The Broadcom-VMware Deal: An Extreme Price Hike For AT&T?

Table of Contents

VMware's Central Role in AT&T's Network Infrastructure

AT&T, like many large telecoms, heavily relies on VMware's virtualization technologies to power its vast network infrastructure. VMware's solutions are integral to AT&T's operational efficiency and scalability. Specifically, products like vSphere, for server virtualization, and NSX, for network virtualization, are critical components of AT&T's network. These technologies aren't just add-ons; they are foundational to AT&T's ability to deliver services effectively and cost-efficiently.

The importance of VMware to AT&T's network can't be overstated:

- Reduced hardware costs through virtualization: VMware allows AT&T to consolidate its physical server infrastructure, significantly reducing hardware expenses and associated energy consumption.

- Improved network agility and resource utilization: VMware's virtualization platform allows for dynamic resource allocation, improving network agility and maximizing the utilization of existing resources.

- Enhanced operational efficiency and reduced downtime: VMware's tools simplify network management, automate tasks, and reduce downtime, leading to significant cost savings and improved service reliability.

The Broadcom Acquisition and Anticipated Price Increases

Broadcom's acquisition of VMware raises serious concerns about future pricing. Broadcom has a history of acquiring companies and subsequently increasing prices for their products and services. Given the lack of significant competition in the enterprise virtualization market, AT&T's negotiating power is significantly weakened. This lack of alternatives means AT&T may have little choice but to accept price increases imposed by Broadcom.

The potential cost implications for AT&T are substantial:

- Increased licensing fees for VMware products: Expect significant increases in licensing fees for core VMware products like vSphere and NSX.

- Potential for higher support and maintenance costs: Support and maintenance contracts are likely to become more expensive, adding further strain to AT&T's budget.

- Limited options for alternative virtualization solutions: The lack of strong competitors in the virtualization space significantly limits AT&T's ability to switch vendors and negotiate better terms.

Potential Financial Impact on AT&T's Bottom Line

The Broadcom-VMware deal's financial impact on AT&T could be considerable. The extent of the increase depends on AT&T's current VMware licensing agreements and usage levels. However, even modest percentage increases in licensing and support fees could translate into millions, if not billions, of dollars in added expenses annually.

This cost surge could have far-reaching consequences:

- Reduced profit margins due to increased operational expenses: Higher VMware costs will directly impact AT&T's profitability, squeezing margins and potentially affecting shareholder returns.

- Pressure to raise service prices for consumers: To offset increased operational costs, AT&T may be forced to raise prices for its services, potentially impacting consumer affordability and competitiveness.

- Impact on AT&T's competitive position in the telecom market: Higher costs could put AT&T at a disadvantage compared to competitors who might be less reliant on VMware or have secured more favorable contracts.

Mitigation Strategies for AT&T

AT&T is not powerless in the face of these challenges. Several mitigation strategies could lessen the blow from the Broadcom-VMware deal's price increases:

- Negotiating long-term contracts with Broadcom: Aggressive negotiation of long-term contracts could potentially lock in more favorable pricing for a defined period.

- Exploring open-source virtualization alternatives: While a significant undertaking, migrating to open-source alternatives like OpenStack or Proxmox could offer a long-term cost-saving solution.

- Optimizing resource utilization to reduce licensing costs: Improving efficiency and resource utilization within its existing VMware environment can reduce the number of licenses required, minimizing overall costs.

Conclusion: Navigating the Post-Merger Landscape of the Broadcom-VMware Deal for AT&T

The Broadcom-VMware deal poses significant financial challenges for AT&T. The anticipated price increases for VMware products and services could severely impact the company's profitability and competitiveness. Proactive mitigation strategies, such as contract negotiations, exploring alternative technologies, and optimizing resource utilization, are crucial for AT&T to navigate this new landscape. The future impact of this merger on the telecom landscape, and specifically the impact on AT&T's pricing structure, requires ongoing monitoring and analysis. Further research and discussion on the implications of the Broadcom-VMware deal for telecom companies are essential to understanding the potential long-term effects on the industry and consumer prices.

Featured Posts

-

Novak Djokovic Yasa Meydan Okuyan Tenis Harikasi

May 17, 2025

Novak Djokovic Yasa Meydan Okuyan Tenis Harikasi

May 17, 2025 -

The New York Knicks Unexpected Depth A Brunson Less Success Story

May 17, 2025

The New York Knicks Unexpected Depth A Brunson Less Success Story

May 17, 2025 -

Alexander Boulos Arrives Tracing The Expanding Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Tracing The Expanding Trump Family Lineage

May 17, 2025 -

Offre Limitee Trottinette Electrique 200 E Sur Cdiscount

May 17, 2025

Offre Limitee Trottinette Electrique 200 E Sur Cdiscount

May 17, 2025 -

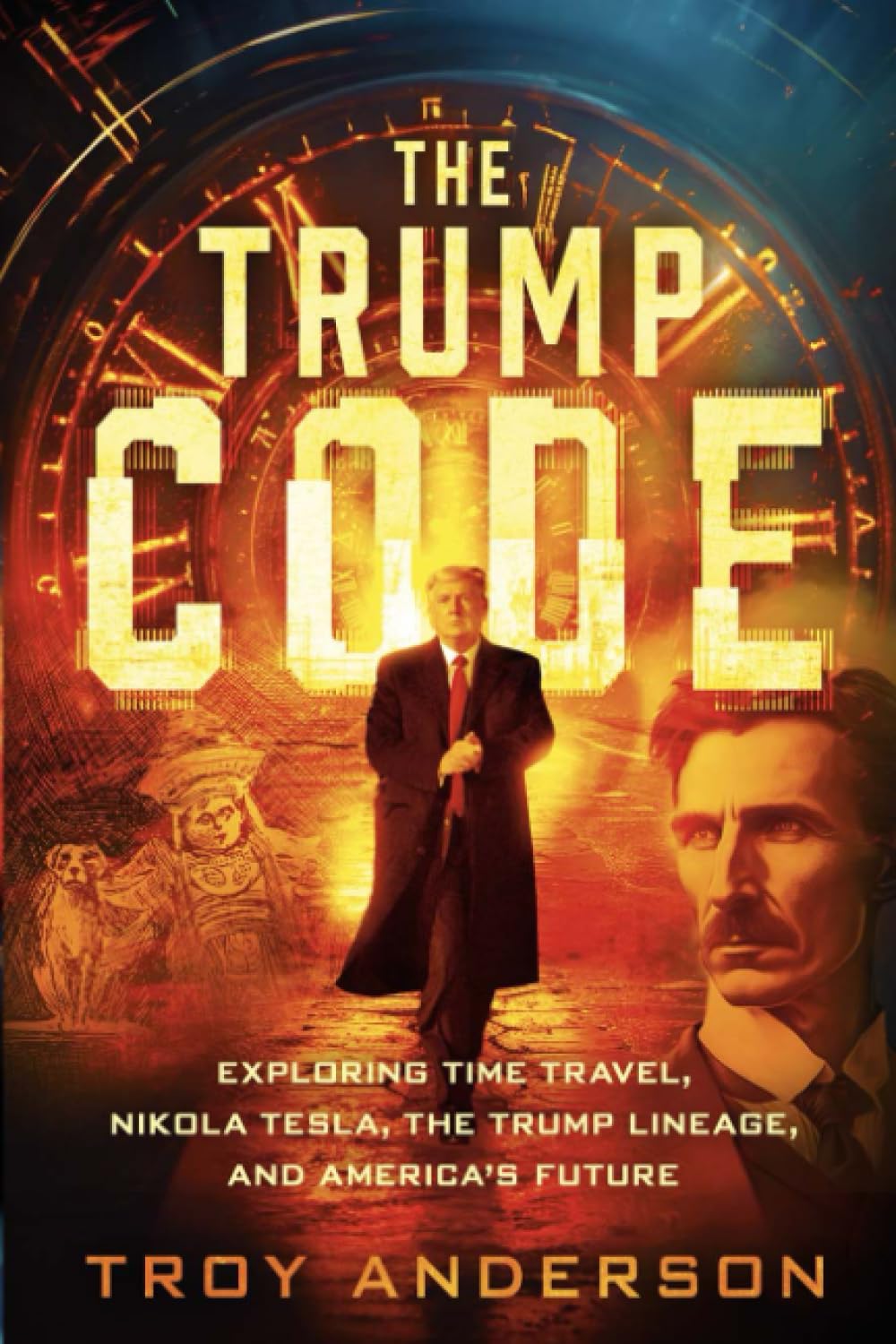

Analyzing Ubers Stock Performance Amidst Recessionary Fears

May 17, 2025

Analyzing Ubers Stock Performance Amidst Recessionary Fears

May 17, 2025