The Correlation Between Tesla Stock And Dogecoin: Understanding Elon Musk's Effect

Table of Contents

Elon Musk's tweets have sent shockwaves through both the stock market and the cryptocurrency world. His pronouncements on Tesla and Dogecoin, in particular, have created a complex interplay, leaving investors wondering about the correlation between these two seemingly disparate assets. This article delves into the intricate relationship between Tesla stock and Dogecoin, exploring how Elon Musk's actions and pronouncements significantly impact the price fluctuations of both. We'll analyze the correlation, assess the inherent risks, and offer insights for investors navigating this volatile landscape.

Elon Musk's Influence on Tesla Stock

Direct Impact of Musk's Actions

Elon Musk's role as CEO of Tesla is intrinsically linked to the company's success and, consequently, its stock price. His decisions concerning innovation, production targets, and overall company strategy directly influence investor confidence and market perception. Major announcements, such as new product launches (like the Cybertruck or the Roadster), production updates (achieving ambitious delivery targets), or breakthroughs in battery technology, often lead to immediate and significant stock price increases. Conversely, negative news, including production delays, controversies surrounding the company's autonomous driving technology (Autopilot), or regulatory challenges, can cause sharp declines.

- Positive news leads to price increases: The unveiling of new, innovative products typically generates significant positive market sentiment, driving up Tesla's stock price.

- Negative news (production delays, controversies) leads to price drops: Reports of production setbacks or negative publicity can severely impact investor confidence, resulting in stock price decreases.

- Investor confidence heavily tied to Musk's leadership: The market's perception of Musk's leadership and vision is a major factor determining Tesla's valuation.

Indirect Impact through Social Media

Beyond formal announcements, Elon Musk's extensive social media presence significantly impacts Tesla's stock price. His tweets, often cryptic or humorous, can drastically shift investor sentiment. A single positive tweet can trigger a buying frenzy, while a negative or ambiguous one can spark a sell-off. The media's amplification of these tweets further exacerbates the effect, creating a powerful feedback loop that influences the market.

- Positive tweets boost investor confidence: Enthusiastic or positive tweets about Tesla's progress or future prospects often lead to immediate price increases.

- Negative or ambiguous tweets create uncertainty and volatility: Conversely, negative or uncertain comments can sow doubt among investors, causing price volatility.

- The power of social media in shaping market perception: Musk's social media activity has become a major factor in shaping the public and investor perception of Tesla.

Elon Musk's Influence on Dogecoin

Musk's Public Endorsement and Dogecoin's Price

Elon Musk's public pronouncements about Dogecoin have had a dramatic effect on its price. His tweets, mentions in interviews, and even seemingly innocuous memes featuring Dogecoin have repeatedly led to significant price surges. This is largely due to his massive social media following and the inherent speculative nature of the cryptocurrency market.

- Musk's tweets often lead to dramatic price increases: Any positive mention of Dogecoin by Musk can trigger a rapid increase in its value.

- Dogecoin's price heavily reliant on speculation and social media trends: Dogecoin's price is highly susceptible to market sentiment, largely driven by social media trends and speculation.

- The risks of investing based on celebrity endorsements: Relying on celebrity endorsements as a primary investment strategy is inherently risky, as it’s based on speculation rather than fundamental value.

The Speculative Nature of Dogecoin and Musk's Role

Dogecoin's value is primarily driven by speculation and market sentiment, rather than any intrinsic value or utility. Musk's influence exacerbates this speculative nature, making its price incredibly volatile. Investing in Dogecoin involves significant risk due to its unpredictable price swings and lack of underlying asset backing.

- Dogecoin's volatility is exceptionally high: Dogecoin's price is notoriously volatile, subject to rapid and dramatic fluctuations.

- Investing in Dogecoin carries significant risk: Investors should be fully aware of the high risk associated with Dogecoin investments.

- Musk's involvement increases both risk and potential reward: While Musk's involvement can lead to significant price gains, it also amplifies the potential for substantial losses.

The Correlation Between Tesla Stock and Dogecoin

Identifying Correlation, Not Causation

While there's a clear correlation between movements in Tesla stock and Dogecoin's price, it's crucial to distinguish between correlation and causation. While both assets are influenced by Elon Musk, their price movements aren't always directly causally linked. Broader market trends, overall investor sentiment, and other macroeconomic factors also play significant roles.

- Correlation does not equal causation: Just because two assets move in tandem doesn't mean one directly causes the movement in the other.

- Shared investor sentiment may influence both assets: Positive or negative market sentiment can affect both Tesla stock and Dogecoin simultaneously.

- Broader market conditions play a role: Macroeconomic factors and broader market trends also influence both assets.

Analyzing the Risk for Investors

Investing in assets heavily influenced by a single individual's actions carries significant risk. Both Tesla stock and Dogecoin are subject to potentially extreme price swings based on Elon Musk's pronouncements and actions. This volatility makes it crucial for investors to diversify their portfolios and implement sound risk management strategies.

- High volatility poses significant risk: The unpredictable nature of both assets makes them high-risk investments.

- Diversification is key to managing risk: Spreading investments across different asset classes is essential to mitigate risk.

- Thorough research is crucial before investing: Before investing in either Tesla stock or Dogecoin, conduct thorough research and carefully assess your risk tolerance.

Conclusion:

The relationship between Tesla stock and Dogecoin, heavily influenced by Elon Musk, presents a compelling case study in market volatility and the power of social media. While a correlation exists, understanding that correlation doesn't equal causation is vital. The speculative nature of Dogecoin and the significant influence of a single individual on both assets necessitate a cautious approach to investment. Before investing in either Tesla stock or Dogecoin, conduct thorough research and develop a diversified investment strategy that accounts for the inherent risks. Understanding the correlation between Tesla stock and Dogecoin, and the impact of Elon Musk, is key to navigating this complex and dynamic market.

Featured Posts

-

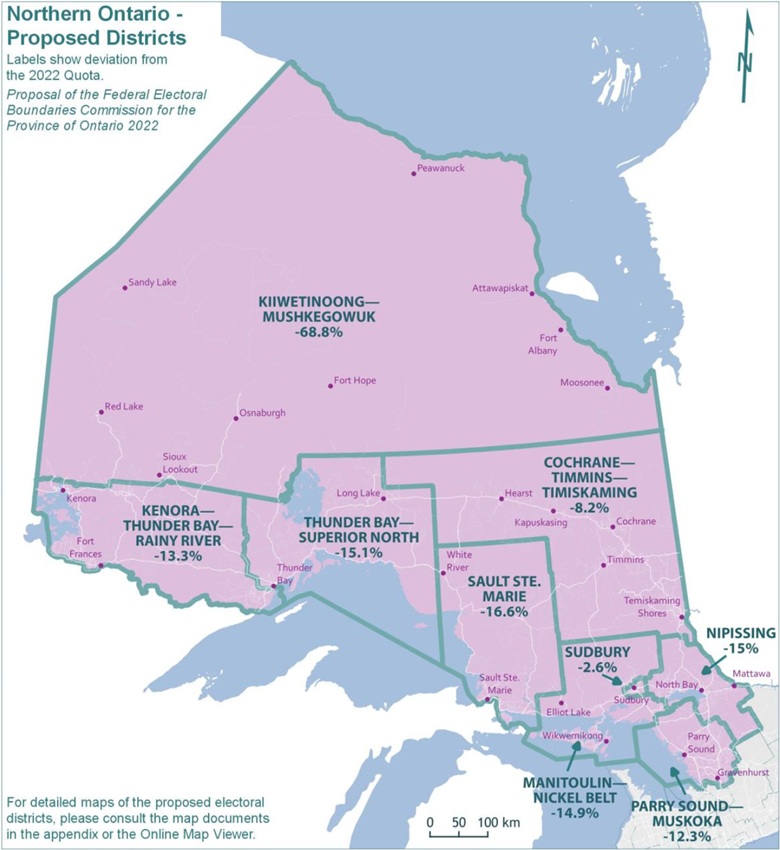

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 10, 2025

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 10, 2025 -

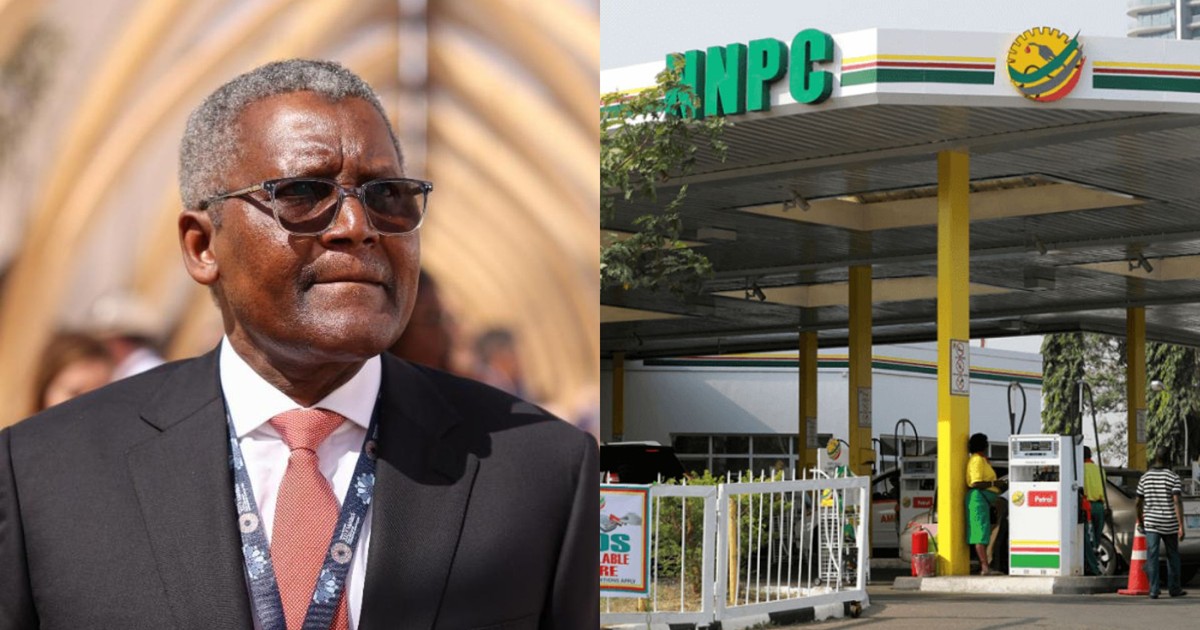

How Dangote And Nnpc Influence Nigerias Petrol Market

May 10, 2025

How Dangote And Nnpc Influence Nigerias Petrol Market

May 10, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Stock Slump And Tariff Issues

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Stock Slump And Tariff Issues

May 10, 2025 -

Over The Counter Birth Control Examining The Post Roe Landscape

May 10, 2025

Over The Counter Birth Control Examining The Post Roe Landscape

May 10, 2025 -

Addressing Accessibility Gaps For Wheelchair Users On The Elizabeth Line

May 10, 2025

Addressing Accessibility Gaps For Wheelchair Users On The Elizabeth Line

May 10, 2025