The Complex Legacy Of Trump's Tariffs On US Manufacturing Growth

Table of Contents

Short-Term Gains vs. Long-Term Pain: Assessing the Immediate Impact of Trump's Tariffs

While some sectors experienced short-term gains due to increased domestic demand spurred by Trump's tariffs, others suffered significantly. The varied responses across different industries highlight the complexity of assessing the overall impact. The initial surge in domestic production in certain sectors, like steel and aluminum, was often accompanied by increased prices for consumers, leading to tariff-induced inflation. This inflation impacted purchasing power and ultimately hindered overall economic growth.

- Increased prices for consumers due to tariff-induced inflation: The added costs associated with tariffs were often passed down to consumers, leading to higher prices for a range of goods. This reduced consumer spending and potentially dampened economic growth.

- Job creation in specific sectors, but job losses in others due to retaliatory tariffs: While some industries saw a boost in domestic production and subsequent job creation, other sectors experienced job losses due to retaliatory tariffs imposed by trading partners. This created a net effect that was difficult to definitively assess as positive or negative.

- Initial boost in domestic production in certain industries, but potential for decreased competitiveness in the long run: The short-term boost in domestic production might have come at the cost of long-term competitiveness. Industries shielded from foreign competition might have been less incentivized to innovate and improve efficiency.

- Case studies of specific industries (e.g., steel, aluminum) showing contrasting effects: Examining specific industries reveals contrasting narratives. The steel industry, for instance, saw some initial gains, while other sectors heavily reliant on imported components faced significant challenges. A comprehensive analysis requires a granular examination of these sector-specific impacts.

The Ripple Effect: How Tariffs Impacted Supply Chains and Global Trade

Trump's tariffs significantly disrupted global supply chains and impacted US trade relationships with key partners. The ripple effect extended far beyond the targeted industries. Businesses reliant on imported materials and components faced increased costs, impacting their profitability and competitiveness.

- Increased costs for businesses relying on imported materials and components: Many businesses depend on imported parts and raw materials. Tariffs increased these input costs, squeezing profit margins and forcing some to reduce production or lay off workers.

- Disruption of established trade relationships, leading to uncertainty and reduced investment: The unpredictable nature of the tariff policy created uncertainty, discouraging investment and hindering long-term economic planning. Existing trade agreements were strained, resulting in diminished trust among trading partners.

- Retaliatory tariffs imposed by other countries harming US exporters: Other countries responded to Trump's tariffs with their own retaliatory measures, harming US exporters and further disrupting global trade flows. This tit-for-tat escalation intensified the negative consequences.

- Shifting of production to other countries to avoid tariffs: Some companies relocated production to countries outside the scope of the tariffs to avoid the added costs, resulting in a loss of US manufacturing jobs.

- Analysis of the impact on specific trade agreements: The tariffs significantly impacted existing trade agreements like NAFTA (now USMCA), creating uncertainty and tension in US relations with key trade partners.

The Role of Uncertainty: How Tariff Volatility Affected Investment and Growth

The unpredictable nature of Trump's tariff policies created substantial uncertainty, significantly impacting long-term investment and economic growth. Businesses hesitated to invest in expansion or new technologies due to the fluctuating landscape.

- Decreased business investment due to uncertainty surrounding future tariff policies: Businesses became reluctant to commit to long-term investments due to the fear of sudden policy changes and unpredictable costs.

- Impact on innovation and technological advancements due to reduced investment: The lack of investment in research and development hindered innovation and slowed down technological advancements across various sectors.

- Delayed expansion plans and reduced hiring due to economic uncertainty: The overall economic uncertainty led businesses to delay expansion plans, reduce hiring, and adopt a more cautious approach to growth.

- Comparison with other periods of trade protectionism to highlight the impact of uncertainty: Historical analyses of other periods of trade protectionism show that uncertainty is a major factor in dampening economic growth and investment.

Winners and Losers: Analyzing the Distributional Effects of Trump's Tariffs

The distributional effects of Trump's tariffs were far from uniform. While some sectors and demographics benefited, others suffered disproportionately. Understanding this complex distribution is crucial for a complete assessment of the policy's impact.

- Analysis of the impact on different income groups and regions: The effects of the tariffs varied significantly across different income groups and geographic regions, with some areas experiencing greater negative impacts than others.

- Examination of the effects on small businesses versus large corporations: Large corporations often had more resources to navigate the complexities of tariffs, while small businesses faced significant challenges.

- Discussion of potential social equity implications: The disproportionate impact on specific demographics raised concerns about social equity and economic fairness.

- Data on job creation and job losses across different demographic groups: Analyzing job creation and loss across different demographic groups reveals the uneven distribution of the tariffs’ effects.

Conclusion

This analysis reveals the complex and multifaceted consequences of Trump's tariffs on US manufacturing growth. While some sectors experienced short-term gains, the overall impact involved significant disruptions to global supply chains, increased uncertainty, and a complex distributional impact across various economic segments. The long-term effects are still unfolding, and continued research is crucial for fully understanding their consequences. The impact of tariffs on manufacturing extends beyond simple job numbers and includes the broader implications for international trade relations and the overall health of the US economy.

Call to Action: Understanding the lasting impact of Trump's tariffs is vital for shaping future trade policy. Further research and analysis are needed to evaluate the true cost and benefit of such protectionist measures. To delve deeper into the nuances of this complex economic issue, explore further resources on the subject of Trump's tariffs and their broader impact on the US economy.

Featured Posts

-

Is Sabrina Carpenter Performing At The Fortnite Festival New Leak Points To Yes

May 06, 2025

Is Sabrina Carpenter Performing At The Fortnite Festival New Leak Points To Yes

May 06, 2025 -

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025 -

Celtics Playoffs 2024 Eastern Conference Semifinals Start Time

May 06, 2025

Celtics Playoffs 2024 Eastern Conference Semifinals Start Time

May 06, 2025 -

Quinta Brunsons Snl Monologue Sabrina Carpenters Unexpected Appearance

May 06, 2025

Quinta Brunsons Snl Monologue Sabrina Carpenters Unexpected Appearance

May 06, 2025 -

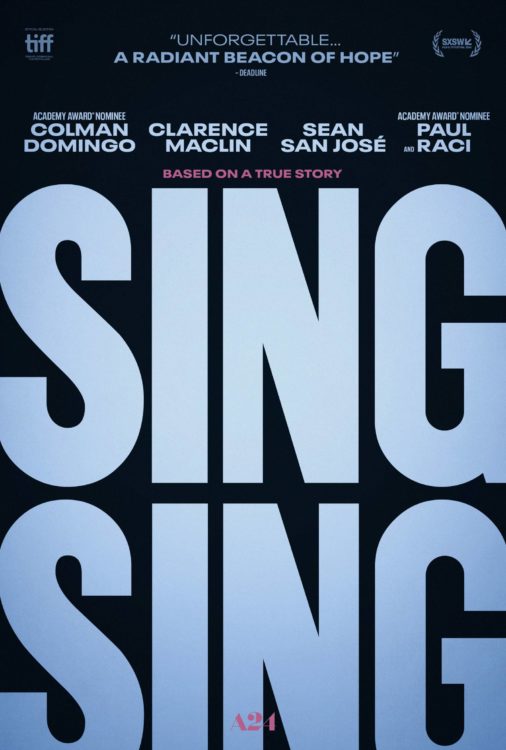

A Year And A Half Later Stream Colman Domingos Critically Acclaimed A24 Movie

May 06, 2025

A Year And A Half Later Stream Colman Domingos Critically Acclaimed A24 Movie

May 06, 2025