The Country's Booming Business Regions: Investment Opportunities Revealed

Table of Contents

The Tech Hubs: Silicon [Country Name] and Beyond

[Country Name]'s tech sector is flourishing, with several regions transforming into vibrant innovation hubs. These areas attract significant tech investment, fueled by a robust startup ecosystem, abundant skilled labor, and government support. Keywords like tech investment, startup ecosystem, and innovation hubs are central to understanding this growth.

-

Presence of leading universities and research institutions: Universities such as [University Name 1] and [University Name 2] are churning out a steady stream of tech-savvy graduates, providing a talent pool for burgeoning startups and established tech giants. This constant influx of skilled workers fuels the region's innovation engine.

-

Government initiatives supporting tech startups: Government programs like [Program Name 1] and [Program Name 2] offer grants, tax breaks, and incubator spaces, significantly reducing the barriers to entry for aspiring entrepreneurs. These initiatives are crucial in fostering a thriving startup ecosystem.

-

Abundant skilled workforce: The availability of a large pool of engineers, software developers, and data scientists attracts venture capital and fosters a competitive landscape. This skilled workforce is a key driver of the region's sustained economic growth and attractiveness for tech investment.

-

Access to venture capital and funding: Significant venture capital investment pours into these regions, providing crucial funding for startups and fueling rapid growth. This access to capital allows promising tech ventures to scale quickly and achieve significant market penetration.

-

Examples of successful tech companies: Companies like [Company Name 1], [Company Name 2], and [Company Name 3] are testaments to the success of these tech hubs, showcasing the region's potential for high-growth investment opportunities.

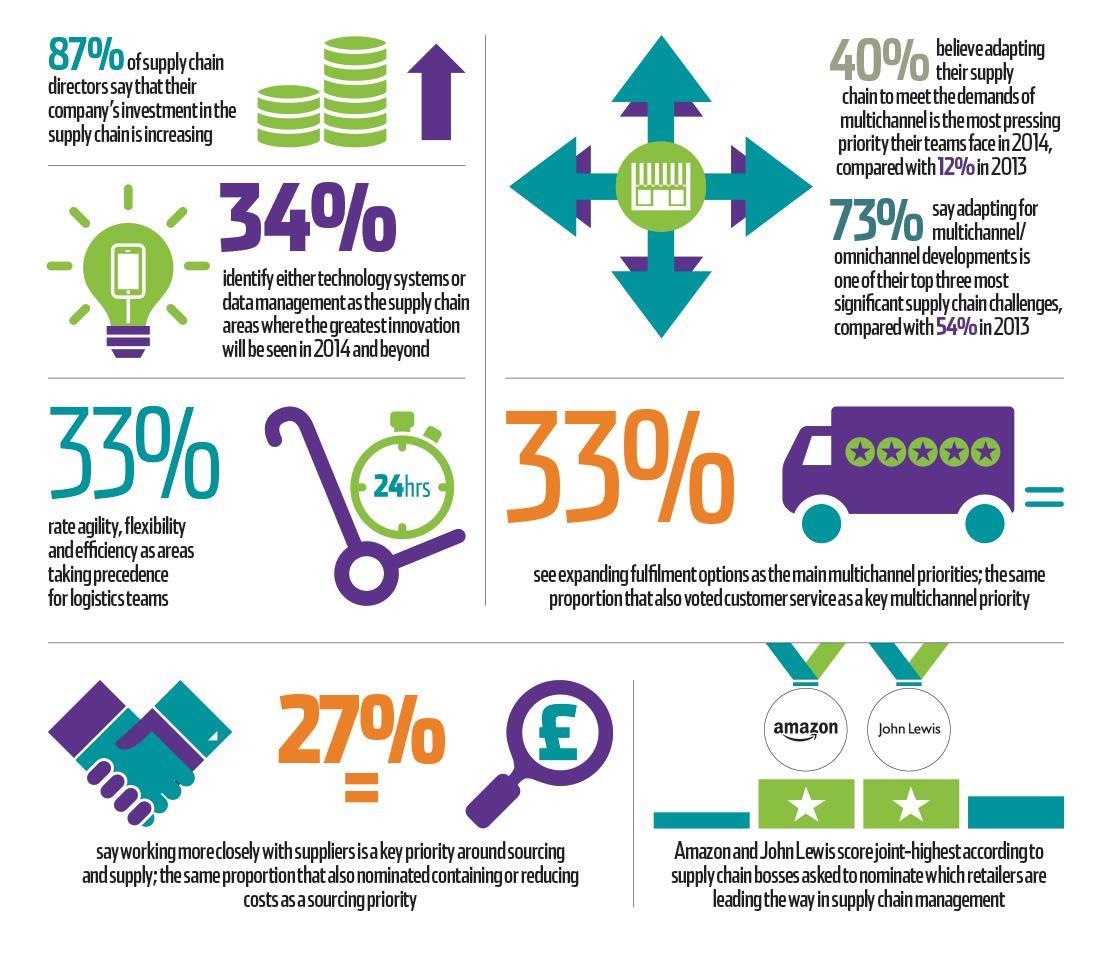

Manufacturing Powerhouses: Industrial Growth and Opportunities

Certain regions within the country are experiencing remarkable growth in the manufacturing sector. These areas benefit from strategic locations, robust infrastructure, and government incentives, making them attractive destinations for manufacturing investment. Keywords such as manufacturing investment, industrial parks, and supply chains are key to this sector's success.

-

Strategic location and access to transportation: Proximity to major ports, airports, and efficient transportation networks facilitates the smooth flow of goods, lowering logistical costs and boosting efficiency. This accessibility to global markets is crucial for export-oriented manufacturing.

-

Government incentives for manufacturing companies: Tax breaks, subsidies, and streamlined regulatory processes encourage domestic and foreign investment in manufacturing facilities, driving industrial expansion. These incentives make the regions highly competitive on a global scale.

-

Availability of skilled labor and industrial infrastructure: A well-established workforce with experience in manufacturing, coupled with modern industrial infrastructure, ensures production efficiency and quality. The availability of both skilled workers and advanced infrastructure is pivotal for attracting investment.

-

Growth in specific manufacturing sectors: Industries like automotive manufacturing, pharmaceuticals, and electronics are experiencing significant growth, offering investors opportunities in diverse niches. Focusing on specific high-growth manufacturing sectors can yield higher returns.

-

Potential for export-oriented manufacturing: Many regions are strategically positioned to leverage global export markets, offering manufacturers access to a broader customer base and greater revenue potential. This export orientation further enhances the attractiveness of these regions for investment.

Emerging Markets: Untapped Potential and High-Growth Sectors

Beyond the established tech and manufacturing hubs, several emerging markets within the country present significant untapped potential. These areas are experiencing rapid development, driven by growth in diverse sectors like renewable energy, tourism, and agriculture. Keywords like emerging markets and high-growth sectors highlight the opportunities and risks in these regions.

-

Renewable energy: Investment in renewable energy projects, such as solar and wind farms, is attracting significant interest, driven by the global push towards sustainable energy sources.

-

Tourism: Regions with natural beauty and cultural attractions are experiencing rapid growth in tourism, creating opportunities in hospitality, infrastructure, and related services.

-

Agriculture: Modernization of agricultural practices and investments in food processing are driving growth in this vital sector.

-

Infrastructure projects: Massive investments in infrastructure development, such as roads, railways, and utilities, are creating opportunities for construction companies and related businesses.

Real Estate Investment in Booming Regions

The robust economic activity in these booming business regions directly impacts the real estate market. Property values are rising, offering attractive investment opportunities, but thorough due diligence is essential. Keywords such as real estate investment, property market, and rental yields are vital to understanding this aspect.

-

Factors influencing property values: Strong economic growth, population increase, and infrastructural development all contribute to rising property values.

-

Potential for rental income and capital appreciation: High demand for commercial and residential properties translates into strong rental yields and significant potential for capital appreciation.

-

Risks associated with real estate investment: Market volatility, interest rate fluctuations, and regulatory changes are factors that investors must consider.

-

Due diligence and market research advice: Thorough market research, professional advice, and due diligence are crucial before making any real estate investment decisions.

Conclusion

The country's booming business regions offer a diverse range of investment opportunities across various sectors, from thriving tech hubs to emerging markets with high-growth potential. While these regions present lucrative prospects, thorough research and due diligence are paramount before committing to any investment. Understanding the specific risks and rewards associated with each region and sector is critical for success.

Discover the most lucrative investment opportunities in the country's booming business regions today! [Link to relevant resources or contact form]

Featured Posts

-

Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot Production

Apr 24, 2025

Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot Production

Apr 24, 2025 -

New Business Opportunities A Regional Overview Of Country Name

Apr 24, 2025

New Business Opportunities A Regional Overview Of Country Name

Apr 24, 2025 -

Canadian Dollars Mixed Performance Strengths And Weaknesses

Apr 24, 2025

Canadian Dollars Mixed Performance Strengths And Weaknesses

Apr 24, 2025 -

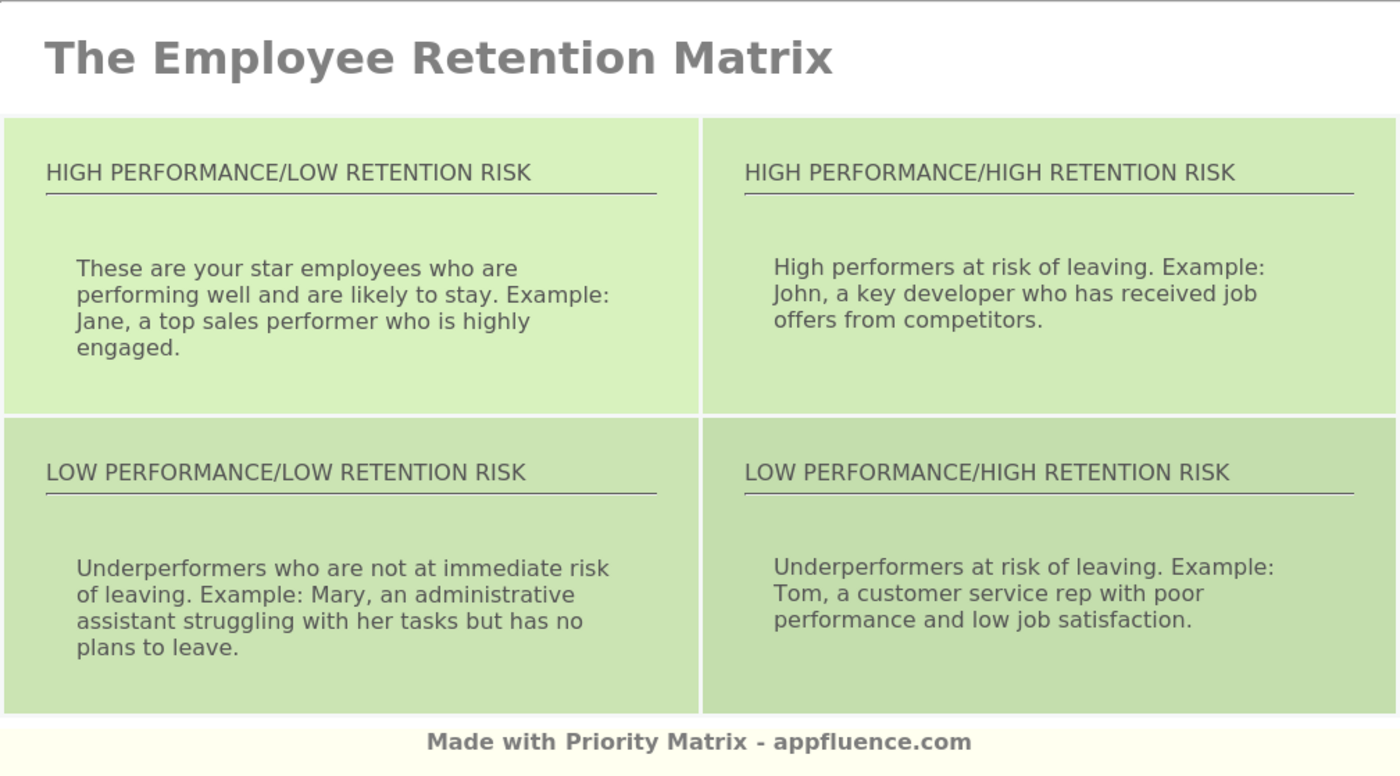

Investing In Middle Management A Strategic Approach To Business Growth And Employee Retention

Apr 24, 2025

Investing In Middle Management A Strategic Approach To Business Growth And Employee Retention

Apr 24, 2025 -

Instagram Launches Video Editor To Attract Tik Tok Creators

Apr 24, 2025

Instagram Launches Video Editor To Attract Tik Tok Creators

Apr 24, 2025

Latest Posts

-

Bondis Alleged Possession Of The Epstein Client List Fact Or Fiction

May 10, 2025

Bondis Alleged Possession Of The Epstein Client List Fact Or Fiction

May 10, 2025 -

Chinas Canola Supply Chain Adapting To The Post Canada Era

May 10, 2025

Chinas Canola Supply Chain Adapting To The Post Canada Era

May 10, 2025 -

Shifting Sands China Diversifies Canola Imports Post Canada Fallout

May 10, 2025

Shifting Sands China Diversifies Canola Imports Post Canada Fallout

May 10, 2025 -

The Us Attorney General And Fox News Understanding The Daily Appearances

May 10, 2025

The Us Attorney General And Fox News Understanding The Daily Appearances

May 10, 2025 -

Chinas Canola Search New Sources After Canada Rift

May 10, 2025

Chinas Canola Search New Sources After Canada Rift

May 10, 2025