The Case Against 10-Year Mortgages: A Canadian Perspective

Table of Contents

The Risk of Locked-In Rates and Market Volatility

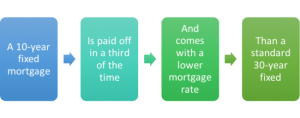

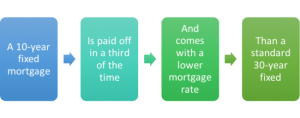

The allure of a fixed interest rate for a decade is undeniable. However, locking into a 10-year mortgage in Canada exposes you to significant risks associated with interest rate fluctuations and missed opportunities.

Interest Rate Fluctuations: The Canadian economy is dynamic; interest rates are subject to change based on various economic factors. Locking in a rate for 10 years means you're vulnerable to potential rate hikes. If rates rise significantly during your mortgage term, you'll be stuck with a potentially higher rate than what's available in the market.

- Example: Imagine locking into a 4% rate today. If rates increase to 6% in a few years, you'll miss out on the opportunity to refinance at a lower rate, potentially paying significantly more over the remaining term.

- Canadian Interest Rate History: Examining the historical fluctuations of the Bank of Canada's overnight rate reveals considerable volatility over the past decade, highlighting the unpredictable nature of interest rates. This underlines the risk of committing to a 10-year fixed mortgage.

- Refinancing Difficulties: Refinancing a 10-year mortgage before maturity can be difficult and expensive, involving significant penalties and fees.

Missed Opportunities: A 10-year mortgage closes the door on potential opportunities to refinance at lower rates. If interest rates decrease during your mortgage term, you are locked out of accessing better mortgage options.

- Scenario: Suppose interest rates fall substantially after three years. With a 10-year mortgage, you remain committed to your initial higher rate, missing out on potential savings that could be substantial over the long term.

- Market Dynamics: The Canadian mortgage market is constantly evolving, with new lenders and products appearing regularly. A 10-year mortgage limits your access to these potentially more beneficial options.

Financial Flexibility and Life Changes

Life is unpredictable. A 10-year mortgage severely limits financial flexibility and your ability to adapt to unforeseen circumstances or major life changes.

Unexpected Expenses: Job loss, medical emergencies, or unexpected home repairs can significantly strain your finances. With a 10-year mortgage, you may lack the flexibility to adjust your payments or refinance to better manage these unexpected costs.

- Examples of Unexpected Expenses: A sudden job loss, a serious illness requiring extensive medical treatment, or costly home repairs can create significant financial pressure, leaving you with limited options if locked into a long-term mortgage.

- Limited Options: Your choices are restricted to potentially expensive refinancing options or struggling to meet your monthly payments, potentially jeopardizing your credit rating.

Changing Life Circumstances: Major life changes, such as marriage, divorce, family expansion, or relocation, can dramatically alter your financial situation. A 10-year mortgage may become unsuitable in these scenarios.

- Scenarios: A change in employment leading to relocation, a divorce requiring a property sale, or the need for a larger home due to a growing family can make a 10-year mortgage burdensome.

- Alternative Mortgage Options: Shorter-term mortgages or those with flexible payment options provide greater adaptability to changing life circumstances.

The Burden of High Early Payments

A 10-year mortgage often results in significantly higher early payments compared to longer-term mortgages. While this accelerates equity building, it can severely impact your cash flow, particularly in the initial years.

Amortization and Principal Payments: The amortization schedule for a 10-year mortgage results in substantially larger principal payments early on, leaving less disposable income.

- Calculations: Comparing amortization schedules clearly demonstrates the higher early payments of a 10-year mortgage compared to, for example, a 25-year mortgage. This difference can be substantial, affecting your ability to save and invest.

- Impact on Savings and Investing: High early payments can limit your ability to contribute to savings plans, RRSPs, or investments, hindering your long-term financial growth.

Building Equity vs. Cash Flow: While a 10-year mortgage builds equity rapidly, it may jeopardize your cash flow, potentially forcing you to sacrifice other financial goals. A longer amortization period can provide greater financial breathing room.

- Trade-off: The speed of equity building needs to be balanced against the need for comfortable cash flow to maintain your lifestyle and pursue other financial objectives.

Conclusion

In conclusion, while the initial appeal of a lower interest rate on a 10-year mortgage in Canada is strong, the inherent risks associated with rate locking, financial inflexibility, and the burden of high early payments should be carefully considered. Before committing to a 10-year mortgage, explore alternative mortgage options, such as shorter-term mortgages with renewal options, or those offering flexible payment structures. These options provide greater flexibility and adaptability to Canada's fluctuating economic landscape and the uncertainties of life. Consulting a mortgage broker can provide personalized advice, helping you find a mortgage solution that best suits your Canadian lifestyle and financial future.

Featured Posts

-

Understanding The Shift Shopifys Updated Developer Revenue Program

May 06, 2025

Understanding The Shift Shopifys Updated Developer Revenue Program

May 06, 2025 -

Miley Cyruss Reported Distance From Billy Ray A Look At The Family Feud

May 06, 2025

Miley Cyruss Reported Distance From Billy Ray A Look At The Family Feud

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025 -

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025 -

Mstqbl Snaet Alsynma Alsewdyt Me Mnst Sbayk

May 06, 2025

Mstqbl Snaet Alsynma Alsewdyt Me Mnst Sbayk

May 06, 2025