuations.

Global Economic Growth Opportunities

The global economy presents numerous growth opportunities that could support stock market valuations well into the future.

- Emerging Markets: Rapid economic growth in emerging markets presents significant investment opportunities.

- Global Trade: Continued growth in global trade provides opportunities for businesses to expand their reach and increase revenue.

- Positive Economic Forecasts: International organizations like the IMF are issuing relatively positive economic forecasts for the coming years.

These global factors contribute to a positive outlook for continued stock market growth and expansion, potentially mitigating concerns surrounding stretched stock market valuations.

Conclusion

While the current stock market valuations may seem high to some, BofA’s analysis suggests a more nuanced perspective. Strong corporate earnings, falling inflation, interest rate stabilization, and significant long-term growth potential driven by technological advancements and global economic opportunities all contribute to a bullish outlook. Don't let high stock market valuations deter you. Re-evaluate your investment strategy in light of BofA's optimistic outlook. Explore the opportunities in the current market based on BofA’s analysis of stretched stock market valuations. Further research into BofA's market analysis can provide valuable insights for informed investment decisions.

Featured Posts

-

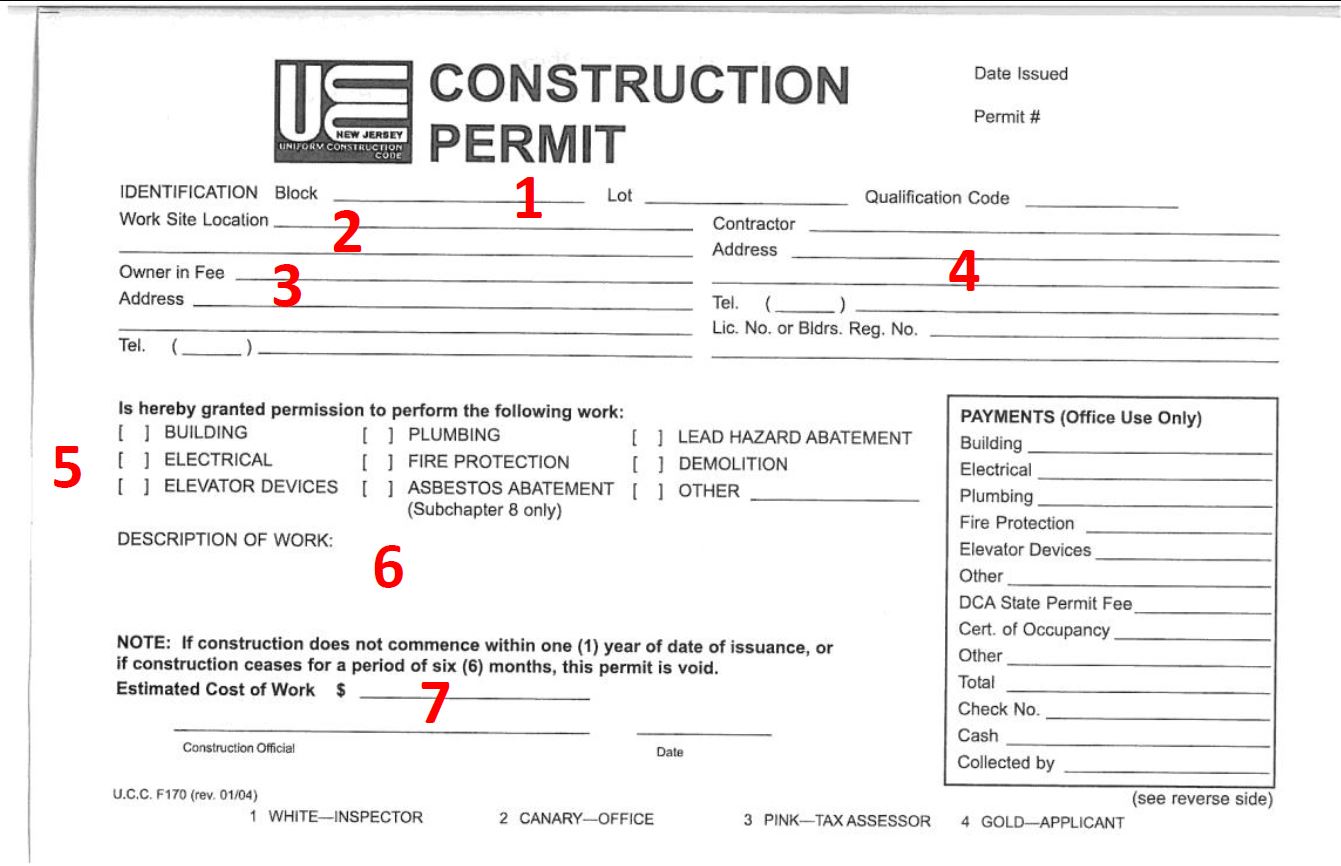

Recent Building Permits Issued In Macon County

Apr 26, 2025

Recent Building Permits Issued In Macon County

Apr 26, 2025 -

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

Apr 26, 2025 -

Dow Futures And China Economic Support Todays Stock Market Overview

Apr 26, 2025

Dow Futures And China Economic Support Todays Stock Market Overview

Apr 26, 2025 -

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025 -

Ambasada Olandei Solicitata Sa Rezolve Situatia De La Santierul Naval Mangalia

Apr 26, 2025

Ambasada Olandei Solicitata Sa Rezolve Situatia De La Santierul Naval Mangalia

Apr 26, 2025

Latest Posts

-

Should We Vote To Release Jeffrey Epstein Files Pam Bondis Decision Under Scrutiny

May 10, 2025

Should We Vote To Release Jeffrey Epstein Files Pam Bondis Decision Under Scrutiny

May 10, 2025 -

Wow High Potentials Finale Proves Its Potential

May 10, 2025

Wow High Potentials Finale Proves Its Potential

May 10, 2025 -

High Potential Season 1 Finale A Bold Move That Paid Off

May 10, 2025

High Potential Season 1 Finale A Bold Move That Paid Off

May 10, 2025 -

Abc Impressed By High Potentials Risky Season 1 Finale

May 10, 2025

Abc Impressed By High Potentials Risky Season 1 Finale

May 10, 2025 -

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Forthcoming Release

May 10, 2025

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Forthcoming Release

May 10, 2025