The ECB On Inflation: How Post-Pandemic Fiscal Support Continues To Impact Prices

Table of Contents

The Role of Fiscal Stimulus in Fueling Inflation

Massive government spending programs designed to mitigate the economic fallout of the pandemic injected significant liquidity into the Eurozone economy. This increased demand, coupled with pre-existing supply chain disruptions, led to a surge in inflation. This demand-pull inflation, driven by increased purchasing power, exacerbated existing price pressures. The sheer scale of fiscal stimulus packages across different Eurozone countries contributed significantly to this inflationary environment.

- Increased consumer spending fueled by government aid and unemployment benefits: Direct payments to citizens and extended unemployment benefits boosted disposable income, leading to increased demand for goods and services.

- Supply chain bottlenecks resulting in shortages and higher prices for goods: The pandemic disrupted global supply chains, creating shortages and driving up the prices of many goods. Fiscal stimulus further increased demand, worsening these shortages.

- Investment in infrastructure projects contributing to increased costs: While beneficial in the long run, increased government investment in infrastructure projects also contributed to inflationary pressures through increased demand for materials and labor.

- Rising energy prices exacerbated by global events and increased demand: The global energy crisis, coupled with increased demand stimulated by fiscal support, significantly impacted inflation across the Eurozone.

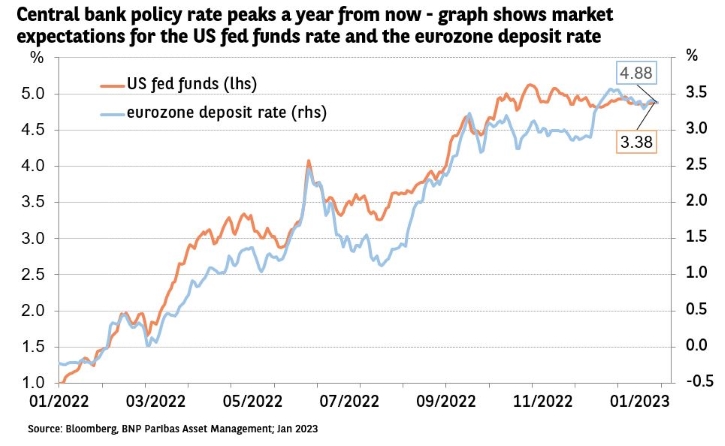

ECB's Response to Inflationary Pressures

The ECB has responded to rising inflation with a series of monetary policy adjustments aimed at curbing inflation by reducing money supply growth. These actions represent a significant shift from the accommodative monetary policy pursued during the pandemic. The effectiveness of these measures is being closely monitored.

- Gradual increases in interest rates to make borrowing more expensive: Raising interest rates makes borrowing more expensive for businesses and consumers, reducing demand and cooling down the economy.

- Reduction of quantitative easing (QE) programs: The ECB has started to unwind its QE program, reducing the amount of money in circulation.

- Active communication strategy to guide market expectations: Clear communication about the ECB's intentions helps to manage market expectations and stabilize the economy.

- Monitoring of key economic indicators to inform future policy decisions: The ECB continuously monitors key economic indicators like inflation, unemployment, and GDP growth to inform future policy decisions.

The Lagging Effects of Fiscal Support on Inflation

The impact of past fiscal support on inflation is not immediate but unfolds over time. This lagging effect complicates the ECB's efforts to control price increases, requiring a nuanced and forward-looking approach to monetary policy.

- Delayed impact of interest rate changes on inflation: Interest rate changes don't immediately translate into lower inflation. There's a significant lag before their full effect is felt.

- Continued pressure on prices from previously implemented fiscal measures: The lingering effects of past fiscal spending continue to exert upward pressure on prices, even as the ECB tightens monetary policy.

- Influence of inflation expectations on wage negotiations and consumer behavior: If people expect inflation to persist, they may demand higher wages and increase spending, further fueling inflation – a self-fulfilling prophecy.

- The challenge of predicting the long-term effects of past fiscal policies: The full long-term impact of past fiscal stimulus is difficult to predict, making it challenging for the ECB to fine-tune its monetary policy.

The Challenge of Balancing Growth and Price Stability

The ECB faces the difficult task of balancing economic growth with the need to control inflation. Aggressive measures to curb inflation risk triggering a recession, creating a policy dilemma. Finding the optimal balance is crucial for ensuring sustainable economic growth in the Eurozone.

- The risk of triggering a recession with overly restrictive monetary policy: Raising interest rates too aggressively could stifle economic growth and potentially lead to a recession.

- The need to find a sustainable path to price stability without jeopardizing economic recovery: The ECB needs to navigate a delicate path to curb inflation without undermining the fragile economic recovery.

- Balancing the needs of different Eurozone economies with varying sensitivities to inflation: Different Eurozone countries have different levels of economic resilience and sensitivity to inflation, requiring a nuanced policy approach.

Conclusion

The ECB's fight against inflation is significantly shaped by the lingering effects of post-pandemic fiscal support. The lagged impact of these measures presents a significant challenge, requiring careful navigation of monetary policy to achieve both price stability and sustainable economic growth. Understanding the complex relationship between fiscal support, inflation, and the ECB's response is crucial for investors, businesses, and policymakers alike. To stay informed on the latest developments in this crucial area, continue to follow updates on the ECB’s actions and their analysis of the impact of post-pandemic fiscal support on inflation and price increases within the Eurozone economy.

Featured Posts

-

Nyt Spelling Bee April 1 2025 Pangram And Clues For Todays Game

Apr 29, 2025

Nyt Spelling Bee April 1 2025 Pangram And Clues For Todays Game

Apr 29, 2025 -

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025 -

Trumps Planned Posthumous Pardon The Pete Rose Case Reexamined

Apr 29, 2025

Trumps Planned Posthumous Pardon The Pete Rose Case Reexamined

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025